Dollar tried to stage a reversal overnight after initial selloff, but upside is so far limited and there is no confirmation of bottoming yet. There are a couple of factors behind the move. Post ADP employment decline was largely undone by better than expected ISM services. In particular, the employment component of ISM service improved notably by 4.4 to 58.1. The upcoming non-farm payroll report may not be as bad as ADP suggests.

Also, while more Fed officials expressed their openness to rate cuts, the development remain very fluid. At least, economic data don’t point to any reversal in the trend in employment, not the economy yet. Inflation outlook is just subdued but not deteriorating. Trump’s tariffs threat to Mexico is a main risk to the economy. Yet firstly, once imposed, the impact on inflation is unknown. Secondly, even if there is no agreement between the two countries in non-trade issue of migration flow, US Congress could challenge Trump’s tariffs and block the move. For now, it’s probably too early to overly bearish on Dollar even though technically it’s not doing very well.

Staying the currency markets, Dollar is currently the weakest one for today, followed by Swiss Franc and then Australian. Yen is the strongest one for today, followed by Kiwi and then Euro. Over the week, Dollar is undoubtedly the weakest one, followed by Yen and then Sterling. Kiwi is the strongest followed by Canadian.

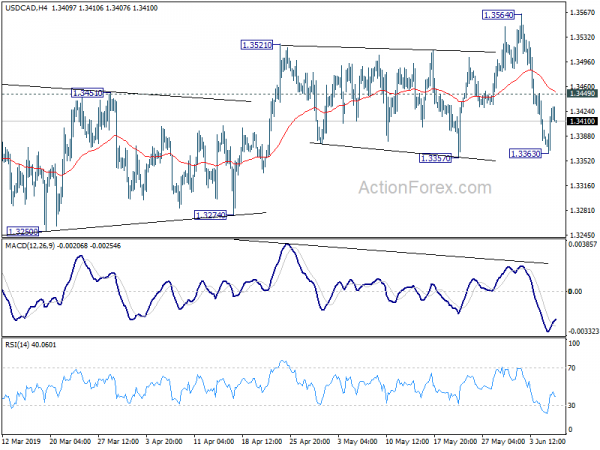

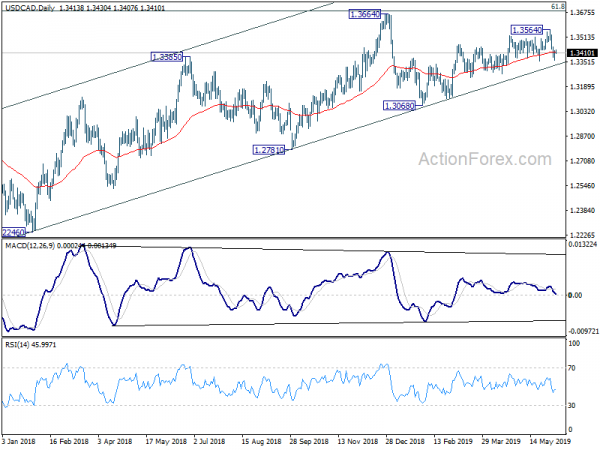

Technically, for now, further rise is expected on EUR/USD as long as 1.1215 minor support holds. And current rebound from 1.1107 could target a test on key resistance level at 1.1448. However, break of 1.1215, possibly on dovish ECB, could turn its focus back to 1.1107 low. USD/CAD recovered ahead of 1.3357 support, thanks to selloff in WTI oil. Further decline is in favor with 1.3349 minor resistance intact. And break of 1.3357 will indicate larger bearish reversal. However, above 1.3449 will revive near term bullishness and turn focus back to 1.3564 high. GBP/USD was held below 1.2747 minor resistance so far. Thus, it remains near term bearish for now.

In Asia, currently, Nikkei is up 0.22%. Hong Kong HSI is up 0.08%. China Shanghai SSE is down -0.77%. Singapore Strait Times is down -0.29%. Japan 10-year JGB yield is up 0.0088 at -0.117. Overnight, DOW rose 0.82%. S&P 500 rose 0.82%. NASDAQ rose 0.64%. 10-yer yield rose 0.004 to 2.123.

ECB to stand pat, may have dovish shift, some previews

ECB rate decision is the main focus for today. The central bank is widely expected to keep benchmark interest rate at 0.00%. Marginal lending facility rate and the deposit facility rate will be held at 0.25% and -0.40% respectively. The forward guidance that interest rates will “remain at their present levels at least through the end of 2019” would likely be untouched too.

Eurozone economy has been slowing down since late last year and the recovery has been very weak. That’s very much reflected in manufacturing PMI which was stuck at 47.7 in May. Deterioration was spreading over to services with PMI held at just 52.9. The survey data indicate a mere 0.2% GDP growth in Q2. Headline CPI also slowed notably to 1.2% yoy in May, well below ECB’s 2% target.

The weak growth and inflation outlook will likely be reflected in the new economic projections to be released today. The question is whether ECB President Mario Draghi will shift to a more dovish tones in the press conference. Also, there’s a chance Draghi could even signal some openness to further easing. Indeed, there are speculations that ECB could cut the deposit rate further into negative territory next year. ECB would also release details of the TLTRO III.

Here are some previews on ECB:

- ECB Preview- More on Dovish Side. Focus on Forward Guidance Extension and Pricing of TLTRO-III

- Does Draghi Have One Last Surprise In Store?

- Base Effects in the Driver’s Seat but ECB Concerns

- ECB To Hold Rates, Reveal Details Of TLTRO3 As Euro Edges Higher

US-Mexico migration meeting ended with insufficient progress, double downgrade for Mexico

The high-level meeting between US and Mexico on migration ended with insufficient progress. Trump tweeted that “Progress is being made, but not nearly enough!” He threatened again “If no agreement is reached, Tariffs at the 5% level will begin on Monday, with monthly increases as per schedule. The higher the Tariffs go, the higher the number of companies that will move back to the USA!”

Vice President Mike Pence, who chaired the meeting including Secretary of State Michael Pompeo and Mexican Foreign Minister Marcelo Ebrard, also echoed Trump’s comments. He tweeted “Progress was made but as @POTUS said “not nearly enough.” @SecPompe, @DHSMcAleenan, & I made clear: Mexico must do more to address the urgent crisis at our Southern Border.”

Ebrard said after the meeting that there was no discussions on tariffs. “The dialogue was focused on migration flows and what Mexico is doing or is proposing to the United States, our concern about the Central American situation.” He noted “what the US government is looking for are measures in the short-term and medium-term”. Instead, Mexico is promoting long term fix involving a development deal for Central America which would eventually slow migration.

Meeting will continue on Thursday and if no agreement is made, US will starting imposing 5% tariffs on all Mexican imports on June 10. That rate would “gradually” go up to 25% on October 1.

Fitch cut Mexico’s rating from BBB+ to BBB and cited that “growth continues to underperform, and downside risks are magnified by threats by U.S. President Trump.” Moody’s downgraded Mexico’s outlook from stable to negative and noted “further evidence that medium-term growth is in decline, whether as a result of policies that actively undermine growth or because of continued policy unpredictability, would put downward pressure.”

USD/MXN has a rough ride but is generally kept inside this week’s range.

Fed officials open to rate cut to counter risks of trade tensions

More Fed officials spoke yesterday today. While they generally sound non-committal to a rate cut, they are all open to, if trade tensions worsen.

Dallas Fed President Robert Kaplan said it’s “early to make a judgement” on rate cut. But he noted “we’re going to be very vigilant in understanding these heightened trade tensions. See if they feed through to the economy. Most importantly, see if they persist.”

Fed Governor Lael Brainard told Yahoo Finance that “we’ll be prepared to adjust policy to sustain the expansion.” And “trade policy is definitely a downside risk to the economy. And our job is to sustain the expansion, and we’ll need to see going forward what that means for policy.”

Chicago Fed President Charles Evans told Bloomberg TV that he’s “a little nervous about the low inflation rate”. And, “that by itself could be a reason for a little more accommodation.”

IMF Lagarde: Global growth stabilizing, but must avoid self-inflicted wounds

In a blog post, released yesterday, titled “How to Help, Not Hinder Global Growth“, IMF Managing Director Christine Lagarde “most recent economic data indicate that global growth may be stabilizing”. She noted “while first-quarter economic activity disappointed in parts of emerging Asia and Latin America, growth was stronger than expected in the United States, the euro area, and Japan. ”

The most important “stumbling block” is trade tensions. Lagarde said “there is strong evidence that the United States, China, and the world economy are the losers from the current trade tensions”. Overall, US-China-tariffs could reduce global GDP by 0.5% in 2020, or USD 455B. And she warned that “these are self-inflicted wounds that must be avoided”.

Later Lagarde told Reuters that the global economy is not under threat of recession due to US tariffs actions on other countries. She said, “Decelerating growth, but growth nonetheless — 3.3 percent at the end of this year, and certainly a strong U.S. economy. We do not see at the moment, in our baseline, a recession.” However, still, “one more tariff here, one more threat there, one more negotiation that has not yet started, add to a global uncertainty which is not conducive to additional growth,” she added.

Australia trade surplus at AUD 4.87B in Apr, exports rose 2.5% mom, imports rose 2.8% mom

Australia trade surplus came in smaller than expected at AUD 4.87B in April. Exports rose 2.5% mom, 17.2% yoy to AUD 40.42B. Imports rose 2.8% mom, 5.4% yoy to AUD 35.55B.

Looking at the details of exports, non-rural goods rose AUD 691m (3%), non-monetary gold rose AUD 272m (20%) and net exports of goods under merchanting rose AUD 8m (73%). Rural goods fell AUD 67m (2%). Services credits rose AUD 65m (1%).

For imports, intermediate and other merchandise goods rose AUD 423m (4%), capital goods rose AUD 308m (5%) and consumption goods rose AUD 298m (3%). Non-monetary gold fell AUD 40m (9%). Services debits fell AUD 5m.

On the data front

Germany will release factory orders. Eurozone will release Q1 GDP final and employment. Later in the data, Canada will release trade balance and Ivey PMI. US will release trade balance, jobless claims and non-farm productivity.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3377; (P) 1.3403; (R1) 1.3445; More…

USD/CAD recovered after dipping to 1.3363, held above 1.3357 support. Intraday bias is turned neutral first. Further decline will remain in favor as long as 1.3449 minor resistance holds. Current development suggests that choppy rise from 1.3068 has completed at 1.3564, on bearish divergence condition in 4 hour MACD. Decisive break of 1.3357 support will confirm this bearish case and target 1.3274 support next. More importantly, that could also have medium term channel support taken out, which carries larger bearish implications too. However, break of 1.3449 will revive near term bullishness and turn bias back to retest 13564.

In the bigger picture, USD/CAD is staying well inside medium term rising channel (support at 1.3335). Thus, the up trend from 1.2061 (2017 low) should be in progress. On the upside, decisive break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will pave the way to 78.6% retracement at 1.4127 next. This will remain the favored case as long as 1.3068 support holds. However, sustained break of the channel support will be the first sign of medium term reversal. Firm break of 1.3068 would confirm.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | Trade Balance (AUD) Apr | 4.87B | 5.05B | 4.95B | 4.89B |

| 6:00 | EUR | German Factory Orders M/M Apr | 0.00% | 0.60% | ||

| 9:00 | EUR | Eurozone Employment Q/Q Q1 F | 0.30% | |||

| 9:00 | EUR | Eurozone GDP Q/Q Q1 F | 0.40% | 0.40% | ||

| 11:30 | USD | Challenger Job Cuts Y/Y May | 10.90% | |||

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | CAD | International Merchandise Trade (CAD) Apr | -2.8B | -3.2B | ||

| 12:30 | USD | Nonfarm Productivity Q1 F | 3.50% | 3.60% | ||

| 12:30 | USD | Unit Labor Costs Q1 F | -0.90% | -0.90% | ||

| 12:30 | USD | Initial Jobless Claims (JUN 1) | 215K | 215K | ||

| 12:30 | USD | Trade Balance Apr | -50.5B | -50.0B | ||

| 14:00 | CAD | Ivey PMI May | 56.2 | 55.9 | ||

| 14:30 | USD | Natural Gas Storage | 114B |