US stocks recovered overnight on talks that Trump is going to delay auto tariffs decision, due May 18, by up to 6-months. All major stock indices staged mild recovery. German DAX also reversed earlier losses to close higher. However, such optimism wasn’t carried through to Asian session today. In particular, Nikkei quickly revised earlier gains and turned red. It’s a clear sign that Japanese investors aren’t buying much into the rumors. And after all, a delay is just a delay, not a resolution. Tariff threats remain for auto exporters like Germany and Japan.

Developments in treasury yields provide another sign of risk aversion in the markets. US 10-year yield closed down -0.0040 at 2.379, breaking 2.4 handle firmly. With 3-month yield closed at 2.404, this most crucial part of yield curve, 3-month to 10-yield, is inverted. German 10-year yield closed at -0.094 after diving to as low as -0.131. Worries over Italy’s budget is a key factor pressuring German yield and it’s not something that’s remotely related to US auto tariffs. Japan 10-year yield is also extending recent decline today, digging deeper in to negative territory.

In the currency markets, Australian Dollar is currently the weakest one for today, as unemployment rate jumped to 8-month high of 5.2%. But that was due to rise in participation rate to record high of 65.8%. It’s healthy development in a strong labor market. The set of data is not bad enough to push for an RBA cut in June. New Zealand Dollar is following as second weakest, then Canadian. Yen is the strongest one for today. Euro and Sterling are in recovery.

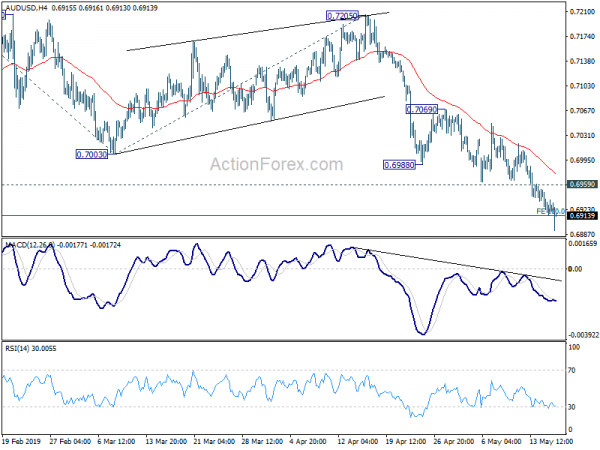

Technically, declines in EUR/JPY and GBP/JPY are losing some downside momentum. But there is no sign of bottoming. More decline is in favor before weekly close. A key to Yen’s development would be on whether USD/JPY would take out 109.02 temporary low to resume recent fall. AUD/USD, breaks 0.6913 fibonacci but the anticipated downside acceleration hasn’t happened yet. We’ll keep a close eye on it.

In Asia, currently, Nikkei is down -0.65%. Hong Kong HSI is up 0.17%. China Shanghai SSE is up 0.30%. Singapore Strait Times is down -0.05%. Japan 10-year JGB yield is down -0.0113 at -0.062. Overnight, DOW rose 0.45%. S&P 500 rose 0.58%. NASDAQ rose 1.13%. 10-year yield dropped -0.040 to 2.379.

Fed Barkin: No strong case for rate hike nor rate cut

Richmond Fed President Tom Barkin said in a speech yesterday that “there’s not a strong case to push rates higher when inflation is under control”. At the same time “there’s not a strong case to move lower when growth remains healthy.” And, “it makes sense to remain patient” on monetary policy.

He noted that there was a short term sentiment shock at the end of last year and the beginning of this year. The significant drop in business, consumer and investor confidence was only fueled by “overreacting” to international uncertainty, financial market volatility and the government shutdown.

He added that business contacts told him the economy is “sound but not spectacular”. And, consumers are ready to resume spending once the environment settled. Though business recovery looks to be slower and they’re worried about political polarization and international markets and trade. Barkin noted “confidence—especially business confidence—is fragile.”

On monetary policy, he emphasized: “In a volatile environment, rate moves can indicate more than stimulation or restriction. They are also taken as signals on the health of the economy. Counter-intuitively, then, rate moves can send unintended messages.”

Canada Freeland: With steel tariffs in place, ratification of USMCA would be very, very problematic

Despite all the talks and rumors that the US is close to lifting steel and aluminum tariffs on Canada and Mexico, Canadian Foreign Affairs Minister Chrysita Freeland left no hints on the progress after she met US Trade representative Robert Lighthizer yesterday.

Freeland acknowledged that there were discussions regrading the tariffs but and details were provided. Instead, she just noted “Canada believes in the new [USMCA] agreement that we reached with the United States and Mexico,” and “we very much hope it can be ratified in all of our countries, although the domestic processes are up to each country.” She emphasized, “when it comes to Canada, it is certainly the case for us that as long as the tariffs remain in place, ratification would be very, very problematic.”

Mexico’s chief North American trade negotiator Jesús Seade said earlier this week “Very quickly we have made a tremendous progress and I’m looking to an early resolution on the basis of lifting the tariff, no quotas. We were getting close to an agreement.” Mexican Secretary of Economy Graciela Márquez Colín also said “if we get similar proposals we might go into a trilateral, but that’s just a possibility”. But Freeland said she would “leave it to the Mexicans and the Americans to comment.”

US Treasury Secretary Steven Mnuchin told a Senate Committee yesterday that “the president has instructed us to try to figure out a solution” on steel and aluminum tariffs.” And, “this is a very important part of passing USMCA which is a very important economic agreement for two of our largest trading partners… I think that we are close to an understanding with Mexico and Canada. I’ve spoken to the finance ministers. Ambassador Lighthizer is leading the effort on this, but I can assure you it is a priority of ours.”

BoJ Wakatabe: QQE has clearly positive impact on the economy and prices

BoJ Deputy Governor Masazumi Wakatabe reiterated to the parliament that the quantitative and qualitative easing program (QQE) had “clearly positive” impact of the economy and prices. And, benefits of easing is “outweighing” its costs. He admitted that BoJ hasn’t put a sustained end to deflation yet while inflation remains below 2% target. But he emphasize “we’re seeing an end to a long period of time when consumer prices kept falling.” On exit, he said “how an exit from easy policy affects BOJ’s balance sheet would depend on various factors such as means, the order in which it exits.”

Released from Japan, Domestic CGPI rose 1.2% yoy in April, above expectation of 1.1% yoy.

Australian employment grew 28.4k driven by part-time jobs, unemployment rate rose to 5.2%

In April, Australia employment rose 28.4k, more than expectation of 15.2k. However, the growth was mainly driven by 34.7k growth in part-time jobs. Full-time employment contracted -6.3k. Unemployment rate rose to 5.2%, up from 5.1% and above expectation of 5.0%. That’s also an eight-month high. But participation rate also rose 0.2% to record high of 65.8%.

Looking at some details, in seasonally adjusted terms, the largest increase in employment was in New South Wales (up 25.1k), followed by Western Australia (up 6.4k) and Queensland (up 5.4k). The only decrease was in Victoria (down 7.6k).

The seasonally adjusted unemployment rate increased in New South Wales (up 0.2 pts to 4.5%), Victoria (up 0.2 pts to 4.9%), South Australia (up 0.2 pts to 6.1%), Western Australia (up 0.1 pts to 6.1%) and Tasmania (up 0.1 pts to 6.8%). The only decrease was observed in Queensland (down 0.2 pts to 5.9%).

Looking ahead

Eurozone trade balance will be released in European session. Later in the day, US will release jobless claims, Philly Fed survey, housing starts and building permits. Canada will release manufacturing sales.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.6913; (P) 0.6930; (R1) 0.6947; More…

AUD/USD drops to as low as 0.6892 today. 100% projection of 0.7295 to 0.7003 from 0.7205 at 0.6913 was breached but there is no follow through selling yet. Nevertheless, intraday bias remains on the downside for the moment. Sustained trading below 0.6913 should ideally bring downside acceleration to extend the fall from 0.7295 to retest 0.6722 low. On the upside, above 0.6959 minor resistance will turn intraday bias neutral for consolidations. But recovery should be limited by 0.6988/7069 resistance zone to bring fall resumption.

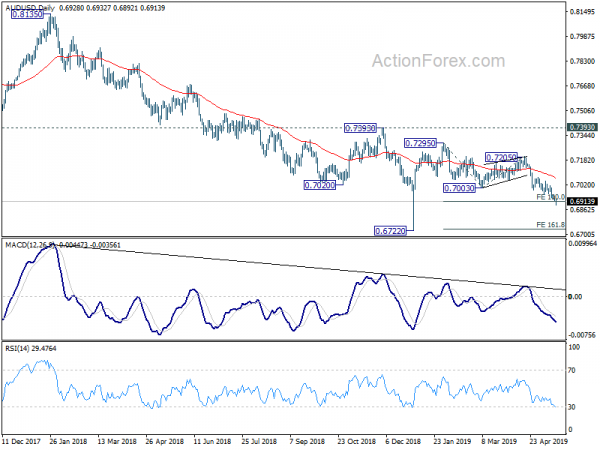

In the bigger picture, with 0.7393 key resistance intact, medium term outlook remains bearish. The decline from 0.8135 (2018 high) is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Apr | 1.20% | 1.10% | 1.30% | |

| 23:50 | JPY | Domestic Corporate Goods Price Index M/M Apr | 0.30% | 0.20% | 0.30% | |

| 1:00 | AUD | Consumer Inflation Expectation May | 3.30% | 3.90% | ||

| 1:30 | AUD | Employment Change Apr | 28.4K | 15.2K | 25.7K | 27.7K |

| 1:30 | AUD | Unemployment Rate Apr | 5.20% | 5.00% | 5.00% | 5.10% |

| 9:00 | EUR | Eurozone Trade Balance (EUR) Mar | 19.0B | 19.5B | ||

| 12:30 | CAD | International Securities Transactions (CAD) Mar | 12.05B | |||

| 12:30 | CAD | Manufacturing Sales M/M Mar | 1.50% | -0.20% | ||

| 12:30 | USD | Housing Starts Apr | 1.21M | 1.14M | ||

| 12:30 | USD | Building Permits Apr | 1.29M | 1.29M | ||

| 12:30 | USD | Philadelphia Fed Business Outlook May | 9 | 8.5 | ||

| 12:30 | USD | Initial Jobless Claims (MAY 11) | 220K | 228K | ||

| 14:30 | USD | Natural Gas Storage | 85B |