Dollar and stocks are give a strong boost after Trump-Xi meeting in Japan delivered what the markets expected. For now, the greenback is trading as the strongest ones while traders are revisiting the chance of Fed cut in July. Canadian Dollar is steadily firm, partly helped by rally resumption in oil price, as WTI breaches 60 handle. Swiss France and Yen are broadly pressured but Euro and Australian Dollar are not far behind.

In short, Trump an Xi agreed to stop further escalations in tariffs for the time being. Trump agreed to loosen up the ban on Chinese tech giant Huawei while China agreed to buy large amount of American farm products. Additionally, Trump surprised the world by being the first sitting US president to visit the Demilitarized Zone between the two Koreas and met North Korean leader Kim Jong-un, for restarting nuclear talks.

Technically, while Dollar is strong today, it has yet to take out key near term resistance levels against others. More is needed to confirm bottoming and bullish reversal in the greenback. 1.1317 minor support in EUR/USD, 1.2642 support in GBP/USD, 0.9854 resistance in USD/CHF and 108.80 resistance in USD/JPY need to be taken out firmly, better together, to confirm Dollar strength.

In other markets, Nikkei closed up 2.14%. China Shanghai SSE is up 1.97%. Singapore Strait Times is up 1.38%. Hong Kong is on holiday. Japan 10-year JGB yield is up 0.0175 at -0.144.

Trump claims winning, Kudlow talks down loosening of Huawei ban

A day after the meeting with Xi, Trump claimed on Sunday, in South Korea, that the US is “winning big because we have created an economy that is second to none”. And, “we’re collecting 25 percent on $250 billion, and China is paying for it, as you know, because, as you notice, our inflation hasn’t gone up.”

Trump further claimed that “China has devalued their currency in order to pay for the tariffs… And in addition to devaluing, they’ve also pumped a lot of money into their economic model… They’ve been pumping money in. We haven’t. We’ve been retracting. We’ve been raising interest rates and they’ve been lowering interest rates.”

Separately, the loosening up of Huawei ban triggered some criticism from Trump’s Republican party. South Carolina Republican Senator Lindsay Graham warned “there will be a lot of pushback if it is a major concession.”

But National Economic Council chairman Larry Kudlow tried to tone it down on Fox News Sunday. He said “all that is going to happen is Commerce will grant some additional licenses where there is a general availability” of the parts the company needs. And, companies “are selling products that are widely available from other countries … This not a general amnesty … The national security concerns will remain paramount.”

China Daily: US-China remain widely apart even on the conceptual level

On the Chinese side, the official China Daily welcomed the agreement between Trump and Xi to ” make way for negotiations”. However, it warned “agreement on 90 percent of the issues has proved not to be enough, and with the remaining 10 percent where their fundamental differences reside, it is not going to be easy to reach a 100-percent consensus, since at this point, they remain widely apart even on the conceptual level.”

USD/CNH (offshore Yuan) drops sharply today and the Yuan rebounds on trade news. With 55 day EMA firmly taken out, the rise from 0.6699 should have completed at 0.6920, after failing 6.9800 resistance. Imminent pressure on breaking the psychologically important 7 handle is eased. Deeper fall could be seen back towards 6.6699 could be seen for the near term. But strong support should be seen around there to contain downside. Eventual break of 6.9800 is still expected at a later stage.

China Caixin PMI manufacturing dropped to 49.4, second lowest since Jun 2016

China Caixin PMI Manufacturing dropped to 49.4 in June, down from 50.2, and missed expectation of 50.1. It’s also the second lowest since June 2016, and below neutral 50-mark dividing expansion from contraction again. It’s noted that output and new work intakes declined for first time since January. There was renewed reduction in export sales while goods producers cutback input purchasing and payroll numbers

Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said: “Overall, China’s economy came under further pressure in June. Domestic demand shrank notably, foreign demand was still underpinned by front-loading exports, and business confidence fell sharply. It’s crucial for policymakers to step up countercyclical policies. New types of infrastructure, high-tech manufacturing and consumption are likely to be the main policy focuses.”

Also released over the weekend, the official China PMI Manufacturing was unchanged at 49.4 in June, below expectation of 49.5. Official PMI Non-Manufacturing dropped to 54.2, down from 54.3, matched expectations.

Australia AiG PMI manufacturing dropped to 49.4, lowest since Aug 2016

Australia AiG Performance of Manufacturing Index dropped -3.3 pts to 49.4 (seasonally adjusted) in June, below 50-points threshold and was the lowest level since August 2016. In trend terms, PMI dropped -0.4 to 51.9. Three of the six sectors are in deep contraction including metal products, TCF paper & printing, and machinery and equipment. Though, food & beverages, building materials and chemicals are holding first.

Employment data are mixed. average wage index rebounded by 4.2 points to 59.7, indicating a faster rate of wage increases (seasonally adjusted). However, employment index fell by -5.5 points to be broadly stable at 50.1.

Japan Tankan large manufacturing index dropped to near three year low

Japan Q2 Tankan survey showed large manufacturing index deteriorated to the worst level in nearly three years. But, improvements was seen in the non-manufacturing sector. Capital expenditure also held up well. Overall, the set of data argues that while the economy is stagnating, it’s not falling off the cliff. And, BoJ will likely maintain its baseline of moderate expansion.

Large Manufacturing Index dropped to 7, down from 12 and missed expectation of 9, lowest since September 2016. Large Manufacturers Outlook dropped to 7, down from 8, but beat expectation of 6. Large Non-Manufacturing Index rose to 23, up from 21, beat expectation of 20. Large Non-Manufacturing Outlook dropped to 17, down from 20, missed expectation of 19. All industry capex rose 7.4%, up from 1.2% but missed expectation of 8.1%.

Also from Japan, PMI manufacturing was finalized at 49.3, revised down from 49.5, below the 50 no-change threshold for the second consecutive month. Consumer confidence dropped to 38.7 in June, down from 39.4 and missed expectation of 39.2.

Looking ahead: RBA to cut interest rates, NFP and ISMs to guide Fed move

RBA is generally expected to cut cash rate again by 25bps to 1.00% this week. Originally, some expected the rate cut to happen in August. But such expectation was pulled ahead after Governor Philip Lowe said after June’s cut that it would be “unrealistic to expect that lowering interest rates by ¼ of a percentage point will materially shift the path we look to be on.” And, “it is not unrealistic to expect a further reduction in the cash rate as the Board seeks to wind back spare capacity in the economy and deliver inflation outcomes in line with the medium-term target.”

Some might argue that RBA could hold fire first and wait until new economic projections before acting. But the problem is, Lowe has already set up expectations with his unusually blunt language. Failure to deliver this week would shoot up the exchange, which should offset some of the effect of prior rate cut. Thus, even though it’s far from certain, RBA is much more likely to cut this week than not.

The string of economic data from the US this are more important than ever. Now that the threat of further trade war escalations is delayed, economic data will be crucial to for Fed to decide on whether to cut interest rate “immediately” in July or not. Let’s recall Chair Jerome Powell just emphasized last week, “we are also mindful that monetary policy should not overreact to any individual data point or short-term swing in sentiment. Doing so would risk adding even more uncertainty to the outlook.” It seems like Fed doesn’t really something stellar in this week’s NFP and ISMs for it to hold its hand. Rather, having the readings back to “normal” would be enough for standing pat for now.

In addition, Japan Tankan, UK PMIs, China PMIs, Australia trade balance and retail sales, Canada employment, will also be closely watched.

- Monday: Japan Tankan survey; Australia AiG manufacturing, MI inflation gauge; China Caixin PMI manufacturing; Swiss retail sales; Eurozone PMI final, M3 money supply, unemployment rate; UK PMI manufacturing, M4; US ISM manufacturing, construction spending.

- Tuesday: New Zealand building permit; RBA rate decision; Germany retail sales; UK PMI construction; Eurozone PPI; Canada PMI manufacturing.

- Wednesday: Australia trade balance, building approvals; Eurozone PMI services final; UK PMI services; US ADP employment, trade balance, jobless claims, ISM services, factory orders; Canada trade balance.

- Thursday: Australia retail sales; Swiss CPI; Eurozone retail sales.

- Friday: Japan household spending, leading indicators; Germany factor orders; Swiss foreign currency reserves; Canada employment, Ivey PMI; US non-farm payrolls.

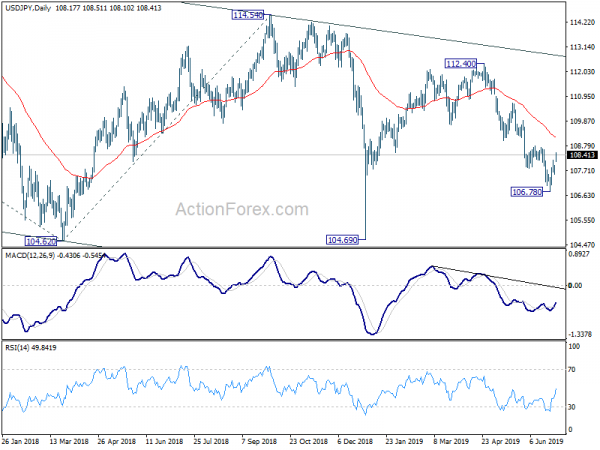

USD/JPY Daily Outlook

Daily Pivots: (S1) 107.68; (P) 107.81; (R1) 108.06; More…

USD/JPY rebounds strongly today but stays below 108.80 resistance. Intraday bias remains neutral first. Considering bullish convergence condition in 4 hour MACD, firm break of 108.80 will confirm short term bottoming at 106.78. In this case, stronger rise should be seen back to 110.67 resistance. On the other hand, rejection by 108.80, followed by break of 107.56 will retain near term bearishness. Intraday bias will be turned back to the downside for 106.78 support instead.

In the bigger picture, decline from 118.65 (Dec 2016) is still in progress, with the pair staying inside long term falling channel. Break of 104.62 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. In any case, break of 112.40 is needed to the first serious sign of medium term bullishness. Otherwise, further decline will remain in favor in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Manufacturing Index Jun | 49.4 | 52.7 | ||

| 23:50 | JPY | Tankan Large Manufacturing Index Q2 | 7 | 9 | 12 | |

| 23:50 | JPY | Tankan Large Manufacturers Outlook Q2 | 7 | 6 | 8 | |

| 23:50 | JPY | Tankan Large Non-Manufacturing Index Q2 | 23 | 20 | 21 | |

| 23:50 | JPY | Tankan Large Non-Manufacturing Outlook Q2 | 17 | 19 | 20 | |

| 23:50 | JPY | Tankan Small Manufacturing Index Q2 | -1 | 2 | 6 | |

| 23:50 | JPY | Tankan Small Manufacturing Outlook Q2 | -5 | -2 | -2 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Index Q2 | 10 | 10 | 12 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Outlook Q2 | 3 | 6 | 5 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q2 | 7.40% | 8.10% | 1.20% | |

| 0:30 | JPY | PMI Manufacturing Jun F | 49.3 | 49.5 | ||

| 1:00 | AUD | TD Securities Inflation M/M Jun | 0.00% | 0.00% | ||

| 1:45 | CNY | Caixin PMI Manufacturing Jun | 49.4 | 50.1 | 50.2 | |

| 5:00 | JPY | Consumer Confidence Index Jun | 38.7 | 39.2 | 39.4 | |

| 6:30 | CHF | Retail Sales Real Y/Y May | -0.70% | |||

| 7:30 | CHF | PMI Manufacturing Jun | 49 | 48.6 | ||

| 7:45 | EUR | Italy Manufacturing PMI Jun | 48.7 | 49.7 | ||

| 7:50 | EUR | France Manufacturing PMI Jun F | 52 | 52 | ||

| 7:55 | EUR | Germany Manufacturing PMI Jun F | 45.4 | 45.4 | ||

| 7:55 | EUR | German Unemployment Change (000’s) Jun | 0.0k | 60.0k | ||

| 7:55 | EUR | German Unemployment Claims Rate Jun | 5.00% | 5.00% | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Jun F | 47.8 | 47.8 | ||

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y May | 4.60% | 4.70% | ||

| 8:30 | GBP | Mortgage Approvals May | 65.5k | 66.3k | ||

| 8:30 | GBP | Money Supply M4 M/M May | 0.90% | |||

| 8:30 | GBP | PMI Manufacturing Jun | 49.5 | 49.4 | ||

| 9:00 | EUR | Eurozone Unemployment Rate May | 7.60% | 7.60% | ||

| 13:45 | USD | Manufacturing PMI Jun F | 50.1 | 50.1 | ||

| 14:00 | USD | ISM Manufacturing Jun | 51 | 52.1 | ||

| 14:00 | USD | ISM Prices Paid Jun | 53 | 53.2 | ||

| 14:00 | USD | ISM Employment Jun | 53.7 | |||

| 14:00 | USD | Construction Spending M/M May | 0.10% | 0.00% |