Dollar, Euro and Sterling are trading as the stronger ones today while commodity currencies are generally weaker. Dollar somewhat shrugs offer weaker treasury yields as markets await the next move in US-China trade war. Euro is underpinned by possible political resolution in Italy. Meanwhile, Sterling is lifted as UK lawmakers are moving to avert no-deal Brexit. Meanwhile, weaker sentiments generally weigh on Australian and New Zealand Dollars.

Technically, there is no clear change in outlook for now as market remains generally consolidative. Despite today’s weakness, AUD and CAD are staying in range against the greenback and more sideway trading could be seen. Break of 0.6677 in AUD/USD is needed to indicate decline resumption. Similarly, break of 1.3345 resistance is needed to indicate rally resumption. Also, USD/JPY, EUR/JPY and GBP/JPY are staying in consolidations, which might extend further.

In Asia, Nikkei is currently up 0.21%. Hong Kong HSI is up 0.09%. China Shanghai SSE is down -0.23%. Singapore Strait Times is down -0.01%. Japan 10-year JGB yield is down -0.0034 at -0.27. Overnight, DOW dropped -0.47%. S&P 500 dropped -0.32%. NASDAQ dropped -0.34%. 10-year yield dropped -0.055 to 1.490. 30-year yield dropped -0.071 to 1.969.

EU Juncker told Johnson no-deal Brexit is UK’s decision

The 20-minute telephone call between UK Prime Minister Boris Johnson and European Commission President Jean-Claude Juncker appeared to have delivered nothing new. Johnson’s spokespersons said he released that ” UK will be leaving the EU on October 31, whatever the circumstances, and that we absolutely want to do so with a deal.” Also, Johnson was “clear, however, that unless the Withdrawal Agreement is reopened and the backstop abolished there is no prospect of that deal.”

On the other hand, Juncker’s spokesperson said he ” repeated his willingness to work constructively with Prime Minister Johnson and to look at any concrete proposals he may have, as long as they are compatible with the Withdrawal Agreement.” And, Juncker underlined the EU27’s support for Ireland is steadfast and that the EU will continue to be very attentive to Ireland’s interests.” Also, EU was “fully prepared for a no-deal scenario” and “a no-deal scenario will only ever be the UK’s decision, not the EU’s.”

Separately, the opposition parties were seeking to pass a law to force a Brexit delay to prevent no-deal Brexit.

Italy edging close to political resolutions

Italy appeared to be edging closer to political resolution even though coalition talks were dragging on to Wednesday’s deadline. Comments from both 5-Star Movement and Democratic Party (PD) were up beat after yesterday’s meeting concluded.

PD’s Senate leader Andrea Marcucci said “our work is continuing in a fruitful way”. Deputy PD leader Paola De Micheli said the two sides had “analyzed points for the basis of a common program”. 5-Star’s Senate chief Stefano Patuanelli also said there was a “good climate” during the meeting.

Both parties are expected to tell President Sergio Mattarella by Wednesday 1400 GMT on whether a coalition could be formed. If not, Mattarella would dissolve the parliament and call for an early election.

RBNZ Orr: Lower interest rates offer greater certainty on the financial and investment front

RBNZ Governor Adrian Orr said in an article that “monetary policy (the domain of central banks) has its limitations and needs to be partnered with broader fiscal and structural economic policy (the domain of the government of the day)… Providing certainty in uncertain times is a great skill to have, and central bankers world-wide are working hard to do just that.”

He added that “lower interest rates do not remove the global political uncertainty.” But they “offer greater certainty on the financial and investment front”. And, “businesses and governments should be re-assessing their hurdle rates on their investment projects. Low and stable global interest rates mean that what was once costly may now be a sound investment for the future.”

On the data front

UK BRC shop price index dropped -0.4% yoy in August. Australia construction work done dropped -3.8% in Q2, worse than expectation of -1.0%. Germany will release import price index and Gfk consumer sentiment in European session. Eurozone will also release M3 money supply.

USD/CAD Daily Outlook

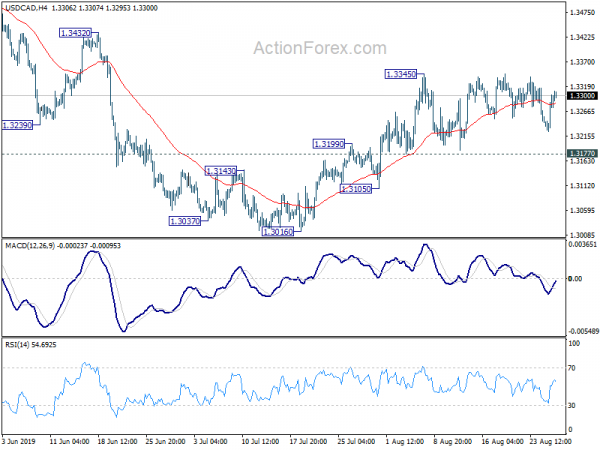

Daily Pivots: (S1) 1.3240; (P) 1.3270; (R1) 1.3316; More…

Intraday bias in USD/CAD remains neutral for the moment. Consolidation from 1.3345 might extend with more sideway trading. Still, further rally is expected as long as 1.3177 minor support holds. On the upside, break of 1.3345 will resume the rebound from 1.3016 to 1.3564/3664 resistance zone. Nevertheless, break of 1.3177 will turn bias back to the downside for 1.3016 instead.

In the bigger picture, focus stays on 1.3068 cluster support (38.2% retracement of 1.2061 to 1.3664 at 1.3052). Strong rebound from there will retain medium term bullish. But sustained break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685, is needed to confirm resumption of up trend from 1.2061 (2017 low). Otherwise, medium term outlook will stay neutral first. Decisive break of 1.3052/68 will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Aug | -0.40% | -0.10% | ||

| 1:30 | AUD | Construction Work Done Q2 | -3.80% | -1.00% | -1.90% | -2.20% |

| 6:00 | EUR | German Import Price Index M/M Jul | -0.10% | -1.40% | ||

| 6:00 | EUR | German GfK Consumer Confidence Sep | 9.6 | 9.7 | ||

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y Jul | 4.70% | 4.50% | ||

| 14:30 | USD | Crude Oil Inventories | -2.7M |