Australian Dollar rebounds notably today as GDP data met market expectations while services data showed improvement. Though, upside is capped so far as RBA is still on track to another rate cut later in the year. Sterling is the second strongest after lawmakers cleared a hurdle to block no-deal Brexit. On the other hand, Yen and Swiss Franc weaken on rally in Asian stocks, in particular Hong Kong HSI. Looking ahead, focus will turn to Canada will BoC rate decision featured.

Technically, Dollar should have made a temporary top against Euro, Sterling, Swiss Franc and Canadian, after yesterday’s post ISM manufacturing pull back. Some more downside is likely for the near term. But there is no clear sign of short term topping yet. Similarly, Yen crosses are generally in recovery now and more upside is likely. But such recovers should be corrective and outlook in the Yen crosses will remain bearish.

In Asia, Nikkei rose 0.12%. Hong Kong HSI is up 3.28%. China SSE is up 0.57%. Singapore Strait Times is up 1.13%. Japan 10-year JGB yield is down -0.0057 at -0.281. Overnight, DOW dropped -1.08%. S&P 500 dropped -0.69%. NASDAQ dropped -1.11%. 10-year yield dropped -0.040 to 1.466.

Fed Rosengren: Don’t use up valuable space, no immediate policy action required

Boston Fed President Eric Rosengren said in a speech that the US economy remained “relatively strong”. And he saw not pressing need to cut interest rate s at the upcoming meeting. He said, “If the consumer continues to spend, and global conditions do not deteriorate further, the economy is likely to continue to grow around 2%”.

Also, “with continued gradual increases in wages and prices, then in my view, no immediate policy action would be required.” “I don’t want to use up that valuable space at a time where we actually think prices are pretty stable and the labor markets are pretty tight,” he added.

Nevertheless, Rosengren also admitted that risks are on the rise. “Clearly, there is a downside risk that trade or geopolitical problems could escalate, resulting in a much weaker situation than is currently anticipated in economic forecasts” However, “to date, these elevated risks have not become reality.” “This is a particularly good time to carefully watch incoming data to determine whether any additional policy adjustments are necessary to achieve” the dual mandate.

Fed Bullard urges 50bps rate cut to realign with markets

St. Louis Fed President James Bullard said Fed’s interest rates are “too high” and a -50bps cut this month is needed to realign with financial markets. Bond yields dropped to record lows on expectation of Fed cut and intensifying risk of global trade war. Bullard said “in this situation I would respect the market signal,” He added, “we should have a robust debate about moving 50 basis points at this meeting…It’d be better in my mind to go ahead and get realigned right now”.

UK lawmakers overcome first hurdle to stop no-deal Brexit

In a motion put forward by oppositions and Conservative rebels to take control of parliamentary schedules, the UK government was defeated by 328 to 301 votes. On Wednesday, those lawmakers will proceed to pass a law to force Prime Minister Boris Johnson to seek another Brexit delay, from October 31 to January 31, to stop no-deal Brexit.

After the vote, Johnson warned, “I don’t want an election, but if MPs vote tomorrow to stop negotiations and compel another pointless delay to Brexit, potentially for years, then that would be the only way to resolve this.” He reiterated ” if I am Prime Minister, I will go to Brussels, I will go for a deal and get a deal but if they won’t do a deal we will leave anyway on 31 October.”

It’s reported that all 21 Conservative rebels could face expulsion from the party as a result of the vote. The group include Nicholas Soames, the grandson of Britain’s World War Two leader Winston Churchill, and two former finance ministers – Philip Hammond and Kenneth Clarke.

Separately, Irish Finance Minister Paschal Donohoe insisted that “a very significant political rationale” is needed for any further Brexit delay. He told national broadcaster RTE, “the European Council and the European Commission have said that were another extension to be looked for, there would have to be a very significant political rationale for it and it is yet to be seen what that rationale would be.”

Australia GDP grew 0.5% in Q2, strengthen the case for RBA rate cut

Australia GDP grew 0.5% qoq in Q2, matched expectations. Annual growth slowed to 1.4%, way slower than 3.1% a year ago and was the worst since 2009. ABS Chief Economist for Bruce Hockman, noted “the external sector drove GDP growth this quarter, while growth in the domestic economy remains steady”. Net exports added 0.6% to Q2’s growth, reflecting strong exports of mining commodities. He added, “strength in mining related activity was seen across a number of measures in the economy”.

According to Westpac, today’s data strengthened the case for further RBA rate cut in the very near term. To achieve RBA’s growth forecasts of 2.5% for 2019, the economy needs to register 1.6% growth in the second half. That’s seen as out of reach while recent retail and housing data were also disappointing. Westpac expects another RBA cut in October.

Australia services returned to mild expansions

Australia AiG Performance of Services Index rose 7.5 pts to 51.4 in August. That’s a return to mildly positive conditions following a weak month in July. Also, trading conditions for some businesses picked up, returning to similar levels seen earlier in the year.

Looking at some details, there were expansions in four of eight services sectors in trend terms. However, among the business-oriented sectors, only finance & insurance reported positive results. Among the consumer-oriented segments, the ‘health, education & community services’ sector was strongest and the retail trade sector continued to perform very weakly.

China Caixin PMI services rose to 52.1, economy showed clear signs of recovery

China Caixin PMI Services rose to 52.1 in August, up from 51.6 and beat expectation of 51.8. PMI Composite rose to 51.6, up from 50.9. Caixin noted that manufacturers and services provides both saw improved rates by business activity growth. The composite new orders expanded at the quickest rate for four months. Also, total employment increased for the first time since April.

Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said: “China’s economy showed clear signs of a recovery in August, especially in the employment sector. Countercyclical policies took effect gradually. However, the Sino-U.S. trade conflict remained a drag, and business confidence remained depressed. Still, there’s no need to be too pessimistic about China’s economy, with the launch of a series of policies to promote high-quality growth.”

Looking ahead

Eurozone will release PMI services final and retail sales. UK will release PMI services too. Later in the day, BoC is expected to stand pat at 1.75%. Canada will release labor productivity and trade balance. US will also release trade balance and Fed’s Beige Book economic report.

AUD/USD Daily Outlook

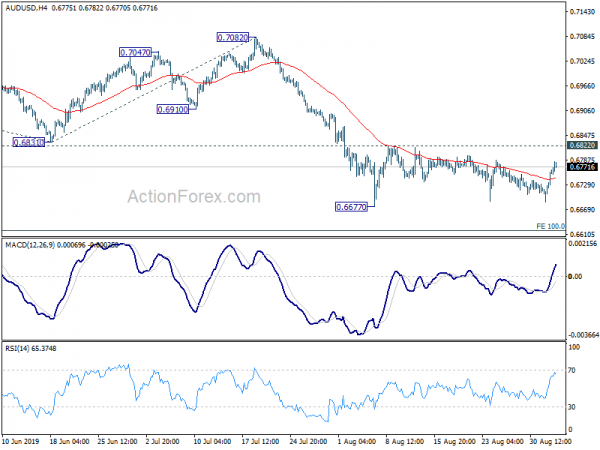

Daily Pivots: (S1) 0.6713; (P) 0.6738; (R1) 0.6789; More…

AUD/USD rebounded strongly ahead of 0.6677. But still, it’s staying in consolidation between 0.6677/6822. Intraday bias remains neutral first. On the downside, break of 0.6677 will resume larger down trend to 100% projections of 0.7295 to 0.6831 from 0.7082 at 0.6618. On the upside, above 0.6822 will bring stronger rebound instead.

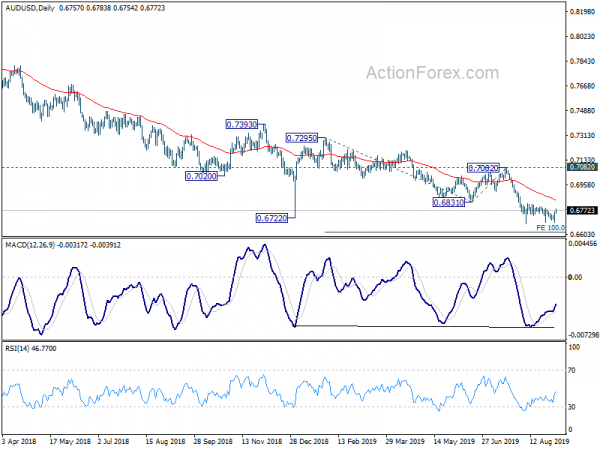

In the bigger picture, decline from 0.8135 (2018 high) is seen as resuming the long term down trend from 1.1079 (2011 high). Firm break of 0.6826 (2016 low) should confirm this bearish view. Further fall should be seen to 0.6008 (2008 low) next. On the upside, break of 0.7082 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Service Index Aug | 51.4 | 43.9 | ||

| 01:00 | NZD | ANZ Commodity Price Aug | 0.30% | -1.40% | ||

| 01:30 | AUD | GDP Q/Q Q2 | 0.50% | 0.50% | 0.40% | 0.50% |

| 01:45 | CNY | Caixin PMI Services Aug | 52.1 | 51.8 | 51.6 | |

| 07:45 | EUR | Italy Services PMI Aug | 51.5 | 51.7 | ||

| 07:50 | EUR | France Services PMI Aug F | 53.3 | 53.3 | ||

| 07:55 | EUR | Germany Services PMI Aug F | 54.4 | 54.4 | ||

| 08:00 | EUR | Eurozone Services PMI Aug F | 53.4 | 53.4 | ||

| 08:30 | GBP | Services PMI Aug | 52 | 51.4 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Jul | -0.60% | 1.10% | ||

| 12:30 | CAD | Labor Productivity Q/Q Q2 | 0.10% | 0.30% | ||

| 12:30 | CAD | International Merchandise Trade (CAD) Jul | 0.2B | 0.1B | ||

| 12:30 | USD | Trade Balance (USD) Jul | -54.2B | -55.2B | ||

| 14:00 | CAD | BoC Rate Decision | 1.75% | 1.75% | ||

| 18:00 | USD | Federal Reserve Beige Book |