The forex markets are rather quiet today as major pairs and crosses are stuck in consolidations. Better than expected trade data from China gives sentiments a mild boost. But momentum of recovery is very weak so far. Treasury yields are also trying to recover after yesterday’s steep decline. For the week, New Zealand Dollar remains the weakest one, followed by Canadian and then Australia, Euro is the strongest, followed by Swiss Franc and then Yen.

Technically, selloff in Australian Dollar loses some momentum and consolidations would likely be seen first. While Dollar tried to decline versus Swiss Franc and Yen, recoveries are seen in both pairs today. USD/CHF and USD/JPY would engage in some more sideway trading before resuming recent decline. Sterling is gyrating in tight range against Dollar, Euro and Yen too. But then, risk of no-deal Brexit will continue to cap the Pound’s recovery, and more selloff is in favor, sooner rather than later.

In Asia, Nikkei rose 0.50%. Hong Kong HSI is up 0.75%. China Shanghai SSE is up 1.02%. Singapore Strait Times is down -0.42%. Japan 10-year JGB yield is up 0.0013 to -0.195. Overnight, DOW dropped -0.09%. S&P 500 rose 0.08%. NASDAQ rose 0.38%. 10-year yield dropped -0.055 to 1.684.

China exports rose 3.3% in July, imports dropped -5.6%, better than expectations

China’s trade data came in better than expected and helped stabilize market sentiments. At least there was recovery in exports in July while imports contracted less than expected. Total trade with US continued to show contraction, with year-to-July trade dropped -13.4% yoy. Imports from US also contracted -28.3% yoy. On the other hand, total trade with EU grew 4.6% yoy from January to July, with exports increased 6.1% yoy and import increased 2.3% yoy. Nevertheless, the real tests will come later in the year as US tariffs on USD 300B in Chinese goods take effect on September 1.

In July, in USD terms: Total trade dropped -0.8% yoy to USD 398.0B. Exports rose 3.3% yoy to USD 221.5B, above expectation of -0.2% yoy. Imports dropped -5.6% yoy to USD 176.5B, above expectation of -8.8% yoy. Trade surplus narrowed to USD 45.0B, down from June’s 51.0B but beat expectations of USD 44.2B.

Year-to-day from January to July: Total trade dropped -1.8% yoy to USD 2559.5B. Exports rose 0.6% to USD 1392.6B. Imports dropped -4.5% to 1166.9B. Trade surplus was at USD 255.7B.

Year-to-day from January to July, with EU: Total trade rose 4.6% yoy to USD 400.2B. Exports rose 6.1% yoy to USD 241.1B. Imports rose 2.3% yoy to USD 159.1B. Trade surplus was at USD 82.1B.

Year-to-day from January to July, with US: Total trade dropped -13.4% yoy to USD 308.0B. Exports dropped -7.8% yoy to USD 238.3B. Imports dropped -28.3% yoy to USD 69.8B. Trade surplus was at USD 168.5B.

Year-to-day from January to July, with AU: Total trade rose 7.7% yoy to USD 94.6B. Exports rose 1.9% yoy to USD 26.2B. Imports rose 10.0% to USD 68.5B. Trade deficit was at USD 42.3B.

RBNZ Hawkesby: Next rate move depends on global environment

RBNZ Assistant Governor Christian Hawkesby said in an interview that, after yesterday’s 50bps rate cut, “we’ve got a more balanced outlook for the OCR now”. However, he added, “even within those projections there’s some probability in there that we will need to reduce the OCR from where it is at the moment.”

Hawkesby explained that markets have already priced in a smaller 25bps before yesterday’s announce. And the New Zealand Dollar faced downward pressure after the decision, which could give an extra boost to exports. He added “it’s all part of the story of us getting back to our targets.” He hoped that the larger cut could help avoid further policy easing. But RBNA is “complete” open to use negative interest rates and other unconventional tools if necessary.

The main consideration for any next move is on global outlook. He said, “the obvious one is the global environment where we feel like the risks are tilted to the downside, and that was one of the factors that prompted us to ease with the 50 basis points this time around.”

Chance of no-deal Brexit jumped to 35% according latest Reuters poll

According to the median forecast of a Reuters poll, between August 2-7, chance of no-deal Brexit jumped to 35%, up from 30% in July. And forecasts ranged from as low as 15% to as high as 75%. New UK Prime Minister Boris has been rather indecisive regarding his Brexit strategy. Except that, it’s trying to force through a exit on October 31, with or without a deal. And as Brexit uncertainty continues, economists expect GBP/USD to trade between 1.17 and 1.20 before the divorce data. That is, there is a bit more downside in the pair.

Regarding the economy, median chance of recession within a year was put at 35%, up from 30% in July. For the next two years, media chance of recession rose to 40%, up from 35%. However, 24 of 55 economists expected BoE to stand pat this year and next. On the one hand, buoyant wage growth makes it too early for call of a cut. Yet Brexit uncertainty, in whatever form, will make it hard to tighten in the foreseeable future. 12 of 55 economists expected a cut, while 19 expected a hike.

Separately, UK Foreign Minister Dominic Raab said in Washington, at a joint news conference with US Secretary of State Mike Pompeo, “We will manage the risks come what may. We will leave at the end of October and are determined to make a success of it.”

Elsewhere

UK RICS house price balance dropped to -9 in July, below expectation of -1. Japan housing loans rose 2.3% yoy in Q2 versus expectation of 2.4% qoq. Current account surplus widened to JPY 1.94T in June versus expectation of JPY 1.31T.

ECB will release monthly economic bulletin today. Canada will release new housing price index. US will release jobless claims and wholesale inventories.

USD/CAD Daily Outlook

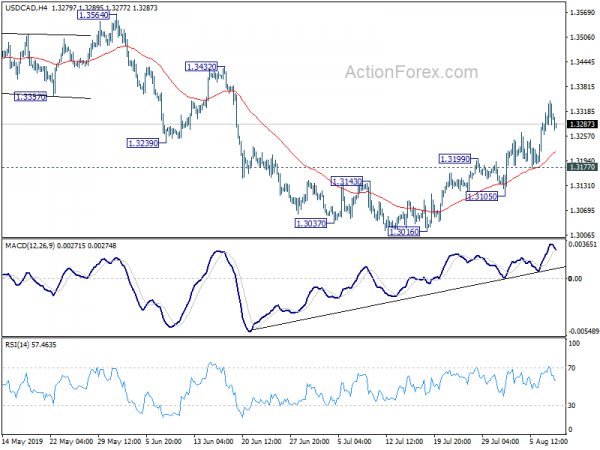

Daily Pivots: (S1) 1.3266; (P) 1.3305; (R1) 1.3343; More…

USD/CAD lost some upside momentum again after hitting 1.3345. But with 1.3177 minor support intact, further rise is expected to 1.3432/3564 resistance zone. On the downside, however, break of 1.3177 support will turn bias back to the downside for retesting 1.3016 low instead.

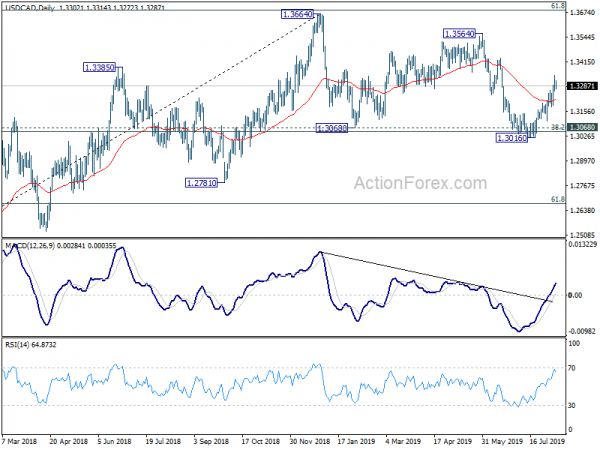

In the bigger picture, focus stays on 1.3068 cluster support (38.2% retracement of 1.2061 to 1.3664 at 1.3052). Decisive break there will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next. Strong rebound from there will retain medium term bullish. But sustained break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685, is needed to confirm resumption of up trend from 1.2061 (2017 low). Otherwise, risk will stay on the downside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS House Price Balance Jul | -9.00% | -1.00% | -1.00% | |

| 23:50 | JPY | Housing Loans Y/Y Q2 | 2.30% | 2.40% | 2.40% | |

| 23:50 | JPY | Current Account (JPY) Jun | 1.94T | 1.76T | 1.31T | |

| 03:05 | CNY | Trade Balance (CNY) Jul | 310.26b | 309.51b | 345.18b | |

| 03:05 | CNY | Imports Y/Y (CNY) Jul | 0.40% | -3.30% | -0.40% | |

| 03:05 | CNY | Exports Y/Y (CNY) Jul | 10.30% | 10.60% | 6.10% | |

| 03:05 | CNY | Trade Balance (USD) Jul | $45.06b | $44.23b | $50.98b | |

| 03:05 | CNY | Imports (USD) Y/Y Jul | -5.60% | -8.80% | -7.30% | |

| 03:05 | CNY | Exports (USD) Y/Y Jul | 3.30% | -0.20% | -1.30% | |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 12:30 | CAD | New Housing Price Index M/M Jun | -0.10% | |||

| 12:30 | CAD | New Housing Price Index Y/Y Jun | 0.10% | 0.00% | ||

| 12:30 | USD | Initial Jobless Claims (AUG 3) | 217K | 215K | ||

| 14:00 | USD | Wholesale Inventories M/M (JUN F) | 0.20% | 0.20% | ||

| 14:30 | USD | Natural Gas Storage | 65B |