Economic data released from the US are mixed today. ADP report shows much stronger than expected growth in private sector jobs. However, ISM manufacturing points to deep cool down in the manufacturing sector, with deteriorating new orders, prices and employment. Dollar chooses to react to the negative one and suffers steep selling after ISM. 10-year yield also tumbles pass 2.5 handle to as low as 2.475. But stocks are relatively steady.

In the currency markets, European majors are generally the strongest ones today, led by Swiss Franc. Sterling shrugs off decline in UK manufacturing PMI. At this point, commodity currencies are the weakest, lead by New Zealand Dollar, which is pressured by weak job data. Dollar is mixed but is vulnerable for deeper selloff. The greenback will need something upbeat from Fed chair Jerome Powell to halt the decline.

Technically, 1.0130 in USD/CHF will be an immediate focus now. Decisive break will at least confirm short term topping and bring deeper pull back. USD/JPY’s fall might accelerate should treasury yield dips further. Break of 110.84 support will add to the case of bearish reversal. GBP/USD has already confirmed short term bottoming yesterday. While EUR/USD is held well below 1.1324 resistance, it’s starting to look a bit vulnerable for stronger rally.

US manufacturing expanding, but at recent historic lows

US ISM manufacturing dropped to 52.8, down from 55.3 and missed expectation of 55.0. Price paid index dropped sharply to 50.0, down from 54.3 and missed expectation of 55.7. Employment index dropped to 52.4, down from 57.5. New orders tumbled to 51.7, down from 57.4.

ISM noted that comments from the panel reflect continued expanding business strength, but at the softest levels since the fourth quarter of 2016. New Orders Index softening to the low 50s. Exports orders contracted for the first time since February 2016. trade elements are in contraction territory. The PMI has been inching down since November 2018. The manufacturing sector is expanding, but at recent historic lows.

US ADP employment grew 275k, service sector strong

US ADP private employment grew strongly by 275k in April, well above expectation of 181k. Looking at the details, jobs in goods-producing sector rose 52k. Jobs in service-providing sector rose 223k.

“April posted an uptick in growth after the first quarter appeared to signal a moderation following a strong 2018,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The bulk of the overall growth is with service providers, adding the strongest gain in more than two years.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market is holding firm, as businesses work hard to fill open positions. The economic soft patch at the start of the year has not materially impacted hiring. April’s job gains overstate the economy’s strength, but they make the case that expansion continues on.”

Dollar to listen to Powell’s comments on growth in inflation

Fed is widely expected to keep federal funds rate unchanged at 2.25-2.50%. Also, Fed will, without a doubt, maintain its patient stance regarding any monetary policy adjustment. The major focus is whether Fed Chair Jerome Powell would dismiss talks of rate cut as premature. Or he’ll sound concerned with sluggish inflation and indicate openness on lowering interest rates.

Some suggested readings on FOMC:

- Traders Eye Fed’s Decision

- FOMC Preview: IOER Cut Possible, But Neutral Outlook Likely For Another Month

- Fed Meets as Rate-Cut Bets Mount

- FOMC Preview -Fed to Reiterate Patience Rhetoric Despite Strong First Quarter Growth, Focus on Soft Inflation

US Mnuchin concluded productive trade meetings with China Liu, next round in Washington

US Treasury Secretary Steven Mnuchin said he has concluded “productive meetings” with Chinese Vice Premier Liu He in Beijing. And, the discussions will continue in Washington next week. But there is so far no details regarding any progress made. Trade Representative Robert Lighthizer is quiet as usual on the topic.

Earlier, China Banking and Insurance Regulatory Commission said it will further open up the banking an insurance sectors. And it plans to issue 12 new measures soon. The measures include dropping the USD 10B asset requirements for foreign companies to set up a legal entity in the country. The USD 20B asset requirements for foreign banks to set up a branch will also be removed. Approval procedures for foreign banks to conduct Yuan businesses will be removed.

UK PMI manufacturing dropped to 53.1, upturn eased at start of Q2

UK PMI manufacturing dropped to 53.1 in April, down from 55.1 and matched expectation of 53.1. Markit noted that new export business declines. Also, stock-building continues at solid, yet slower, pace.

Rob Dobson, Director at IHS Markit, said: “The upturn in the UK manufacturing sector eased at the start of the second quarter. Growth of output and new orders slowed, leading to job cuts for the third time in the past four months. The trend in new export business was especially weak, as high stock holdings at clients and slower global economic growth led to reduced demand from key markets such as the European Union, the USA and China. There were also reports of overseas clients acting now to re-route their supply chains away from the UK in advance of Brexit.”

“Manufacturers’ outlook remained relatively upbeat, however, with over 50% forecasting their output will be higher in 12 months’ time. Companies plan to use new product launches, new technologies and improved marketing strategies to drive growth forward in the coming months. However, Brexit uncertainty continues to weigh on plans, as some firms remain concerned about future growth prospects and the likely impact on output and demand from the unwinding of inventory positions later in the year.”

Also released from UK, M4 money supply dropped -0.5% mom in March versus expectation of 0.3% mom. Mortgage approvals dropped -3k to 62k in March. BRC shop price index rose 0.4% yoy in April.

EU Katainen: Situation of British in European Parliament before Brexit looks very messy

European Commission Vice-President Jyrki Katainen complained that the prospects of British candidates getting into European Parliament just months ahead of Brexit creates a “messy” situation. He said “the UK has been given a deadline (to leave the EU) which is later in the autumn but the Commission president might be elected before that … It looks very messy at the moment.”

He added: “We have to make sure all MEPs have the same rights and responsibilities because we cannot be in a situation where some MEPs have a partial mandate … But a temporary majority may cause lots of questions and troubles.”

ECB de Guindos: Interest rates to stay low even once monetary policy normalizes

ECB Vice-President Luis de Guindos reiterated the central bank’s accommodative stance in an event in London today. He said “the low interest rate environment is with us for the foreseeable future and is caused in large part by durable structural factors”. He added, “even once monetary policy normalizes, interest rates are likely to remain below levels that were common in previous decades.”

On Brexit, he said “I hope we will be able to take advantage of the new period of time that British government, parliament have at its disposable to reach an orderly Brexit. On Italy, he said “the main recommendation is to pursue reforms that improve the effectiveness of the economy.”

Australia AiG PMI improved to 54.8, but employment and wage indices dropped

Australia AiG Performance of Manufacturing Index rose 3.8 pts to 54.8 in April, indicating faster growth. All subsectors except machinery & equipment, and metal products improved. Top concerns for manufacturers in April included the upcoming Federal election, high energy prices, high input costs (due to drought, a low dollar and high commodity prices) and tighter credit conditions.

Employment index dropped sharply by -5.1 pts to 51.5. The release also noted ABS data indicated that total manufacturing employment fell dramatically over summer, with a reduction in employment of 41,600 over the three months to February 2019 (-6.3% q/q, trend). Average wage index dropped -3.5 to 57.7, indicating lower wage pressures across the manufacturing sector. Also, this wage index has been trending down since peaking at September 2018.

New Zealand employment dropped -0.2% qoq in Q1, NZD dips

New Zealand Dollar drops notably today after weaker than expected job data. Employment contracted -0.2% qoq in Q1, below expectation of 0.5% qoq growth. Unemployment rate dropped to 4.2%, down from 4.3% and matched expectations. But labor force participation rate dropped -0.5% to 70.4%. Labor cost index rose 0.3% qoq, below expectation of 0.5% qoq.

Today’s data shouldn’t change RBNZ’s view that New Zealand is current staying at maximum sustainable employment. The reduced momentum in job growth and sluggish wage would provide little support to the already low inflation reading. Weak CPI is a key factor around the case of RBNZ rate cut in near term, probably in May, but the meeting remains live.

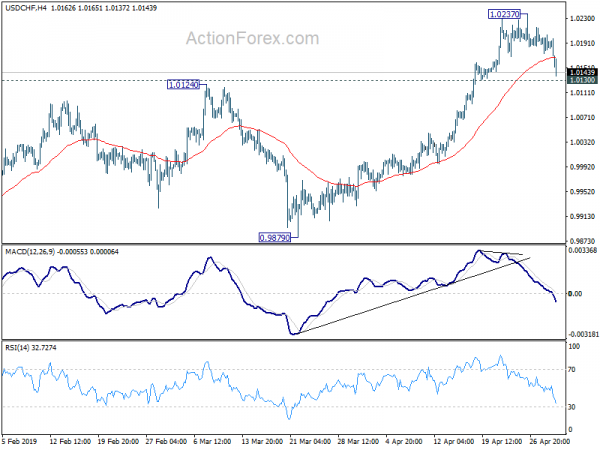

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 1.0175; (P) 1.0190; (R1) 1.0205; More…

USD/CHF drops sharply in early US session but stays above 1.0130 minor support. Intraday bias remains neutral first. We’d still expect strong support from 1.0130 to contain downside to bring rise resumption. Break of 1.0237 will resume larger up trend to 1.0342 key resistance. However, sustained break of 1.0130 will confirm short term topping. In that case, deeper pull back would be seen back to 55 day EMA (now at 1.0053) and below.

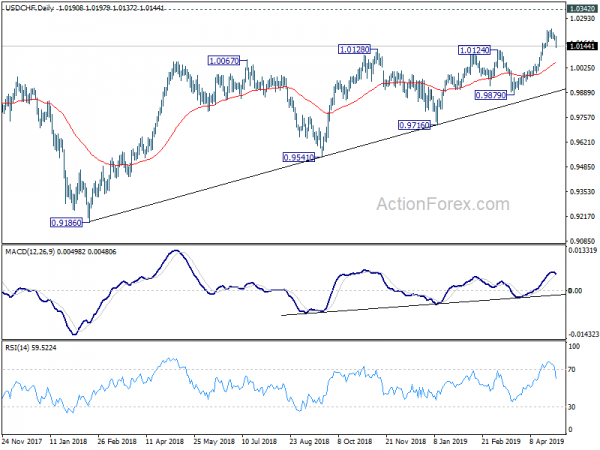

In the bigger picture, medium term up trend from 0.9186 is extending. Current rise should target 1.0342 resistance next. For now, we’d be cautious on strong resistance from there to limit upside, until we see medium term upside acceleration. On the downside, break of 0.9879 support is needed to indicate reversal. Otherwise, outlook will stay bullish in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Manufacturing Index Apr | 54.8 | 51 | ||

| 22:45 | NZD | Employment Change Q/Q Q1 | -0.20% | 0.50% | 0.10% | |

| 22:45 | NZD | Unemployment Rate Q1 | 4.20% | 4.20% | 4.30% | |

| 22:45 | NZD | Labor Cost Private Sector Q/Q Q1 | 0.30% | 0.50% | 0.50% | |

| 23:01 | GBP | BRC Shop Price Index Y/Y Apr | 0.40% | 0.90% | ||

| 08:30 | GBP | Mortgage Approvals Mar | 62K | 64K | 64K | 65K |

| 08:30 | GBP | Money Supply M4 M/M Mar | -0.50% | 0.30% | 0.30% | |

| 08:30 | GBP | PMI Manufacturing Apr | 53.1 | 53.1 | 55.1 | |

| 12:15 | USD | ADP Employment Change Apr | 275K | 181K | 129K | 151K |

| 13:30 | CAD | Manufacturing PMI Apr | 49.7 | 50.5 | ||

| 13:45 | USD | Manufacturing PMI Apr F | 52.6 | 52.4 | 52.4 | |

| 14:00 | USD | ISM Manufacturing Apr | 52.8 | 55 | 55.3 | |

| 14:00 | USD | ISM Prices Paid Apr | 50 | 55.7 | 54.3 | |

| 14:00 | USD | ISM Employment Apr | 52.4 | 57.5 | ||

| 14:00 | USD | Construction Spending M/M Mar | -0.90% | 0.10% | 1.00% | 0.70% |

| 14:30 | USD | Crude Oil Inventories | 9.9M | 1.3M | 5.5M | |

| 18:00 | USD | FOMC Rate Decision (Lower Bound) | 2.25% | 2.25% | ||

| 18:00 | USD | FOMC Rate Decision (Upper Bound) | 2.50% | 2.50% |