Asian markets are generally lifted by confirmation that US-China trade talk is going to resume next month. Commodity currencies gain most as led by Australian Dollar. Swiss Franc and Yen are pressured in risk seeking environment naturally. But Sterling also turns softer on overnight condition. It’s getting much more likely that no-deal Brexit could be averted on October 31. Yet, the UK parliament is still unclear on what it truly wants regarding Brexit. Dollar is mixed as focus will turn to services and job data.

Technically, USD/CAD and USD/CHF could have completed recent rebound at 1.3382 and 0.9929 respectively. More downside is now mildly in favor for both pairs. AUD/USD is pressing 0.6822 resistance and break will extend the rebound from 0.6677. But there is no confirmation of weakness in Dollar against Euro, Yen and even Sterling. Talking about Yen, despite today’s rebound, EUR/JPY is held below 117.91 resistance, GBP/JPY by 130.89 resistance, USD/JPY by 106.73 resistance. More is needed to confirm selling momentum in Yen.

In Asia, Nikkei rose 2.12%. Hong Kong HSI is down -0.62%. China Shanghai SSE is up 1.25%. Singapore Strait Times is up 0.38%. Japan 10-year JGB yield is up 0.0148 at -0.269. Overnight, DOW rose 0.91%. S&P 500 rose 1.08%. NASDAQ rose 1.30%. 10-year yield dropped -0.007 to 1.459.

US and China agreed to continue trade negotiations in October

Sentiments in Asia are apparently lifted after confirmation of US-China trade meeting in early October. The Chinese Ministry of Commerce said “both sides agreed that they should work together and take practical actions to create good conditions for consultations.” That came after a telephone call between Vice Premier Liu He and PBoC Governor Yi Gang, with US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin. Conversations between two sides will continue this month, in preparation for high level negotiation in early October.

Separately, USTR spokesperson Jeff Emerson also confirmed in a statement that “They agreed to hold meetings at the ministerial level in Washington in the coming weeks. And, “In advance of these discussions, deputy-level meetings will take place in mid-September to lay the ground work for meaningful progress.”

Fed Beige Book: Effect of tariffs not to be felt for a few months

Fed’s Beige Book economic report noted that economy expanded at a “modest pace” through the end of August”. Concerns regarding tariffs and trade policy uncertainty continued. But businesses remained “optimistic” about the near-term outlook.

Overall, districts indicated that employment grew at a “modest pace”, “on par” with previous period. However, manufacturing was “flat to down” and “tightness” continued to “contrain growth” in overall business activity. Wage growth remained “modest to moderate”. There was “strong upward pressure” on pay for entry-level and low-skill workers, technology, construction, and some professional services positions.

There were “modest price increases”. Retailers and manufacturers reported “slight increases in input costs”. Firms in some districts “noted an ability to pass along price increases”. But manufacturers relayed limited ability to raise prices. Impact of tariffs on pricing were “mixed” and some districts expected effects not to be felt for a few months.

Fed Williams is carefully monitoring a nuance picture, ready to act as appropriate

New York Fed President John Williams said in a speech that “the economy is in a good place, but not without risk and uncertainty”. “Persistently low inflation” is a key area of his attention. In particular, he noted the “broader context is important”, with “ongoing disinflationary pressures from abroad”.

Meanwhile, beyond the “good” headline GDP figure, there are “more mixed signals coming from different sectors”. “Robust consumer spending is balanced by signs of slowing business investment. We’ve also seen a decline in exports and weakening manufacturing data, reflecting slowing global growth and uncertainty related to trade and geopolitical risks.” Williams said he is carefully monitoring this “nuance picture” and “remain vigilant to act as appropriate”. And, Fed will maintain a “data-dependent approach that takes into account the risks and uncertainty that are weighing on the economy.”

Dallas Fed President Robert Kaplan said recent economic slowdown was largely due to trade uncertainty and global weakness. And “risks to forecast are to the downside.. He added that policymakers are “watching credit conditions, which are currently robust, and the treasury curve. The downward move in the curve has been stimulative.” He also warned that “if the Fed and policy makers waited to see that weakness in the consumer, that’s probably too late.”

Sterling extends rebound as Johnson’s defeat at Commons

UK Prime Minister Boris Johnson suffered heavy defeat in the Commons overnight.. Sterling extended recent rebound as it’s now much less likely for no-deal Brexit to happen on October 31.

The backbench launched bill on blocking no-deal Brexit has passed all stages and will head to the Lords on Thursday. Johnson then reacted to the defeat by calling a vote on general election on October 15, via the Fixed-term Parliaments Act. Support from two-thirds or more of MPs is required to pass the motion. But Labour and other oppositions mainly abstained. The motion won by 298 to 44 , way short of the 430-plus threshold.

Labour has indicated that they might still back an election once the bill to stop a no-deal Brexit had become law. Even, Labour might only push for a election after October 31 Brexit date.

BoC stood pat and sounded less dovish than expected

Overnight, BOC left the policy rate unchanged at1.75%. Policymakers’ monetary policy stance was less dovish than previously anticipated. While showing more concerns about US-China trade war and downplaying GDP growth in the second quarter, the members described the current monetary policy as appropriate. They also appeared upbeat about the situation in household debt and wage growth. Nonetheless, BOC noted that it is working “to update its projection in light of incoming data”. Given the deterioration in global economic developments, a rate cut in October is still possible.

More in BOC Sounds Less Dovish than Expected, as Housing Market and Wage Growth Improve

On the data front

Australia trade surplus narrowed to AUD 7.27B in July, slightly above expectation of AUD 7.20B. Swiss GDP grew 0.3% qoq in Q2, above expectation of 0.2% qoq. Germany will release factory orders in European session. Later in the day, US will release ADP employment, jobless claims, non-farm productivity, factory orders and ISM non-manufacturing.

AUD/USD Daily Outlook

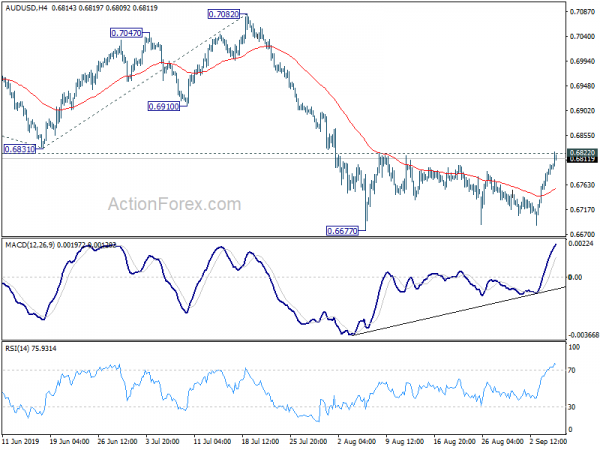

Daily Pivots: (S1) 0.6768; (P) 0.6784; (R1) 0.6814; More…

AUD/USD rebounds further today and is pressing 0.6822 resistance. Break will resume rebound from 0.6677. Intraday bias will be turned back to the upside for 0.6910 support turned resistance. Though, rejection by 0.6822 resistance will maintain near term bearishness. Break of 0.6677 will extend larger down trend to 100% projections of 0.7295 to 0.6831 from 0.7082 at 0.6618.

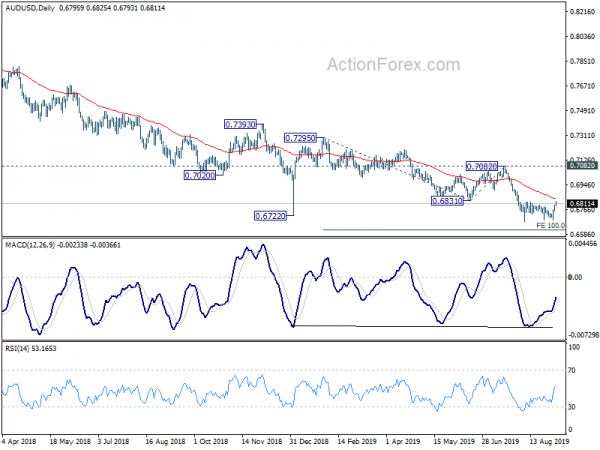

In the bigger picture, decline from 0.8135 (2018 high) is seen as resuming the long term down trend from 1.1079 (2011 high). Firm break of 0.6826 (2016 low) should confirm this bearish view. Further fall should be seen to 0.6008 (2008 low) next. On the upside, break of 0.7082 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | Trade Balance (AUD) Jul | 7.27B | 7.20B | 8.04B | 7.98B |

| 5:45 | CHF | GDP Q/Q Q2 | 0.30% | 0.20% | 0.60% | 0.40% |

| 6:00 | EUR | German Factory Orders M/M Jul | -2.70% | -1.10% | 2.50% | 2.7 % |

| 11:30 | USD | Challenger Job Cuts Y/Y Aug | 43.20% | |||

| 12:15 | USD | ADP Employment Change Aug | 140k | 156k | ||

| 12:30 | USD | Nonfarm Productivity Q2 F | 2.20% | 2.30% | ||

| 12:30 | USD | Unit Labor Costs Q2 F | 2.50% | 2.40% | ||

| 12:30 | USD | Initial Jobless Claims (AUG 31) | 215K | 215K | ||

| 13:45 | USD | Services PMI Aug F | 51 | 50.9 | ||

| 14:00 | USD | Factory Orders Jul | 0.80% | 0.60% | ||

| 14:00 | USD | ISM Non-Manufacturing/Services Composite Aug | 54 | 53.7 | ||

| 14:30 | USD | Natural Gas Storage | 60B | |||

| 15:00 | USD | Crude Oil Inventories | -10.0M |