Sterling is back under pressure again in early US session and is trading as the weakest for today. Prime Minister Boris Johnson urged MPs to keep the promise to people an deliver Brexit on October 31. At the same time Financial Times reported that Johnson, if loses a confidence vote in the parliament, would delay general election after Brexit date. Staying in the currency markets, Australian and New Zealand Dollar recover generally after Chinese data stabilizes market sentiments. Swiss Franc is following Sterling as second weakest, then Dollar.

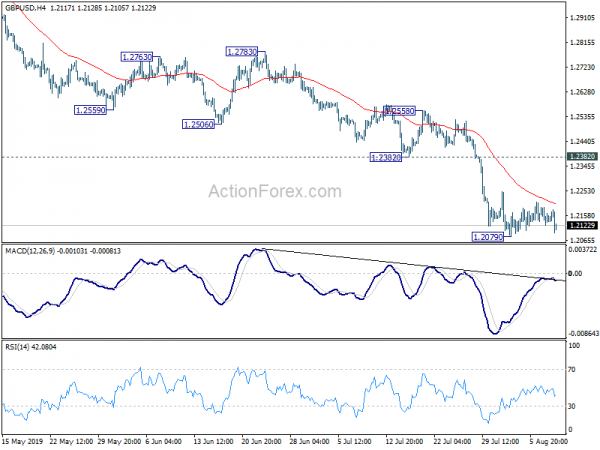

Technically, EUR/GBP’s rally extends after brief consolidation and is on track to 0.9305 key resistance. GBP/USD and GBP/JPY will be the focus in US session. GBP/USD is eyeing 1.2079 again while GBP/JPY is heading back to 128.11 temporary low. Break of these level will solidify selling momentum in the Pound for further broad-based declines.

In Europe, currently, FTSE is up 0.62%. DAX is up 0.88%. CAC is up 1.42%. German 10-year yield is up 0.0404 at -0.542. Earlier in Asia, Nikkei rose 0.37%. Hong Kong HSI rose 0.48%. China Shanghai SSE rose 0.93%. Singapore Strait Times dropped -0.49%. Japan 10-year JGB yield rose 0.005 to -0.191.

US initial jobless claims dropped -8k to 209k

US initial jobless claims dropped -8k to 209k in the week ending August 3, below expectation of 217k. Four week moving average of initial claims rose 0.25k to 212.25k. Continuing claims dropped -15k to 1.684m. Four-week moving average of continuing claims dropped -11k to 1.687m.

From Canada, new housing price index dropped -0.1% mom in June versus expectation 0.0% mom.

ECB: Growth softens on weak global trade and prolonged uncertainties

In ECB’s monthly economic bulletin, it’s noted the recent data and survey results suggest “somewhat weaker growth” in Q2 and Q3. The softening of growth can be ” primarily attributed to weak global trade and the prolonged presence of uncertainties.

The Governing Council underlined the need for “highly accommodative” monetary policy stance for a “prolonged period of time”. And if medium-term inflation outlook continues to fall short, ECB is “determined to act”, in line with the commitment to “symmetry” in inflation target.

ECB also reiterated it “stands ready” to adjust all of its instruments”. And the Governing Council has tasked the relevant Eurosystem Committees with examining options, including ways to reinforce forward guidance on policy rates, mitigating measures such as the design of a tiered system for reserve remuneration, and options for the size and composition of potential new net asset purchases.

Bank of Franc MIBA suggests 0.3% GDP growth in Q3

As noted in the latest Bank of France Business Survey report, the monthly index of business activity suggests that the country’s GDP would growth 0.3% in Q3.

Manufacturing industry business sentiment indicator stood at 95. Industrial production rose “moderately” and staff levels were “stable”. Activity is expected to continue to grow at the same pace in August.

Services business sentiment indicator stood at 100. Service sector activity “picked up slightly” and is expected to continue to growth at same pace in August.

In construction, the business sentiment indicator stood at 104. Construction sector activity bounced back, both in structural and finishing works. Construction sector growth is expected to “return towards its long-term average in August.”

RBNZ Hawkesby: Next rate move depends on global environment

RBNZ Assistant Governor Christian Hawkesby said in an interview that, after yesterday’s 50bps rate cut, “we’ve got a more balanced outlook for the OCR now”. However, he added, “even within those projections there’s some probability in there that we will need to reduce the OCR from where it is at the moment.”

Hawkesby explained that markets have already priced in a smaller 25bps before yesterday’s announce. And the New Zealand Dollar faced downward pressure after the decision, which could give an extra boost to exports. He added “it’s all part of the story of us getting back to our targets.” He hoped that the larger cut could help avoid further policy easing. But RBNA is “complete” open to use negative interest rates and other unconventional tools if necessary.

The main consideration for any next move is on global outlook. He said, “the obvious one is the global environment where we feel like the risks are tilted to the downside, and that was one of the factors that prompted us to ease with the 50 basis points this time around.”

China exports rose 3.3% in July, imports dropped -5.6%, better than expectations

China’s trade data came in better than expected and helped stabilize market sentiments. At least there was recovery in exports in July while imports contracted less than expected. Total trade with US continued to show contraction, with year-to-July trade dropped -13.4% yoy. Imports from US also contracted -28.3% yoy. On the other hand, total trade with EU grew 4.6% yoy from January to July, with exports increased 6.1% yoy and import increased 2.3% yoy. Nevertheless, the real tests will come later in the year as US tariffs on USD 300B in Chinese goods take effect on September 1.

In July, in USD terms: Total trade dropped -0.8% yoy to USD 398.0B. Exports rose 3.3% yoy to USD 221.5B, above expectation of -0.2% yoy. Imports dropped -5.6% yoy to USD 176.5B, above expectation of -8.8% yoy. Trade surplus narrowed to USD 45.0B, down from June’s 51.0B but beat expectations of USD 44.2B.

Year-to-day from January to July: Total trade dropped -1.8% yoy to USD 2559.5B. Exports rose 0.6% to USD 1392.6B. Imports dropped -4.5% to 1166.9B. Trade surplus was at USD 255.7B.

Year-to-day from January to July, with EU: Total trade rose 4.6% yoy to USD 400.2B. Exports rose 6.1% yoy to USD 241.1B. Imports rose 2.3% yoy to USD 159.1B. Trade surplus was at USD 82.1B.

Year-to-day from January to July, with US: Total trade dropped -13.4% yoy to USD 308.0B. Exports dropped -7.8% yoy to USD 238.3B. Imports dropped -28.3% yoy to USD 69.8B. Trade surplus was at USD 168.5B.

Year-to-day from January to July, with AU: Total trade rose 7.7% yoy to USD 94.6B. Exports rose 1.9% yoy to USD 26.2B. Imports rose 10.0% to USD 68.5B. Trade deficit was at USD 42.3B.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2112; (P) 1.2152; (R1) 1.2182; More…

GBP/USD weakens in early US session but stays above 1.2079 temporary low. Intraday bias remains neutral first. In case of stronger recovery, upside should be limited by 1.2382 support turned resistance to bring fall resumption. On the downside, break of 1.2079 will target 1.1946 low. Break will target 100% projection of 1.4376 to 1.2391 from 1.3381 at 1.1396.

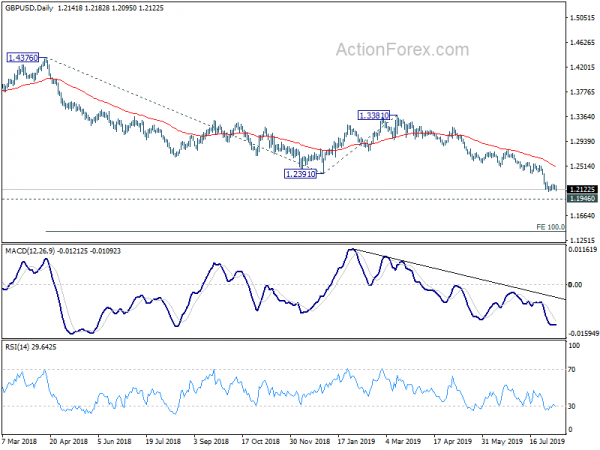

In the bigger picture, down trend from 1.4376 (2018 high) is extending towards 1.1946 low. We’d be cautious on bottoming there. But decisive break will resume down trend from 2.1161 (2007 high) to 61.8% projection of 1.7190 to 1.1946 from 1.4376 at 1.1135. In any case, medium term outlook will stay bearish as long as 1.3381 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS House Price Balance Jul | -9.00% | -1.00% | -1.00% | |

| 23:50 | JPY | Housing Loans Y/Y Q2 | 2.30% | 2.40% | 2.40% | |

| 23:50 | JPY | Current Account (JPY) Jun | 1.94T | 1.76T | 1.31T | |

| 03:05 | CNY | Trade Balance (CNY) Jul | 310.26b | 309.51b | 345.18b | |

| 03:05 | CNY | Imports Y/Y (CNY) Jul | 0.40% | -3.30% | -0.40% | |

| 03:05 | CNY | Exports Y/Y (CNY) Jul | 10.30% | 10.60% | 6.10% | |

| 03:05 | CNY | Trade Balance (USD) Jul | $45.06b | $44.23b | $50.98b | |

| 03:05 | CNY | Imports (USD) Y/Y Jul | -5.60% | -8.80% | -7.30% | |

| 03:05 | CNY | Exports (USD) Y/Y Jul | 3.30% | -0.20% | -1.30% | |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 12:30 | CAD | New Housing Price Index M/M Jun | -0.10% | 0.00% | -0.10% | |

| 12:30 | USD | Initial Jobless Claims (AUG 3) | 209K | 217K | 215K | 217K |

| 14:00 | USD | Wholesale Inventories M/M (JUN F) | 0.20% | 0.20% | ||

| 14:30 | USD | Natural Gas Storage | 65B |