Risk sentiments are knocked down heavily in Asia after Trump confused the markets by announcement to push trade war with China to full blown level. Just as investors were told dozens of times by Trump and his administration that both sides were “very close” to a deal, Trump made an about turn to decide to impose new tariffs on Chinese imports. Investors were left clueless on what’s next as they were originally prepared for a deal to be announce somewhat in Washington this week.

As Asian markets and DOW futures tumble sharply, Yen rides on risk aversion and surges around the board. Swiss Franc Dollar follow as the next strongest as usual in such situations. Australian Dollar is the weakest one, partly for its tie to China, partly on speculation that RBA could pull ahead rate cut to this Tuesday. Sterling is the second weakest for the moment, paring some of last week’s strong gains, then Canadian.

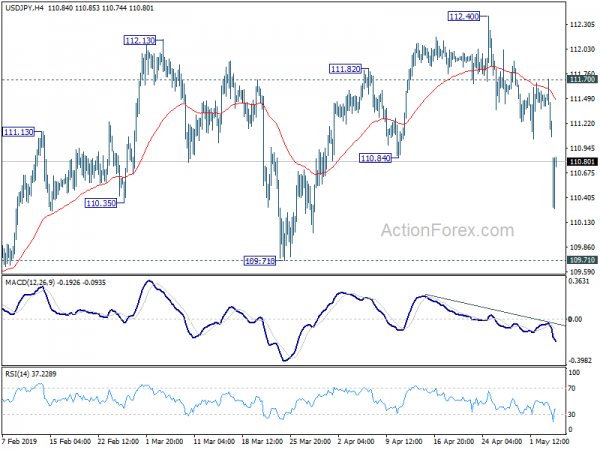

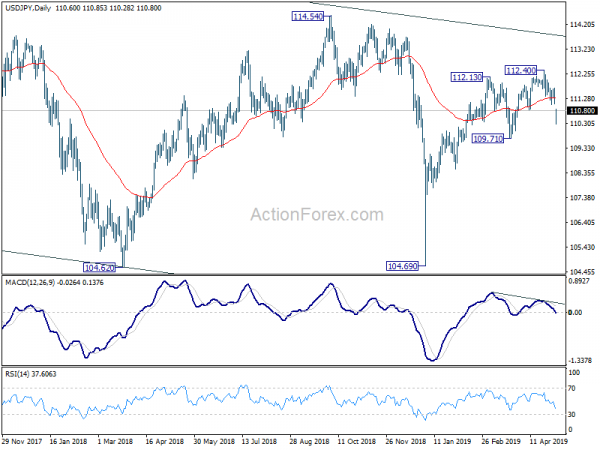

Technically, USD/JPY’s steep decline solidify the case of near term bearish reversal. That is, rebound from 104.69 flash crash low has completed at 112.40. Immediately focus is now back on 109.71 support for confirmation. EUR/JPY also breaks 123.65 support today as fall fro 127.50 resumes. Focus is now on 123.39 key support level. Decisive break the will align the outlook with USD/JPY for bearish near term reversal too. AUD/USD also resumes recent fall by braking through 0.6984. Though, EUR/USD, USD/CHF and USD/CAD are range bound.

In Asia, currently, Hong Kong HSI is down -3.22%. China Shanghai SSE is down -4.9%, losing both 3000 and 2900 handles. Singapore Strait Times is down -3.24%. Japan remains in 10-day holiday. DOW future is currently down -465 pts.

Trump to push US-China trade war to full-blown level on Friday

In his tweets on Sunday, Trump complained that the trade deal with China continues “too slower”, as “they attempt to renegotiate”. Thus, he decided to push trade war with China to full-blown level on Friday, even though Treasury Secretary Steven Mnuchin and Trade Representative Robert Lighthizer are planning to wrap up trade talks with Chinese Vice Premier Liu He in Washington this week.

Trump claimed that the “great economic results” of the US as of late can “partially” be attributed to the additional tariffs China has been paying for 10 months. The included 5% tariffs on USD 50B of high tech goods and 10% on USD 200B of other goods. Trump also claimed that “the tariffs paid to the USA have little impact of product cost, mostly borne by China”.

On Friday, Trump will raise the 10% tariffs on the USD 200B of “other goods” to 25%. Additionally, currently “untaxed” USD 325B will be tariffed at rate of 25%.

Trump got full support from Democrat Schumer on trade war escalation, but others unsure.

Trump’s move to escalate trade war with China got firm support from Democrat Senate leader Chuck Schumer. Schumer urged Trump to “hang tough on China” in a tweet” and “don’t back down”. He added “strength is the only way to win with China”.

White House economic adviser Larry Kudlow tried to tone down the threat and said trump is merely “issuing a warning here”. He told Fox News that ” we bent over backwards earlier, we suspended the 25 percent tariff to 10 and then we’ve left it there. That may not be forever if the talks don’t work out”

However, an informal trade adviser to Trump, Michael Pillsbury, clearly disagreed with Kudlow. He said “I take the president’s tweet at face value. I was disappointed that Larry Kudlow downgraded it to a mere warning, which may tend to undermine American credibility as the Chinese delegation prepares its position”.

It’s unsure for now whether Trump is really intending to drop the negotiations abruptly. Or, he’s just trying to push China for last minute concessions on some key issues. But the act could firstly undermine credibility of the US in negotiations with other countries. And, it could also undermine Trump’s own credibility as he’s told the public numerous times that a deal was close.

Yuan dives as trade tensions re-escalate, PBoC cut RRR for smaller banks

At this point, it’s unsure how China will respond to renewed tariff threats by Trump at this “very last” stage of negotiations. Vice Premier Liu He is originally scheduled to travel to Washington on Wednesday to wrap up the trade deal. It’s reported that Trump’s erratic change in position shocked Chinese officials. but so far there is no decision made on whether to cancel Liu’s trip or even cancel all trade negotiations. There are rumors that Liu is only delaying the trip by a few days.

At the same time the PBoC announced to lower the Reserve Requirement Ratio for small to medium banks starting next Wednesday on May 15. The move is expected to to release CNY 280B in long-term funds to the markets.

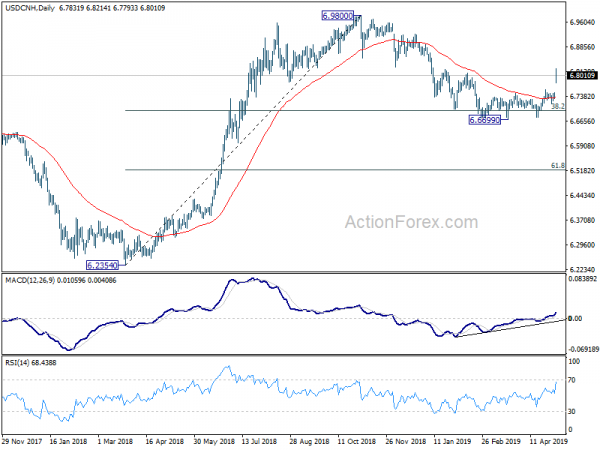

Chinese Yuan tumbles sharply today in reaction to all the news collectively. USD/CNH (off-shore Yuan) hits as high as 6.8214 after gapping up. Technically, the development suggests that pull back from 6.9800 (2018 high) has completed at 6.6699, after hitting 38.2% retracement of 6.2354 to 6.9800 at 6.6956. It’s a bit early to say, but 7 handle in USD/CHN could be at risk again if trade tensions worsen further.

RBA and RBNZ rate cuts to highlight the week, UK GDP, US CPI also watched

Two central banks will meet this week RBA and RBNZ. RBNZ is generally expected to cut OCR by -25bps to 1.50%. That’s rather certain. Opinions on RBA is divided though. Much weaker than expected Q1 CPI prompted speculations of an imminent cut this week to 1.25%. But as employment market remains robust, RBA could opt for standing pat again first before deciding to act in August. We believe the key would lie in new economy projections as presented in the SoMP. There could be enough reasons for a pre-emptive cut should inflation outlook materially worsen in the new projections.

In addition to the the two central bank meetings, ECB will also release monetary policy accounts but that will likely be a non-event, given that the central bank’s view is rather clearly conveyed already. Some important economic data will also be featured, including US CPI, UK GDP, Canada employment and China trade balance.

Here are some highlights for the week:

- Monday: China Caixin PMI services; Eurozone PMI services final, ,Sentix investor confidence, retail sales;

- Tuesday: Japan PMI manufacturing final; Australian retail sales, trade balance, RBA rate decision; New Zealand RBNZ inflation expectation; Germany factory orders; Swiss foreign currency reserves; Canada Ivey PMI;

- Wednesday: UK BRC retail sales monitor; RBNZ rate decision; China trade balance; Swiss unemployment rate; ECB monetary policy meeting accounts; Canada housing starts;

- Thursday: China CPI, PPI; Japan consumer confidence; Canada trade balance, new housing price index; US PPI, trade balance, jobless claims;

- Friday: RBA monetary policy statement; Germany trade balance; UK GDP, productions, trade balance; Canada employment, building permits; US CPI

USD/JPY Daily Outlook

Daily Pivots: (S1) 110.88; (P) 111.29; (R1) 111.52; More…

USD/JPY drops sharply to as low as 110.28 so far as fall from 112.40 accelerates. Break of 110.84 support adds to the case of bearish reversal. That is, whole rebound from 104.69 has completed at 112.40 on bearish divergence condition in daily MACD. Intraday bias is now on the downside for 109.71 support. Decisive break will confirm this bearish case and targets retesting 104.69 low. On the upside, break of 111.70 resistance is needed to confirm completion of the fall. Otherwise, outlook will now remain cautiously bearish in case of recovery.

In the bigger picture, medium term outlook in USD/JPY remains a bit mixed as it’s staying inside falling channel from 118.65, but there are signs of bullish reversal. On the upside, break of 114.54 resistance will revive the case the corrective fall from 118.65 has completed with three waves down to 104.69. And whole rise from 98.97 (2016 low) is resuming for 118.65 and above. However, sustained break of 109.71 will raise the chance that fall from 118.65 is still in progress for another low below 104.62.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:00 | AUD | TD Securities Inflation M/M Apr | 0.20% | 0.40% | ||

| 1:45 | CNY | Caixin China PMI Services Apr | 54.5 | 54.2 | 54.4 | |

| 7:45 | EUR | Italy Services PMI Apr | 51.8 | 53.1 | ||

| 7:50 | EUR | France Services PMI Apr F | 50.5 | 50.5 | ||

| 7:55 | EUR | Germany Services PMI Apr F | 55.6 | 55.6 | ||

| 8:00 | EUR | Eurozone Services PMI Apr F | 52.5 | 52.5 | ||

| 8:30 | EUR | Eurozone Sentix Investor Confidence May | 1.1 | -0.3 | ||

| 9:00 | EUR | Eurozone Retail Sales M/M Mar | -0.10% | 0.40% |