Risk aversion stays in Asia after the -3% crash in Dow overnight. More importantly, treasury yields took another dive on recession fears. US 30-year yield even drops through 2% handle in Asia and hit as low as 1.964. In the currency markets, though, Australian Dollar rises generally after better than expected job data. New Zealand and Canadian Dollar shrug risk aversion and recover generally. At this time of writing, Sterling and Dollar are among the weakest for today, awaiting important data ahead.

Technically, 1.1133 minor support in EUR/USD is a key focus today. Firm break there should indicate completion of rebound from 1.1026 and larger down trend might be resuming. Ideally, that should be accompanied by firm break of 1.0841 in EUR/CHF to confirm over weakness in Euro. Yen crosses will also be eyeing recent lows, in particular 105.04 in USD/JPY, 117.51 in EUR/JPY and 126.54 in GBP/JPY.

In Asia, currently, Nikkei is down -1.46%. Hong Kong HSI is down -0.17%. China Shanghai SSE is down -0.62%. Singapore Strait Times is down -1.49%. Japan 10-year JGB yield is down -0.0183 at -0.238. Overnight, DOWN dropped -3.05%. S&P 500 dropped -2.93%. NASDAQ dropped -3.02%. 10-year yield dropped -0.099 to 1.488.

Trump puts human rights in Hong Kong as precondition to China trade deal

US President Donald Trump appeared to be putting human rights condition in Hong Kong as a prerequisite of a trade deal with China. He tweeted that “Of course China wants to make a deal. Let them work humanely with Hong Kong first!” Trump repeated his usual praise of Chinese President Xi Jinping as a “great leader”, and a good man in a “tough business. He even said he has “ZERO doubt” Xi wanted to “quickly and humanely” solve the Hong Kong problem. And he even called Xi for a “personal meeting” on the issue.

Trump’s comment came after State Department spokeswoman said US was “deeply concerned” about reports of paramilitary movements along the Hong Kong border. Additionally, she urged the Hong Kong government to respect “freedoms of speech and peaceful assembly”. She also noted that recent protests reflected “broad and legitimate concerns about the erosion of Hong Kong’s autonomy.” Further, “the continued erosion of Hong Kong’s autonomy puts at risk its long-established special status in international affairs,” she said.

US House Speaker Nancy Pelosi also issued a statement earlier this week, warning: “The escalating violence and use of force perpetrated against the Hong Kong protestors is extremely alarming. The pro-Beijing Chief Executive and the Hong Kong police forces must immediately cease the aggression and abuse being perpetrated against their own people.

UN Human Rights Office also said in a statement that there were “credible evidence of law enforcement officials employing less-lethal weapons in ways that are prohibited by international norms and standards” in handing the protests in Hong Kong that lasted for more than two months. For example, “officials can be seen firing tear gas canisters into crowded, enclosed areas and directly at individual protesters on multiple occasions, creating a considerable risk of death or serious injury.”. UNHR also urged the Hong Kong Government to ensure “response by law enforcement officials to any violence that may take place is proportionate and in conformity with international standards on the use of force, including the principles of necessity and proportionality.”

RBA Debelle: Technology dispute could have larger impacts than tariffs

RBA Deputy Governor Guy Debelle said in a speech today that the direct effects of US-China tariffs “has not been all that large”. However, the larger impact has been the uncertainty generated by the dispute. The uncertainty takes “two forms”. Firstly, there was uncertainty about the “size and incidence” of tariffs. Secondly, it’s unsure how “technology dispute” will be resolved.

Debelle also warned that “it is plausible that the effect of the technology dispute will be larger than that of the tariffs” And, “the technology dispute raises the possibility that any business involved in the technology production chain will have to choose between East and West rather than selling into a global market.”

Also, he said current trade dispute would have a “large and long-lasting impact” on the “system of rules-based trade”. And, “The China–US dispute casts serious doubt on that. We can also see that manifest in the US–Europe trade issues, as well as those between South Korea and Japan.” Also, “trade is being used as the bargaining tool of choice, including for issues that don’t have much to do with trade.”

Australia added 41.1k jobs, but unemployment rate stuck at 5.2%

Australia employment grew 41.1k in July, well above expectation of 14.2k. Full-time jobs rose 34.5k while part time jobs rose 6.7k. Unemployment rate was steady at 5.2%, matched expectations. Participation rate rose 0.1% to 66.1%.

In seasonally adjusted terms, the largest increases in employment were in Queensland (up 19.9), New South Wales (up 13.0k), and Victoria (up 3.6k). The largest decrease was in Western Australia (down -4.2k). Unemployment rate increased in South Australia (up 0.9 pts to 6.9%) and Western Australia (up 0.2 pts to 5.9%), Decreases were recorded in Tasmania (down -0.8 pts to 6.0%), New South Wales (down -0.2 pts to 4.4%) and Queensland (down -0.1 pts to 6.4%), with Victoria recording no change.

The better than expected job growth should keep RBA on sideline in September. However, unemployment continues to be stuck at 5.2%. There is no sign of falling towards RBA’s natural rate of 4.5%. The central bank will still need more easing ahead to push down unemployment rate so as to push up inflation to target.

Also from Australian, consumer inflation expectation rose to 3.5$ in August, up from 3.2%.

Looking ahead

UK retail sales is the major focus in European session. Swiss will release PPI. Later in the day, a long list of US economic data will be released. Retail sales will catch most attention. But Empire state manufacturing, Philly Fed survey, industrial production and jobless could also be market moving. Non-farm productivity, NAHB housing index and business inventories will also be featured.

AUD/USD Daily Outlook

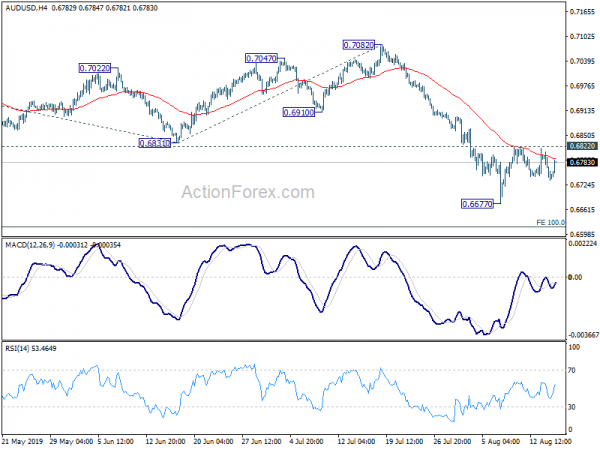

Daily Pivots: (S1) 0.6720; (P) 0.6764; (R1) 0.6793; More…

AUD/USD is staying in consolidation from 0.6677 and intraday bias remains neutral first. On the upside, break of 0.6822 will extend the rebound. But upside should be limited below 0.6910 support turned resistance to bring fall resumption. On the downside, break of 0.6677 will target 100% projections of 0.7295 to 0.6831 from 0.7082 at 0.6618.

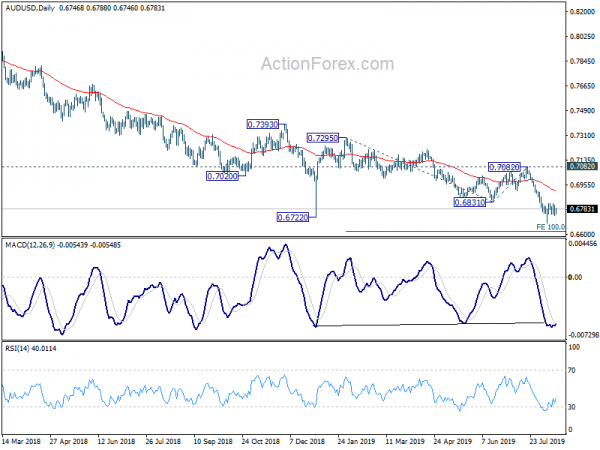

In the bigger picture, decline from 0.8135 (2018 high) is seen as resuming the long term down trend from 1.1079 (2011 high). Firm break of 0.6826 (2016 low) should confirm this bearish view. Further fall should be seen to 0.6008 (2008 low) next. On the upside, break of 0.7082 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:00 | AUD | Consumer Inflation Expectation Aug | 3.50% | 3.20% | ||

| 1:30 | AUD | Employment Change Jul | 41.1K | 14.2K | 0.5K | |

| 1:30 | AUD | Unemployment Rate Jul | 5.20% | 5.20% | 5.20% | |

| 4:30 | JPY | Industrial Production M/M Jun F | -3.30% | -3.60% | -3.60% | |

| 6:30 | CHF | Producer & Import Prices M/M Jul | -0.20% | -0.50% | ||

| 6:30 | CHF | Producer & Import Prices Y/Y Jul | -1.70% | -1.40% | ||

| 8:30 | GBP | Retail Sales Inc Auto Fuel M/M Jul | -0.20% | 1.00% | ||

| 8:30 | GBP | Retail Sales Inc Auto Fuel Y/Y Jul | 2.50% | 3.80% | ||

| 8:30 | GBP | Retail Sales Ex Auto Fuel M/M Jul | -0.20% | 0.90% | ||

| 8:30 | GBP | Retail Sales Ex Auto Fuel Y/Y Jul | 2.30% | 3.60% | ||

| 12:30 | CAD | ADP Employment July | 30.4K | |||

| 12:30 | USD | Nonfarm Productivity Q2 P | 1.40% | 3.40% | ||

| 12:30 | USD | Unit Labor Costs Q2 P | 1.80% | -1.60% | ||

| 12:30 | USD | Empire State Manufacturing Aug | 1.9 | 4.3 | ||

| 12:30 | USD | Philadelphia Fed Business Outlook Aug | 10 | 21.8 | ||

| 12:30 | USD | Retail Sales Advance M/M Jul | 0.30% | 0.40% | ||

| 12:30 | USD | Retail Sales Ex Auto M/M Jul | 0.40% | 0.40% | ||

| 12:30 | USD | Initial Jobless Claims (AUG 10) | 212K | 209K | ||

| 13:15 | USD | Industrial Production M/M Jul | 0.10% | 0.00% | ||

| 13:15 | USD | Capacity Utilization Jul | 77.80% | 77.90% | ||

| 14:00 | USD | NAHB Housing Market Index Aug | 66 | 65 | ||

| 14:00 | USD | Business Inventories Jun | 0.10% | 0.30% | ||

| 14:30 | USD | Natural Gas Storage | 55B |