The forex markets are generally quiet in Asian session today. Major pairs and crosses are bounded inside yesterday’s range. Australian and New Zealand Dollars are mildly firmer while Yen and Canadian are the weakest. Dollar rebound overnight after Fed Chair Jerome Powell talked down the chance of a rate cut. But there is no follow through buying for now. Focus will turn to BoE Super Thursday first. But traders could have to wait for Friday’s non-farm payroll for the bigger moves.

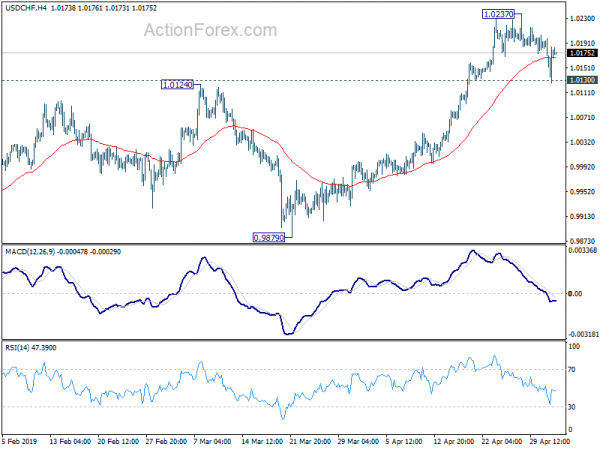

Technically, USD/CHF recovered after drawing support from 1.0130 minor support, and maintained near term bullishness. USD/JPY’s decline also slowed ahead of 110.84 near term support and recovered, providing no indication of bearish reversal. EUR/USD was held well below 1.1324 near term resistance, maintaining bearishness. For now, Dollar appears to be safe and more upside is in favor, subject to solid job data tomorrow. AUD/USD could be a pair to watch today. Deterioration in risk sentiment could drag it through 0.6988 support to resume recent decline from 0.7295.

In Asia, Hong Kong HSI is up 0.62%. China Shanghai SSE is up 0.52%. Singapore Strait Times is down -0.56%. Japan is in ultra-long 10-days holidays. Overnight, DOW closed down -0.61%, S&P 500 lost -0.75% and NASDAQ dropped -0.57%. 10-year yield rose 0.002 to 2.511 after hitting 2.455.

Dollar and yield rebounded as Fed Powell talked down rate cuts

Dollar and treasury yields rebounded overnight after Fed Chair Jerome Powell talked down the chance of a rate cut after Fed kept interest rate unchanged at 2.25-2.50% as widely expected. In particular, 10-year yield hit as low as 2.455 earlier in the day but closed up 0.002 at 2.511, regained 2.5 handle.

In the post meeting press conference, Powell noted that “our policy stance is appropriate at the moment” and emphasized “we don’t see a strong case for moving it in either direction. Fed acknowledged that both headline and core inflation were running below targets. But Powell said that’s mostly due to transient factors. He predicted inflation to pick rise back to 2% target ahead.

Here are some suggested readings on FOMC:

- Fed Judges Weak Inflation as Transitory, Dismissing Rate Cut Chance

- Northern Exposure: FOMC Hold to Sanguine View of Outlook

- Fed Holds Rate Target and Guidance Steady, Onboarding Mixed Economic Data

- Fed Leaves Rates Unchanged in May, Notes Deceleration in Inflation

- FOMC Recap: Technical Tweaks Do Little To Dissuade Doves

- Fed chair Jerome Powell press conference live stream

- Fed stands pat, acknowledges below target inflation, but maintains patient stance

Sterling maintain gains as focus turns to BoE Super Thursday

Sterling is trading as the strongest one for the week and is maintain gains. Focus turns to BoE “Super Thursday”. Bank Rate is widely expected to be kept at 0.75%. Asset purchase target should be held at GBP 435B. Decisions should be made by unanimous 9-0 votes.

Economic development appeared to be positive in Q1, both domestically in UK and globally. But the resilience in UK GDP appeared to be boosted by pre-Brexit stockpiling. Momentum could dissipate easily in Q2, which was seen in the fall in April PMI manufacturing already. Headline CPI steadied at 1.9% yoy in March, which was within BoE’s target range. Such developments shouldn’t prompt any change in BoE’s policy. Adding to that, Brexit uncertainty is prolonged after UK was granted flexible extension until October 31.

The more interest things to note would be in the new economic projections in the quarterly inflation report. But for now, the figures are rather academic given that the form of Brexit is yet to be known.

Here are some suggested readings on BoE:

- BOE Preview: Looking Through Strong First Quarter, with Focus on Softer Inflation and Prolonged Brexit Uncertainty

- Cable Rallies on Expectations for BOE to Deliver a Hawkish Hold

On the data front

New Zealand building permits dropped -6.9% mom in March. German retail sales, Swiss retail sales and PMI manufacturing, Eurozone PMI manufacturing final and UK PMI construction will be featured in European session.

Later in the day, US will release Challenger job cuts, jobless claims, non-farm productivity and factory orders.

USD/CHF Daily Outlook

Daily Pivots: (S1) 1.0136; (P) 1.0168; (R1) 1.0209; More…

USD/CHF dipped to 1.0126 but draw support from 1.0130 minor support and recovered quickly. Intraday bias remains neutral first and outlook is unchanged. USD/CHF is staying in medium term rise from 0.9186 and further rally is expected. On the upside, break of 1.0237 will resume larger up trend to 1.0342 key resistance. However, sustained break of 1.0130 will confirm short term topping. In that case, deeper pull back would be seen back to 55 day EMA (now at 1.0058) and below.

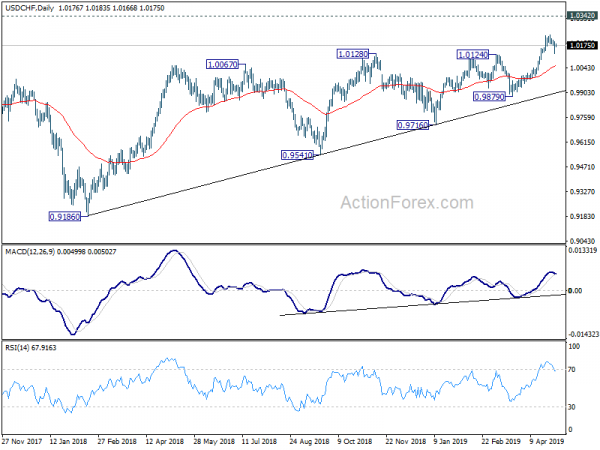

In the bigger picture, medium term up trend from 0.9186 is extending. Current rise should target 1.0342 resistance next. For now, we’d be cautious on strong resistance from there to limit upside, until we see medium term upside acceleration. On the downside, break of 0.9879 support is needed to indicate reversal. Otherwise, outlook will stay bullish in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Mar | -6.90% | 1.90% | 1.70% | |

| 6:00 | EUR | German Retail Sales M/M Mar | -0.50% | 0.90% | ||

| 6:30 | CHF | Retail Sales Real Y/Y Mar | -0.40% | -0.20% | ||

| 7:30 | CHF | PMI Manufacturing Apr | 51 | 50.3 | ||

| 7:45 | EUR | Italy Manufacturing PMI Apr | 47.7 | 47.4 | ||

| 7:50 | EUR | France Manufacturing PMI Apr F | 49.6 | 49.6 | ||

| 7:55 | EUR | Germany Manufacturing PMI Apr F | 44.5 | 44.5 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Apr F | 47.8 | 47.8 | ||

| 8:30 | GBP | Construction PMI Apr | 50.3 | 49.7 | ||

| 11:00 | GBP | BoE Rate Decision | 0.75% | 0.75% | ||

| 11:00 | GBP | BoE Asset Purchase Target May | 435B | 435B | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Apr | 0.40% | |||

| 12:30 | USD | Initial Jobless Claims (APR 27) | 220K | 230K | ||

| 12:30 | USD | Nonfarm Productivity Q1 P | 1.20% | 1.90% | ||

| 12:30 | USD | Unit Labor Costs Q1 P | 2.10% | 2.00% | ||

| 14:00 | USD | Factory Orders Mar | 1.40% | -0.50% | ||

| 14:30 | USD | Natural Gas Storage | 92B |