Australian Dollar open generally higher this week as traders cheer election results over the weekend. Canadian Dollar is also firm after USMCA members reached an agreement to remove steel tariffs and retaliations. Risks sentiments are steady in mixed Asian markets. Nikkei closed mildly higher following much stronger than expected Q1 headline GDP. Nevertheless, stocks in Hong Kong, China and Singapore are in red. In the currency markets, Swiss Franc, Euro and Yen are trading generally

Technically, AUD/USD should have formed a temporary low at 0.6864. Some consolidations might be seen but there is no indication of bullish reversal yet. Similarly, EUR/AUD has formed a temporary top at 1.6262 but outlook will stay bullish as long as 1.5959 resistance turned support holds. EUR/USD is extending the decline from 1.1263 and might be heading to retest 1.1111 low. GBP/USD’s fall is also in progress on Brexit uncertainty.

In Asia, Nikkei closed up 0.24%. Hong Kong HSI is down -0.67%. China Shanghai SSE is down -0.56%. Singapore Strait Times is down -0.77%.

Australian Dollar rebounds on election results, upside capped by RBA and trade

Australian Dollar spikes higher today after the central-right coalition’s surprising victory in the elections over the weekend, securing an outright majority too. The Liberal-Party led coalition is seen by some economists as better manager of the economy. Also, returning to power, the coalition will continue with their promised tax cuts on July 1. That’s seen by some as stimulus equivalent to a 25bps rate cut, without the cut of course.

Nevertheless, upside in Aussie is so far limited. There are two major factors that’s clouding the outlook. Firstly, RBA Governor Philip Lowe Philip Lowe will deliver a speech on Tuesday. After surprised jump in unemployment rate in April, there are speculations that Lowe could make use of the occasion to chart out the course for rate cuts in the second half of the year. Secondly, after recent escalations in US-China trade war, there is only one way to go in tensions between the two countries. Relationships will only worsen.

Japan reported strong 0.5% headline GDP growth, but consumer and business spendings contracted

Japan’s economy showed surprising resilience even though there were speculations of contractions. Q1 GDP grew 0.5% qoq versus expectations -0.1% qoq. Annualized, GDP grew 2.1%. However, the details are rather weak indeed. Consumer spending dropped -0.1% qoq. Business spending also dropped -0.3% qoq. Exports also had the biggest contraction since 2015. The figures argue that Japan might be entering into a mild recession

Economy Minister Toshimitsu Motegi, nevertheless, hailed that Japan’s economic fundamentals remain sound, supported by strong domestic demand, which is continuing up trend. Also, employment and income environments have improved while corporate profits are high.

Though, the government will watch the impact of trade tensions carefully. Exports are already slowing, and output remains weak due to China’s economic slowdown. Some manufacturers are also delaying capital spending, leading to decline in capital expenditure.

USTR Lighthizer said to meet Japan Motegi on May 24, dashing to close trade deal

It’s reported, without confirmation yet, US Trade Representative Robert Lighthizer will travel to Japan on May 24. He will meet Japanese Economy Minister Toshimitsu Motegi to resume trade negotiations. Trump declared auto-imports as threat to national security last week. And Lighthizer will have 180 days to complete the trade agreement. Otherwise, Trump might start imposing tariffs on autos and parts from Japan.

The claim of auto imports as national security threat to US infuriated Japanese maker Toyota Motor. Toyota said in a statement that Trump’s proclamation “sends a message to Toyota that our investments are not welcomed, and the contributions from each of our employees across America are not valued.”

Toyota added “our operations and employees contribute significantly to the American way of life, the U.S. economy and are not a national security threat”. Toyota added that “history has shown” that limiting imports is “counterproductive in creating jobs, stimulating the economy and influencing consumer buying habits.” “If import quotas are imposed, the biggest losers will be consumers who will pay more and have fewer vehicle choices.”

Trump wants an unfair deal with China, but farmers just want level playing field

Trump revealed that he has been pushing for an unfair trade deal with China, before the negotiations collapsed. In an interview with Fox News Channel aired on Sunday, Trump said he told Xi the agreement “can’t be like a 50/50 deal”. And, ” you are so far ahead from presidents that allowed you to get away. This can’t be a 50/50 deal.”

He further claimed: “We had a very strong deal. We had a good deal, and at the end, they changed it. And I said, that’s OK, we’re going to tariff their products”. And, “it hurts China so badly.”

Trump also talked about his subsidy plan to farmers. He noted conversations with farmers as they said “Sir, we don’t want a subsidy. We just want a level playing field. And we also know that we’re being killed by these countries — by many of the countries, not just China.”

Looking ahead

Some central bank activities will be closely watched. RBA minutes will be scrutinized for hints on rate cuts in the second half of the year. BoE inflation report hearing will be important. Yet, the key for Sterling’s outlook is in Brexit. Hence, the hearing might be a non-event. FOMC minutes will catch a lot of attention. Fed Chair Jerome Powell talked down the chance of a rate cut after last meeting. Recent comments from Fed officials also suggest that there is no case for a cut yet. But they came before escalation of trade war with China. ECB minutes will also be featured but the central bank has been rather clear in its communications. So, we’re not expecting something ground breaking.

O the data front, Eurozone PMIs and German Ifo could be the most market moving. Euro would be vulnerable if PMIs suggest that the worst in slowdown is not over. Canadian Dollar will look into retail sales for the needed commitment from traders for a breakout. UK CPI and retail sales, New Zealand trade balance and US durable goods orders will also be watched closely.

Here are some highlights for the week:

- Monday: Japan GDP; Germany PPI, Eurozone current account.

- Tuesday: RBA minutes; BoE inflation report hearings; Eurozone consumer confidence; US existing home sales

- Wednesday: New Zealand retail sales; Japan trade balance, machine orders; Australia construction work done; UK CPI, PPI, public sector net borrowing; Canada retail sales; FOMC minutes;

- Thursday: Japan PMI manufacturing; Germany GDP final, Ifo business climate; Eurozone PMIs, ECB minutes; US jobless claims, PMIs, new home sales;

- Friday: New Zealand trade balance; Japan CPI, all industry index; UK retail sales; US durable goods orders;

AUD/USD Daily Outlook

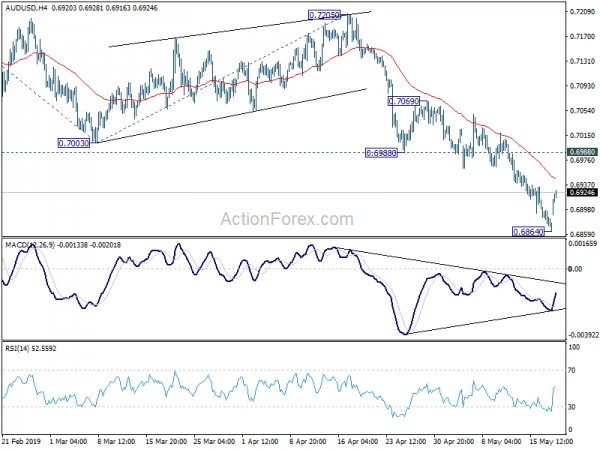

Daily Pivots: (S1) 0.6855; (P) 0.6877; (R1) 0.6889; More…

A temporary lot is formed at 0.6864 with today’s strong recovery. Intraday bias in AUD/USD is turned neutral for some consolidations first. Nevertheless, upside should be limited by 0.6988/7069 resistance zone to bring fall resumption. On the downside, break of 0.6864 will turn bias to the downside and extend the fall from 0.7295 to 161.8% projection of 0.7295 to 0.7003 from 0.7205 at 0.6733, which is close to 0.6722 low.

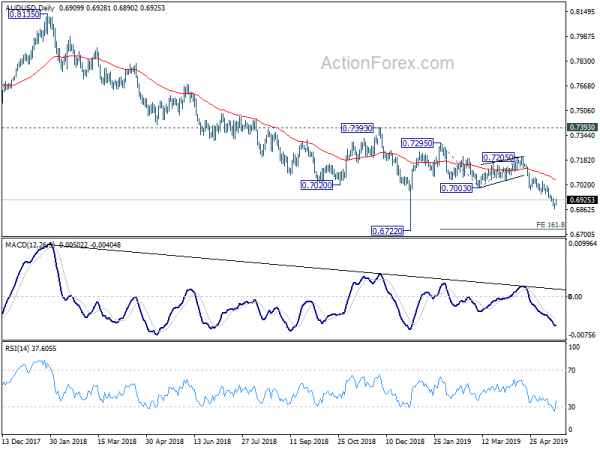

In the bigger picture, with 0.7393 key resistance intact, medium term outlook remains bearish. The decline from 0.8135 (2018 high) is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M May | 0.90% | 1.10% | ||

| 23:01 | GBP | Rightmove House Prices Y/Y May | 0.10% | -0.10% | ||

| 23:50 | JPY | GDP Q/Q Q1 P | 0.50% | -0.10% | 0.50% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 P | 0.20% | 0.20% | -0.30% | |

| 4:30 | JPY | Industrial Production M/M Mar F | -0.60% | -0.90% | ||

| 6:00 | EUR | German PPI M/M Apr | 0.50% | 0.30% | -0.10% | |

| 6:00 | EUR | German PPI Y/Y Apr | 2.50% | 2.40% | 2.40% | |

| 8:00 | EUR | Eurozone Current Account (EUR) Mar | 24.2B | 26.8B |