Yen strengthens broadly today, mainly follows decline in major benchmark yields. German 10-year yield hit another record low at -0.597. US 10-year yield also breaks 1.7 handle. Yields are pressured after deeper the surprised -50bps cut by RBNZ and expectation of more global central bank easing. Asian stocks ended mixed while European indices recover today. But weakness in US stocks could eventually drag sentiments down again. For now, Swiss Franc is the second strongest, followed by Euro. Meanwhile, commodity currencies are the weakest, led by New Zealand Dollar.

Technically, USD/CAD is picking up upside momentum in early US session and it’s on track for 1.3432 resistance next. GBP/JPY’s recovery from 128.11 temporary low could have completed and break will resume recent decline for 122.36 support next. Both USD/JPY and USD/CHF weaken slightly in early US session. Break of 105.52 and 0.9703 will resume recent declines too.

In Europe, currently, FTSE is up 0.30%. DAX is up 0.51%. CAC is up 0.64%. German 10-year yield is down -0.058 at -0.589. Earlier in Asia, Nikkei dropped -0.33%. Hong Kong HSI rose 0.08%. China Shanghai SSE dropped -0.32%. Singapore Strait Times rose 0.45%. Japan 10-year JGB yield dropped -0.0161 to -0.197.

China’s foreign reserve dropped slightly to USD 3.104T in July

China’s PBoC said that the country’s foreign currency reserves dropped to USD 3.104T in July, down from USD 3.119T. The modest decline suggested that PBoC has refrained from selling foreign exchange directly for currency intervention. And according to economists, China’s capital inflows and outflows are roughly balanced. Thus, there is little need for PBoC to buy of sell foreign currencies.

State Administration of Foreign Exchange spokeswoman Wang Chunying said China’s economy has continued “the overall stable, steady and progressive development trend, and the main macroeconomic indicators have remained within a reasonable range.” Also, ” cross-border capital flows have remained stable. ” Wang also dismissed claim of China as currency manipulator as groundless.

German industrial production dropped -1.5%, much worse than expectation

Germany industrial production dropped -1.5% mom in June, (price, seasonally and calendar adjusted), worse than expectation of -0.5 mom. Production in industry excluding energy and construction was down by -1.8%. Within industry, the production of intermediate goods decreased by -2.0% and the production of capital goods by -1.8%. The production of consumer goods showed a decrease by -1.4%. Outside industry, energy production was down by -1.6% in June 2019 and the production in construction increased by 0.3%.

RBNZ surprises with -50bps cut, hinted on negative rates

RBNZ surprised the market by reducing the OCR, by -50 bps, to 1%. The market had only anticipated a -25 bps cut. The aggressive rate cut is “necessary” to help support employment and inflation in the country as downside risks are growing. Governor Orr also signaled that negative interests are possible as the central bank seeks to boost inflation and the job market. New Zealand dollar slumped as the decision came in much more dovish than expected. We expect further reduction in coming months.

More rate cuts are expected after the aggressive reduction today. At the press conference, Governor Orr signaled that the easing cycle has just started. As he suggested, “it is easily within the realms of possibility that we might have to do negative interest rates”. He added that “probably the single biggest challenge to us is just how low global nominal interest rates are”.

Suggested readings:

- RBNZ Cut Policy Rate by -50 bps, Hinting Negative Interest Rate

- RBNZ: Review Of The August 2019 Monetary Policy Statement

BoJ summary of opinions indicates needs to discuss pre-emptive easing

According to Summary of Opinions of July 29-30 BoJ meeting, some policymakers were clearly concerned with risks to economic outlook. And there were calls for discussions on ideas of ramping up monetary stimulus. Some economists took that as a signal that BoJ could deploy pre-emptive easing measures as soon as at the meeting next month.

In the summary, one member warned that “the BOJ must communicate more clearly its resolve to take additional monetary easing steps without hesitation if the momentum to achieve its price target is under threat”. And, “we must also consider in advance what steps we can take if we were to ease.”

Another member urged to use both interest rates and forward guidance to ease policy further. But there was also voice regarding the need to “assess the benefits and demerits of various monetary easing steps”.

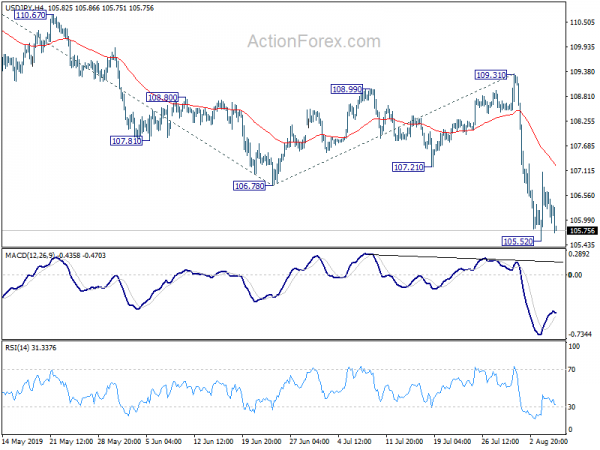

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 105.63; (P) 106.36; (R1) 107.20; More…

USD/JPY weakens today but stays above 105.52 temporary low. Intraday bias remains neutral first and more consolidation could be seen. But upside should be limited well below 109.31 resistance to bring fall resumption. On the downside, break of 105.52 will target 104.69 low next.

In the bigger picture, decline from 118.65 (Dec 2016) not completed yet, with the pair staying inside long term falling channel. Break of 104.62 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. In any case, break of 112.40 is needed to the first serious sign of medium term bullishness. Otherwise, further decline will remain in favor in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Jul | 39.1 | 43 | ||

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 1:30 | AUD | Home Loans M/M Jun | -0.90% | 0.50% | -0.10% | -0.3 |

| 2:00 | NZD | RBNZ Official Cash Rate | 1.00% | 1.25% | 1.50% | |

| 6:00 | EUR | German Industrial Production M/M Jun | -1.50% | -0.50% | 0.30% | 0.10% |

| 7:00 | CHF | Foreign Currency Reserves (CHF) Jul | 768B | 759B | 760B | |

| 14:00 | CAD | Ivey PMI Jul | 52.7 | 52.4 | ||

| 14:30 | USD | Crude Oil Inventories | -8.5M |