The financial markets somewhat decouple in Asian session today. Australian Dollar is sold off broadly while Yen strengthens, Yet it’s has nothing to do with risk appetite with Asian equity indices generally higher. Aussie’s weakness is mainly due to RBA rate expectations following poor PMIs. In particular, sharp deterioration is seen in employment, which could eventually force RBA to cut interest rate earlier in October, and deliver another one in February. This is what Westpac believes in now.

Staying in the currency markets. Sterling rises mildly today but lacks clear momentum yet. The Pound stays mixed as Boris Johnson’s win as Conservative leader provides no resolution to the Brexit dead lock at this point. (More in Brexit Update – New PM, Old Challenge). Euro also turns mixed after yesterday’s selloff. But the common currency will likely remain soft as ECB meeting looms. Expectation is high for ECB to indicate how it’s going to ease monetary policy further later in September. (More in ECB Preview – Expecting Change in Forward Guidance and Hints on QE Resumption and Tiering). Before ECB tomorrow, there will be Eurozone PMIs featured today too.

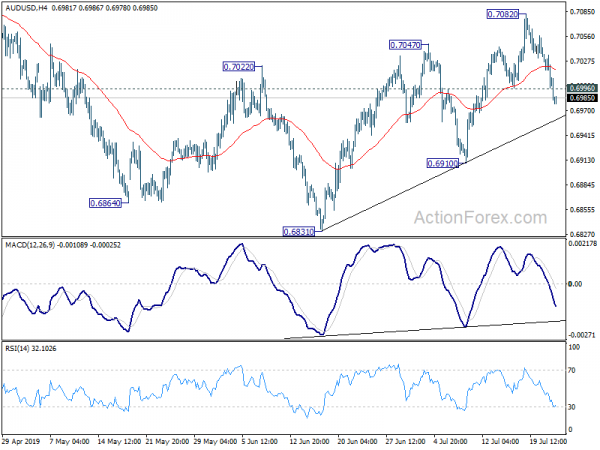

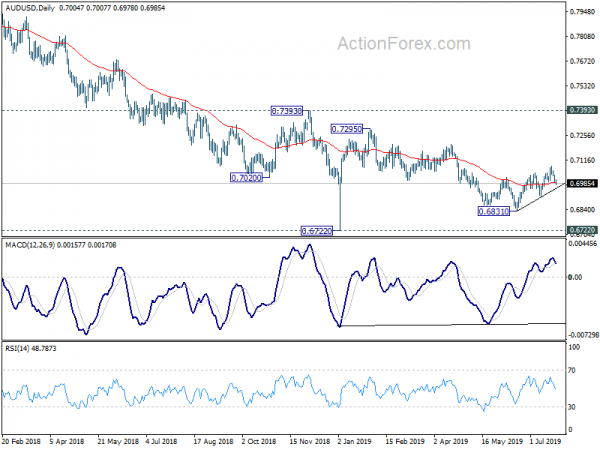

Technically, EUR/USD is on track to retest 1.1107 low and we’ll pay attention to bottoming there. AUD/USD’s break of 0.6996 suggests near term topping and deeper fall should be seen to 0.6910 support next. That’s another sign of Dollar strength. Yet, we’ll still prefer to see break of 108.37 in USD/JPY to confirm underlying momentum in Dollar. Also 0.8954 minor support in EUR/GBP is also a focus today and break will indicate near term reversal in the cross.

In Asia, Nikkei closed up 0.41%. Hong Kong HSI is up 0.56%. China Shanghai SSE is up 0.58%. Singapore Strait Times is up 0.08%. Japan 10-year JGB yield is down -0.0016 to -0.0147. Overnight, DOW rose 0.65%. S&P 500 rose 0.68%. NASDAQ rose 0.58%. 10-year yield rose 0.031 to 2.074.

US Kudlow hopeful on China trade talks, Perdue reveals new farmer aids

White House economic adviser Larry Kudlow indicated yesterday that US trade team could travel to China to restart trade negotiations. Meanwhile, China could re-start agricultural purchases soon. He said, “as I read it, it looks like there will be a trip to China and we expect, we hope strongly that China will very soon start buying agriculture products, No. 1 as part of an overall deal and No. 2 as a goodwill gesture.”

Kudlow also sounded positive and added, “I wouldn’t be surprised if we saw a lot of positive news on that coming up… I’m going to strike a note of hopefulness.” However, Commerce Secretary Wilbur Ross sounded more cautious and said “I’m not aware that the gate has opened to any significant degree.”

Separately, Agriculture Secretary Sonny Perdue announced new aid package to help farms hurt by Trump’s trade war with China. The government will pay a minimum of USD 15 per acre to farmers. He said, “we’re anticipating right now three tranches; probably 50 percent … or minimum there of $15 an acre initially.” The second and third tranches would be dependant on market conditions.

Australia PMI composite dropped to 51.8, sharp fall in employment

Australia CBA PMI manufacturing dropped to 51.4 in July, down from 52.0. PMI services dropped to 51.9, down from 52.6. PMI composite dropped to 51.8, down from 52.5. CBA noted that “Slower growth fed through to staffing levels, which decreased for the first time in three months.” More importantly, employment decreased for the greatest extent since the survey began in May 2016. Reduction in jobs were centered of service sector.

CBA Senior Economist, Belinda Allen said: “Overall the “flash” PMI does suggest business activity should continue to expand in Q3… The sharp fall in employment intentions underlines the importance of the tax cuts now filtering into the economy and calls for more policy stimulus via infrastructure spending and microeconomic reform. Input costs continued to lift and is worth watching if businesses can pass it on, we could see some impact on consumer inflation over 2H 2019 and into 2020″.

Japan PMIs: Fastest expansion in 7 months on services, but manufacturing sector’s plight continued

Japan PMI manufacturing improved to 49.6 in July, up from 49.3, but missed expectation of 49.7. PMI services rose to 52.3, up from 51.9. PMI composite rose to 51.2, up from 50.8.

Joe Hayes, Economist at IHS Markit, noted, “overall private sector output expanded at the fastest pace in seven months on the back of faster growth in services activity”. “The manufacturing sector’s plight continued, however, where production was cut in July for the seventh successive month. ”

Also, “weak demand from China remained a key factor behind sluggish demand for Japanese goods. Heightened frictions between Japan and South Korea also add downside risk to the manufacturing supply chain in Japan, creating additional slack that services may once again have to compensate for.”

IMF: Global growth sluggish and precarious on some self-inflicted reasons

IMF downgrades global growth forecasts to 3.2% in 2019 and 3.5% in 202, down from April projections of 3.3% and 3.6% respectively. The revision for 2019 reflects “negative surprises for growth in emerging market and developing economies that offset positive surprises in some advanced economies”.

The report added, “global growth is sluggish and precarious but it does not have to be this way because some of this is self-inflicted”. “Dynamism in the global economy is being weighed down by prolonged policy uncertainty as trade tensions remain heightened despite the recent US-China trade truce, technology tensions have erupted threatening global technology supply chains, and the prospects of a no-deal Brexit have increased.”

IMF also urged monetary policy to remain “accommodative”, especially “where inflation is softening below target”. Though, it should accompanied by “sound trade policies”. Fiscal policy should “balance growth, equity and sustainability concerns”. Also, ” the need for greater global cooperation is ever urgent”, including resolving trade and technology tensions, climate change, international taxation, corruption, cybersecurity, and digital payment technology.

Looking at some details:

- US growth in 2019 revised up by 0.3% to 2.6%.

- US growth in 2020 unchanged at 1.9%.

- Eurozone growth in 2019 unchanged at 1.3%.

- Eurozone growth in 2020 revised up by 0.1% to 1.6%.

- Germany growth in 2019 revised down by -0.1% to 0.7%.

- Germany growth in 2020 revised up by 0.3% to 1.7%.

- UK growth in 2019 revised up by 0.1% to 1.3%.

- UK growth in 2020 unchanged at 1.4%.

- Japan growth in 2019 revised down by -0.1% to 0.9%.

- Japan growth in 2020 revised down -0.1% to 0.4%.

- China growth in 2019 revised down by -0.1% to 6.2%.

- China growth in 2020 revised down by -0.1% to 6.0%.

Looking ahead

Eurozone PMIs will be the major focus in European session. Eurozone M3 and UK BBA mortgage approvals will also be featured. Later in the day, US will release PMIs and new home sales.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.6989; (P) 0.7012; (R1) 0.7029; More…

AUD/USD’s sharp fall and break of 0.6996 minor support suggests that rebound from 0.6831 has completed with three waves up to 0.7082. Intraday bias is turned back to the downside for 0.6910 support first. Break will confirm and pave the way back to retest 0.6831 support next. Such development will also argue that fall from 0.7295 is in progress for 0.6722 low. On the upside, break of 0.7082 will extend the rebound from 0.6831 instead.

In the bigger picture, with 0.7393 key resistance intact, medium term outlook remains bearish. The decline from 0.8135 (2018 high) is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance Jun | 365M | 100M | 264M | 175M |

| 23:00 | AUD | CBA PMI Manufacturing Jul P | 51.4 | 52 | ||

| 23:00 | AUD | CBA PMI Services Jul P | 51.9 | 52.6 | ||

| 0:30 | JPY | PMI Manufacturing Jul P | 49.6 | 49.7 | 49.3 | |

| 7:15 | EUR | France Manufacturing PMI Jul P | 51.6 | 51.9 | ||

| 7:15 | EUR | France Services PMI Jul P | 52.8 | 52.9 | ||

| 7:30 | EUR | Germany Manufacturing PMI Jul P | 45.2 | 45 | ||

| 7:30 | EUR | Germany Services PMI Jul P | 55.2 | 55.8 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Jul P | 47.6 | 47.6 | ||

| 8:00 | EUR | Eurozone Services PMI Jul P | 53.3 | 53.6 | ||

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y Jun | 4.60% | 4.80% | ||

| 8:30 | GBP | BBA Loans for House Purchase Jun | 42.9K | 42.4K | ||

| 13:45 | USD | Manufacturing PMI Jul P | 51 | 50.6 | ||

| 13:45 | USD | Services PMI Jul P | 51.8 | 51.5 | ||

| 14:00 | USD | New Home Sales Jun | 659K | 626K | ||

| 14:30 | USD | Crude Oil Inventories | -3.1M |