Dollar trades generally higher today as risk markets stabilized, partly helped by recovery in treasury yields too. Economic data from US generally matched expectations. Markets also shrugged off repeated comments from US and China regarding trade war. Though, at the time of writing, Canadian Dollar is the strongest one, lifted by rebound in oil price. Yen is the weakest one as stocks are recovering..

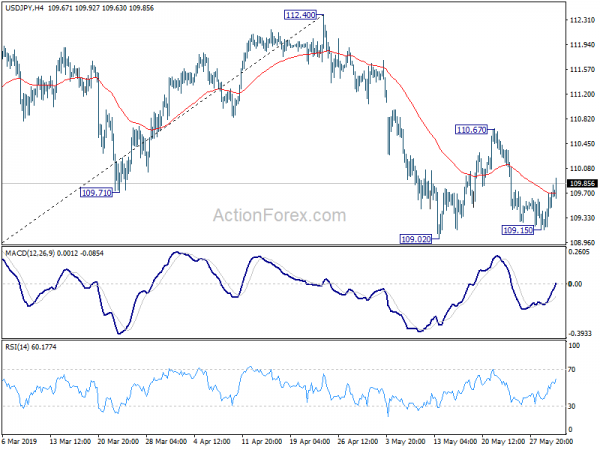

Technically,current developments suggests that USD/JPY’s consolidation from 109.02 low is in its third leg and further rise is in favor. That might help lift EUR/JPY higher today. Meanwhile, GBP/USD continues to gyrate towards 1.2605 support. EUR/GBP also refuses to retreat deeper below 0.8805 temporary top. The Pound is vulnerable to around of selloff. And that could limit any recovery attempt in GBP/JPY. It’s a bit early to call for a breakout. But EUR/USD is edging lower towards 1.1107 support and this level will be watched.

In other markets, US stocks open generally higher, with DOW trading up 65 pts at the time of writing. 10-year yield is also up 0.037 at 2.273. We’ll see if the recovery could sustain for the whole session. In Europe, FTSE is currently up 0.56%. DAX is up 0.59%. CAC is up 0.56%. German 10-year yield is up 0.014 at -0.161. Earlier in Asia, Nikkei dropped -0.29%. Hong Kong HSI dropped -0.44%. China Shanghai SSE dropped -0.31% to 2905.81, holding on to 2900 handle. Singapore Strait Times dropped -0.64%. Japan 10-year JGB yield rose 0.0114 to -0.081.

Trump: Americans paying very little of tariffs, China is subsidizing

On trade war with China, Trump insisted things are going well. He told reports at the White House that “China would love to make a deal with us. We had a deal and they broke the deal. I think if they had it to do again they wouldn’t have done what they did.” On the tariffs, he said “China is subsidizing products, so the United States taxpayers are paying for very little of it.” And pointed to the little impact of tariffs on inflation. Trump also said, “I think we’re doing very well with China.”

China open to sell rare earths to other countries, halted US soy purchases

China continued its hard line rhetorics on the topic of US-China trade war. Commerce industry repeated the pledge to fight till the end if US keeps escalating tensions. And China will firmly defend its own national interests. There is no indication of more talks as China said US sincerity is in doubt.

In addition to the usual stuffs, the Commerce industry also said China is willing to meet reasonable demand for rare earths from other countries. Though, it would be unacceptable that countries using Chinese rare earths to manufacture products would turn around and suppress China.

Separately, it’s reported that China has halted soy purchases from the US already. Government data indicates China bought about 13 million metric tons of US soybeans since December. While there is no cancellation of previous orders, there is no further orders to continued the so called goodwill buying.

US Q1 GDP growth revised down to 3.1%, price index rose 0.8%

US Q1 GDP growth was revised down to 3.1% annualized, from first estimate of 3.2%, matched expectations. GDP price index was revised down to 0.8% down from 0.9% and missed expectation of 0.9%.

Looking at the details, there were positive contributions from PCE, private inventory investment, exports, state and local government spending, and non-residential fixed investment. Imports also decreased. There was negative contribution from residential fixed investment.

The acceleration in GDP growth reflected an upturn in state and local government spending, accelerations in private inventory investment and in exports, and a smaller decrease in residential investment. These were partly offset by decelerations in PCE and nonresidential fixed investment, and a downturn in federal government spending.

US trade deficit widened slightly to USD 72.1B, both exports and imports contracted

US trade deficit widened slightly to USD 72.1B in April, up from USD 71.9B. Looking at the details, pretty much all category of of both exports and imports contracted. Overall exports dropped -4.2% to USD 134.6B. Imports dropped -2.7% to USD 206.7B.

Initial jobless claims rose 3k to 215k in the week ending May 25, slightly above expectation of 214k. Four-week moving average of initial claims dropped -3.75k to 216.75k. Continuing claims dropped -26k to 1.657M in the week ending May 18. Four-week moving average of continuing claims dropped -3.5k to 1.673M.

BoE Ramsden: Most financial stability risks from no-deal Brexit mitigated

BoE Deputy Governor Dave Ramsden said in case of a smooth Brexit with transition, the MPC expected UK growth to pick up, leading to excess demand and building domestic inflationary pressure. In such case, further monetary tightening is appropriate. Ramsden’s GDP growth expectation was “a little more pessimistic”. However, he also saw “downside risks to productivity, while he’s also “less optimistic on investment recovery”. Thus, his overall view on monetary policy was broadly in line with the MPC.

Ramsden noted that the “biggest risk to the UK economy and UK financial stability, remains that of a Brexit outcome of no deal and no transition.” But he emphasized that “most risks to financial stability that could arise have been mitigated”, even though “a no deal, no transition Brexit could still be expected to bring significant market volatility, as well as economic instability.”

BoJ Sakurai: Shouldn’t recklessly seek to hit price target with additional easing

BoJ board member Makoto Sakurai said the central bank “shouldn’t recklessly seek to achieve our price target with additional easing”. Instead, the best monetary policy approach was to “patiently maintain” the current stimulus program. He acknowledged that “achievement of our price target is being delayed”. But that’s because “the relationship between monetary policy and price moves are changing and becoming more complex.”

Sakurai also said BoJ should be very mindful of the negative effects of the ultra-loose monetary policy. He added, “while financial institutions’ capital-to-asset ratios are sufficient from a regulatory standpoint, what’s important to note is that they are declining as a trend.” Hence, “the BoJ must make appropriate policy decisions by scrutinizing the merits and demerits, including the risk our policy is building up financial imbalances.”

Australia building approvals dropped -4.7% mom, capital expenditure dropped -1.7%

Australia dwelling approvals contracted by -4.7% mom in seasonally adjusted terms in April. That’s well below expectation of 0.0% mom. Regionally, the decline was driven by falls in Tasmania (19.1%), Victoria (16.1%), Western Australia (6.7%) and South Australia (3.3%). Private dwellings excluding houses fell 6.5% while private house approvals decreased 2.6%.

Seasonally adjusted new capital expenditure dropped -1.7% in Q1, also way below expectation of 0.5% qoq. Buildings and structures fell -2.8% while equipment, plant and machinery fell -0.5%

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.26; (P) 109.48; (R1) 109.81; More…

USD/JPY’s recovery from 109.15 extends higher today and further rise might be seen. But it’s seen as in consolidation pattern from 109.02. Thus, upside should be limited by 110.67 resistance to bring fall resumption eventually. On the downside, break of 109.02 will resume the fall from 112.40 and target 61.8% retracement of 104.69 to 112.40 at 107.63 next. Nevertheless, firm break of 110.67 will argue that fall from 112.40 could be completed and turn focus back to this resistance.

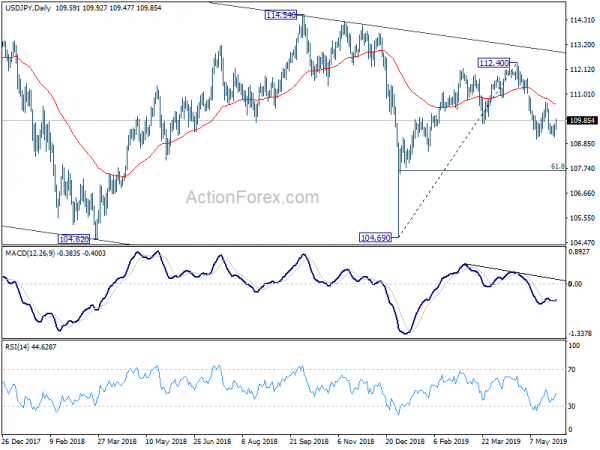

In the bigger picture, USD/JPY is staying inside falling channel from 118.65. Current development suggests that rebound from 104.69 is only a corrective move. And fall from 118.65 is not completed yet. Decisive break of 104.69 will extend the down trend towards 98.97 support (2016 low). For now, we’d expect strong support above there to bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Apr | -7.90% | -6.90% | -7.40% | |

| 01:30 | AUD | Private Capital Expenditure Q1 | -1.70% | 0.50% | 2.00% | 1.30% |

| 01:30 | AUD | Building Approvals M/M Apr | -4.70% | 0.00% | -15.50% | -13.40% |

| 12:30 | CAD | Current Account Balance (CAD) Q1 | -17.35B | -17.9B | -15.5B | -16.6B |

| 12:30 | USD | GDP Annualized Q/Q Q1 S | 3.10% | 3.10% | 3.20% | |

| 12:30 | USD | GDP Price Index Q1 S | 0.80% | 0.90% | 0.90% | |

| 12:30 | USD | Initial Jobless Claims (MAY 25) | 215K | 214k | 211k | 212K |

| 12:30 | USD | Advance Goods Trade Balance Apr | -72.1B | -72.0B | -71.4B | -71.9B |

| 12:30 | USD | Wholesale Inventories M/M Apr P | 0.70% | 0.10% | -0.10% | |

| 14:00 | USD | Pending Home Sales M/M Apr | -1.50% | 0.50% | 3.80% | 3.90% |

| 14:30 | USD | Natural Gas Storage | 98B | 100B | ||

| 15:00 | USD | Crude Oil Inventories | -0.9M | 4.7M |