Yen’s weakness continue in quiet trading today and trades a touch softer after trade balance release. But overall, the markets are trading in tight range. The only exception is New Zealand Dollar which is resuming this month’s broad based rally ahead of RBNZ rate decision on Thursday. Sterling recovers mildly as Brexit negotiations are finally starting today. Dollar and Euro are mixed. In other markets, gold is trading in tight range between 1250/60 for the moment. WTI crude oil is also range bound below 45 handle.

Brexit negotiation finally starts

UK is set to finally start formal Brexit negotiations with EU in European Commission buildings in Brussels today. UK’s Brexit Secretary David Davis said that there is a "long road ahead" but that will lead to a "deep and special partnership", "a deal like no other in history". He also pledged to approach the difficulties in a "constructive way". The negotiations would start with EU’s top priorities including the divorce bill, rights of citizens and border of Ireland. Meanwhile, EU’s chief negotiator Michel Barnier would report in October this year on whether there are sufficient progress to move on to phase two of trade agreements. And it’s expected that the whole talks would last until October 2018 before making an agreement. Davis and Barnier would be meeting for one week every month and return to their base to develop the positions.

Yen weakens after trade surplus miss

In Japan, trade surplus narrowed to JPY 0.13% in May, below expectation of 0.35T. Export growth was flat monthly at 0.0% mom. But annually, exports jumped 14.9% yoy, highest since 2015. Nevertheless, that was below expectation of 18.2% yoy. It’s also overshadowed by the 0.3% mom, 17.8% yoy rise in imports. Yen trades a touch lower today, accompanying the rise in Asian equities. Nikkei is back above 20000 handle and is trading up 0.6% at the time of writing. Hong Kong HSI is trading up 0.95%. Meanwhile, China SSE composite is up 0.66%.

RBA Lowe expects stronger economy ahead

RBA Governor Philip Lowe said in a speech in Canberra that growth in Australia over the next couple of years will be "a bit stronger than it has been recently". And, the "pick-up in the global economy is helping us". He noted that monetary policy continues to provide support to the economy and "survey-based measures of business conditions have improved noticeably". He also added that "employment growth has also strengthened over recent months." But he also warned that wage growth is "unusually low" and averages hours worked have "declined". Also, the "nature of employment is changing" while there are higher debt levels for households. He emphasized the need to watch these issues carefully.

RBNZ a focus in a light week ahead

The economic calendar is rather light today and the only notable events are speeches of Bundesbank chief Jens Weidmann, New York Fed President William Dudley and Chicago Fed President Charles Evans. Looking ahead, RBNZ rate decision is a key focus this week and it’s expected to keep the OCR unchanged at 1.75%. RBA and BoJ will release meeting minutes while ECB will release monthly economic bulletin. The more important economic data are scheduled to release towards the end of the week, including Canada retail sales and CPI and Eurozone PMIs.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3190; (P) 1.3231; (R1) 1.3254; More….

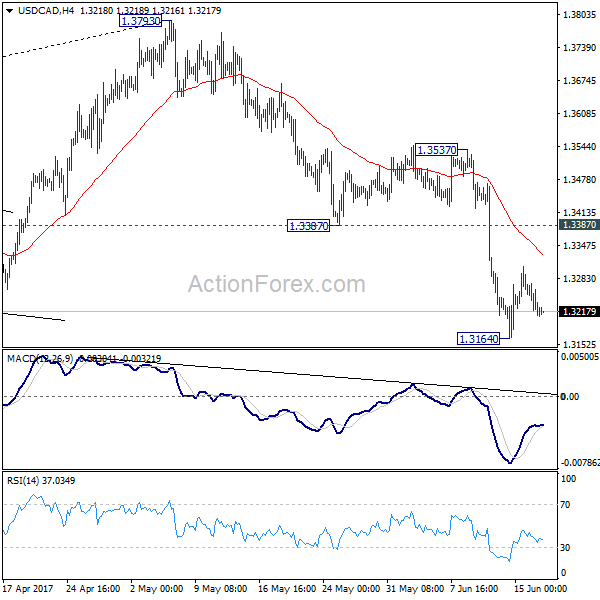

Intraday bias in USD/CAD remains neutral as consolidation from 1.3164 might extend. In case of another rise, upside should be limited by 1.3387 support turned resistance and bring fall resumption. We’re holding on to the view that corrective rise from 1.2460 has completed at 1.3793 already. Below 1.3164 will target 1.2968 cluster support, 61.8% retracement of 1.2460 to 1.3793 at 1.2969.

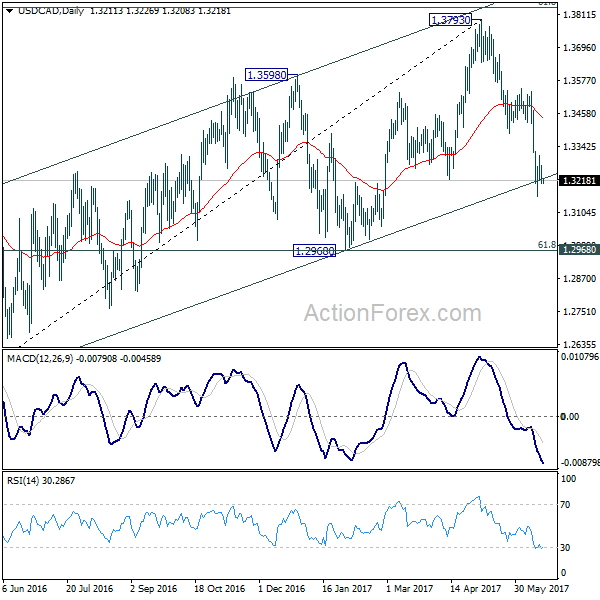

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. Rise from 1.2460 is seen as the second leg and has completed at 1.3793, ahead of 61.8% retracement of 1.4689 to 1.2460 at 1.3838. Break of 1.3222 should now indicate the start of the third leg while further break of 1.2968 should confirm. In that case, USD/CAD should decline through 1.2460 support to 50% retracement of 0.9406 to 1.4869 at 1.2048.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Jun | -0.40% | 1.20% | ||

| 23:50 | JPY | Trade Balance (JPY) May | 0.13T | 0.35T | 0.10T | 0.16T |

| 1:30 | AUD | New Motor Vehicle Sales M/M May | 2.90% | 0.30% | ||

| 23:00 | USD | Fed’s Evans Speaks in New York |