Canadian Dollar jumps broadly in early US session after stronger than expected consumer inflation data. Australian Dollar follows as the second strongest, with help from risk appetite since European session. Fed Kashkari’s push for forward guidance raises expectation that Fed will keep rates low for longer. Yen and Swiss Franc weaken as a result of the strength in stocks. Yet, Sterling is the weakest one so far on Brexit uncertainty.

Some more volatility could be seen for the rest of the day. FOMC minutes would reveal the debates behind the rate cut last month. We’d probably seen how dovish Fed policy makers were leading to the cut. Though, chair Jerome Powell’s speech at Jackson hole on Friday could be more market moving. On other hand, Italian President Sergio Mattarella will begin his two days talks with political parties after the coalition collapsed with Prime Minister Giuseppe Conte’s resignation yesterday. A key would be on whether rivals 5-Star Movement and Democratic Party could form a coalition.

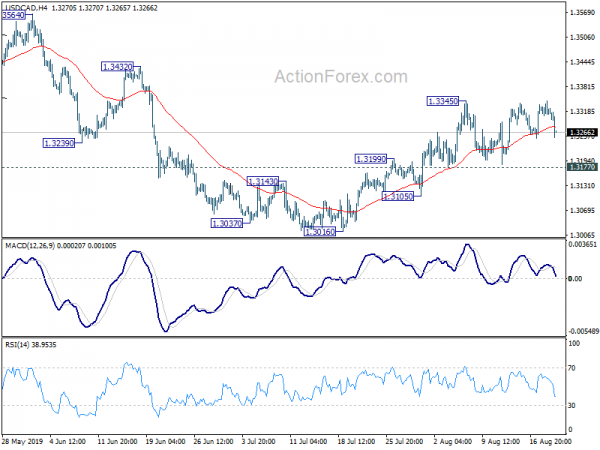

Technically, despite the dip in USD/CAD, there is no change in the near term outlook. With 1.3177 minor support intact, further rise is still in favor through 1.3345 at a later stage. USD/CHF recovered ahead of 0.9762 minor support. Focus is back on 0.9821 temporary top and break will resume the rebound from 0.9659.

In US, DOW futures is currently up 190 pts and points to extended rebound. FTSE is up 1.16%. DAX is up 1.27%. CAC is up 1.57%. German 10-year yield is up 0.0201 at -0.668. Earlier in Asia, Nikkei dropped -0.28%. Hong Kong HSI rose 0.15%. China Shanghai SSE rose 0.01%. Singapore Strait Times dropped -0.43%. Japan 10-year JGB yield dropped -0.0052 to -0.24.

Canadian Dollar rebounds as headline CPI rose 0.5% mom, 2.0% yoy

Canadian Dollar rebounds notably after stronger than expected inflation data. CPI rose 0.5% mom in July versus expectation of 0.2% mom. Annually, CPI was unchanged at 2.0% yoy, above expectation of 1.7% yoy. CPI core-common rose to 1.9% yoy, up from 1.8% yoy and beat expectation of 1.8% yoy. CPI core-median slowed to 2.1% yoy, down from 2.2% yoy, matched expectations. CPI core-trim was unchanged at 2.1% yoy, above expectation of 2.0% yoy.

Kashkari: Fed should use forward guidance now to avoid recession

In an op-ed article published in the Financial Times, Minneapolis Fed President Neel Kashkari said Fed should use forward guidance now to stimulate the economy. He explained that “forward guidance can also provide stimulus by signalling that overnight rates will be low in the future.” That is, Fed can “influence long-term rates by giving guidance about the future path of their short-term equivalents. The firmer the Fed’s commitment, the more influence it can have.”

Kashkari added that “forward guidance should be used now, before the federal funds rate returns to zero.” He argued that “if a central bank cuts rates to zero in response to a downturn and then announces that it plans to keep rates low, that can actually be perceived as a sign of weakness rather than strength.” Instead, “it would be better to deploy guidance now in an effort to avoid hitting zero.

Regarding the guidance, he said “at a minimum, we should commit to not raising rates again until core inflation returns to our 2 per cent target on a sustained basis.”

Germany rejects UK Johnson’s call to reopen Brexit negotiation

German lawmaker Norbert Röttgen, an ally of Chancellor Angela Merkel, who heads the German parliament’s foreign affairs committee, said UK Prime Minister Boris Johnson’s visit won’t change Germany’s stance on Brexit. He criticized that Johnson’s four-page letter to European Council was “not a serious offer”.

Further, he said “the British prime minister starts his letter by saying he is personally committed to finding an agreement, but there is no sign in the rest of the letter that this is actually the case.” And, “if Johnson really wanted to achieve something on his visits to Paris and Berlin, he would have been well advised against writing this letter.”

Separately, government spokesman Steffen Seibert said “we have always said an orderly British withdrawal from the EU is preferable to a disorderly one but we live with realities and we must prepare for possible realities”.

Germany’s BDI industry association said Johnson’s call to reopen Brexit negotiation was irresponsible. And German firms had no choice but to prepare for a hard Brexit on October 31. The group also backed the government on the Brexit stance. Managing Director Joachim Lang said in a statement: “German businesses support the German government and the European Commission in standing by the negotiated treaty. Brussels and London must set the right course to avoid the threat of a hard Brexit.”

RBA Lowe worried about “time for Team West to muscle up against China” idea

RBA Philip Lowe was reported saying in a private business event this week that trade war between US and China was the single biggest threat to the global economy. According to The Sydney Morning Herald and The Age, Lowe said “I do not have a clear idea of what strategy the US has. (Some in the US) say that it is time for Team West to muscle up against China and that is very worrying.”

In August RBA minutes released yesterday, it’s noted that “uncertainty around trade policy had already had a negative effect on investment in many economies”. And, Board “members observed that the escalation of the trade and technology disputes had increased the downside risks to the global growth outlook, although the central forecast was still for reasonable growth.”

Australian Prime Minister Scott Morrison, on the other hand, was rather calm on the situation. He said yesterday that “we’re going to have to get used to this for a while, this level of tension.” And, “we’ve just got to accommodate that, we’ve got to absorb it, we’ve got to see the opportunities in it, of which there are many.”

RBNZ Hawkesby: It would be better to do too much too early

RBNZ Assistant Governor Christian Hawkesby explained the decision of the surprised -50bps rate cut in speech today. He said “we judged that it would be better to do too much too early, than do too little too late”. The alternative approach of cutting by -25bps “risked inflation remaining stubbornly below target, with little room to lift inflation expectations later with conventional tools in the face of a downside shock.”

On the other hand, “a more decisive action now gave inflation the best chance to lift earlier, reducing the probability that unconventional tools would be needed in the response to any future adverse shock.”

Hawkesby also noted that neutral rate is currently in a “wide range centred on 3.25 percent, down from around 5 percent before the GFC”. And, “all else equal, a lower neutral rate implies that we need to set our Official Cash Rate lower to deliver the same amount of monetary stimulus to the economy.”

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3304; (P) 1.3325; (R1) 1.3341; More…

USD/CAD is still staying in consolidation from 1.3345 and intraday bias remains neutral. Despite today’s dip, further rise is still expected with 1.3177 support intact. On the upside, break of 1.3345 will extend the rebound from 1.3016 to 1.3564/3664 resistance zone. On the downside, however, break of 1.3177 support will turn bias back to the downside for retesting 1.3016 low instead.

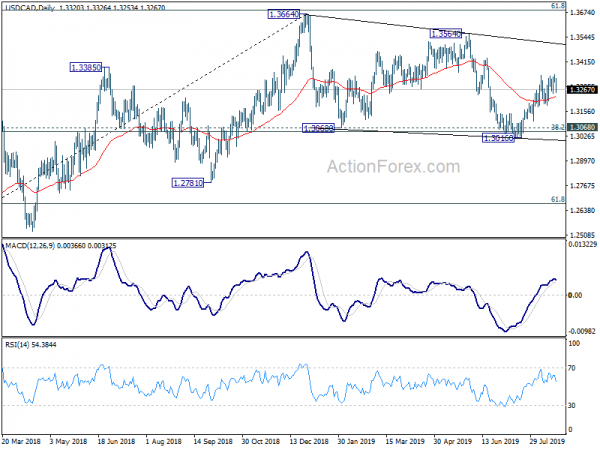

In the bigger picture, focus stays on 1.3068 cluster support (38.2% retracement of 1.2061 to 1.3664 at 1.3052). Strong rebound from there will retain medium term bullish. But sustained break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685, is needed to confirm resumption of up trend from 1.2061 (2017 low). Otherwise, medium term outlook will stay neutral first. Decisive break of 1.3052/68 will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Leading Index M/M Jul | 0.10% | -0.08% | ||

| 08:30 | GBP | Public Sector Net Borrowing (GBP) Jul | -2.0B | -3.7B | 6.5B | 5.7B |

| 12:30 | CAD | CPI M/M Jul | 0.50% | 0.20% | -0.20% | |

| 12:30 | CAD | CPI Y/Y Jul | 2.00% | 1.70% | 2.00% | |

| 12:30 | CAD | CPI Core – Common Y/Y Jul | 1.90% | 1.80% | 1.80% | |

| 12:30 | CAD | CPI Core – Median Y/Y Jul | 2.10% | 2.10% | 2.20% | |

| 12:30 | CAD | CPI Core – Trim Y/Y Jul | 2.10% | 2.00% | 2.10% | |

| 14:00 | USD | Existing Home Sales Jul | 5.41M | 5.27M | ||

| 14:30 | USD | Crude Oil Inventories | -1.4M | 1.6M | ||

| 18:00 | USD | FOMC Meeting Minutes |