News from the UK catch most headline today as, finally, Prime Minister Theresa May announced to resign. Pound’s reaction is generally softer but selloff is so far limited. Sterling has been under much selling pressure up to today’s announcement and thus, the decision was well priced in. Now, the next trigger of a major move would be Conservative Party Leader election, which is set to complete by end of June.

Dollar also remains generally weak for today on weakness in treasury yields, impact of trade war with China, as well as speculations of Fed rate cut. Trump might hinted at willingness to compromise national security to include the “very dangerous” Huawei in a trade deal with China. But the Chinese side sounds like they’re “mentally” preparing for a prolonged trade war. No trade talk is scheduled for now. No decision of a Trump-Xi summit. And Premier Li Keqiang indicated openness to more tax cuts for stimulating the economy.

In the currency markets, Dollar and Sterling are so far the weakest ones for today, followed by Swiss Franc. New Zealand Dollar lead commodity currencies higher. For the week, Pound is the weakest one followed by Dollar, and then Canadian. Swiss Franc is the strongest, followed by Aussie, despite talks of three RBA rate cuts.

In other markets, DOW future is currently up more than 100 pts. 10-year yield is down -0.0027 at 2.32. In Europe, FTSE is up 0.98%. DAX is up 0.81%. CAC is up 0.88%. German 10-year yield is up 0.004 at -0.112, staying well below -0.1 handle. Earlier in Asia, Nikkei dropped -0.16%. Hong Kong HSI rose 0.32%. China Shanghai SSE rose 0.02%. Singapore Strait Times rose 0.29%. Japan 10-year JGB yield dropped -0.0092 to -0.069.

US durable goods orders dropped -2.1%, second decline in three months

US headline durable goods orders dropped -2.1% mom in April, slightly better than expectation of 2.0%. That’s, nonetheless, the second decline in three months. Ex-transport orders was virtually unchanged, also slightly better than expectation of -0.1% mom. Ex-defense orders dropped -2.5% mom.

Theresa May announces to step down as Conservative leader on June 7

May admitted that despite having done her best, she has “not been able” to deliver Brexit. And announces to resign as leader of the Conservative party on Friday June 7. The process for electing the new leader will start the following week. May will stay as caretaker Prime Minister until a new leader is found.

She quote British humanitarian Nicholas Winton that “compromise is not a dirty word”. And she urged that consensus on Brexit can only be reached if all sides are willing to compromise.

Conservatives to select the next leader and UK Prime Minister by end of June

The Conservative party chairman Brandon Lewis and the vice-chairs of the 1922 Committee, Cheryl Gillan and Charles Walker, have issued a joint statement setting out the process for selecting the next Conservative Party Leader.

Nominations will close in the week commencing 10 June. Then, successive rounds of voting will take place until a final choice of candidates to put to a vote of all party members is determined.

Together, they expect the process to be concluded by the end of June, allowing for a series of hustings around the UK for members to meet and question the candidates, then cast their votes in time for the result to be announced before parliament rises for the summer.”

No change in EU’s Brexit position after UK PM May’s resignation

European Commission spokesperson Mina Andreeva reiterated that there is no change in EU’s position on the Brexit withdrawal agreement after resignation of UK Prime Minister Theresa May.

Andreeva noted “President Juncker followed Prime Minister May’s announcement this morning without personal joy… The President very much liked and appreciated working with Prime Minister May. He will equally respect and establish working relations with any new prime minister, whomever it may be.”

However, “our position on the withdrawal agreement — there is no change to that,” Andreeva said. That is, the agreement won’t be opened for renegotiation.

UK retail sales flat versus expectation of -0.4% mom

UK April retail sales data came in better than expected: Retail sales include auto & fuel rose 0.0% mom versus expectation of -0.4% mom. Retail sales include auto & fuel rose 5.2% yoy versus expectation of 4.5% yoy. Retail sales exclude auto & fuel dropped -0.2% mom versus expectation of -0.5% mom. Retail sales exclude auto & fuel rose 4.9% yoy versus expectation of 4.3% yoy.

The details, though, are not tool impressive and fuel stores and non-store retailing were the only positive contributors to the quantity bought in April.

BoC expected to stand pat next week, opinions on future path split

BoC is going to decide on interest rate next week again. It’s generally expected to keep the overnight rate unchanged at 1.75%. Indeed, according to a Reuters poll, all 40 economists surveyed expected so too. However, forecasters are split on the rate path for BoC ahead.

Probability of a rate cut by the end of 2019 stands at 23% only. Probability of a rate cut by end of 2020 stands at 40%. However, there are still some forecasts expected a rate cut. Around 11 of 33 respondents expect a hike by the end of next year. And 4 even expect two hikes.

Westpac forecasts three RBA cuts this year, QE becomes attractive in 2020

AUD/USD recovered overnight as Dollar was dragged down by heavy decline in treasury yields. US 10-year yield ended down as much as -0.097 at 2.296, showing steep downside acceleration. However, recovery in AUD/USD was relatively limited and it’s indeed back under pressure today as Westpac now forecasts three rate cuts by RBA this year, with possibility to start QE in 2020.

On the economy, Westpac sees unemployment rate drifting up to 5.4% by year end, growth as 2.2% for 2019 and underlying inflation at merely 1.4%. Housing market is expected to stay weak despite some stabilization. After RBA Governor Philip Lowe’s speech earlier this week Westpac believed that a June cut is a certain, and the second will come in August. Based on the weak outlook, a third in November to 0.75% is expected too.

Westpac also noted that some form of Quantitative Easing is an option for RBA if there is need to ease policy further. For now, RBA’s own research suggests that policy transmission mechanism will still have some effect at a cash rate below 1%. However, in 2020, the case for QE will become more attractive.

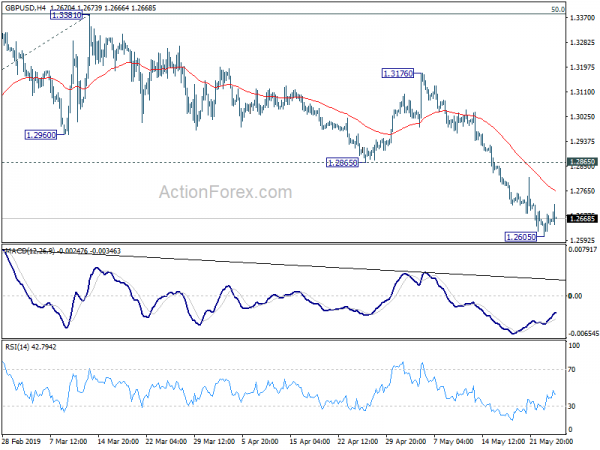

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2615; (P) 1.2649; (R1) 1.2694; More….

A temporary low is in place at 1.2605 with today’s recovery. Intraday bias in GBP/USD is turned neutral for some consolidations. Upside should be limited by 1.2865 support turned resistance to bring fall resumption. On the downside, break of 1.2605 will extend the fall from 1.3381 to 1.2391 low. Larger decline from 1.4376 might be resuming. Break of 1.2391 will target 61.8% projection of 1.4376 to 1.2391 from 1.3381 at 1.2154 next.

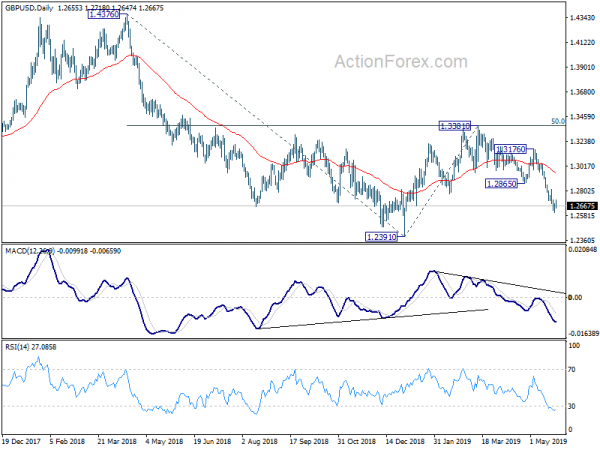

In the bigger picture, current development suggests that medium term decline from 1.4376 (2018 high) is not completed, and is possibly ready to resume. Decisive break of 1.2391 would target a test on 1.1946 long term bottom (2016 low). For now, we don’t expect a firm break there yet. Hence focus will be on bottoming signal as it approaches 1.1946. In any case, medium term outlook will stay bearish as long as 1.3381 resistance holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Apr | 433M | 400M | 922M | 824M |

| 23:30 | JPY | National CPI Core Y/Y Apr | 0.90% | 0.90% | 0.80% | |

| 05:30 | JPY | All Industry Activity Index M/M Mar | -0.40% | -0.20% | -0.20% | |

| 08:30 | GBP | Retail Sales Ex Auto Fuel M/M Apr | -0.20% | -0.50% | 1.20% | 1.40% |

| 08:30 | GBP | Retail Sales Ex Auto Fuel Y/Y Apr | 4.90% | 4.30% | 6.20% | 6.30% |

| 08:30 | GBP | Retail Sales Inc Auto Fuel M/M Apr | 0.00% | -0.40% | 1.10% | 1.20% |

| 08:30 | GBP | Retail Sales Inc Auto Fuel Y/Y Apr | 5.20% | 4.50% | 6.70% | |

| 10:00 | GBP | CBI Reported Sales May | -27 | 6 | 13 | |

| 12:30 | USD | Durable Goods Orders Apr P | -2.10% | -2.00% | 2.60% | |

| 12:30 | USD | Durables Ex Transportation Apr P | 0.00% | 0.20% | 0.30% |