Sterling dives broadly today after BoE Governor Mark Carney tried to talk down rate hike expectations and said it’s not the time yet. Meanwhile, Canadian dollar was also pressured as WTI crude oil tumbles through 43.76 support to as low as 42.93, hitting the lowest level since November. The Japanese Yen rebounds as risk appetite recedes. Meanwhile, Dollar and Euro are trading mixed. Technically, key focuses in US session will be on whether GBP/USD would take out 1.2633 support, and whether EUR/GBP would take out 0.8865 resistance.

BoE Carney: "Now is not yet the time"

BoE Governor Mark Carney said in his Mansion House speech that "now is not yet the time to begin that adjustment" of monetary policies. He added that "different members of the MPC will understandably have different views about the outlook and therefore on the potential timing of any Bank Rate increase. But all expect that any changes would be limited in scope and gradual in pace." For him, he would like to see "the extent to which weaker consumption growth is offset by other components of demand, whether wages begin to firm, and more generally, how the economy reacts to the prospect of tighter financial conditions and the reality of Brexit negotiations."

Talking about Brexit, Chancellor of Exchequer Philip Hammond said in the Mansion House speech and urged to ensure a "smooth pathway to a deep and special future partnership with our EU neighbors". And he emphasized a way that "protects jobs, prosperity, and living standards in Britain will require every ounce of skill and diplomacy." And, the government must avoid "unnecessary disruption and dangerous cliff edges."

SNB Jordan: Stimulus exit will be difficult, bumpy

SNB Chairman Thomas Jordan said in a conference that exit from the current monetary stimulus will be "difficult" and "may be a bumpy road". But, by then, "it is also positive that we are at the point where we can talk about normalization." For now, negative interest rates and currency market intervention help keep the Swiss Franc on track. The Swiss State Secretariat for Economic Affairs cut the country’s GDP forecast for 2017 to 1.4%, down from 1.6%. For 2018, growth projection was held unchanged at 1.9%. SECO kept 2017 inflation projection unchanged at 0.5%. However, for 2018, inflation forecast was lowered to 0.2%, down from 0.3%.

RBA minutes added nothing new

RBA minutes showed that the central bank was confident that growth will pick up again the the weak Q1. Nonetheless, the board cautioned the developments in labor and housing markets and said they "warranted careful monitoring". In particular, the minutes said that "members observed that low growth in incomes, along with high levels of household debt, appeared to have been constraining growth in household consumption." Overall, the minutes added little to what Governor Philip Lowe said yesterday. Lowe painted an optimistic picture and said that growth over the next couple of years will be "a bit stronger than it has been recently".

On the data front

US current account deficit widened to USD -116.8b in Q1. Canada wholesale sales rose 1.0% mom in April. Eurozone current account surplus narrowed to EUR 22.2b in April. German PPI dropped -0.2% mom, rose 2.8% yoy in May. Australia house price index rose 2.2% qoq in Q1.

GBP/USD Mid-Day Outlook

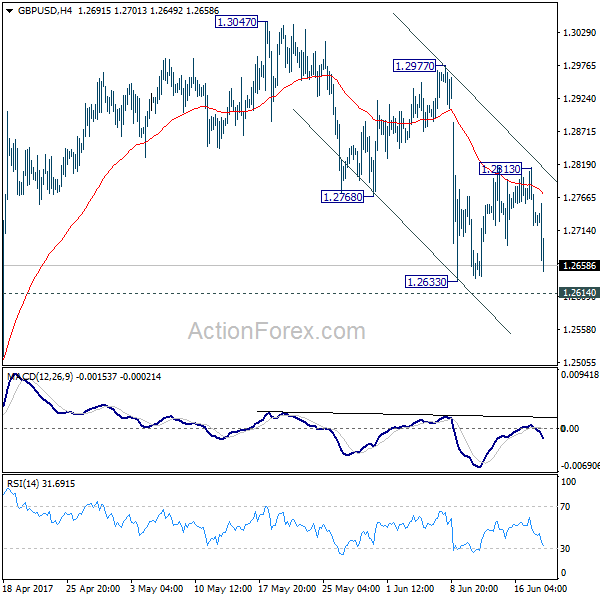

Daily Pivots: (S1) 1.2700; (P) 1.2757; (R1) 1.2792; More…

GBP/USD’s fall accelerates today but for the moment, it’s still staying above 1.2614/33 support zone. Intraday bias stays neutral at this point. overall, we’re still favoring the bearish case. That is, consolidation pattern from 1.1946 has completed at 1.3047 already. Break of 1.2614 resistance turned support should confirm our bearish view and target a test on 1.1946 low next. However, break of 1.2813 resistance will dampen our view and turn bias back to the upside for 1.3047 and above.

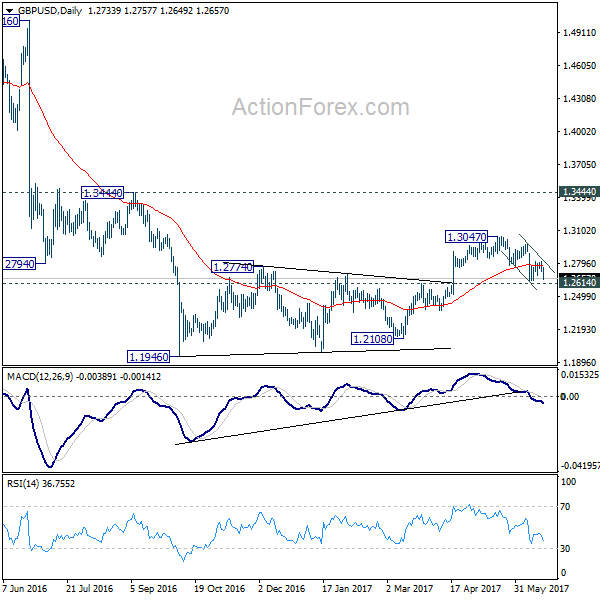

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. Price actions from 1.1946 medium term low are seen as a consolidation pattern, which could have completed after hitting 55 week EMA. Break of 1.1946 low will target 61.8% projection of 1.5016 to 1.1946 from 1.3047 at 1.1150 next. In case the consolidation from 1.1946 extends, outlook will stay remain bearish as long as 1.3444 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | House Price Index Q/Q Q1 | 2.20% | 2.20% | 4.10% | |

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 06:00 | EUR | German PPI M/M May | -0.20% | -0.10% | 0.40% | |

| 06:00 | EUR | German PPI Y/Y May | 2.80% | 2.90% | 3.40% | |

| 08:00 | EUR | Eurozone Current Account (EUR) Apr | 22.2B | 31.3B | 34.1B | 35.7B |

| 12:30 | CAD | Wholesale Sales M/M Apr | 1.00% | 0.50% | 0.90% | 1.20% |

| 12:30 | USD | Current Account (USD) Q1 | -116.8B | -124B | -112B | -114.0B |