Dollar continues to trade with a soft tone in early US session. Job data from US is slightly better than expected. US-China trade negotiations concluded in Shanghai without any concrete progress. But traders’ minds remain on FOMC rate cut later today. For now, New Zealand Dollar is the weakest one, weighed down by poor business confidence. Euro is the second weakest as CPI slowed further in July. Dollar is just the third weakest. On the other hand, Australian Dollar is the strongest, after CPI and China data, followed by Sterling.

Technically, there is no clear development in the markets today. Sterling’s decline slowed a bit and should have turned into consolidations. But there is no sign of bottoming in the Pound. 1.1107 support remains the key for Dollar to over in rally attempts. Firm break of this key support is needed to confirm commitment of Dollar buying USD/CAD is eyeing 1.3116 minor support but further rise is still in favor as long as it holds.

In Europe, FTSE is down -0.60%. DAX is up 0.31%. CAC is up 0.16%. German 10-year yield is down -0.0139 at -0.41. Earlier in Asia, Nikkei dropped -0.86%. Hong Kong HSI dropped -1.31%. China Shanghai SSE dropped -0.67%. Singapore Strait Times dropped -1.49%. Japan 10-year yield dropped -0.0017 to -0.153.

Fed is widely expected to cut interest rate by -25bps to 2.00-2.25% today. Such rate cut should very well be priced in. The questions are whether it’s a start of an easing cycle, or just a one-off response to risks. The voting will reflect the split inside the committee. Chair Jerome Powell’s press conference is even more important in framing the cut.

Suggested readings:

- FOMC Preview – Expecting -25 bps Cut From a Divided Fed

- The Fed Are Expected To Cut Today – How Has That Fared For Markets Historically?

- What Does The Fed Decision Mean For Gold And Stocks?

- FOMC Preview: One (Or Two) And Done?

- Was the Fed’s Rate Hike in December a “Policy Mistake”?

- Fed Rate Decision: One Cut at a Time

US ADP employment grew 156k, job growth still healthy but slowing

US ADP private employment grew 156k in July, slightly above expectation of 150k. Prior month’s figure was revised up from 102k to 112k. Goods producing jobs rise 9k. Service-providing jobs rose 146k.

“While we still see strength in the labor market, it has shown signs of weakening,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “A moderation in growth is expected as the labor market tightens further.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth is healthy, but steadily slowing. Small businesses are suffering the brunt of the slowdown. Hampering job growth are labor shortages, layoffs at bricks-and-mortar retailers, and fallout from weaker global trade.”

Also from US, employment cost index rose 0.6% in Q2, below expectation of 0.7%.

China MOFCOM: Candid, effective, constructive and deep exchange on major trade and economic issues with US

Regarding the two-day face-to-face US-China trade talks in Shanghai, Chinese Ministry of Commerce said “both sides, according to the consensus reached by the two leaders in Osaka, had a candid, highly effective, constructive and deep exchange on major trade and economic issues of mutual interest”.

The Ministry also noted in the statement that “the two sides also discussed that China will increase its procurement of US agricultural products according to domestic needs and the US will create favorable conditions for procurement.”

On the Chinese side, Minister of Commerce Zhong Shan and Governor of the People’s Bank of China Yi Gang, participated with involvements from Central Finance Office, Finance Ministry, Foreign Affairs Ministry, Industry and Information Technology Ministry, Central Agricultural Office, Ministry of Agriculture, etc.

Next high-level trade meeting will be held in the US in September.

Canada GDP grew 0.2% in May, third straight month of expansion

Canada GDP grew for a third consecutive month in May, by 0.2% mom, beat expectation of 0.1% mom. The increase was led by a rebound in manufacturing with 13 out of 20 industrial sectors expanding. On a three-month rolling average basis, real gross domestic product increased 0.7%.

Also from Canada, IPPI dropped -1.4% mom in June versus expectation of -0.1% mom. RMPI dropped -5.9% mom versus expectation of -0.4% mom.

Eurozone CPI slowed to 1.1%, core to 0.9%, GDP grew just 0.2%

Eurozone CPI slowed to 1.1% yoy in July, down from 1.2%, matched expectation. Core CPI slowed to 0.9% yoy, down from 1.1% yoy, missed expectation of 1.0% yoy.

Eurozone GDP grew 0.2% qoq in Q2, slowed from Q1’s 0.4% qoq and matched expectations. Over the year, Eurozone GDP grew 1.1%. EU 28 GDP grew 0.2% qoq, 1.3% yoy.

Eurozone unemployment rate dropped to 7.5% in June, down from 7.6% in May, matched expectations. EU28 unemployment was unchanged at 6.3%. Among the Member States, the lowest unemployment rates in June 2019 were recorded in Czechia (1.9%) and Germany (3.1%). The highest unemployment rates were observed in Greece (17.6% in April 2019) and Spain (14.0%).

Germany retail sales rose 3.5% in Jun, unemployment rate unchanged at 5% in Jul

Germany retail sales rose 3.5% mom in June, well above expectation of 0.5% mom. Over the year, retail sales dropped -1.9% yoy. Compared with the previous year, turnover in retail trade was in the first six months of 2019 in real terms 2.2% higher than in the corresponding period of the previous year.

Also from Germany, unemployment rose 1k in July versus expectation of 2k. Unemployment claims rate was unchanged at 5.0%, matched expectations.

Australia CPI accelerated to 1.6% on automotive fuel prices

Australia CPI rose 0.6% qoq in Q2, above expectation of 0.5% qoq. Annually, headline CPI accelerated to 1.6% yoy, up from 1.3% yoy and beat expectation of 1.5% yoy. RBA trimmed mean CPI was unchanged at 1.6% yoy versus expectation of 1.5% yoy. RBA weighted median CPI slowed to 1.2% yoy, down from 1.4% yoy, matched expectations.

ABS Chief Economist, Bruce Hockman said: “automotive fuel prices rose 10.2 per cent in the June quarter 2019. This rise had a significant impact on the CPI, contributing half of the 0.6 per cent rise this quarter. Automotive fuel prices returned to levels recorded in late 2018 after falling 8.7 per cent in the March quarter 2019.”

And, “annual growth in the CPI continues to be subdued due to falls in a number of administered prices. Through the year, utility prices have fallen 0.2 per cent and child care has fallen 7.9 per cent following the introduction of the Child Care Subsidy package in July 2018.”

ANZ business confidence dropped to -44.3, two more RBNZ cuts expected this year

New Zealand ANZ Business Confidence dropped to -44.3 in July, down from -38.1. That’s also the worst reading sine August 2018. Among the sectors, agriculture scored worse at -78.5 while retail was best at -30.4. Activity Outlook Index dropped to 5.0, down from 8.0. Construction outlook was worst at -33.3 while services was best at 11.2.

ANZ noted: “The outlook for the economy is deteriorating. Despite generally good commodity prices and interest rates at record lows, the headwinds of a global slowdown and credit and cost constraints appear to be winning out. With the inflation outlook not consistent with the target midpoint we expect two more OCR cuts this year, helping the economy to find its feet once more.”

China PMI manufacturing rose to 49.7, foundation for stabilization still needs to be consolidated

The official China PMI Manufacturing Index rose to 49.7 in July, up from 49.4 and beat expectation of 49.6. Looking at the details, production, new order, new export order, backlog, purchase volume, import, purchase price,, ex-factory price, employment, production and operation improved. But finished goods inventories, raw material inventory and supplier delivered dropped.

Analyst Zhang Liqun noted that: “Economic downturn is slowing down…. activities have been restored…. there are signs of recovery in production and operation activities, indicating that the effect of macroeconomic policy counter-cyclical adjustment has begun to appear.”

However, he also warned that ” downward pressure on the economy is still not to be underestimated. And, the foundation for stabilization still needs to be consolidated.

Also released, official PMI Non-Manufacturing Index dropped to 53.7, down from 54.2 and missed expectation of 54.0.

USD/JPY Mid-Day Outlook

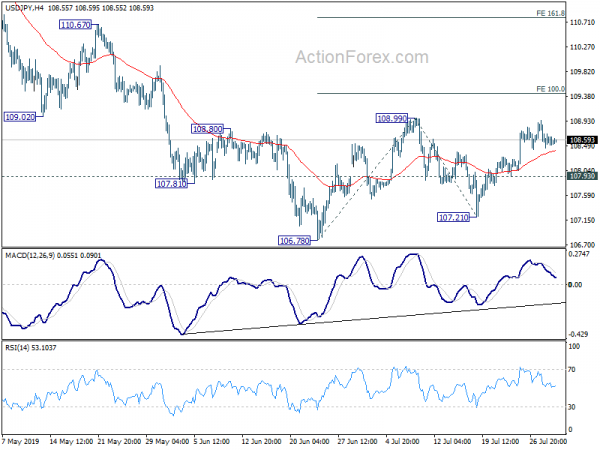

Daily Pivots: (S1) 108.38; (P) 108.67; (R1) 108.88; More…

Intraday bias in USD/JPY remains neutral first. As long as 107.93 minor support holds, further rally is expected. On the upside, break of 108.99 will resume the rebound from 106.78 for 100% projection of 106.78 to 108.99 from 107.21 at 109.42 and then 161.8% projection at 110.78. On the downside, below 107.93 minor support will turn bias back to the downside instead.

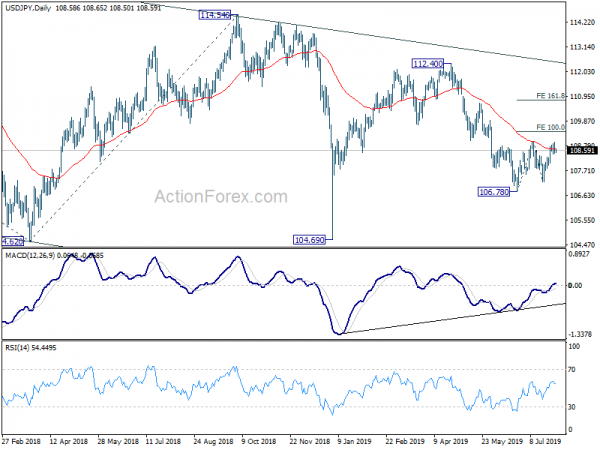

In the bigger picture, decline from 118.65 (Dec 2016) not completed yet, with the pair staying inside long term falling channel. Break of 104.62 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. In any case, break of 112.40 is needed to the first serious sign of medium term bullishness. Otherwise, further decline will remain in favor in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Jul | -11 | -13 | -13 | |

| 23:01 | GBP | BRC Shop Price Index Y/Y Jul | -0.10% | -0.10% | ||

| 01:00 | NZD | ANZ Business Confidence Jul | -44.3 | -38.1 | ||

| 01:00 | CNY | Manufacturing PMI Jul | 49.7 | 49.6 | 49.4 | |

| 01:00 | CNY | Non-manufacturing PMI Jul | 53.7 | 54 | 54.2 | |

| 01:30 | AUD | CPI Q/Q Q2 | 0.60% | 0.50% | 0.00% | |

| 01:30 | AUD | CPI Y/Y Q2 | 1.60% | 1.50% | 1.30% | |

| 01:30 | AUD | CPI RBA Trimmed Mean Q/Q Q2 | 0.40% | 0.40% | 0.30% | |

| 01:30 | AUD | CPI RBA Trimmed Mean Y/Y Q2 | 1.60% | 1.50% | 1.60% | |

| 01:30 | AUD | CPI RBA Weighted Median Q/Q Q2 | 0.40% | 0.40% | 0.10% | |

| 01:30 | AUD | CPI RBA Weighted Median Y/Y Q2 | 1.20% | 1.20% | 1.20% | 1.40% |

| 01:30 | AUD | Private Sector Credit M/M Jun | 0.10% | 0.30% | 0.20% | |

| 05:00 | JPY | Housing Starts Y/Y Jun | 0.30% | -2.20% | -8.70% | |

| 05:00 | JPY | Consumer Confidence Index Jul | 37.8 | 38.5 | 38.7 | |

| 06:00 | EUR | German Retail Sales M/M Jun | 3.50% | 0.50% | -0.60% | |

| 07:55 | EUR | German Unemployment Change Jul | 1K | 2K | -1K | |

| 07:55 | EUR | German Unemployment Claims Rate Jul | 5.00% | 5.00% | 5.00% | |

| 09:00 | EUR | Eurozone Unemployment Rate Jun | 7.50% | 7.50% | 7.50% | 7.60% |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 A | 0.20% | 0.20% | 0.40% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jul A | 0.90% | 1.00% | 1.10% | |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y Jul | 1.10% | 1.10% | 1.20% | |

| 10:00 | EUR | Italian GDP Q/Q Q2 P | 0.00% | -0.10% | 0.10% | |

| 12:15 | USD | ADP Employment Change Jul | 156K | 150K | 102K | 112K |

| 12:30 | USD | Employment Cost Index Q2 | 0.60% | 0.70% | 0.70% | |

| 12:30 | CAD | GDP M/M May | 0.20% | 0.10% | 0.30% | |

| 12:30 | CAD | Industrial Product Price M/M Jun | -1.40% | -0.10% | 0.10% | -0.10% |

| 12:30 | CAD | Raw Materials Price Index M/M Jun | -5.90% | -0.40% | -2.30% | -2.40% |

| 13:45 | USD | Chicago PMI Jul | 51.5 | 49.7 | ||

| 14:30 | USD | Crude Oil Inventories | -2.5M | -10.8M | ||

| 18:00 | USD | FOMC Rate Decision (Upper Bound) | 2.25% | 2.50% | ||

| 18:00 | USD | FOMC Rate Decision (Lower Bound) | 2.00% | 2.25% | ||

| 18:30 | USD | FOMC Press Conference |