Euro trades broadly lower today as investor confidence deteriorated further despite slightly easing US-China trade tensions. German 10-year yield also weakens again following weaker investor sentiments, as German lender Deutsche Bank AG started its most aggressive restructuring and layoff. Sterling and Yen are also among the weakest ones. On the other hand, New Zealand Dollar is leading commodity currencies higher.

Technically, though, trading is rather subdued as most pairs and crosses are bounded in tight range. For now, further rise is mildly in Dollar in general, except versus Canadian. USD/CAD’s recovery failed 1.3145 minor resistance and is eyeing 1.3037 low again. With resilience in commodity currencies, EUR/AUD is looking at 1.6025 temporary low for resuming recent fall from 1.6448. EUR/CAD’s decline is on track for medium term projection level at 100% projection of 1.6151 to 1.4759 from 1.5645 at 1.4253.

In Europe, currently, FTSE is down -0.06%. DAX is down -0.34%. CAC is down -0.24%. German 10-year yield is down -0.009 at -0.371. Earlier in Asia, Nikkei dropped -0.98%. Hong Kong HSI dropped -1.54%. China Shanghai SSE dropped -2.58%. Singapore Strait Times dropped -0.97%. Japan 10-year JGB yield rose 0.126 to -0.15.

Eurozone Sentix investor confidence dropped to -5.8, lowest since 2014, Germany even worse

Eurozone Sentix Economic Index dropped to -5.8 in June, down from -3.3 and missed expectation of 0.2. It’s also the lowest level since November 2014. Current Situation Index dropped from 6.0 to 1.8, lowest since February 2015. Expectations Index also dropped from -12.3 to -13.0, lowest since February 2019.

Sentix noted that after the supposed de-escalation signals in US-China trade war at G20, there was “great hope that the downward trend in the economy could be stopped”. But, investors are “not blinded by the rising share prices” as expectations show no upward reaction to the news. It warned, “without resilient negotiation results, it will be difficult for investors worldwide to develop a different perspective.”

For Germany, Overall Economic Index dropped from -0.7 to -4.8, lowest since November 2009. Current Situation Index dropped from 13.5 to 7.0, lowest since April 2010. Expectations Index dropped from -14.0 to -16.0, lowest since February 2019.

Sentix said “things are even worse for the German economy”. “The high dependence on exports and the Chinese sales market is increasingly becoming a burden and the customs dispute hovers like a sword of Damocles over the former model boy of the Euro region.” Also, the automotive industry is “simply not emerging from the crisis”.

German trade surplus widened to EUR 20.6B, industrial production rose 0.3%

German foreign trade surplus widened to EUR 20.6B in May. On calendar and seasonally adjusted terms, trade surplus widened to EUR 18.7B. Exports rose 1.1% mom, 4.5% yoy to EUR 113.9B. Imports dropped -0.5% mom, 4.9% yoy to EUR 93.4B.

Industrial production rose 0.3% mom in May, matched expectations. Production in industry excluding energy and construction was up by 0.9%. Outside industry, energy production was down by -.2% in May 2019 and the production in construction decreased by -2.4%.

BoJ: All nine regions expanding or recovering, but uncertainties heightened

In the quarterly Regional Economic Report, BoJ kept assessment of all nine regions unchanged. All nine regions reported that their economy had been “either expanding or recovering”. Domestic demand had “continued on an uptrend”, with a virtuous cycle from income to spending operating in both the corporate and household sectors. But, exports and production had been affected by the “slowdown in overseas economies”.

Also, while the assessments were overall unchanged, “a somewhat increasing number of firms were pointing to heightening uncertainties over the outlook for overseas economies and their impacts, reflecting, for example, the U.S.-China trade friction.”

Governor Haruhiko Kuroda told the central bank’s regional branch managers that inflation is still expected to pick up gradually to 2% target. The economy is expected to continue expanding moderately as a trend, even though it’s affected by overseas slowdown. But still, BoJ would maintain easing for as long as needed to hit stable target.

Kuroda reiterated that short- and long-term interest rate will be kept at current very low levels for extended period, “at least through around spring 2020”. Also, monetary base will continue to expand, and QQE will be maintained under the yield curve control framework. Also, Kuroda pledged that “the BOJ will make necessary policy adjustments to sustain the economy’s momentum towards achieving its inflation target.”

Released from Japan, machine orders dropped sharply by -7.8% mom in May versus expectation of -3.7% mom. Current account surplus narrowed to JPY 1.31T versus expectation of JPY 1.24T.

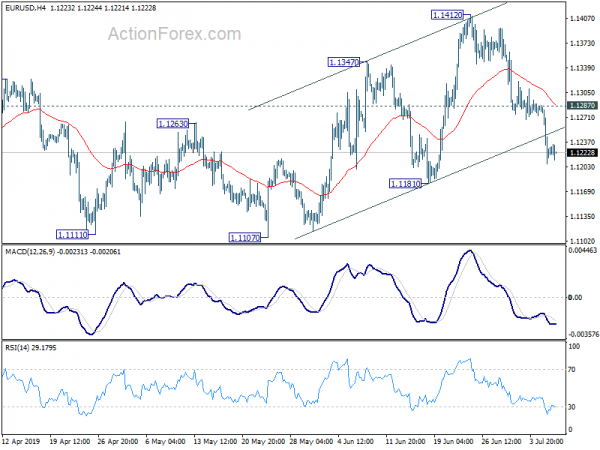

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1193; (P) 1.1240; (R1) 1.1274; More…

No change in EUR/USD’s outlook and intraday bias remains on the downside for the moment. Corrective recovery from 1.1107 should have completed way earlier than expected at 1.1412. Firm break of 1.1181 support will confirm this bearish case and target retest of 1.1107 low. On the upside, above 1.1287 minor resistance will turn intraday bias back to the upside for 1.1412 instead.

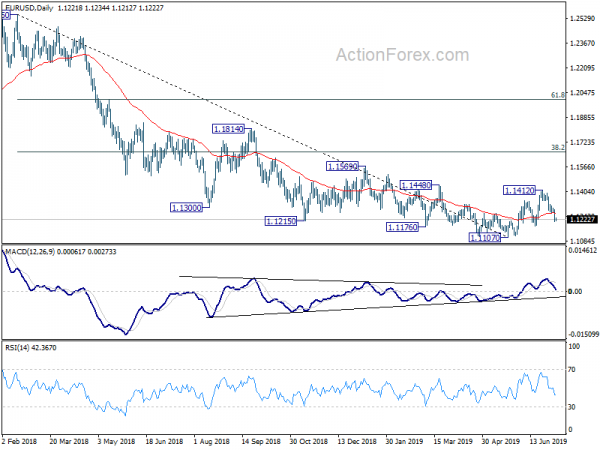

In the bigger picture, bullish convergence condition in daily and weekly MACD suggests that 1.1107 is a medium term bottom. However, rejection by 55 EMA retains medium term bearish. Outlook will be neutral for now. On the downside, break of 1.1107 will resume the down trend from 1.2555 (2018 high) to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Meanwhile, break of 1.1412 will resume the rebound to 38.2% retracement of 1.2555 to 1.1107 at 1.1660

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Current Account (JPY) May P | 1.31T | 1.24T | 1.60T | |

| 23:50 | JPY | Machine Orders M/M May | -7.80% | -3.70% | 5.20% | |

| 5:00 | JPY | Eco Watchers Survey Current Jun | 44 | 43.8 | 44.1 | |

| 6:00 | EUR | German Industrial Production M/M May | 0.30% | 0.30% | -1.90% | -2.00% |

| 6:00 | EUR | German Trade Balance (EUR) May | 18.7B | 16.8B | 17.0B | 16.9B |

| 8:30 | EUR | Eurozone Sentix Investor Confidence Jul | -5.8 | 0.2 | -3.3 | |

| 19:00 | USD | Consumer Credit (USD) May | 15.2B | 17.5B |