Monetary easing from central banks remain a major background theme in the markets. Euro is sold off this week as markets are preparing for dovishness from ECB today. While immediate policy action is not envisaged, President Mario Draghi is expected to explicitly set the stage for some announcement next month.

Though, for today, Australian Dollar is the weakest one so far after RBA Governor Philip Lowe’s dovish messages. New Zealand Dollar follows as second weakest while Sterling follows as knee jerk reaction to Boris Johnson fades. Yen is currently the strongest one, followed by Canadian, which was lifted by oil inventory report. Dollar is third strongest and would look to durable goods orders for some guidance.

Technically, EUR/USD is on track to 1.1107 low. We’re not expecting a break there yet and would look for bottoming signs around there. But firm break of this key support will resume will resume medium term down trend. 108.37 resistance in USD/JPY remains a focus as firm break will affirm broad based strength in Dollar.

In Asia, Nikkei closed up 0.25%. Hong Kong HSI is up 0.34%, China Shanghai SSE is up 0.37%. Singapore Strait Times is up 0.26%. Japan 10-year JGB yield is down -0.0006 at -0.147. Overnight, DOW dropped -0.29%. S&P 500 rose 0.47%. NASDAQ rose 0.85%. 10-year yield dropped -0.025 to 2.050.

ECB to stand pat but set the stage for Sept easing

ECB rate decision is the major focus today. It’s widely expected to keep monetary policy unchanged for now. That is, main refinancing, marginal lending and deposit facility rates will be held unchanged at 0.00%, 0.25% and -0.40% respectively. Nevertheless, president Mario Draghi should provide explicit dovishness in the press conference that set the stage for policy easing in September. In particular, focuses will be on issues including rate floor, restart of QE, and emphasis on “symmetric” inflation target.

Suggested readings:

- ECB To Guide On More Stimulus

- ECB Preview – Expecting Change in Forward Guidance and Hints on QE Resumption and Tiering

- ECB Preview: Warming Up For Draghi’s Grande Finale

- Slow Growth, Low Inflation: What’s the ECB to Do?

RBA Lowe: Prepared to provide additional easing, extended period of low interest rates expected

In a speech delivered today, RBA Governor Philip Lowe reiterated the dovish stance that, “the Board is prepared to provide additional support by easing monetary policy further.” At the same time, “whether or not further monetary easing is needed, it is reasonable to expect an extended period of low interest rates.”

Lowe also noted, “on current projections, it will be some time before inflation is comfortably back within the target range”. And, it’s “highly unlikely that we will be contemplating higher interest rates until we are confident that inflation will return to around the midpoint of the target range.”

He also defended current inflation target a said it has “stood the test of time”. He warned that lowering the target could “hardly seems a good way to build long-term credibility”. ” Lowe said. “Shifting the goal posts could also entrench a low inflation mindset.” Thus, “this brings me back to the question: is inflation targeting still appropriate? The short answer is yes.” And, ” the evidence does not support the idea that a change to our inflation target would deliver better economic outcomes than achieved by our current flexible inflation target,” he noted.

Johnson: Ports, banks, factories, businesses ready for no-deal Brexit

New UK Prime Minister Boris Johnson executed a “brutal”, as some described, cabinet reshuffle after taking the top job. 18 of 29 ministers were dumped out. Instead, some Brexit hardliners are brought into the cabinet. New cabinet include Sajid Javid as chancellor of the exchequer, Dominic Raab as foreign secretary and first secretary of state, Priti Patel as home secretary, Michael Gove as chancellor of the Duchy of Lancaster, Liz Truss as international trade secretary, etc.

Johnson also said, “the doubters, the doomsters, the gloomsters — they are going to get it wrong again. We are going to fulfill the repeated promises of Parliament to the people and come out of the EU on Oct. 31, no ifs or buts, and we will do a new deal, a better deal.”

He added, “We can do a deal without checks at the Irish border. It is of course vital at the same time that we prepare for the remote possibility that Brussels refuses any further to negotiate and we are forced to come out with no deal.”

He also insisted the economy is ready for no-deal. “The ports will be ready, the banks will be ready, the factories will be ready, business will be ready,” he said. “The British people have had enough of waiting.

On the data front

Japan corporate service price index rose 0.7% yoy in June, missed expectation of 0.8% yoy. German Ifo business claims will be a focus in European session before ECB. Later in the day, US will release durable goods orders, advance goods trade balance, jobless claims and wholesale inventories.

EUR/CHF Daily Outlook

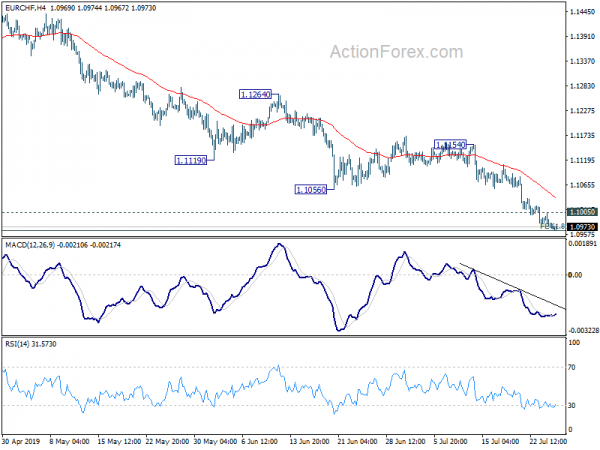

Daily Pivots: (S1) 1.0959; (P) 1.0982; (R1) 1.0994; More…

Intraday bias in EUR/CHF remains on the downside as recent decline continues. Firm break of 61.8% projection of 1.2004 to 1.1173 from 1.1476 at 1.0962 will pave the way to 100% projection at 1.0645 next. On the upside, above 1.1005 minor resistance will turn intraday bias neutral and bring consolidation. But outlook will stay bearish as long as 1.1154 resistance holds, in case of recovery.

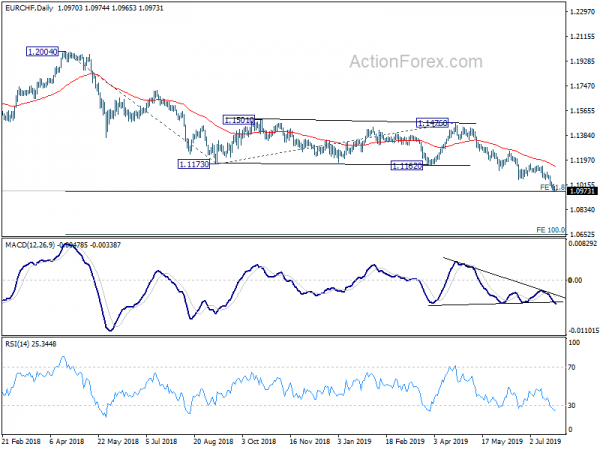

In the bigger picture, current development firstly suggests that down trend from 1.2004 is still in progress. More importantly, it’s likely a long term down trend itself, rather than a correction. Outlook will remain bearish as long as 1.1476 resistance holds. EUR/CHF could target 1.0629 support and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Y/Y Jun | 0.70% | 0.80% | 0.80% | 0.90% |

| 8:00 | EUR | German IFO Business Climate Jul | 97 | 97.4 | ||

| 8:00 | EUR | German IFO Expectations Jul | 94 | 94.2 | ||

| 8:00 | EUR | German IFO Current Assessment Jul | 100.4 | 100.8 | ||

| 10:00 | GBP | CBI Reported Sales Jul | -8 | -42 | ||

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 11:45 | EUR | ECB Marginal Lending Facility | 0.25% | 0.25% | ||

| 11:45 | EUR | ECB Deposit Facility Rate | -0.40% | -0.40% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Wholesale Inventories M/M Jun P | 0.40% | 0.40% | ||

| 12:30 | USD | Durable Goods Orders Jun P | 0.70% | -1.30% | ||

| 12:30 | USD | Durables Ex Transportation Jun P | 0.20% | 0.40% | ||

| 12:30 | USD | Advance Goods Trade Balance (USD) Jun | -72.4B | -74.5B | ||

| 12:30 | USD | Initial Jobless Claims (JUL 20) | 220K | 216K | ||

| 14:30 | USD | Natural Gas Storage | 62B |