Dollar stays in tight consolidation against European majors but strengthens against commodity currencies in holiday trading. In particular, Canadian dollar is weighed down by the dip in oil price. Released in US, initial jobless claims rose to 274k in the week ended December 17, above expectation of 255k. Durable goods orders dropped -4.6% mom in November, slightly better than expectation of -4.9%. Ex-transport orders rose 0.5% mom, above expectation of 0.2% mom. Q3 GDP was finalized at 3.5% annualized, GDP price index at 1.4%. From Canada, retail sales rose 1.1% mom in October while ex-auto sales rose 1.4% mom. Both were above expectation. But headline CPI slowed to 1.2% yoy and BoC core CPI slowed to 1.5% yoy, missing expectations.

ECB said in its monthly bulletin that "the medium-term outlook for global activity remains one of strengthening growth, albeit below its pre-crisis pace." And, "overall, growth appears to be holding up in advanced economies and seems to have bottomed out in emerging market economies." ECB expected inflation to exceed 1% at the turn of the year. However, the central cautioned some risks to outlook including policy uncertainty in US, rebalance in Chinese economy and low raw material prices.

In UK, Gfk consumer confidence rose to -7 in December, above expectation of -8. Gfk noted that consumers "remain relatively confident about their personal financial situation." However, "confidence in the general economic situation…has collapsed in the face of uncertainty about the future both at home and abroad." And, "looking ahead to 2017, against a backdrop of Brexit negotiations, the decline in the value of sterling, and the prospect of higher inflation impacting purchasing power, we forecast that confidence will be tested by the storm and stress…of the year to come."

New Zealand GDP grew 1.1% qoq in Q3, up from prior quarter’s 0.7% qoq, and beat expectation of 0.8% qoq. Statistics New Zealand noted that the data points to "broad-based growth" with 13 of 16 industries up. Main weakness came from agriculture. Household spending "continued its strong growth" and jumped 1.6%. Exports volumes "remain high" even though growth fell over the quarter. Manufacturing activity also rose "on the back of food beverage, and tobacco manufacturing; and transport equipment, machinery and equipment manufacturing." Also from New Zealand, current account deficit widened to NZD -4.89b in Q3.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0386; (P) 1.0419 (R1) 1.0455; More…..

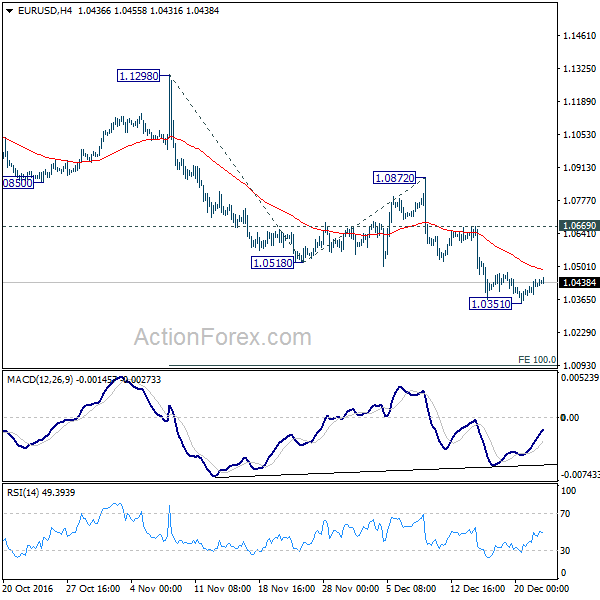

Intraday bias in EUR/USD remains neutral for consolidation above 1.0351 temporary low. Upside of recovery should be limited below 1.0669 resistance and bring another fall. Below 1.0351 will extend the larger down trend to 100% projection of 1.1298 to 1.0518 from 1.0872 at 1.0092, which is close to parity.

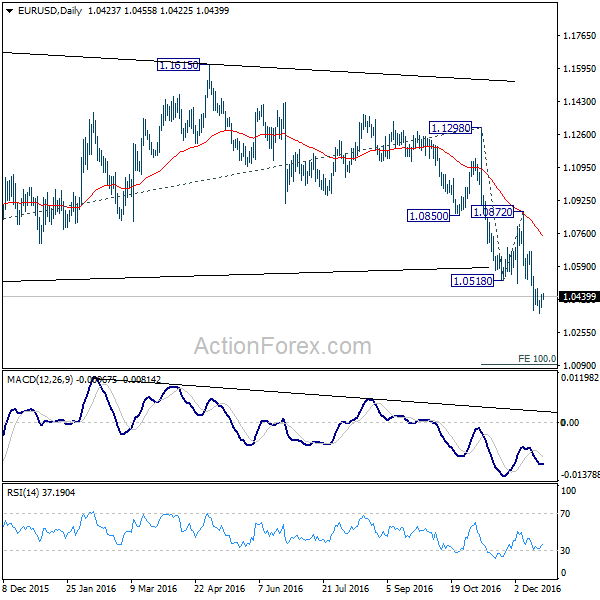

In the bigger picture, break of 1.0461 key support indicates that consolidation from there has completed as a triangle at 1.1298. And, the down trend from 1.6039 (2008 high) is resuming. Current downtrend is now expected to target 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q3 | 1.10% | 0.80% | 0.90% | 0.70% |

| 21:45 | NZD | Current Account Balance Q3 | -4.89B | -4.89B | -0.95B | -0.93B |

| 00:01 | GBP | GfK Consumer Confidence Dec | -7 | -8 | -8 | |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 13:30 | USD | Initial Jobless Claims (DEC 17) | 275K | 255K | 254K | |

| 13:30 | USD | GDP (Annualized) Q3 T | 3.50% | 3.30% | 3.20% | |

| 13:30 | USD | Durable Goods Orders M/M Nov | -4.60% | -4.90% | 4.80% | 4.60% |

| 13:30 | USD | Durable Goods Orders Ex-Transport M/M Nov | 0.50% | 0.20% | 1.00% | 0.80% |

| 13:30 | USD | GDP Price Index Q3 T | 1.40% | 1.40% | 1.40% | |

| 13:30 | CAD | Retail Sales M/M Oct | 1.10% | 0.20% | 0.60% | 0.80% |

| 13:30 | CAD | Retail Sales Less Autos M/M Oct | 1.40% | 0.70% | 0.00% | 0.30% |

| 13:30 | CAD | CPI M/M Nov | -0.40% | -0.10% | 0.20% | |

| 13:30 | CAD | CPI Y/Y Nov | 1.20% | 1.40% | 1.50% | |

| 13:30 | CAD | BoC CPI Core M/M Nov | -0.50% | -0.20% | 0.20% | |

| 13:30 | CAD | BoC CPI Core Y/Y Nov | 1.50% | 1.80% | 1.70% | |

| 14:00 | USD | House Price Index M/M Oct | 0.40% | 0.40% | 0.60% | |

| 15:00 | USD | Leading Indicators Nov | 0.20% | 0.10% | ||

| 15:00 | USD | Personal Income Nov | 0.30% | 0.60% | ||

| 15:00 | USD | Personal Spending Nov | 0.30% | 0.30% | ||

| 15:00 | USD | PCE Deflator M/M Nov | 0.20% | |||

| 15:00 | USD | PCE Deflator Y/Y Nov | 1.40% | |||

| 15:00 | USD | PCE Core M/M Nov | 0.10% | 0.10% | ||

| 15:00 | USD | PCE Core Y/Y Nov | 1.70% | |||

| 15:30 | USD | Natural Gas Storage | -147B |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box