Risk aversion stays in the global financial markets today but it’s not in the most intense state yet. A trigger for selloff in stocks and decline in yield is China’s threat to squeeze supply of rare earths to the US as part of a countermeasures in trade war. However, it’s also widely know that Japan has discovered huge source of rare earths last year that could act as semi-unlimited supply to the whole world. Hence, the impact of China’s move is highly doubtful. Though, it’s for sure that US-China trade war is going to drag on longer, much longer.

In the currency markets, Swiss Franc and Yen are so far the strongest ones for today. In particular, more upside is in favor in both, following free fall in treasury yields. US 10-year yield has realistic chance of breaking 2.2 handle in the very near term. For now, Australian Dollar is the third strongest, rather unmoved by risk aversion. On the other hand, New Zealand Dollar is the weakest one. Euro follows as European Commission is said to have sent the formal warning letter to Italy on its budget deficit already. Canadian Dollar is mixed, awaiting BoC rate decision and statement.

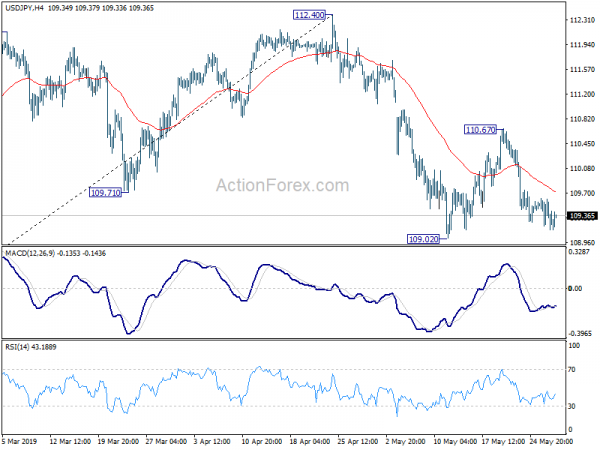

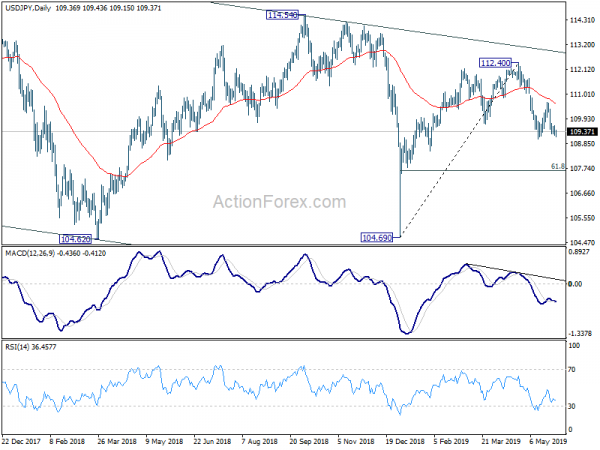

Technically, EUR/JPY and GBP/JPY are both extending recent decline. It’s now time for USD/JPY to follow with a break through 109.02 support. USD/CAD’s rally attempt is limited by 1.3521 resistance so far. This level will be closely watched to confirm up trend resumption.

In Europe, currently, FTSE is down -1.56%. DAX is down -1.49%. CAC is down -1.95%. German 10-year yield is down -0.004 at -0162. Earlier in Asia, Nikkei dropped -1.21%. Hong Kong HSI dropped -0.57%. China Shanghai SSE rose 0.16%. Singapore Strait Times dropped -0.06%. Japan 10-year JGB yield dropped -0.0229 to -0.094.

ECB Rehn: Central scenario is not recession despite soft patch in economy

ECB Governing Council member Olli Rehn told Reuters today that the “central scenario is not a recession,” despite the “soft patch in the economy.” Though, he reiterated the unified message that an ample degree of stimulus is still appropriate for now. Policymakers are going to wait for the new economic forecasts, to be released next week, before debating on adjusting monetary policies.

Regarding the policy framework, Rehn said the definite of price stability should be loosened. Currently ECB sees inflation target as being close to 2%, below 2%. But Rehn said “My view is that 2% is not a ceiling and inflation can deviate in both directions.”

Italian Deputy Prime Minister Matteo Salvini called for a new role for ECB to “guarantee” government debt in order to keep bond yields low. Rehn bluntly responded saying it goes against the principal of modern central banking that we are forbidden to do monetary financing.”

ECB: Growth outlook central to all main risks to financial stability

ECB warned in the Financial Stability Review that “uncertainty about global economic growth prospects has contributed to bouts of high volatility in financial markets”. And, “weaker than expected growth and a possible escalation of trade tensions could trigger further falls in asset prices”.

The report noted that materialization of downside risks to economic growth could spark greater financial market volatility. Persistent downside risks to growth reinforce the need to strengthen balance sheets of highly indebted firms and governments . Bank profitability prospects are subdued given slow progress in addressing structural issues

ECB Vice President Luis de Guindos said in the statement, “if downside risks to the growth outlook were to materialize, risks to financial stability may arise. And “the growth outlook is central to all the main risks to financial stability.”

Swiss KOF dropped to 94.4, economy developing rather sluggishly

Swiss KOF Economic Barometer dropped to 94.4 in May, down from 96.2 and missed expectation of 96.2. The reading dived further below its long-term average. KOF noted “Swiss economy is developing rather sluggishly.” And, majority of sets of indicators are tending downwards.

The indicators for banking and insurance, consumption and foreign demand have developed negatively. The prospects for accommodation and food service activities and the other service providers have become gloomier. In the manufacturing sector, the outlook hardly changed compared to the previous month. For the construction sector, the outlook has improved.

France Q1 GDP growth confirmed at 0.3%, exports growth decelerated sharply

France GDP grew 0.3% qoq in Q1, unrevised from first estimate. Looking at the details, Households disposable income rose 0.9%. However, household consumption expenditure just grew 0.4%. Total gross fixed capital formation slowed down a bit to 0.5%. Overall, final domestic demand excluding inventory changes kept increasing at the same pace. Imports jumped 1.4% due to fuel. Exports growth decelerated sharply to 0.4%, down from 2.0%. Foreign trade balance contributed negatively to GDP growth: -0.3%.

From Germany, unemployment rose 60k in May versus expectation of -8k. Unemployment rate rose 0.1% to 5.0%, above expectation of 4.9%.

BoJ Kuroda: Best to manage inflation expectations with flexible targeting framework

In academic conference organized by BoJ, Governor Haruhiko Kuroda expressed his openness to flexible inflation targeting. Former ECB President Jean-Claude Trichet also emphasized that medium- to long-term inflation expectations are what really matter.

Kuroda said “If missing inflation comes from structural factors such as globalization and digitalization, central banks should continue examining how best to manage inflation expectations .. within the flexible inflation targeting framework.” He also noted the need to expand the policy tools to fight the next downturn. “While policy makers have developed a wide range of unconventional policy tools, their effectiveness and transmission mechanisms may differ depending on financial conditions and economic structure,” Kuroda said.

Trichet also said it’s not necessary for central banks to target exactly the same level of inflation in a set period of time. Instead, “there is a consensus among central banks that real success is to solidly anchor inflation expectations in the medium- to long-term in line with their definition of price stability.”

New Zealand ANZ business confidence improved to -32.0

New Zealand ANZ Business Confidence rose to -32.0 in May, up from -37.5. But all sectors remained deeply negative, with agriculture confidence worst at -63.9. Activity Outlook also improved to 8.5, up from 7.1. Manufacturing scored best in activity at 21.5.

ANZ noted that “how quickly the economy will bounce back is a key question. If the forward indicators start to suggest that the Reserve Bank’s relatively sharp V-shaped recovery is overly optimistic, it will be game on for further OCR cuts this year.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.17; (P) 109.40; (R1) 109.59; More…

USD/JPY stays soft today but it’s held above 109.02 support. Intraday bias remains neutral at this point. Consolidation from 109.02 could still extend further. In case of another rise upside should be limited below 110.67 resistance to bring fall resumption eventually. On the downside, break of 109.02 will resume the fall from 112.40 and target 61.8% retracement of 104.69 to 112.40 at 107.63 next.

In the bigger picture, USD/JPY is staying inside falling channel from 118.65. Current development suggests that rebound from 104.69 is only a corrective move. And fall from 118.65 is not completed yet. Decisive break of 104.69 will extend the down trend towards 98.97 support (2016 low). For now, we’d expect strong support above there to bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | RBNZ Financial Stability Report | ||||

| 23:01 | GBP | BRC Shop Price Index Y/Y May | 0.80% | 0.40% | ||

| 1:00 | NZD | ANZ Business Confidence May | -32 | -37.5 | ||

| 6:45 | EUR | French GDP Q/Q Q1 F | 0.30% | 0.30% | 0.30% | |

| 7:00 | CHF | KOF Economic Barometer May | 94.4 | 96.2 | 96.2 | |

| 7:55 | EUR | German Unemployment Change (000’s) May | 60K | -8K | -12K | |

| 7:55 | EUR | German Unemployment Claims Rate May | 5.00% | 4.90% | 4.90% | |

| 8:00 | EUR | ECB Financial Stability Review | ||||

| 14:00 | CAD | BoC Rate Decision | 1.75% | 1.75% |