Yen surges broadly again today as major global treasury yield resumed recent free fall. US 10-year yield down -0.058 to 1.976 overnight and it’s now trading further lower to 1.947. German 10-year bund yield opens lower and is down -0.025 at -0.390, continuing to make new record low. Japan 10-year yield JGB yield is relatively steady, just down -0.005 at -0.147. For now, Swiss Franc is the second strongest, followed by New Zealand Dollar.

On the downside, Sterling is suffering most as the weakest. Selling took off overnight on dovish comments from BoE Governor Mark Carney. Canadian Dollar is the second weakest following steep pull back in oil price. WTI crude oil was rejected by 60 handle again earlier in the week and it’s back at 56.5. Euro is the third weakest as markets are not too encouraged by nomination of IMF Managing director Christine Lagarde as next ECB President. Dollar is mixed, awaiting ADP employment and ISM services.

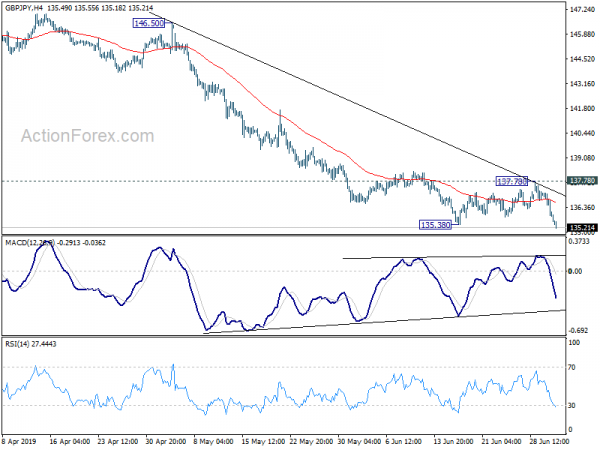

Technically, GBP/JPY’s break of 135.38 confirms resumption of fall from 148.87. Next target is 131.51 low. EUR/JPY breaks 121.65 minor support and focus is now on 120.78. Break will resume fall from 127.50 towards 118.62 low. USD/JPY’s is back pressing 107.56 and break will also put focus to 106.78 support first.

In Asia, Nikkei closed down -0.53%. Hong Kong HSI is down -0.33%. China Shanghai SSE is down -0.97%. Singapore Strait Times is down -0.35%. Japan 10-year JGB yield is down -0.005 at -0.147. Overnight, DOW rose 0.26%. S&P 500 rose 0.29%. NASDAQ rose 0.22%. 10-year yield dropped -0.058 to 1.976.

IMF Lagarde nominated to be next ECB president

After three days of marathon summit negotiations, EU leaders have finally agreed to nominate two women for the two top posts. France’s IMF Managing Director Christine Lagarde is chosen as the successor of Mario Draghi as ECB President. German Defence Minister Ursula von der Leyen, a close ally of Chancellor Angela Merkel, would succeed Jean-Claude Juncker as European Commission President.

In other decision, Belgium’s Liberal caretaker Prime Minister Charles Michel would overtake Donald Tusk as European Council President. Spain’s acting Foreign Minister, Josep Borrell, is nominated as EU’s foreign policy chief.

Fed Mester: Too soon to decide to cut interest rate

Yesterday, Cleveland Fed President Loretta Mester said in a speech that she will be monitoring incoming data to determine if her baseline outlook of sustainable-growth remains intact. And for now, it’s “too soon” to make that determination. Hence, she said, “I prefer to gather more information before considering a change in our monetary policy stance.”

To be more specific, Mester added, “if I see a few weak job reports, further declines in manufacturing activity, indicators pointing to weaker business investment and consumption, and declines in readings of longer-term inflation expectations, I would view this as evidence that the base case is shifting to the weak-growth scenario. In this scenario, the economy’s short- to medium-term equilibrium interest rate would be moving down, and our policy rate could need to move down ”

BoE Carney: Global negative spillovers to UK increasing, drag from Brexit uncertainties intensifying

Yesterday, BoE Governor Mark Carney said in a speech that the robust, broad-based expansion in the global economy has turned into a widespread slowdown. He warned “the latest actions raise the possibility that trade tensions could be far more pervasive, persistent and damaging than previously expected.” Risks have shifted to the downside.

Regarding UK, Carney said Q2 is likely to be “considerably weaker” than Q1. Also, “recent data also raise the possibility that the negative spillovers to the UK from a weaker world economy are increasing and the drag from Brexit uncertainties on underlying growth here could be intensifying.” Also, “underlying growth in the UK is currently running below its potential, and is heavily reliant on the resilience of household spending.”

Further, Carney warned “a no deal outcome would result in an immediate, material reduction in the supply capacity of the UK economy as well as a negative shock to demand. And, “as in other advanced economies, if there is a material trade shock, other policies, including fiscal policy, would likely need to play important roles in supporting the economy.”

BoJ Funo: Necessary to maintain low rates for prolonged period, but no need to ease further

BoJ board member Yukitoshi Funo said it’s necessary to maintain current ultra-loose monetary policy. However, he saw no need to ramp up stimulus for now.

Funo said, “given price growth and inflation expectations aren’t heightening much, it’s necessary to maintain sufficiently low rates for a prolonged period to achieve the BoJ’s price target.” However, he’s also optimistic that “we can expect Japan’s economy to recover in the latter half of this year”. And, “as such, I see no need to ease policy further now,”

He also noted the forward guidance is already leaving open the possibility of the BoJ maintaining current policy for long. “We say ‘at least’ until spring 2020 because there’s a good chance current low rates will be maintained beyond spring next year.”

Australia trade surplus jumped to record high, building approvals recovered

Australia trade surplus widened to a fresh record high of AUD 5.7B in May, up fro AUD 4.8B in April, and beat expectation of USD 5.3B.

Exports rose AUD 1,442M (4%) to AUD41,585m. Non-rural goods rose AUD 1,316M (5%), rural goods rose AUD 46M (1%) and non-monetary gold rose AUD 22M (1%). Net exports of goods under merchanting fell AUD 1M (5%). Services credits rose AUD 58M (1%).

Import rose AUD515m (1%) to AUD 35,839M. Capital goods rose AUD 348M (5%), non-monetary gold rose AUD 68M (17%) and intermediate and other merchandise goods rose AUD 66M (1%). Consumption goods fell AUD 73M (1%). Services debits rose AUD 107M (1%).

Also from Australia, building approvals rose 0.7% (seasonally adjusted) in May, versus expectation of 0.0%. Rise in Victoria (14.4%) drove the national increase. Meanwhile falls were recorded in Queensland (6.3%), Western Australia (4.7%), South Australia (2.9%) and Tasmania (1.2%), while New South Wales was flat. Private dwellings excluding houses rose 1.2%, while private house approvals decreased 0.3%.

Australia AiG Performance of Service Index dropped -0.3 to 52.2.

From China, Caixin PMI Services dropped to 52.0 in June, down from 52.7 and missed expectation of 52.6.

Looking ahead

UK PMI services will be the main focus in European session. Eurozone PMI services will also be released. Later in the day, US will release ISM services, factor orders, jobless claims, ADP employment and trade balance. Canada will also release trade balance.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 135.47; (P) 136.31; (R1) 136.75; More…

GBP/JPY drops sharply today and break of 135.38 support indicate resumptions of recent fall from 148.87. Intraday bias is back on the downside for 131.51 low next. On the upside, break of 137.78 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, current development suggests that GBP/JPY’s medium term fall from 156.59 (2018 high) is still in progress. Break of 131.51 will target 122.36 (2016 low). Structure of such decline is corrective looking so far, arguing that it’s just the second leg of consolidation from 122.36. Thus, we’d expect strong support from 122.36 to contain downside to bring reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Service Index Jun | 52.2 | 52.5 | ||

| 1:30 | AUD | Building Approvals M/M May | 0.70% | 0.00% | -4.70% | -3.40% |

| 1:30 | AUD | Trade Balance (AUD) May | 5.75B | 5.25B | 4.87B | 4.82B |

| 1:45 | CNY | Caixin PMI Services Jun | 52 | 52.6 | 52.7 | |

| 7:45 | EUR | Italy Services PMI Jun | 50 | 50 | ||

| 7:50 | EUR | France Services PMI Jun F | 53.1 | 53.1 | ||

| 7:55 | EUR | Germany Services PMI Jun F | 55.6 | 55.6 | ||

| 8:00 | EUR | Eurozone Services PMI Jun F | 53.4 | 53.4 | ||

| 8:30 | GBP | Services PMI Jun | 51 | 51 | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Jun | 85.90% | |||

| 12:15 | USD | ADP Employment Change Jun | 140k | 27k | ||

| 12:30 | CAD | International Merchandise Trade (CAD) May | -1.0B | |||

| 12:30 | USD | Trade Balance May | -53.2B | -50.8B | ||

| 12:30 | USD | Initial Jobless Claims (JUN 29) | 220K | 227K | ||

| 13:45 | USD | Services PMI Jun F | 50.7 | 50.7 | ||

| 14:00 | USD | Factory Orders May | -0.50% | -0.80% | ||

| 14:00 | USD | ISM Non-Manufacturing/Services Composite Jun | 56 | 56.9 | ||

| 14:30 | USD | Crude Oil Inventories | -12.8M | |||

| 16:00 | USD | Natural Gas Storage | 98B |