Risk aversion quickly comes back to the market as German data suggests that the economy is on the edge of recession. Major European indices are trading in deep red and German 10-year yield also hit new record low at -0.649. Sentiments are further weighed down by US Commerce Secretary Wilbur Ross’ comments, which suggested that tariff delay on China was merely for avoiding Christmas seasons disruption. At the time of writing, Yen is the strongest one for today followed by Swiss Franc. Commodity currencies are weakest as led by Australian Dollar.

Technically, near term outlook of USD/JPY, EUR/JPY and GBP/JPY remain bearish with 107.09, 119.87 and 130.06 minor resistance levels intact. Focuses are back on 105.04, 117.51 and 126.54 temporary lows respectively. Break will resume recent declines. AUD/USD seems to be rejected by 0.6822 minor resistance deeper fall today would put focus on 0.6677 temporary low. Also, USD/CAD is heading back to 1.3345 resistance and break will resume recent rebound from 1.3016.

In Europe, currently, FTSE is down -1.31%. DAX is down -1.94%. CAC is down -1.80%. German 10-year yield is down -0.032 at -0.637. Earlier in Asia, Nikkei rose 0.98%. Hong Kong HSI rose 0.08%. China Shanghai SSE rose 0.42%. Singapore Strait Times rose 0.03%. Japan 10 year JGB yield rose 0.133 to -0.22.

US Ross: Tariff delays not quid pro quo with China

US Commerce Secretary Wilbur Ross told CNBC that the tariff delay decision were not a trade ‘quid pro quo’ with China. He referred to the delay in 10% tariffs on some Chinese imports until December 15. Instead, it’s just because “nobody wants to take any chance of disrupting the Christmas season”. Ross added that “we’ve been doing analysis since the hearings were announced by the USTR”. And, “even though they were only announced as being imposed recently, the analytical work began well before that.”

German GDP contracted -0.1% in Q2, 10-year yield hits new record low

German GDP contracted -0.1% qoq in Q2, matched expectations. There were positive contributions from domestic demand, with growth in household final consumption and government final consumption. However, gross fixed capital formation in construction declined. Additionally, development of foreign trade slowed down economic growth because exports recorded a stronger quarter-on-quarter decrease than imports.

Germany Altmaier said can avoid recession with right measures, but government said no need

German Economy Minister Peter Altmaier warned that the -0.1% contraction in Q2 GDP was a “wake-up call and a warning signal”. He added that “the smouldering trade conflict is taking its toll — and export-focused German industry is feeling it especially keenly”.

Altmaier also emphasized “We are in a phase of economic weakness but not yet in recession. We can avoid that if we take the right measures.” However, Chancellor Angel Merkel’s spokesman said “the government does not currently see any need for further measures to stabilize the economy – the fiscal policy of the German government is already expansive.”

Eurozone GDP grew 0.2% in Q2, employment rose 0.2%

Eurozone GDP grew 0.2% qoq in Q2, unchanged from Q1, matched expectations. Annually, GDP rose 1.1%. For EU 28, GDP grew 0.2% qoq, 1.3% yoy. Eurozone employment rose 0.2% qoq, below expectation of 0.3%. EU28 employment rose 0.2% qoq.

Also released, Eurozone industrial production dropped -1.6% mom in May, worse than expectation of -1.4% mom. Production of capital goods fell by 4.0%, non-durable consumer goods by 2.8%, durable consumer goods by 1.2%,intermediate goods by 0.8% and energy by 0.2%

UK CPI rose to 2.1%, core CPI rose to 1.9%

UK CPI accelerated to 2.1% yoy in July, up from 2.0% yoy and beat expectation of 1.9% yoy. Core CPI also rose to 1.9% yoy, up from 1.8% yoy and beat expectation of 1.8% yoy. Also from UK, RPI slowed to 2.8% yoy, down from 2.9% yoy, matched expectations.

PPI input rose 0.9% mom, 1.3% yoy, above expectation of 0.6% mom, 0.3% yoy. PPI output rose 0.3% mom, 1.8% yoy, above expectation of 0.1% mom, 1.7% yoy. PPI output core rose 0.4% mom, 2.0% yoy, above expectation of 0.1% mom, 1.7% yoy. House price index rose 0.9% yoy in June, down from 1.2% yoy, missed expectation of 1.0% yoy.

China industrial production slowed to 4.8%, lowest in 17 year, other data missed too

China’s economic data surprised to the downside in July. Industrial production gained 4.8% y/y in July, missing consensus of 5.8% and June’s 6.3%. The slowdown is the most severe since February 2009 and caught the market in surprise. Manufacturing PMIs compiled by government and Markit/ Caixin showed upticks in July, despite staying the contractionary territory.

Looking into details of the IP report, auto output declined -4.4%, worsening from -2.5% in July, while output growth in general equipment, and computers, communications and other electronic equipment weakened significantly. Moderation in Chinese exports should continue to weigh on IP in coming months.

Also released, retail sales grew 7.6% yoy, down from 9.8% yoy and missed expectation of 8.6% yoy. Fixed assets investment ex rural grew 5.7% yoy, down from 5.8% yoy and missed expectation of 5.9% yoy. Surveyed unemployment rate rose from 5.1% to 5.3%.

More in Chinese Data Surprised to Downside in July. Tariff Delay Won’t Help Arrest Slowdown

Australia Westpac Consumer Confidence rose 3.6%, superficially a surprise

Australia Westpac Consumer Confidence rose 3.6% to 100 in August, up from 96.5. Westpac said: “Superficially this result comes as somewhat of a surprise given that the survey was conducted against a turbulent backdrop with global financial markets roiled by escalating trade tensions between the US and China, the ASX down 3.4% and the AUD off 3¢ US since the July survey.” However, it’s came in the “aftermath” of the unexpected -4.7% fall in July, despite back-to-back RBA rate cuts. Also, there was political certainty restoration following the May Federal election.

Regarding RBA, Westpac expects the central bank to stand page in September, before delivering another -25bps rate cut in October. Also, there wold be a final -25bps move to take Cash Rate to 0.50% in February. Westpac noted that the “signals from the RBA are quite clear”. And, In its recent Statement on Monetary Policy the RBA lowered its forecasts for inflation, wages and growth, while lifting its forecasts for the unemployment rate. Those forecasts were despite basing them on the technical assumption of adopting market pricing, which anticipates two more rate cuts.

Australia wage price index rose 3.6% qoq, on the back of strong public sector growth

Australia Wage Price Index rose 3.6% qoq in Q2, but couldn’t reverse the -4.1% fall in Q1. Annually, Wage Price Index rose 2.3% yoy comparing to Q2 2018. ABS Chief Economist, Bruce Hockman said: “Wage growth continues at a steady rate in the Australian economy on the back of strong public sector growth over the quarter. The most significant contribution to wage growth this quarter came from the public sector component of the health care and social assistance industry, where a number of large increases were recorded in Victoria under a plan to ensure wage parity with other states.”

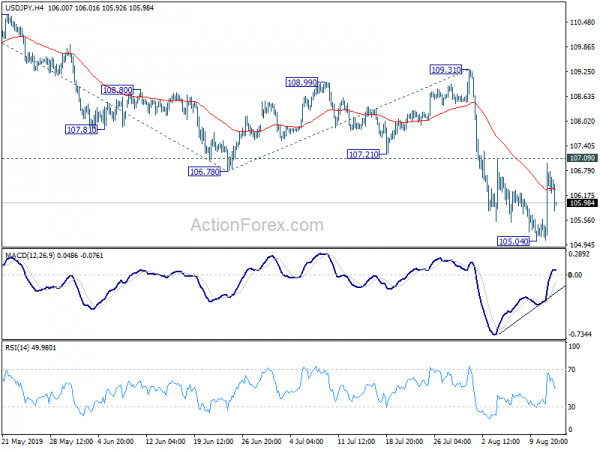

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 105.55; (P) 106.26; (R1) 107.46; More…

Intraday bias in USD/JPY remains neutral at this point. Also, with 107.09 minor resistance intact, further decline is in favor. On the downside, break of 105.04 will resume larger decline from 112.40 to 104.69 low. Break will target 100% projection of 112.40 to 106.78 from 109.31 at 103.69. On the upside, though, break of 107.09 resistance will indicate short term bottoming. In this case, stronger rebound would be seen back to 55 day EMA (now at 107.94).

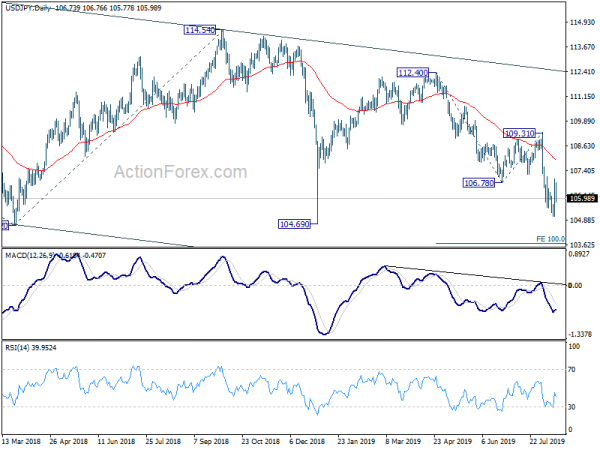

In the bigger picture, decline from 118.65 (Dec 2016) is still in progress and the pair is staying well inside long term falling channel. Break of 104.62 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. In any case, break of 112.40 is needed to the first serious sign of medium term bullishness. Otherwise, further decline will remain in favor in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machine Orders M/M Jun | 13.90% | -1.00% | -7.80% | |

| 00:30 | AUD | Westpac Consumer Confidence Aug | 3.60% | -4.10% | ||

| 01:30 | AUD | Wage Price Index Q/Q Q2 | 0.60% | 0.50% | 0.50% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Jul | 5.70% | 5.90% | 5.80% | |

| 02:00 | CNY | Industrial Production Y/Y Jul | 4.80% | 6.00% | 6.30% | |

| 02:00 | CNY | Retail Sales Y/Y Jul | 7.60% | 8.60% | 9.80% | |

| 02:00 | CNY | Surveyed Jobless Rate Jul | 5.30% | 5.10% | ||

| 06:00 | EUR | German GDP Q/Q Q2 P | -0.10% | -0.10% | 0.40% | |

| 08:30 | GBP | CPI M/M Jul | 0.00% | -0.10% | 0.00% | |

| 08:30 | GBP | CPI Y/Y Jul | 2.10% | 1.90% | 2.00% | |

| 08:30 | GBP | Core CPI Y/Y Jul | 1.90% | 1.80% | 1.80% | |

| 08:30 | GBP | RPI M/M Jul | 0.00% | 0.00% | 0.10% | |

| 08:30 | GBP | RPI Y/Y Jul | 2.80% | 2.80% | 2.90% | |

| 08:30 | GBP | PPI Input M/M Jul | 0.90% | 0.60% | -1.40% | -0.80% |

| 08:30 | GBP | PPI Input Y/Y Jul | 1.30% | 0.30% | -0.30% | 0.30% |

| 08:30 | GBP | PPI Output M/M Jul | 0.30% | 0.10% | -0.10% | |

| 08:30 | GBP | PPI Output Y/Y Jul | 1.80% | 1.70% | 1.60% | |

| 08:30 | GBP | PPI Output Core M/M Jul | 0.40% | 0.10% | 0.10% | |

| 08:30 | GBP | PPI Output Core Y/Y Jul | 2.00% | 1.70% | 1.70% | |

| 08:30 | GBP | House Price Index Y/Y Jun | 0.90% | 1.00% | 1.20% | 0.90% |

| 09:00 | EUR | Eurozone Industrial Production M/M Jun | -1.60% | -1.40% | 0.90% | |

| 09:00 | EUR | Eurozone Employment Q/Q Q2 P | 0.20% | 0.30% | 0.30% | 0.40% |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | Import Price Index M/M Jul | 0.20% | -0.10% | -0.90% | |

| 14:30 | USD | Crude Oil Inventories | -2.5M | 2.4M |