Risk appetite is general strong today on rather positive news. Firstly, US and China both confirmed that trade negotiations are continuing and both teams are in preparing for a high-level face to face meeting in October. There is no specific date for the meeting yet. But with new tariffs looming on October, it’s clear that China is refraining from more retaliation, but opt for consultations.

In the UK, it’s now look very likely that no-deal Brexit on October 31 would be averted. The government announced it was dropping its opposition to the legislation in the House of Lords. The question is now on when general would be held. In Italy, new coalition, with a pro-EU economy minister, sworn in today, suggesting better relationship with EU ahead.

In the currency markets, Yen and Swiss Franc are overwhelmingly the weakest ones, followed by Dollar. Sterling is the strongest, followed by New Zealand Dollar and then Australian. Technically, USD/JPY’s break of 106.73 resistance confirms short term bottoming. Similarly, EUR/JPY’s break of 117.91 also confirms short term bottoming. Both are in-line with underlying risk appetite. GBP/USD’s break of 1.2309 resistance also suggests short term bottoming. A focus would be on 0.8819 support in EUR/GBP. Break there will be another evidence of sustainable Sterling rebound.

In Europe, FTSE is down -0.72%. DAX is up 0.82%. CAC is up 1.12%. German 10-year yield is up 0.0652 at -0.605, and a close above -0.6 today will certainly be an indication of improving market sentiments. Earlier in Asia, Nikkei rose 2.12%. Hong Kong HSI dropped -0.03%. China Shanghai SSE rose 0.96%. Singapore Strait Times rose 0.53%. Japan 10-year JGB yield rose 0.0128 to -0.271.

US ADP grew 195k, recession will remain at bay

ADP report showed 195k growth in private sector jobs in August, well above expectation of 140k. Jobs in goods-producing sector grew 11k while jobs in service-providing sectors grew 184k. Small businesses added 66k, medium business added 77k, large businesses added 52k.

“In August we saw a rebound in private-sector employment,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “This is the first time in the last 12 months that we have seen balanced job growth across small, medium and large-sized companies.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Businesses are holding firm on their payrolls despite the slowing economy. Hiring has moderated, but layoffs remain low. As long as this continues recession will remain at bay.”

Initial jobless close rose to 217k, slightly above expectations

Also from US, initial jobless claims rose 1k to 217k in the week ending August 31, slightly above expectation of 215k. Four-week moving average rose 1.5k to 216.25k. Continuing claims dropped -39k to 1.662m in the week ending August 24. Four-week moving average dropped -6.25k to 1.692m.

Non-farm productivity was finalized at 2.3% in Q2, unrevised. Unit labor costs was finalized at 2.6%, revised up from 2.4%. Challenger job cuts rose 39.0% yoy in August.

Released earlier today, Germany factory orders tumbled -2.7% mom in July, way below expectation of -1.1% mom. Australia trade surplus narrowed to AUD 7.27B in July, slightly above expectation of AUD 7.20B. Swiss GDP grew 0.3% qoq in Q2, above expectation of 0.2% qoq.

UK government to hold another vote on election next Monday

UK leader of the House of Commons, Jacob Rees-Mogg said that the government is going to hold another vote on on Monday, to push for early election. The vote to hold an election on October ended with 298 to 44, way short of the 430-plus threshold as Labour and some other opposition abstained.

Prime Minister Boris Johnson is still aiming at a general election before EU summit on October 17. It’s clear that he need support from Labour. But the latter has indicated that it would support support an early election until legislation which aims to block a no-deal exit at the end of October has become law.

The bill to block no-deal Brexit was passed in Commons yesterday Conservative Party members of the Lords originally tabled a series of time wasting amendments to delay the bill. But earlier today, the government announced it was dropping its opposition to the legislation.

New Italian government sworn in with pro-EU democrat as economy minister

The new coalition government of 5-Star Movement and Democratic Party (PD) finally sworn into office today, ending recent political turmoil. Giuseppe Conte remains as Prime Minister that leads a cabinet with 7 women and 14 men. The government will now face confidence votes in the lower and upper houses next Monday and Tuesday. Conte is expected to win both votes.

The important role of economy minister is taken up by Roberto Gualtieri, a Democrat, and the chairman of the European Parliament’s Committee on Economic and Monetary Affairs. His appointment is seen as sending a clear signal Rome wanted to reset its relations with Brussels.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 106.01; (P) 106.23; (R1) 106.63; More…

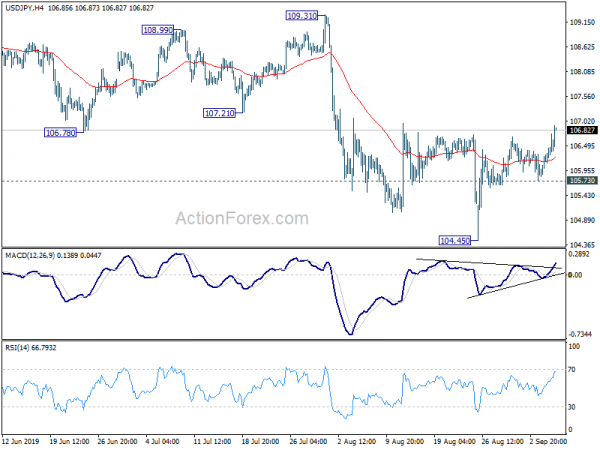

USD/JPY’s break of 106.73 resistance now suggests short term bottoming at 104.45, on bullish convergence condition in 4 hour MACD. Intraday bias is now back on the upside for 55 day EMA (now at 107.17). Note that USD/JPY has just drew support from 104.62 key support. Sustained break of 55 day EMA will indicate short term reversal and pave the way to 109.31 resistance next. On the downside, break of 105.73 minor support will turn bias back to the downside for retesting 104.45 low instead.

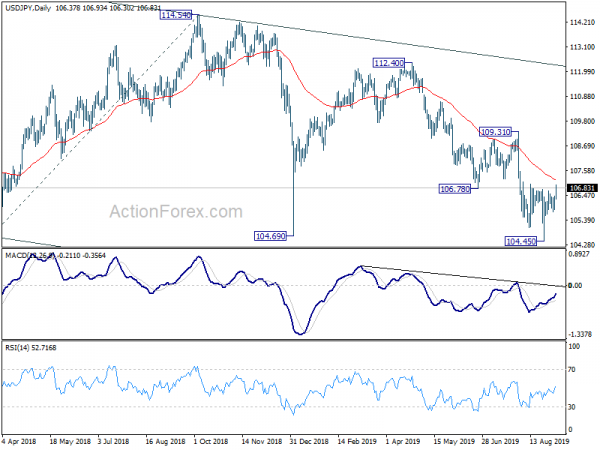

In the bigger picture, decline from 118.65 (Dec 2016) is still in progress and the pair is staying well inside long term falling channel. Firm break of 104.69 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. In any case, break of 109.31 resistance is needed to the first sign of medium term bottoming. Otherwise, further decline will remain in favor in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) Jul | 7.27B | 7.20B | 8.04B | 7.98B |

| 05:45 | CHF | GDP Q/Q Q2 | 0.30% | 0.20% | 0.60% | 0.40% |

| 06:00 | EUR | German Factory Orders M/M Jul | -2.70% | -1.10% | 2.50% | 2.7 |

| 11:30 | USD | Challenger Job Cuts Y/Y Aug | 39.00% | 43.20% | ||

| 12:15 | USD | ADP Employment Change Aug | 195K | 140k | 156k | |

| 12:30 | USD | Nonfarm Productivity Q2 F | 2.30% | 2.20% | 2.30% | |

| 12:30 | USD | Unit Labor Costs Q2 F | 2.60% | 2.50% | 2.40% | |

| 12:30 | USD | Initial Jobless Claims (AUG 31) | 217K | 215K | 215K | 216K |

| 13:45 | USD | Services PMI Aug F | 51 | 50.9 | ||

| 14:00 | USD | Factory Orders Jul | 0.80% | 0.60% | ||

| 14:00 | USD | ISM Non-Manufacturing/Services Composite Aug | 54 | 53.7 | ||

| 14:30 | USD | Natural Gas Storage | 77B | 60B | ||

| 15:00 | USD | Crude Oil Inventories | -2.4M | -10.0M |