Global financial markets are rocked by Trump’s decision to use tariffs as a way to force Mexico to solve border security crisis of the US. 5% tariffs will be imposed in all Mexico imports to US starting June 10, then “gradually” as Trump claimed, go up to 25% on October 1. The implications to some is huge as Trump is now using tariffs for non-economic issues. It’s much more than just protectionism. On the other hand, the never-ending trade negotiations are going nowhere after the collapse and China is preparing more retaliations. The positive news, though, is that US economy data released remain solid.

To talk about the seriousness of today’s moves, firstly, Mexico Peso sank as much as 3% today while CDS was pushed to two-month high. German 10-year yield dived to new record low at -0.212 even though it gradually climbed above above -0.2 handle. European indices are all in deep red. DOW opens down -250 pts or -1% and is set to press 24900. US 10-year yield gaps down and reaches as low as 2.161 so far. 2% handle is not far away.

In the currency markets, Yen and Swiss Franc are the strongest ones. But Euro is following closely, partly helped by rally in EUR/GBP. Canadian Dollar is the weakness one for today, with WTI crude oil breaching 55 handle. Sterling is the next weakest as selloff resumes. Dollar is indeed the third weakest, decoupling from Yen and Franc.

In Europe, currently, FTSE is down -1.02%. DAX is down -1.75%. CAC is down -1.40%. German 10-year yield is down -0.021 at -0.192. Earlier in Asia, Nikkei dropped -1.63%. Hong Kong HSI dropped -0.79%. China Shanghai SSE dropped -0.24%. Singapore Strait Times dropped -0.80%. Japan 10-year yield dropped -0.0161 to -0.098.

US personal income rose 0.5%, spending rose 0.3%, core PCE at 1.6%

In April, US personal income rose 0.5% or USD 92.8B, above expectation of 0.3%. Spending rose 0.3% or USD 42.7B, above above expectation of 0.2%. Headline PCE rose to 1.5% yoy, up from 1.4% and matched expectations. Core PCE inflation rose to 1.6% yoy, up from 1.5% yoy and matched expectations.

Little reaction is seen in Dollar after the release. The question remains on whether inflation will “persistently” miss 2% target that eventually force a Fed cut. For now, there is no clear evidence for that yet. The greenback might need to look at ISMs and NFP next week for more inspirations.

Canada GDP grew 0.5% mom in March, 0.4% annualized in Q1

Canada GDP grew 0.5% mom in March, , well above expectation of 0.3% mom. Goods-producing industries were up 0.7%, offsetting most of the decline in February, while services-producing industries (+0.4%) posted their strongest increase since May 2018. There were gains in 16 of the 20 industrial sectors.

For Q1, GDP grew an annualized 0.4%, well below expectation of 0.7%. Growth in real GDP was driven by a 0.9% increase in household spending and an 8.7% rise in business investment in machinery and equipment. These increases were moderated by a 1.0% decline in exports, coupled with a 1.9% increase in imports. Additionally, investment in housing continued to decline, down 1.6% in the first quarter.

German retail sales dropped -2.0%, CPI slowed to 1.4%

Released in European session, German retail sales dropped -2.0% mom in April, well below expectation of 0.4% mom rise. German CPI slowed back to 1.4% yoy in May, down from 2.0% yoy, missed expectation of 1.6% yoy. Swiss retail sales dropped -0.7% yoy in April, below expectation of -0.8% yoy. UK Mortgage approvals rose to 66k in April, above expectation of 64k. UK M4 money supply rose 0.9% mom in April, above expectation of 0.4% mom.

China’s unreliable entities list on the way as countermeasures to US

Just as the Chinese Communist Party run hawkish tabloid Global Times warned that “major retaliative measures’ on US for Huawei are underway, the Commerce Ministry announced to set up a list of “unreliable entities” targets companies that violate market rules, cut off supply to the country.

The ministry noted that for non-commercial purposes, some foreign entities impose blockades, confessions and other discriminatory measures against Chinese enterprises and damage their legitimate rights and interests”. Such entities endanger China’s national security and interests, and also pose a threat to global supply chain. Detailed measures regarding the list will be announced later.

China PMI manufacturing dropped to 49.4, widening decline, increasing downward pressure

The official China PMI manufacturing dropped to 49.4 in May, down from 50.1 and missed expectation of 49.9. It further confirmed that March’s recovery was a false dawn and the slowdown trajectory in China is ongoing. More importantly, deterioration could quick further with the current round of US-China trade war escalation. Non-manufacturing PMI was unchanged at 54.3.

Analyst Zhang Liqun noted that “the decline was widening, indicating that the downward pressure on the economy has increased.” And, “foundation for economic stabilization has not yet been established.” In particular, new orders index, the export order index decreased significantly, “reflecting the lack of market demand is more prominent, especially the downward pressure on exports”.

Looking at some details: Production dropped -0.4 to 51.7; New order dropped -1.6 to 49.8; New Export order dropped -2.7 to 46.5; Import dropped -2.6 to 47.1; Employment dropped -0.2 to 47.0.

Japan unemployment rate dropped, so was consumer confidence

The batch of economic data released from Japan today is mixed. Unemployment rate dropped to 2.4% in April, down from 2.5%, matched expectations. However, better employment was not reflected in retail sales nor consumer sentiment. Retail sales rose 0.5% yoy, missed expectation of 1.0% yoy. Consumer confidence dropped to 39.4, below expectation of 40.6.

Meanwhile, industrial production rose 0.6% mom in April, above expectation of 0.2% mom. However, the road ahead could be bumpy with trade war escalation in May. Housing starts dropped -5.7% yoy in April, below expectation of -0.8% yoy. Tokyo CPI core slowed to 1.1% yoy in May, down from 1.3% yoy and missed expectation of 1.2% yoy.

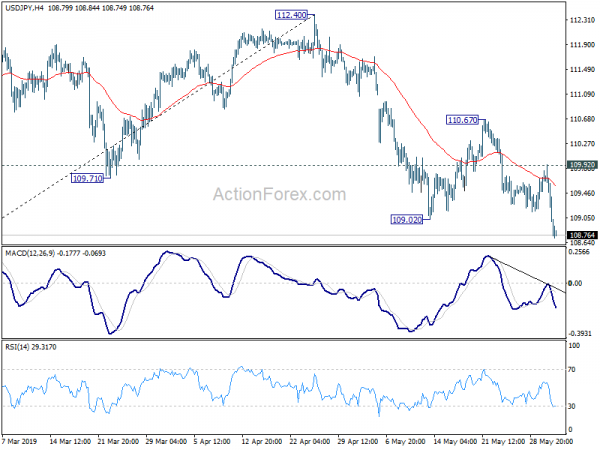

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.42; (P) 109.68; (R1) 109.88; More…

Intraday bias in USD/JPY remains on the downside for the moment. Fall from 112.40 has just resumed and should now target 61.8% retracement of 104.69 to 112.40 at 107.63 next. Sustained trading below 107.63 will pave the way to retest 104.69 low. On the upside, break of 109.92 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

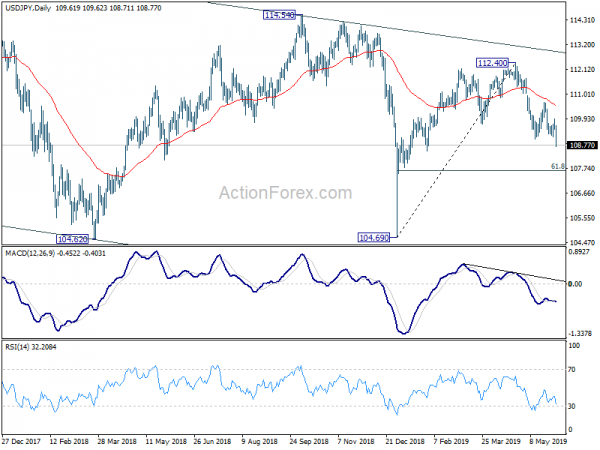

In the bigger picture, USD/JPY is staying inside falling channel from 118.65. Current development suggests that rebound from 104.69 is only a corrective move. And fall from 118.65 is not completed yet. Decisive break of 104.69 will extend the down trend towards 98.97 support (2016 low). For now, we’d expect strong support above there to bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence May | -10 | -12 | -13 | |

| 23:30 | JPY | Unemployment Rate Apr | 2.40% | 2.40% | 2.50% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y May | 1.10% | 1.20% | 1.30% | |

| 23:50 | JPY | Industrial Production M/M Apr P | 0.60% | 0.20% | -0.60% | |

| 23:50 | JPY | Retail Trade Y/Y Apr | 0.50% | 1.00% | 1.00% | |

| 01:00 | CNY | Manufacturing PMI May | 49.4 | 49.9 | 50.1 | |

| 01:00 | CNY | Non-manufacturing PMI May | 54.3 | 54.3 | 54.3 | |

| 01:30 | AUD | Private Sector Credit M/M Apr | 0.20% | 0.30% | 0.30% | |

| 05:00 | JPY | Consumer Confidence Index May | 39.4 | 40.6 | 40.4 | |

| 05:00 | JPY | Housing Starts Y/Y Apr | -5.70% | -0.80% | 10.00% | |

| 06:00 | EUR | German Retail Sales M/M Apr | -2.00% | 0.40% | -0.20% | |

| 06:30 | CHF | Retail Sales Real Y/Y Apr | -0.70% | -0.80% | -0.70% | |

| 08:30 | GBP | Mortgage Approvals Apr | 66K | 64K | 62K | |

| 08:30 | GBP | Money Supply M4 M/M Apr | 0.90% | 0.40% | -0.50% | |

| 12:00 | EUR | German CPI M/M May P | 0.20% | 0.30% | 1.00% | |

| 12:00 | EUR | German CPI Y/Y May P | 1.40% | 1.60% | 2.00% | |

| 12:30 | CAD | GDP M/M Mar | 0.50% | 0.30% | -0.10% | -0.20% |

| 12:30 | CAD | GDP Annualized Q/Q Q1 | 0.40% | 0.70% | 0.30% | |

| 12:30 | CAD | Industrial Product Price M/M Apr | 0.80% | 0.30% | 1.30% | |

| 12:30 | CAD | Raw Materials Price Index M/M Apr | 5.60% | 2.40% | 2.80% | |

| 12:30 | USD | Personal Income Apr | 0.50% | 0.30% | 0.10% | |

| 12:30 | USD | Personal Spending Apr | 0.30% | 0.20% | 0.90% | 1.10% |

| 12:30 | USD | PCE Deflator M/M Apr | 0.30% | 0.30% | 0.20% | |

| 12:30 | USD | PCE Deflator Y/Y Apr | 1.50% | 1.50% | 1.50% | 1.40% |

| 12:30 | USD | PCE Core M/M Apr | 0.20% | 0.20% | 0.00% | 0.10% |

| 12:30 | USD | PCE Core Y/Y Apr | 1.60% | 1.60% | 1.60% | 1.50% |

| 13:45 | USD | Chicago PMI May | 54 | 52.6 | ||

| 14:00 | USD | U. of Mich. Sentiment May F | 101 | 102.4 |