It’s a roller coaster ride for Euro. It initially dipped after ECB said there will be no rate hike at least through mid 2020. Then it recovered and breaks yesterday’s higher against Dollar as the press conference and new economic projections turn out to be not that dovish. Though, upside is capped as President Mario Draghi bluntly said “no” to the idea that next move is more likely a hike. After all, the announcement was, just like Draghi said, an expression of “confidence in the present baseline, but also clear acknowledgement of risks”

On the other hand, Dollar’s recovery attempt faltered quickly today with tariffs threats ahead. US and Mexico are going to resume negotiations after progress were “not nearly enough” with yesterday’s meeting. Trump hinted he’s likely to impose the 5% tariffs next Monday. On another front, Trump repeated his threat to tariff all currently untaxed USD 300B of Chinese imports. Such a decision could be made soon after G20 meeting later in month. For now, there is no sign that Trump and Xi will even meet of shake hands there given recent hard-line rhetorics from both sides.

In the currency markets, currently, Euro is the strongest one, followed by Swiss Franc. Dollar is the weakest followed by Canadian. But all major pairs and crosses are bounded inside yesterday’s range. Over the week, Dollar is undoubtedly the weakest on bet of Fed rate cut. Yen follows as second weakest. Kiwi and Loonie are the strongest ones, followed by Swiss and Euro.

In other markets, DOW open slightly higher and is currently up 0.10%. 10-year yield is down -0.0163 at 2.118. In Europe, FTSE is up 0.43%. DAX is down -0.22%. CAC is flat. German 10-year yield is up 0.0229 at -0.201, still below -0.2 handle. Earlier in Asia, Nikkei dropped -0.01%. Hong Kong HSI rose 0.26%. China Shanghai SSE dropped -1.17%. Singapore Strait Times rose 0.12%. Japan 10-year JGB yield rose 0.0042 to -0.121.

ECB said rates to stay low longer, but overall announcement not dovish enough

ECB left interest rates unchanged today as widely expected. That is, main refinancing, marginal lending and deposit rates are kept at 0.00%, 0.25% and -0.40% respectively. ECB changed the forwards guidance and said interest rates will remain at present levels “at least through the first half of 2020, longer than “the end of 2019”. ECB also announce the rates of TLTRO III operations.

President Mario Draghi didn’t sound too dovish in the post meeting press conference, nor were the new economic projections. He noted that “most recent information indicates that global headwinds continue to weigh on the euro area outlook”. And, “the prolonged presence of uncertainties, related to geopolitical factors, the rising threat of protectionism and vulnerabilities in emerging markets, is leaving its mark on economic sentiment.”

However, “further employment gains and increasing wages continue to underpin the resilience of the euro area economy and gradually rising inflation.” And, ECB is “determined to act in case of adverse contingencies and also stands ready to adjust all of its instruments, as appropriate”.

In the June 2019 Eurosystem staff macroeconomic projections for Eurozone, growth is projected to be at 1.2% in 2019 (revised up by 0.1%), 1.4% in 2020 (down by -0.2%) and 1.4% in 2021 (down by -0.1%). HICP is projected to be at 1.3% in 2019 (revised up by 0.1%), 1.4% in 2020 (revised down by -0.1%) and 1.6% in 2021 (unchanged).

Draghi noted that risks to growth outlook remain “tilted to the downside”.

EU Dombrovskis: Italy needs substantial deficit correction in 2019 and 2020

European Commission Vice President Valdis Dombrovskis said that Italy will need a “substantial deficit correction in 2019 and 2020”. He told La Repubblica daily a day after the Commission opened the way to so called “Excessive Deficit Procedure” on Italy. Dombrovskis also warned the coalition government’s planned tax cut reform could be very expensive and risks further deteriorating Italy’s public finances.

Economics Commissioner Pierre Moscovici told the European affairs commission of the lower house of France’s parliament, “it’s up to Italy to bear the burden of proof that it’s reducing its deficits and debt.” He reiterated that “my door is open to talk, to listen and to take note.”

Italy’s Deputy Prime Minister Luigi Di Maio insisted “there should not be a budget correction.” The coalition will start negotiations with EU to avoid disciplinary proceedings over its rising debt. However, Di Maio emphasized that such negotiations should be led by politicians, not “bureaucrats”.

Eurozone Q1 GDP growth finalized at 0.4%, EU at 0.5%

Eurozone Q1 GDP growth was finalized at 0.4% qoq, unrevised. Over the year, Eurozone GDP grew 1.2% yoy. EU28 growth was finalized at 0.5% qoq, 1.5% yoy. Among Member States for which data are available for the first quarter of 2019, Croatia (1.8%) recorded the highest growth compared with the previous quarter, followed by Hungary and Poland (both 1.5%). A decrease was observed in Latvia (-0.1%).

Quarterly, on the components, household final consumption expenditure rose by 0.5% in both the euro area and the EU28. Gross fixed capital formation increased by 1.1% in the euro area and by 1.3% in the EU28. Exports increased by 0.6% in the euro area and by 0.5% in the EU28. Imports increased by 0.4% in the euro area and 1.2% in the EU28.

Also released, Eurozone employment growth was finalized at 0.3% qoq in Q1. German factory orders rose 0.3% mom in April, above expectation of 0.0% mom.

US jobless claims unchanged at 218k, trade deficit dropped to USD 50.8B

US initial jobless claims was unchanged at 218k in the week ending June 1, slightly above expectation of 215k. Four-week moving average of initial claims dropped -2.5k to 215k. Continuing claims rose 20k to 1.682m in the week ending May 25. Four-week moving average of continuing claims dropped -1k to 1.673m.

Trade deficit dropped -2.1% to USD -50.8B, slightly larger than expectation of USD -50.5B. Exports dropped -2.2% to USD 206.8B. Imports dropped -2.2% to USD 257.6B.

With China, in April, deficit increased USD 2.1B to USD 29.4B. Exports decreased USD 1.8B to USD 8.5B and imports increased USD 0.3B to USD 37.9B. In Q1 after revisions, deficit decreased USD 22.9B to USD 80.8B. Exports increased USD 4.9B to USD 41.4B and imports decreased USD 18.0B to USD 122.2B.

Non-farm productivity was finalized at 3.4% in Q4, unit labor costs at -1.6%%. From Canada, trade deficit narrowed to CAD -0.97B in April.

Trump repeats his verbal threat of tariffs on $300B Chinese imports

Trump reiterated his threat to further escalate trade war with China again as the told reporters today. He said “Our talks with China, a lot of interesting things are happening. We’ll see what happens… I could go up another at least $300 billion and I’ll do that at the right time. But he added that “China wants to make a deal” and “Mexico wants to make a deal badly.”

On the other hand, China’s Commerce Ministry blamed Trump’s use of “ultimate pressure” has caused serious setbacks to trade negotiations. The ball is in the US court as future direction of talks would depend on Washington. MOFCOM also said China will have to adopt the necessary countermeasures if the United States decides to unilaterally escalate trade tensions.

Australia trade surplus at AUD 4.87B in Apr, exports rose 2.5% mom, imports rose 2.8% mom

Australia trade surplus came in smaller than expected at AUD 4.87B in April. Exports rose 2.5% mom, 17.2% yoy to AUD 40.42B. Imports rose 2.8% mom, 5.4% yoy to AUD 35.55B.

Looking at the details of exports, non-rural goods rose AUD 691m (3%), non-monetary gold rose AUD 272m (20%) and net exports of goods under merchanting rose AUD 8m (73%). Rural goods fell AUD 67m (2%). Services credits rose AUD 65m (1%).

For imports, intermediate and other merchandise goods rose AUD 423m (4%), capital goods rose AUD 308m (5%) and consumption goods rose AUD 298m (3%). Non-monetary gold fell AUD 40m (9%). Services debits fell AUD 5m.

EUR/USD Mid-Day Outlook

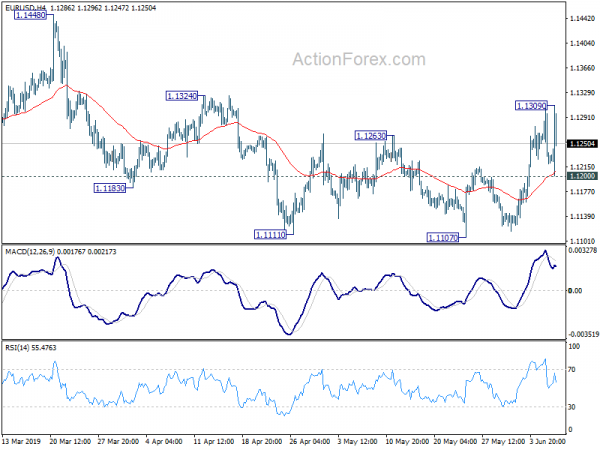

Daily Pivots: (S1) 1.1192; (P) 1.1248; (R1) 1.1278; More…..

After some volatility and breaking yesterday’s low and high, EUR/USD is staying in consolidative mode. Intraday bias remains neutral for the moment. Further rise is still currently in favor and break of 1.1309 will extend the rebound from 1.1107 short term bottom to 1.1448 key resistance. Decisive break there will carry larger bullish implications. However, break of 1.1200 should now confirm completion of the rebound from 1.1107. Intraday bias will then be turned back to the downside for 1.1107 low instead.

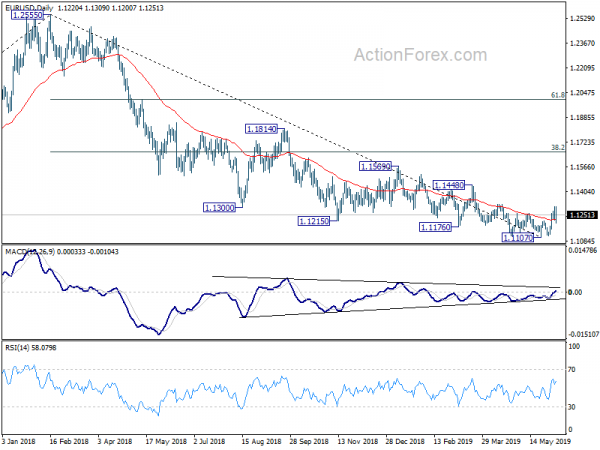

In the bigger picture, down trend from 1.2555 (2018 high) might still be in progress. Such decline would target 78.6% retracement of 1.0339 (2016 low) to 1.2555 (2018 high) at 1.0813 on resumption. However, break of 1.1448 resistance would confirm medium term bottoming, on bullish convergence condition in daily MACD. In such case, stronger rebound should be seen to 38.2% retracement of 1.2555 to 1.1107 at 1.1660. We’d look at the structure of the rebound to decide whether it’s a corrective rise later.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) Apr | 4.87B | 5.05B | 4.95B | 4.89B |

| 06:00 | EUR | German Factory Orders M/M Apr | 0.30% | 0.00% | 0.60% | 0.80% |

| 09:00 | EUR | Eurozone Employment Q/Q Q1 F | 0.30% | 0.30% | 0.30% | |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 F | 0.40% | 0.40% | 0.40% | |

| 11:30 | USD | Challenger Job Cuts Y/Y May | 85.90% | 10.90% | ||

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | 0.00% | |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | CAD | International Merchandise Trade (CAD) Apr | -0.97B | -2.8B | -3.2B | -2.34B |

| 12:30 | USD | Nonfarm Productivity Q1 F | 3.40% | 3.50% | 3.60% | |

| 12:30 | USD | Unit Labor Costs Q1 F | -1.60% | -0.90% | -0.90% | |

| 12:30 | USD | Initial Jobless Claims (JUN 1) | 218K | 215K | 215K | 218K |

| 12:30 | USD | Trade Balance Apr | -50.8B | -50.5B | -50.0B | -51.9B |

| 14:00 | CAD | Ivey PMI May | 56.2 | 55.9 | ||

| 14:30 | USD | Natural Gas Storage | 110B | 114B |