The forex markets are rather mixed today. Italy’s budget clash with EU is clearly a concern of investors. Markets are anticipating the tension between Rome and Brussels to intensify with a penalty on breach of EU fiscal rules. Italian 10-year yield jumps sharply higher today while German 10-year yield is extending recent free fall. But such concerns are not much reflected in other markets.

Yen attempted to rally on falling yields earlier today but there is no follow through buying. It’s nonetheless, among the strongest ones, together with Australian and New Zealand Dollars. On the other hand, at the time of writing, Canadian Dollar and Swiss Franc are the weakest. The picture could drastically change as US traders will be back after Monday’s holiday.

Technically, 109.02 in USD/JPY and 122.08 in EUR/JPY will remain the focuses today. In picture, Yen rally would pick up steam again should US 10-year yield accelerates down through 2.9 handle. For now, there is no clear strength in Dollar but there is no sign of bearish reversal yet. Dollar is stuck in range against Euro, Aussie and Canadian. It might need to wait for US inflation data on Friday to trigger a range breakout.

In Europe, FTSE is currently up 0.48%. DAX is up 0.08%. CAC is up 0.08%. All three indices reversed initial losses. German 10-year yield is down -0.0197 at -0.148, after hitting as low as -0.16. Earlier in Asia:, Nikkei rose 0.37%. Hong Kong HSI rose 0.38%. China Shanghai SSE rose 0.361% to 2.909.91, regained 2900. Singapore Strait Times dropped -0.17%. Japan 10-year JGB yield dropped -0.0038 to -0.07.

Italy Salvini: Let’s see if EU will fine us EUR 3B

Italian Deputy Prime Minister Matteo Salvini said today that European Commission could impose a EUR 3B penalty on the country, for breaking EU fiscal rules. This is in line with other reports that the Commission is ready to start disciplinary steps against Italy on June 5. The actions will likely be confirmed should the Commission send a warning letter to Rome this week.

Salvini said, “let’s see if we get this letter where they give us a fine for debt accumulated over the past and tell us to pay 3 billion euros.” He also urged ECB to take a new role and “guarantee” government debt in order to keep bond yields low. He also pledged earlier, after his far-right League party triumphed in European elections on Sunday , to use “all my energies” to fight his perceived outdated and unfair European fiscal rules.

Eurozone economic sentiment jumped to 105.1, driven by industry and France

Eurozone Economic Sentiment rose to 105.1 in May, up from 103.9 and beat expectation of 103.9. The improvement of euro-area sentiment resulted from higher confidence in industry and, to a lesser extent, in services and among consumers, while confidence remained virtually flat in retail trade and cooled down significantly in construction.

Amongst the largest euro-area economies, the ESI increased sharply in France (+4.0), markedly also in Italy (+1.7) and Spain (+1.3) and mildly in Germany (+0.4). Sentiment eased only in the Netherlands (-1.3).

Industrial Confidence rose to -2.9, up from -4.3 and beat expectation of -4.2. Services Confidence rose to 12.2, up from 11.8 and beat expectation of 11.0. Consumer Confidence was finalized at -6.5.

For EU28, ESI was muted, up 0.2 to 103.8 only. That was mostly due to a strong deterioration in the largest non-euro area EU economy, the UK (-4.8).

Also released, Business Climate dropped -0.12 to 0.30, below expectation of 0.40. Managers’ views on the past production, as well as export order books deteriorated sharply, as did, to a lesser extent, their assessments of overall order books, while the production expectations and appraisals of the stocks of finished products improved.

Eurozone M3 money supply rose 4.7% yoy in April, above expectation of 4.4% yoy.

German GfK consumer confidence dropped to 10.1, downward spiral of economic outlook continued

Germany GfK consumer confidence for June dropped to 10.1, down from 10.2 and missed expectation of 10.4. That’s also the lowest level in more than two years. GfK noted that following a period of stability, the consumer climate was forced to take a small hit once more.

In particular, the steep downward spiral of the economic outlook has continued. The indicator dropped -1.3 to 1.7. It lost almost 32 points within just a 12-month period. GfK added, “The global cooling off of the economy, the endless discussions around Brexit, and the risk of an escalation of the trade conflict with the USA have also put a noticeable brake on the economic outlook of consumers. Persistent trade conflicts pose a particular threat to the export nation of Germany. Weak periods of economic activity have a similar effect on export markets.”

Also from Germany, import price rose 0.3% mom in April, below expectation of 0.5% mom.

Swiss GDP grew 0.6% in Q1, driven by strong domestic demand

Swiss GDP grew 0.6% qoq in Q1, accelerated from prior 0.3% qoq and beat expectation of 0.4% qoq. SECO noted that “Growth was driven primarily by increasing domestic demand. Foreign trade also provided positive impetus. Value added grew in most sectors.”

On the positive side, private consumption grew slightly above average for the first time in six quarters, at 0.4%. The increase in consumption expenditures were also broad-based, in almost all segments. Additionally, most service sectors development positively in Q1. Manufacturing saw dynamic growth at 1.5%. Production stepped up in the pharmaceutical industry as well as in watchmaking and precision instruments.

Japan Motegi: Trade deal in August just Trump’s hopes, two sides still narrowing the gap

Japan Economy Minister Toshimitsu Motegi said today that Trump’s comment regarding a trade deal in August just reflects his own hope for quick progress in the negotiations. For now, the two sides are still working on “narrowing the gap”.

Motegi told reporters, “When you look at the exact wording of his comments, you can see that the president was voicing his hopes of swift progress in talks toward something that is mutually beneficial.” He also reiterated the differences between US and Japan, and no timetable had yet be set for more meetings. He noted, “we’ve agreed that we’ll strive to narrow the gap, including through possibly holding working-level talks.”

Trump said on Monday, after meeting Japanese Prime Minister Shinzo Abe in Japan, that he expected the two countries to be “announcing some things, probably in August, that will be very good for both countries” on trade.

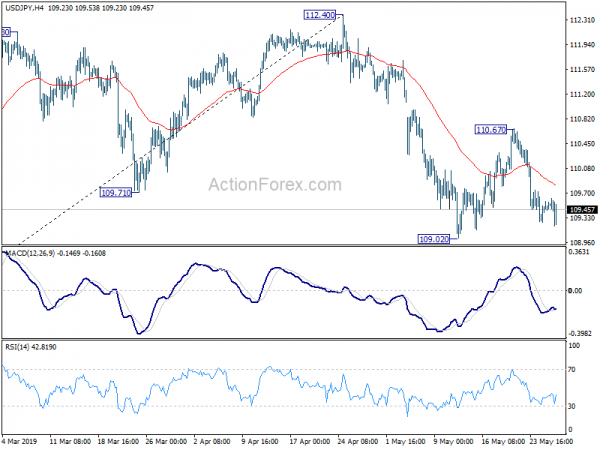

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.35; (P) 109.46; (R1) 109.65; More…

Intraday bias in USD/JPY remains neutral for the moment. Consolidation from 109.02 low might extend further. In case of another rise upside should be limited below 110.67 resistance to bring fall resumption eventually. On the downside, break of 109.02 will resume the fall from 112.40 and target 61.8% retracement of 104.69 to 112.40 at 107.63 next.

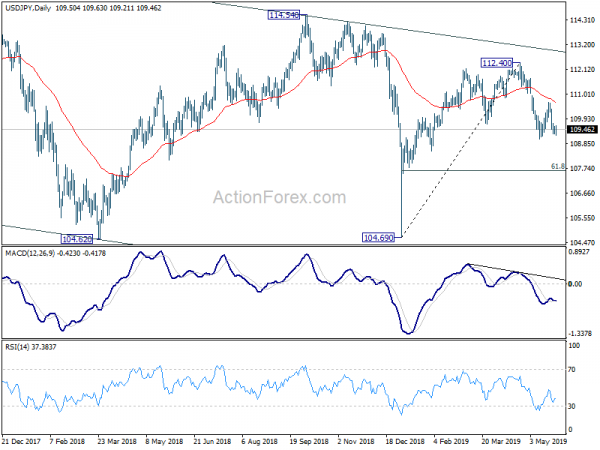

In the bigger picture, USD/JPY is staying inside falling channel from 118.65. Current development suggests that rebound from 104.69 is only a corrective move. And fall from 118.65 is not completed yet. Decisive break of 104.69 will extend the down trend towards 98.97 support (2016 low). For now, we’d expect strong support above there to bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Y/Y Apr | 0.90% | 1.10% | 1.10% | |

| 5:45 | CHF | GDP Q/Q Q1 | 0.60% | 0.40% | 0.20% | 0.30% |

| 6:00 | EUR | German Import Price Index M/M Apr | 0.30% | 0.50% | 0.00% | |

| 6:00 | EUR | German GfK Consumer Confidence Jun | 10.1 | 10.4 | 10.4 | 10.2 |

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y Apr | 4.70% | 4.40% | 4.50% | |

| 8:30 | GBP | BBA Loans for House Purchase Apr | 42989 | 39450 | 39980 | 40564 |

| 9:00 | EUR | Eurozone Business Climate Indicator May | 0.3 | 0.4 | 0.42 | |

| 9:00 | EUR | Eurozone Economic Confidence May | 105.1 | 103.9 | 104 | 103.9 |

| 9:00 | EUR | Eurozone Industrial Confidence May | -2.9 | -4.2 | -4.1 | -4.3 |

| 9:00 | EUR | Eurozone Services Confidence May | 12.2 | 11 | 11.5 | 11.8 |

| 9:00 | EUR | Eurozone Consumer Confidence May F | -6.5 | -6.5 | -6.5 | -7.3 |

| 13:00 | USD | House Price Index M/M Mar | 0.20% | 0.30% | ||

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Mar | 2.55% | 3.00% | ||

| 14:00 | USD | Consumer Confidence Index May | 130 | 129.2 |