After some initial hesitation, Asian markets picked up some momentum and strengthen broadly, recovering some of this week’s losses. Though, strength is so far limited with lots of uncertainty ahead. It’s a fact that US-China trade war is dragging on for longer despite Trump’s “positive” words. At the same time, April data from China showed that March rebound was just temporary. Slowdown in the economy is still in progress, even before collapse of trade negotiations. With new round of tariffs, it’s not optimistic for China to bottom out soon.

In the currency markets, Australian Dollar is currently the weakest one for today. Weaker wage than expected wage growth in Q1 is another drag on the Aussie. New Zealand Dollar and Yen follow as next weakest. Sterling and Euro are the strongest ones for today, followed by Canadian. The Loonie will need some solid reading from toady’s CPI release to revive recent rebound. For the week, Swiss Franc, Yen and Dollar are the strongest in order. Aussie, Sterling and Kiwi are the weakest.

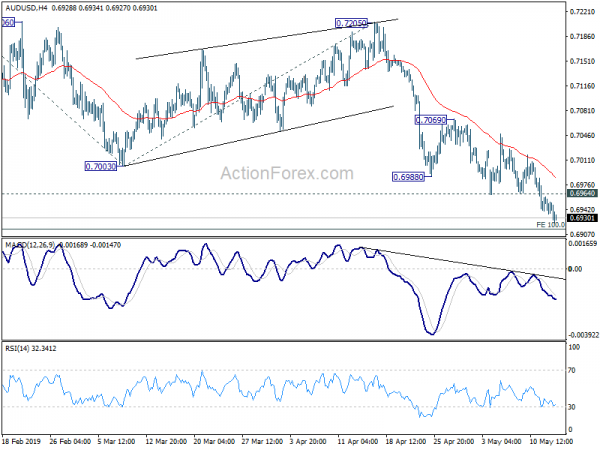

Technically, as AUD/USD’s decline extends, focus is on 0.6913 fibonacci projection level. Decisive break there, with downside acceleration, will solidify the case for larger down trend resumption. USD/JPY and EUR/JPY staying in consolidation. Focuses will be on 109.02 and 122.48 temporary lows respectively, for indication of fall resumption. USD/CAD will be a pair to watch today. It’s staying in consolidation inside 1.3376/3521. Technically, we’d favor an upside breakout soon.

In Asia, Nikkei closed up 0.56%. Hong Kong HSI is up 0.98%. China Shanghai SSE is up 1.76%, back above 2900 handle. Singapore Strait Times is down -0.07%. Japan 10-year JGB yield is down -0.0008 at -0.052. Overnight, DOW rose 0.82%. S&P 500 rose 0.80%. NASDAQ rose 1.14%. 10-year yield rose 0.014 to 2.419. 2.4 level will remain a level to watch today.

China said to scrapped 30% of of draft trade agreement, Mnuchin going to Beijing again soon

Nikkei Asia Review reported that China scrapped as much as 30% of the draft trade agreement with US, before the negotiation collapsed. The original 150-page document was reduced to 105 pages. According to unnamed source, Chinese President Xi deemed legally binding parts of the draft text to be tantamount to “an unequal treaty.” And all relevant parts of the inequality were deleted or revised.

On the other hand, Trump tried to tone down the situation and said said “we’re having a squabble with” China only., and “we have a dialogue going. It will always continue.” Treasury spokesman also indicated that Steven Mnuchin will plan for another meeting with China, without details. The spokesman said: “As the secretary has indicated, the negotiations will continue. We do anticipate, as the secretary indicated yesterday, that we will plan for a meeting in China at some point soon.” However, nothing is heard from Trade Representative Robert Lighthizer yet.

China retail sales growth slowed to lowest since 2003, industrial production and fixed asset investment missed too

Despite the rebound in US stocks overnight, Asian markets are mixed. Upside of recovery was capped by poor data from China. It’s now rather apparent that the rebound in March was just temporary due to seasonal reasons. The slowdown in China is in place and could even worsen further as trade war with US drags on.

China industrial production growth slowed to 5.4% yoy in April, missed expectation of 6.5% yoy. That’s also sharp deterioration from 4-year high of 8.5% yoy in March. Fixed-asset investment growth slowed to 6.1% ytd yoy, down from 6.3% and missed expectation of 6.4%.

More seriously, retail sales growth slowed to 7.2% yoy, down from 8.7% yoy and missed expectation of 7.2% yoy. That’s also the lowest growth since May 2003. That dents hope of shifting the burden of the economy from exports to domestic demand growth. Unemployment rate, though, dropped to 5.2%.

Aussie drops after wage price miss, consumer sentiment barely rose

Australian Dollar weakens broadly today and is trading as the worst performing one for today. The Aussie is partly dragged down by poor Chinese data. It’s own data provide no help too.

Wage Price Index rose only 0.5% qoq in Q1, below expectation of 0.6% qoq. ABS Chief Economist Bruce Hockman said: “Annual wages in seasonally adjusted terms grew 2.3 per cent for the third quarter in a row. The main contributors to growth over the quarter were regularly scheduled wage rises in the Health care and social assistance and Education and training industries, as was the case in the previous March quarter.”

Westpac Consumer Sentiment rose 0.3% to 101.3 in May, up from 100.7. Westpac noted that easing bias was delivered by RBA at last week’s meeting, with growth and inflation forecasts lowered to “barely acceptable” levels. More importantly, such forecasts are based on market pricing for a full rate cut for. Westpac maintained that the tensions between strong labor market and weak GDP will be resolved over the next few months. And the case of August RBA cut would become clear.

UK PM May plans to bring back Brexit bill on June 3

UK Prime Minister Theresa May laid out her “plan” to complete the Brexit withdrawal agreement by the end of next month. Her spokesman said May is planning to put forward the bill again in the week beginning June 3. And he added “it is imperative we do so then if the UK is to leave the EU before the summer parliamentary recess.”

May’s Cabinet agreed to press head with talk with opposite Labour a meeting. As “Ministers involved in the negotiations set out details of the compromises which the government was prepared to consider in order to consider an agreement which would allow the UK to leave the EU with a deal as soon as possible.” And, “it was agreed that it is imperative to bring forward the Withdrawal Agreement Bill in time for it to receive royal assent by the summer parliamentary recess.”

However opposition Labour leader Jeremy Corbyn remained doubtful on the May’s plan. His spokesman said Corbyn raised doubts over the credibility of government commitments, following statements by Conservative MPs and cabinet ministers seeking to replace the prime minister.”

Looking ahead

Eurozone GDP and employment, German GDP will be released in European session. But major focuses will be in the US session. Canada CPI will be a key data to watch to gauge BoC’s rate path. US will release retail sales, industrial production, Empire state manufacturing, NAHB housing index and business inventories.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.6933; (P) 0.6947; (R1) 0.6958; More…

AUD/USD’s fall continues today and reaches as low as 0.6922 so far today. Intraday bias remains on the downside for 100% projection of 0.7295 to 0.7003 from 0.7205 at 0.6913. Decisive break there will indicate further downside acceleration. Further decline would be seen to retest 0.6722 low. On the upside, above 0.6964 minor resistance will turn intraday bias neutral for consolidations. But recovery should be limited by 0.6988/7069 resistance zone to bring fall resumption.

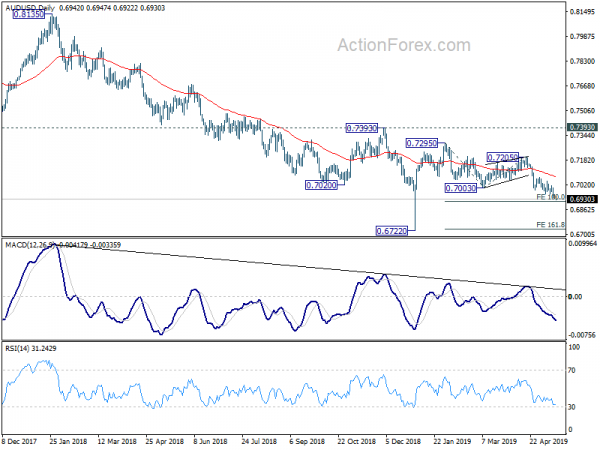

In the bigger picture, with 0.7393 key resistance intact, medium term outlook remains bearish. The decline from 0.8135 (2018 high) is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Apr | 2.60% | 2.30% | 2.40% | |

| 0:30 | AUD | Westpac Consumer Confidence May | 0.60% | 1.90% | ||

| 1:30 | AUD | Wage Price Index Q/Q Q1 | 0.50% | 0.60% | 0.50% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Apr | 6.10% | 6.40% | 6.30% | |

| 2:00 | CNY | Industrial Production Y/Y Apr | 5.40% | 6.50% | 8.50% | |

| 2:00 | CNY | Retail Sales Y/Y Apr | 7.20% | 8.60% | 8.70% | |

| 2:00 | CNY | Surveyed Jobless Rate Apr | 5.00% | 5.20% | ||

| 6:00 | JPY | Machine Tool Orders Y/Y Q1 Apr P | -28.50% | |||

| 6:00 | EUR | German GDP Q/Q Q1 P | 0.40% | 0.00% | ||

| 9:00 | EUR | Eurozone Employment Q/Q Q1 P | 0.20% | 0.30% | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q1 P | 0.40% | 0.40% | ||

| 12:30 | CAD | CPI M/M Apr | 0.40% | 0.70% | ||

| 12:30 | CAD | CPI Y/Y Apr | 2.00% | 1.90% | ||

| 12:30 | CAD | CPI Core – Common Y/Y Apr | 1.80% | 1.80% | ||

| 12:30 | CAD | CPI Core – Median Y/Y Apr | 2.00% | 2.00% | ||

| 12:30 | CAD | CPI Core – Trim Y/Y Apr | 2.10% | 2.10% | ||

| 12:30 | USD | Empire State Manufacturing May | 8 | 10.1 | ||

| 12:30 | USD | Retail Sales Advance M/M Apr | 0.20% | 1.60% | ||

| 12:30 | USD | Retail Sales Ex Auto M/M Apr | 0.70% | 1.20% | ||

| 13:15 | USD | Industrial Production M/M Apr | 0.00% | -0.10% | ||

| 13:15 | USD | Capacity Utilization Apr | 78.70% | 78.80% | ||

| 14:00 | USD | NAHB Housing Market Index May | 64 | 63 | ||

| 14:00 | USD | Business Inventories Mar | 0.00% | 0.30% | ||

| 14:30 | USD | Crude Oil Inventories | -4.0M |