Dollar remains generally firm in quiet Asian markets today. The greenback continues to be supported by expectation that FOMC won’t deliver any “insurance” rate cut this week. Instead, Fed policy makers will look at the upcoming developments before making a decision, in particular the result of G20 summit regarding US China trade war.

Also, market pricing of as much as three insurances cuts, or 75bps, by the end of the year is questioned by Goldman Sachs as “overly hasty”. We agree that the hurdle for such amount of policy easing is much higher than widely believed.

Staying in the currency markets, commodity currencies recover generally, following mild strengthen in Asian session. But upside of Aussie, Kiwi and Canadian are all rather limited. Swiss Franc is currently the weakest one as worries over geopolitical tensions faded mildly. Euro is the second weakest.

Technically, AUD/USD recovers mildly today, after breaching 0.6864 last week. Outlook is unchanged as further decline is still expected through 0.6864 decisively to 0.6722 low. Similarly, despite today’s mildly recovery, further decline is expected in GBP/JPY, decisively, through 136.55 to 131.51 low. A focus today is whether EUR/USD or GBP/USD would hit recent low at 1.1107 and 1.2559 respectively first.

In Asia, Nikkei closed up 0.03%. Hong Kong HSI is up 0.48%. China Shanghai SSE is up 0.04%. Singapore Strait Times is down -0.27%. Japan 10-year JGB yield is up 0.0041 at -0.12.

BCC: Contraction in business investment to drag UK growth in 2020 and 2021

The British Chambers of Commerce revised up 2019 UK growth forecast to 1.3% (from 1.2%), driven by the “exceptionally rapid stock-building” early in the year. However, 2020 growth forecast was downgraded notably to 1.0% (from 1.3%), 2021 downgraded to 1.2% (from 1.4%). In particular, business investment is forecast to contract -1.3% in 2019 before recovering slightly by 0.4% 2020.

Adam Marshall, Director General of BCC noted: “Businesses are putting resources into contingency plans, such as stockpiling, rather than investing in ventures that would positively contribute to long-term economic growth. This is simply not sustainable”,

Suren Thiru, Head of Economics at BCC said: “The deteriorating outlook for business investment is a key concern as it limits the UK’s productivity potential and long-term growth prospects…. A messy and disorderly exit from the EU remains the main downside risk to the UK’s economic outlook as the disruption caused would increase the likelihood of the UK’s weak growth trajectory translating into a more pronounced deterioration in economic conditions.”

ECB de Guindos: De-anchoring of inflation expectations needed before more monetary stimulus

Over the weekend, ECB Vice President Luis de Guindos said current monetary policy is “fully compatible with both inflation and real activity.” And, “de-anchoring of inflation expectations” is needed before ECB ease monetary policy again.

He told Italian newspaper Corriere della Sera that “what we need to see is a de-anchoring of inflation expectations” for more policy stimulus. However, “this has not yet happened, despite the fact that there has been a drop in market-based inflation expectations.” “If there is a further deterioration, then we will react,” de Guindos added. “But for now, our monetary policy stance is fully compatible with both inflation and real activity.”

On the impact of global trade tensions, de Guindos said “you can certainly smooth the impact with monetary policy, but you will not be able to address and fix this kind of problems with monetary policy”.

Separately, Governing Council member Ewald Nowotny said it would be “reasonable” to have “some more flexibility” on inflation target. And, he was “in favor of keeping the 2 percent target but with a corridor of 0.5 or 1 percent, up or down. A precision landing is hardly possible.”

FOMC as highlight of the week, data from Canada and Eurozone could be market moving

FOMC rate decision will be the major focus this week. For now, Fed expected to stand pat this month, and probably save the “insurance” rate cut for July. After all, the outcome of any meeting between Trump and Xi at G20 on June 28-29 is crucial to the overall outlook. Recent data suggests Fed doesn’t need to jump the gun for now. Fed might tweak the statement to indicator openness for rate adjustments. But then, the new economic projections would need to confirm the need for such rate cuts. Otherwise, it’s premature for Fed to reverse course. Other than Fed, BoJ and BoE will both meet this week too. Neither of them are expected to have any change in monetary policies. RBA minutes shouldn’t provide any newer than Governor Philip Lowe’s speeches. ECB will also release monthly bulletin.

Meanwhile, data from Canada and Eurozone could probably be most market moving. In particular, Canada CPI and retail sales could add to the case of no rate cut by BoC. Eurozone PMIs will one again reveal if the anticipated recovery in manufacturing is happening, or the spillover to services is continuing. UK CPI, New Zealand GDP and Japan CPI will also be watched too.

- Monday: Canada foreign securities transactions; US Empire State manufacturing index, NAHB housing index.

- Tuesday: RBA June minutes, Australia house price index; Germany ZEW economic sentiment; Eurozone trade balance, CPI final; Canada manufacturing sales; US housing starts and building permits.

- Wednesday: New Zealand current account; Japan trade balance; Germany PPI; Eurozone current account; UK CPI, PPI; Canada CPI; FOMC rate decision.

- Thursday New Zealand GDP; BoJ rate decision; Swiss trade balance; ECB monthly bulletin, Eurozone consumer confidence; BoE rate decision; US Philly Fed survey, jobless claims, current account, leading indicator.

- Friday: Australia PMIs; Japan CPI, PMI manufacturing; Eurozone PMIs; UK public sector net borrowing; Canada retail sales; US PMIs, existing home sales.

GBP/USD Daily Outlook

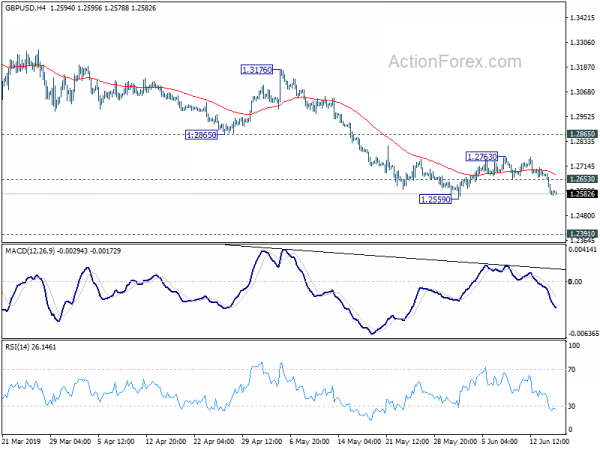

Daily Pivots: (S1) 1.2551; (P) 1.2619; (R1) 1.2660; More….

Intraday bias in GBP/USD remains on the downside for 1.2559 support. Break there should confirm resumption of whole fall from 1.3381 and target 1.2391 low next. On the upside, above 1.2653 minor resistance will delay the bearish case and bring more consolidations first. But in case of another recovery, upside should be limited by by 1.2865 support turned resistance to bring fall resumption eventually.

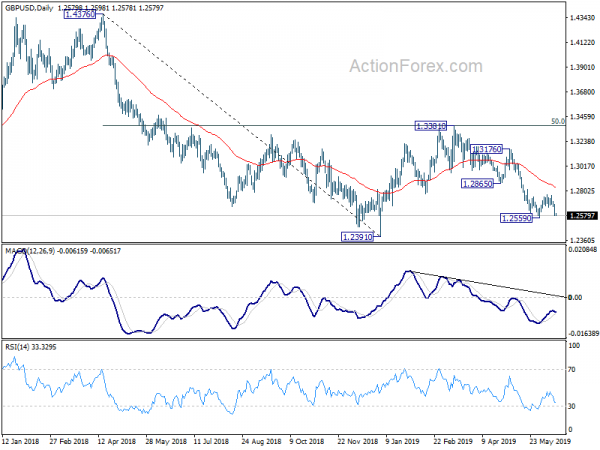

In the bigger picture, medium term decline from 1.4376 (2018 high) is possibly ready to resume. Decisive break of 1.2391 would target a test on 1.1946 long term bottom (2016 low). For now, we don’t expect a firm break there yet. Hence, focus will be on bottoming signal as it approaches 1.1946. In any case, medium term outlook will stay bearish as long as 1.3381 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Jun | 0.30% | 0.90% | ||

| 9:00 | EUR | Eurozone Labour Costs Y/Y Q1 | 2.30% | |||

| 12:30 | CAD | International Securities Transactions (CAD) Apr | -1.49B | |||

| 12:30 | USD | Empire State Manufacturing Jun | 11 | 17.8 | ||

| 14:00 | USD | NAHB Housing Market Index Jun | 67 | 66 |