The forex markets are generally mixed today in rather quiet trading. Dollar lacks a clear direction despite rumors that US and China trade teams are going finally meet to resume negotiations. Canadian Dollar is currently the weakest one, followed by Sterling, and then Yen. On the other hand, New Zealand Dollar is leading Australian higher. Yet, risk appetite is not too apparent in other financial markets.

Technically, Sterling weakens again today, ahead of near term resistance against both Euro and Dollar. The case of bullish reversal is not happening yet. EUR/USD and USD/CAD are stuck in familiar range for now. Should Dollar strengthens in US session, 1.1193 support in EUR/USD and 1.3143 in USD/CAD will be the focuses.

In other markets, US stocks open mildly higher with DOW up 0.15% at the time of writing. In Europe, FTSE is up 0.21%. DAX is up 0.44%. CAC is up 0.21%. German 10-year yield is down -0.0143 at -0.335. Earlier in Asia, Nikkei dropped -0.23%. Hong Kong HSI dropped -1.37%. China Shanghai SSE dropped -1.27%. Singapore Strait Times dropped -0.61%. Japan 10-year JGB yield rose 0.0005 to -0.135.

US trade delegation said to visit China for negotiations next week

A Hong Kong newspaper SCMP reported today that US trade delegation will likely visit China next week, for the first face-to-face meeting since G20. US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin will be on the US side as expected. Vice Premier Liu He will lead the Chinese team.

According to unnamed source, the initial arrangements for the meeting would include exemptions to 110 Chinese products, including medical equipment and key electronic components, from import tariffs. on the other hand, several Chinese companies would finally start buying American agricultural products.

EU ready to work with any new UK PM

European Commission spokesperson Natasha Bertaud said that EU is ready to work with “any new prime minister of the United Kingdom”. Boris Johnson, who’s favorite to take over from Theresa May, has repeatedly said he’s prepared for a no-deal Brexit.

Also, the commission reiterated that it’s ready to “engage with the member states that would be most affected” by no-deal Brexit. The measures include programs for emergency support. Additionally, contingency plans include a scenario in which “the UK also fails to pay what is envisaged” under the current EU budget.

NIESR: 25% chance UK in technical recession already, 40% chance of no-deal Brexit

According to the latest “prospect for the UK economy”, NIESR said there is around a one-in-four chance that the country is already in a “technical recession”. The outlook beyond the October 31 Brexit date is “very murky indeed” with possibility of a “severe downturn” in case of a disorderly no-deal Brexit.

The think thank also assign a 40% chance of no-deal Brexit, versus 60% for deal/delay. Even if a no-deal Brexit is avoided, the economy is forecast to growth at around only 1% in 2019 and 2020, as “uncertainty continues to hold back investment and productivity growth remains weak”.

Most economists expect RBA to stand pat in August

According to a Reuters’ poll, 39 of 40 surveyed economists surveyed over the past week expect RBA to keep interest rate unchanged at 1.00% at the August 6 meeting.

By the end of the year, 13 of 40 expect RBA to be on hold through this year. 25 expect another rate cut to 0.75% by year-end. Only two banks, Standard Chartered and Goldman Sachs, predict two cuts to 0.50%.

RBA delivered two back-to-back cuts in June and July to 1.00%. The central bank’s research indicates such rate cut would boost GDP growth by 0.25-0.40% over two years. However, inflation would be lifted by 0.1% only.

Japan Abe pledges to take more aggressive and bold economic measures than ever

Japanese Prime Minister Shinzo Abe’s ruling coalition kept a solid majority in the upper house election. He said today that “based on a stable political basis, the Abe cabinet will take more aggressive and bold economic measures than ever.”

Abe said “uncertainty remains over the global economic outlook such as trade frictions and Britain’s exit from the European Union… We’ll respond to downside risks without hesitation and take flexible and all possible steps.”

The Japanese government has designated JPY 2T in stimulus measures to offset the impact of the planned sales tax hike, from 8% to 10% in October. Abe also noted “we will underpin domestic consumption which accounts for the bulk of the economy by taking sufficient measures.”

EUR/USD Mid-Day Outlook

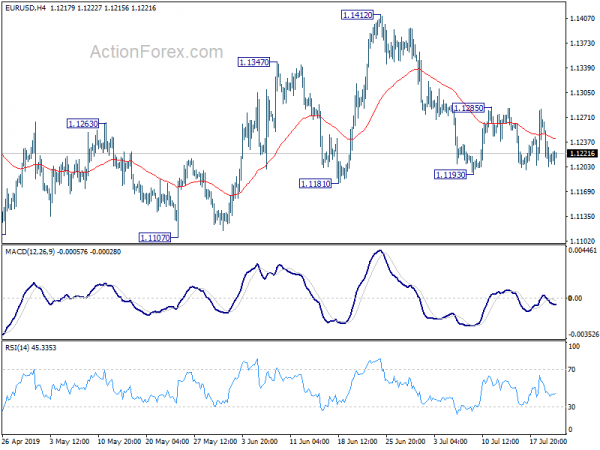

Daily Pivots: (S1) 1.1189; (P) 1.1235; (R1) 1.1268; More…

Intraday bias in EUR/USD remains neutral for the moment as it’s staying in range of 1.1193/1285. On the downside, break of 1.1193 will resume the fall from 1.1412 to retest 1.1107 low. On the upside, above 1.1285 resistance will turn bias back to the upside for 1.1412 resistance.

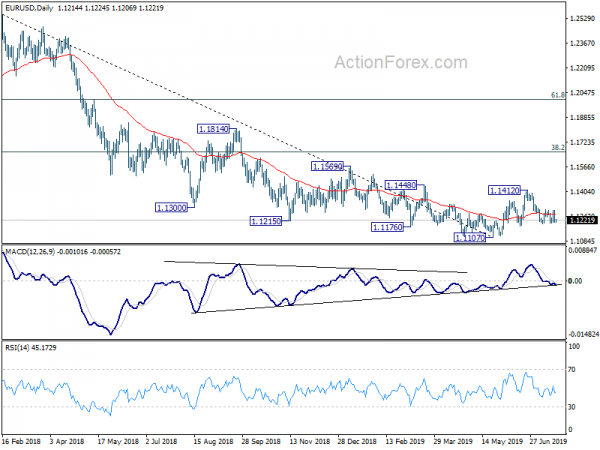

In the bigger picture, on the one hand, 1.1107 is seen as a medium term bottom on bullish convergence condition in weekly MACD. On the other hand, rejection by 55 week EMA retains medium term bearishness. Outlook stays neutral for now. On the downside, break of 1.1107 will resume the down trend from 1.2555 (2018 high) to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Meanwhile, break of 1.1412 will resume the rebound to 38.2% retracement of 1.2555 to 1.1107 at 1.1660.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 12:30 | CAD | Wholesale Trade Sales M/M May | -1.80% | 0.50% | 1.70% | 1.60% |