Asian markets tumble broadly, partly as reactions to Japan’s export controls on certain Korean semiconductor materials. Also, the weakness is partly due to adjustment in expectations on Fed’s rate cut this month, after Friday’s solid US job data. Though, the currency markets are steadily mixed. Yen is one of the strongest among Australian and New Zealand Dollar. Sterling and Euro are among the weakest. Yet, Dollar is also soft, paring some of last week’s gains. The greenback’s fate will very much depends on Fed Chair Jerome Powell’s testimony and FOMC Minutes scheduled for the week.

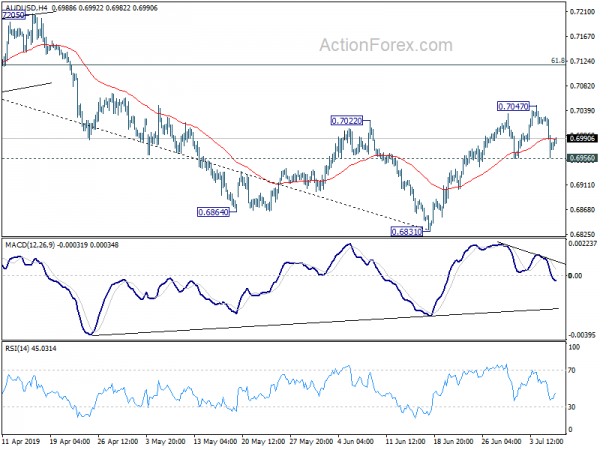

Technically, Dollar pairs will remain the major focuses today. In particular, EUR/USD is looking at 1.1181 support to confirm near term weakness for 1.1107 low. AUD/USD is looking at 0.6956 minor support to confirm completion of rebound form 1.6831. USD/JPY is still looking at 108.80 resistance to confirm near term reversal. USD/CAD is staying in tight range below 1.3145 minor resistance without confirming short term bottoming at 1.3037 yet.

In Asia, Nikkei closed down -0.98%. China Shanghai SSE closed down -2.58 at 2933.36, below 3000 handle. Hong Kong HSI is down -1.66%. Singapore Strait Times is down -1.20%. Japan 10-year JGB yield is up 0.0124 at -0.151.

BoJ: All nine regions expanding or recovering, but uncertainties heightened

In the quarterly Regional Economic Report, BoJ kept assessment of all nine regions unchanged. All nine regions reported that their economy had been “either expanding or recovering”. Domestic demand had “continued on an uptrend”, with a virtuous cycle from income to spending operating in both the corporate and household sectors. But, exports and production had been affected by the “slowdown in overseas economies”.

Also, while the assessments were overall unchanged, “a somewhat increasing number of firms were pointing to heightening uncertainties over the outlook for overseas economies and their impacts, reflecting, for example, the U.S.-China trade friction.”

BoJ Kuroda: Will make necessary policy adjustments to sustain the economy’s momentum

BoJ Governor Haruhiko Kuroda told the central bank’s regional branch managers that inflation is still expected to pick up gradually to 2% target. The economy is expected to continue expanding moderately as a trend, even though it’s affected by overseas slowdown. But still, BoJ would maintain easing for as long as needed to hit stable target.

Kuroda reiterated that short- and long-term interest rate will be kept at current very low levels for extended period, “at least through around spring 2020”. Also, monetary base will continue to expand, and QQE will be maintained under the yield curve control framework.

Also, Kuroda pledged that “the BOJ will make necessary policy adjustments to sustain the economy’s momentum towards achieving its inflation target.”

Released from Japan, machine orders dropped sharply by -7.8% mom in May versus expectation of -3.7% mom. Current account surplus narrowed to JPY 1.31T versus expectation of JPY 1.24T.

Wang: China can’t shut out the world, world can’t shut out China

Chinese Vice President Wang Qishan said in the World Peace Forum that “China’s development can’t shut out the rest of the world. The world’s development can’t shut out China”. Without naming any country, he warned against “protectionism in the name of national security”

Wang also called on major powers to contribute more to global peace and stability. He added, “large countries must assume their responsibilities and set an example, make more contributions to global peace and stability, and broaden the path of joint development.”

And he emphasized that “development is the key to resolving all issues”. At the same time, Wang pledged that China will walk the path of peace, as “if there is no peaceful, stable international environment, there will be no development to talk of.”

Wang is an extremely close ally of President Xi Jinping but rarely speaks in the public regarding public issues. It remains to be seen if he’s speech was part of the campaign in stronger rhetorics in Sino-US relationships. Recently, China has warned that all punitive tariffs have to be removed to complete a trade deal. Also, it’s reported that purchases of US agricultural products are tied to how Huawei ban would be lifted.

China foreign exchange reserves rose 0.6% to USD 3.119T

China’s foreign exchange reserves rose USD 18.2B, or 0.6%, to USD 3.119T in June. Value of gold reserves rose from USD 79.83B to USD 87.27B. China’s State Administration of Foreign Exchange noted that Dollar index dropped while asset prices in international markets rose in June, factored by global trade situation and monetary policy of major central banks. Combined together, exchange rate conversion and asset price changes contributed to the increase in the country’s foreign exchange reserves.

SAFE also noted despite increased uncertainties, China’s economy has been “generally stable and operating in a reasonable range”. Supply and demand in the foreign exchange market has been “basically balance”. Looking forward, China will continue to promote high-quality economic development and actively implement all-round opening up measures.

Resilience and sustainability of economic growth will be further enhanced. These will provide strong support for the stability of China’s foreign exchange market, thus providing a solid foundation for maintaining the overall stability of foreign exchange reserves.

ECB Villeroy: Economic signals continuing slowdown, but also significant wage increase and job creation

ECB Governor Council member François Villeroy de Galhau hinted that the central bank could launch fresh stimulus before IMF Managing Director Christine Lagarde takes over Mario Draghi’s job as ECB President. He noted that “If we speak about monetary policy we have several Governing Councils to come, in the next month, including with Mario Draghi. And if and when needed, there must be no doubt about our determination to act and our capacity to act.”

Villeroy said policymakers look at the market, but emphasized “we are not market dependent, we are data dependent”. And, “if we look at the economic signals there is a continuing slowdown but there also significant wage increases … significant job creation on both sides of the Atlantic. So let us wait for our next Governing Council, and there are several to come, to assess the data and then to decide.”

Meanwhile, he also pointed to trade tensions as the biggest uncertainty and threat to the global economy. However, “it’s up to political leaders to reduce these uncertainties, which are sometimes self created. We cannot compensate for trade tensions.”

Fed Powell, FOMC Minutes, ECB Accounts and BoC to highlight the week

Fed Chair Jerome Powell’s testimony and FOMC minutes will be two major focuses this week. At this point, fed fund futures are still pricing in 100% chance of a 25bps July Fed cut, even though 50% bps cut is basically priced out. If Powell would like to correct such expectations, the testimony will be his ideal chance to explain that Fed is indeed not that desperate for the insurance cut. Also, while a total of eight policymakers penciled in rate cuts this year, the minutes could reveal how urgent they think the cuts are needed. Additionally, US CPI release could also be an important factor for Fed to consider.

Back on June 18, ECB President Mario Draghi opened the door for further easing in a speech. He “in the absence of improvement, such that the sustained return of inflation to our aim is threatened, additional stimulus will be required.” And, the options on further measures were “raised and discussed” at ECB’s last meting. Last week, Governor Council member Olli Rehn even issued a panic call as “further monetary stimulus is now needed until there is improvement in economic and inflation prospects”. Expectations are now building up for ECB to act on July 25. This week’s minutes of June meeting would reveal what were actually being discussed.

BoC is widely expected to keep policy rate unchanged at 1.75% this week. The case for easing faded after recent data continued to show broad-based pick-up in the economy. Also, WTI crude oil has already rebounded notably from last year’s low of 42 and settled between 50/60. Headline inflation also picked up to 2.4% yoy, with core measures averaged at 2.1%. BoC would possibly shift towards a more neutral stance. But for now, due to external risks, there shouldn’t be any case to turn hawkish yet.

BoE Governor Mark Carney sounded surprisingly dovish in a speech last week. He warned that “recent data also raise the possibility that the negative spillovers to the UK from a weaker world economy are increasing and the drag from Brexit uncertainties on underlying growth here could be intensifying.”. UK GDP and productions data will be closely watched to verify Carney’s view point.

Here are some highlights for the week:

- Monday: Japan current account, machine orders; German industrial production, trade balance, Eurozone Sentix investor confidence.

- Tuesday: Japan M2; Australia NAB business confidence; Swiss unemployment rate; UK BRC retail sales monitor; Canada housing starts, building permits.

- Wednesday: Japan PPI; China CPI, PPI; UK GDP, industrial and manufacturing productions, construction output, goods trade balance; BoC rate decision; Fed chair Powell testimony, FOMC minutes.

- Thursday: Australia inflation expectations, home loans; Japan tertiary industry index; German CPI final; ECB monetary policy accounts; Canada new housing price index; US CPI, jobless claims, Fed chair Powell testimony.

- Friday: New Zealand Business NZ manufacturing index; China trade balance; Eurozone industrial production; US PPI.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.6948; (P) 0.6989; (R1) 0.7020; More…

AUD/USD recovers ahead of 0.6956 minor support and intraday bias remains neutral first. On the upside, break of 0.7047 will resume the rebound from 0.6831 to 61.8% retracement of 0.7295 to 0.6831 at 0.7118. Sustained break will target 0.7295 resistance next. On the downside, break of 0.6956 support, however, will indicate completion of the rebound. Intraday bias will be turned back to the downside for retesting 0.6831 low.

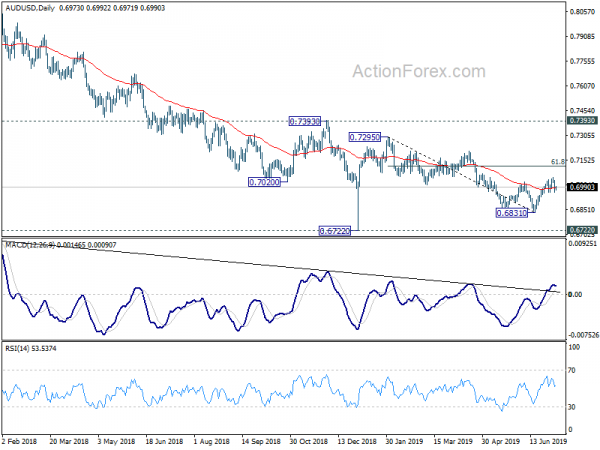

In the bigger picture, with 0.7393 key resistance intact, medium term outlook remains bearish. The decline from 0.8135 (2018 high) is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Current Account (JPY) May P | 1.31T | 1.24T | 1.60T | |

| 23:50 | JPY | Machine Orders M/M May | -7.80% | -3.70% | 5.20% | |

| 5:00 | JPY | Eco Watchers Survey Current Jun | 44 | 43.8 | 44.1 | |

| 6:00 | EUR | German Industrial Production M/M May | 0.30% | 0.30% | -1.90% | -2.00% |

| 6:00 | EUR | German Trade Balance (EUR) May | 18.7B | 16.8B | 17.0B | 16.9B |

| 8:30 | EUR | Eurozone Sentix Investor Confidence Jul | 0.2 | -3.3 | ||

| 19:00 | USD | Consumer Credit (USD) May | 15.2B | 17.5B |