Global markets stage a strong rebound today with help from talk of global stimulus. China has already indicated that it will reform rate system to lower lending cost. There were also talks that Germany is considering stimulus measures. Markets response well to US decision to delay Huawei sanctions for another 90 days. In the currency markets, Swiss Franc is the weakest one for today so far, followed by Sterling and Yen. Euro is the strongest, followed by Canadian and then Dollar.

Technically, Euro recovers generally today, including against Swiss Franc. But there is no clear sign of bottoming in the common currency. Near term levels to watch including 1.1130 minor resistance in EUR/USD, 0.9194 in EUR/GBP, 1.0922 in EUR/CHF. As long as these levels hold, further decline is still in favor. Meanwhile, Sterling’s recovery stays to lose momentum. It’s still a bit far, but 1.2014 support in GBP/USD and 126.54 support in GBP/JPY are the focuses. Break will resume recent decline.

In Europe, FTSE is up 1.18%. DAX is up 1.47%. CAC is up 1.37%. German 10-yer yield is up 0.044 at -0.640. Earlier in Asia, Nikkei rose 0.71%. Hong Kong HSI rose 2.17%. China Shanghai SSE rose 2.10%. Singapore Strait Times rose 0.43%. Japan 10-year JGB yield rose 0.0065 to -0.23.

US Commerce Department extends Huawei reprieve for another 90 days

US Commerce Secretary Wilbur Ross said that China’s tech giant Huawei will be granted another 90 days delay to the implementation of penalty. He told Fox Business Network that “It is another 90 days for the U.S. telecom companies. Some of the rural companies are dependent on Huawei. So we’re giving them a little more time to wean themselves off. But no specific licenses are being granted for anything.” The next deadline is roughly November 19.

Ross also said that 46 more Huawei subsidiaries were added to the Entity list. And, “we now have more than 100 subsidiaries on the Entity List,” he said, explaining that “adding more entities makes it more difficult for Huawei to get around the sanctions.”

US President Donald Trump indicated he’s not ready to do business with China’s tech giant Huawei yet. He said “at this moment it looks much more like we’re not going to do business… because it is a national security threat and I really believe that the media has covered it a little bit differently than that.”

Bundesbank: Economic activity could decline slightly in the current quarter

Germany’s Bundesbank noted in its monthly report that “economic output fell slightly” in Q2, referring to the -0.1% qoq GDP contraction. And, “economic activity could also decline slightly in the current quarter”. The downturn in industry “is not yet apparent” and this may also “gradually affect some service sectors.”

But President Jens Weidmann still noted that “domestic economy is still doing well”. And, “the weakness has so far been concentrated on industry and exports”. He added that important reasons for the slowdown are the “international trade conflicts and the Brexit ”

The reported also noted that falling demand abroad has increased the downturn. In particular, exports to the UK were weak in spring, due to original Brexit date of March. The large purchases from UK in winter months resulted in counter-movement in spring. Additionally, with exports “slumping sharply”, and “given the declining capacity utilization and subdued manufacturing outlook, companies are likely to hold back on investment in new equipment and facilities.”

Further, construction investment had also declined. Private consumption should have been only slightly above the level of the strong previous quarter. Only public consumption could have supported the economy significantly.

Muller: Inflation is far from target, ECB needs to further boost the economy

ECB Governing Council member Madis Muller warned today that “inflation is far from our target of almost 2%”. Thus, “that the central bank has to further boost the economy.” He added that the Governing Council will “discuss this at its mid-September meeting”.

His comments were in-line with another Governing Council member Olli Rehn’s. Rehn noted last week that “there is a certain weakening of the economic outlook for Europe in the last couple of months”. And, the backdrop “justifies taking further action in monetary policy, as we intend to do in September.”

Eurozone CPI finalized at 1.0%, core CPI at 0.9%

Eurozone CPI was finalized at 1.0% yoy in July, revised down from 1.1% yoy, down from June’s 1.3% yoy. CPI core was finalized at 0.9% yoy, unchanged from flash estimate and June’s figure. The highest contribution to the annual euro area inflation rate came from services (0.53%), followed by food, alcohol & tobacco (0.37%), non-energy industrial goods (0.08%) and energy (0.05%).

In EU, annual inflation slowed to 1.4% yoy, down from 1.6% yoy. The lowest annual rates were registered in Portugal (-0.7%), Cyprus (0.1%) and Italy (0.3%). The highest annual rates were recorded in Romania (4.1%), Hungary (3.3%), Latvia and Slovakia (both 3.0%). Compared with June, annual inflation fell in fifteen Member States, remained stable in two and rose in eleven.

Also released, Eurozone current account surplus narrowed to EUR 18.4B in June, missed expectation of EUR 32.2B.

UK Johnson to discuss foreign policy, security and Brexit with German Merkel and French Macron

UK Prime Minister Boris Johnson is set to visit French President Emmanuel Macron and German Chancellor Angela Merkel this week. His spokesperson said that “Ahead of the G7, the prime minister believes it is important to speak to the leaders of France and Germany to deliver the message that he has been setting out through the phonecalls he’s had with leaders and face to face.”

And, she added, “it is likely they will discuss other issues: foreign policy issues, security issues and so on, but clearly Brexit will form a key part of both bilateral meetings.” However, she also reiterated that there will be no formal negotiations on Brexit until the EU dropped the Irish backstop in the withdrawal agreement.

On the other hand, European Commission spokesperson Natasha Bertaud warned that no-deal Brexit will “obviously cause significant disruption both for citizens and for businesses and this will have a serious negative economic impact:. And, “that would be proportionally much greater in the United Kingdom than it would be in the EU 27 states.” She also repeated President Jean-Claude Juncker’s comment that “it is the British who will unfortunately be the biggest losers”. if it came to a no-deal Brexit.

USD/CHF Mid-Day Outlook

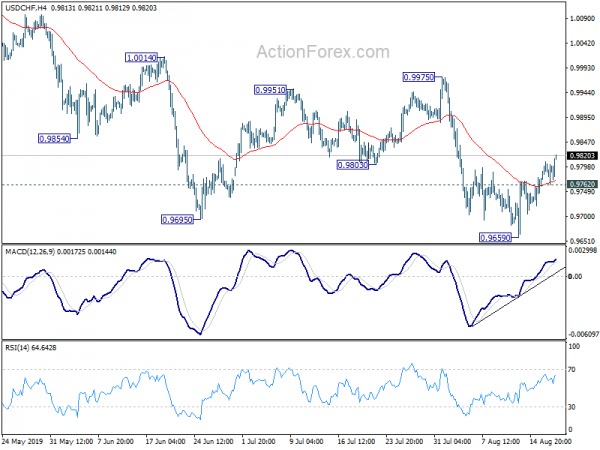

Daily Pivots: (S1) 0.9759; (P) 0.9784; (R1) 0.9809; More…

USD/CHF’s rebound from 0.9762 extends to as high as 0.9821 so far today. Intraday bias remains on the upside for 55 day EMA (now at 0.9861). Sustained break will target 0.9975 resistance. On the downside, break of 0.9762 minor support will turn bias back to the downside for 0.9659 low instead.

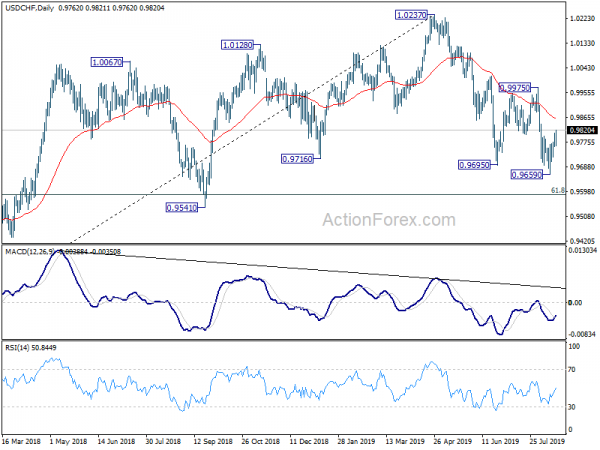

In the bigger picture, up trend from 0.9186 (2018 low) should have completed at 1.0237 already. Deeper decline would be seen to 61.8% retracement of 0.9186 to 1.0237 at 0.9587 and below. For now, USD/CHF is seen as in long term range pattern between 0.9186 and 1.0342. Hence, we’d pay attention to bottoming signal below 0.9587. Nevertheless, break of 0.9975 resistance is needed to indicate completion of the decline from 1.0237. Otherwise, risk will stay on the downside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Input Q/Q Q2 | 0.30% | -0.60% | -0.90% | |

| 22:45 | NZD | PPI Output Q/Q Q2 | 0.50% | -0.40% | -0.50% | |

| 23:01 | GBP | Rightmove House Prices M/M Aug | -1.00% | -0.20% | ||

| 23:50 | JPY | Trade Balance (JPY) Jul | -0.13T | -0.15T | -0.01T | -0.03T |

| 8:00 | EUR | Eurozone Current Account (EUR) Jun | 18.4B | 32.2B | 29.7B | |

| 9:00 | EUR | Eurozone CPI M/M Jul | -0.50% | -0.40% | 0.20% | |

| 9:00 | EUR | Eurozone CPI Y/Y Jul F | 1.00% | 1.10% | 1.30% | |

| 9:00 | EUR | Eurozone CPI Core Y/Y Jul F | 0.90% | 0.90% | 0.90% |