Quick update: Dollar has little reaction to better than expected ISM manufacturing, which rose 0.1 pt to 54.9 in May.

Dollar strengthens mildly in early US session as lifted by solid job data. The ADP report showed impressive growth of 253k in private sector jobs in May, much higher than expectation of 181k. Mark Zandi, chief economist at Moody’s Analytics Inc. described the job growth as "rip roaring". And he noted "the current pace of job growth is nearly three times the rate necessary to absorb growth in the labor force. Increasingly, businesses’ number one challenge will be a shortage of labor." Moody’s helps ADP produce the report.

Initial jobless claims rose 13k to 248k in the week ended May 27, above expectation of 238k. But that’s still way below the 300k mark. It’s the 117 straight weeks that the data is below this 300k level, longest run since early 1970s. The four week moving average rose 2.5k to 238k, up slightly from prior week’s figure which was at a 44-year low. Continuing claims dropped 9k to 1.92m, staying below 2m handle for seven straight week, best streak since 1974.

Dollar index staying bearish

Dollar index is back at 97.2 after tipping to 96.90 earlier today. Nonetheless, there is no change in the bearish outlook, at least, not until a break of 97.77 resistance to indicate short term bottoming.

San Francisco Fed Williams expects 3-4 hike this year

San Francisco Fed President John Williams expressed his optimism on the economy and noted that a total of three rate hikes this year as his base case. Meanwhile, four hikes is also an option if the US economy improves further. He noted that "there is potential for upside occurrences in the economy. One big question mark is if there is big fiscal stimulus or other changes in the outlook that we see the economy is doing better than we thought." And, "in the end we are only moving gradually and to a relatively low level, 3 percent or less," he said.

Fed Governor Powell: balance could be halved by 2022

Fed Governor Jerome Powell said that the USD4.5T balance sheet of Fed could eventually be shrank to between USD2.4T to USD 2.9T by 2022. Nonetheless, that would still be 2-3 times the pre-crisis size at USD 0.9T. Meanwhile Powell showed little concern regarding recent slowdown in inflation and said that could be explained by "transitory factors". He expects strong spending and tightening labor market to pull up wages and prices.

UK Conservative stepping up campaign

In UK, in response to losing lead over Labour, Conservative is stepping up their election campaign on the Internet. A one-minute clip attacking Labour leader Jeremy Corbyn got 5m views on facebook since it was published last Friday and millions on YouTube. The clip focused on things like Corbyn’s opposition to anti-terror legislation and push for cut in military spending. The "American style" campaign is seen by as a breakthrough by some analysts as the British used to resist such an approach. While the number of views of the video was impressive, the impact is unsure. The election was predicted to be a landslide victory for Prime Minister Theresa and it’s now an open one with realistic possibility of even a hung parliament.

More on UK election in Sterling Volatility Soars Ahead Of Election

UK PMI manufacturing dropped o 56.7 in May, down from 57.3, but beat expectation of 56.5. Markit noted that "the sector should have sufficient momentum to see it through the uncertainty generated by the current unexpected general election and into the start of Brexit negotiations." Meanwhile, "the trend in foreign demand (is) continuing to improve only in fits and starts, despite the assistance of a historically weak sterling exchange rate." Also from UK, Nationwide house price dropped -0.2 mom in May.

Germans urge ECB to discuss changing forward guidance

In Germany, Bundesbank President Jens Weidmann the ECB Governing Council is "beginning to discuss" whether and when to adjust the forward guidance. That is warranted by the "current economic outlook together with the improvement in the balance of risks". Separately, ECB Executive Board member Sabine Lautenschlaeger said that "all ingredients for an appropriate increase in prices are present." And, "against that backdrop, we should prepare to slowly reduce the dose of monetary medicine."

Released from Swiss, GDP rose 0.3% qoq in Q1, below expectation of 0.5% qoq. Retail sales dropped -1.2% yoy in April, below expectation of 2.4% yoy. SVME PMI dropped to 55.6 in May, down from 57.4, below expectation of 57.8. From Eurozone, PMI manufacturing was finalized at 57.0 in May. Italy GDP rose 0.4% qoq in Q1, manufacturing PMI dropped to 55.1. in May.

BoJ Harada: No big long term losses on stimulus exit

BoJ board member Yutaka Harada addressed the concerns of stimulus exit and noted that the central bank won’t suffer large long-term losses because of that. Harada said that it’s "of course possible" that BoJ would register losses because it will "receive low interest rates while paying high interest rates". But such losses will be temporary. Instead, BoJ will "always make a profit in the long rung as it can buy high-yielding government bonds using cash and current account deposits that carry almost no cost." Regarding the economy, he pointed to the fall in unemployment rate to 2.8% and emphasized that "if this trend continues and the jobless rate falls further, there’s no doubt prices will rise".

Released from Japan, capital spending rose 4.5% in Q1, above expectation of 3.9%. PMI manufacturing was finalized at 53.1 in May.

China’s manufacturing sector contracted for the first time in almost a year

China’s manufacturing activities contracted for the first time in 11 months, as Caixin/Markit’s PMI index suggested. The report shows that the manufacturing PMI dropped -0.7 points to 49.6 in May (a reading below 50 signals contraction), compared with consensus of a milder drop to 50.1. While the sub-indices of output and new business remained in the expansionary territory, but both fell to their lowest levels since June last year. Meanwhile, the sub- indices of input costs and output prices drifted to the contractionary territory for the first time since June 2016 and February 2016, respectively. Meanwhile, the sub-index of stocks of purchases showed renewed decline. The rebound in the sub-index of stocks of finished goods suggested that companies stopped restocking as inventory levels increased. More in China’s Manufacturing Sector Contracted For First Time In Almost A Year.

USD/JPY Mid-Day Outlook

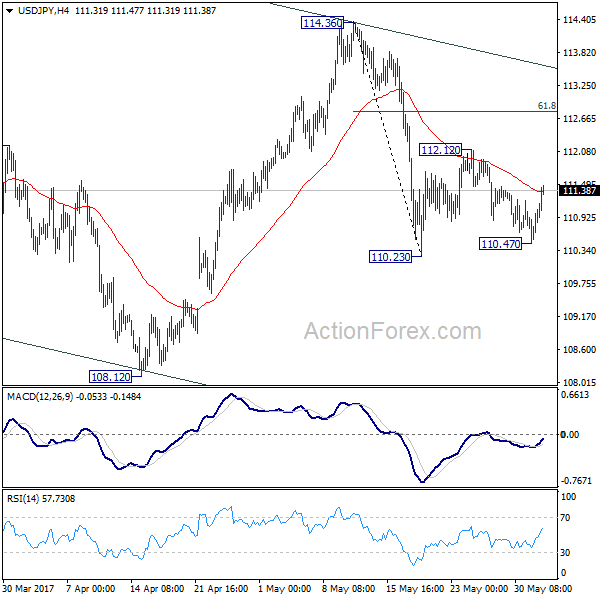

Daily Pivots: (S1) 110.41; (P) 110.82; (R1) 111.16; More…

Intraday bias in USD/JPY is turned neutral as the consolidation from 110.23 should be extending with another rise. Further rebound might be seen to 112.12. But upside should be limited by 61.8% retracement of 114.36 to 110.23 at 112.78 to bring fall resumption. Below 110.23 will turn bias to the downside and will likely resume the fall from 118.65 through 108.12 low. At fall from 118.65 is seen as a correction, we’ll look for bottoming signal again at 61.8% retracement of 98.97 to 118.65 at 106.48. However, sustained break of 112.78 will turn focus back to 114.36 resistance instead.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. It’s uncertain whether it’s completed yet. But in case of another fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77 to bring rebound. Overall, rise from 75.56 is still expected to resume later after the correction from 125.85 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q/Q Q1 | 5.10% | 3.90% | 5.70% | 5.80% |

| 23:50 | JPY | Capital Spending Q1 | 4.50% | 3.90% | 3.80% | |

| 00:30 | JPY | PMI Manufacturing May F | 53.1 | 52 | 52 | |

| 01:30 | AUD | Private Capital Expenditure Q1 | 0.30% | 0.50% | -2.10% | -1.00% |

| 01:30 | AUD | Retail Sales M/M Apr | 1.00% | 0.30% | -0.10% | -0.20% |

| 01:45 | CNY | Caixin PMI Manufacturing May | 49.6 | 50.2 | 50.3 | |

| 05:45 | CHF | GDP Q/Q Q1 | 0.30% | 0.50% | 0.10% | 0.20% |

| 06:00 | GBP | Nationwide House Prices M/M May | -0.20% | 0.20% | -0.40% | |

| 07:15 | CHF | Retail Sales (Real) Y/Y Apr | -1.20% | 2.40% | 2.10% | |

| 07:30 | CHF | SVME PMI May | 55.6 | 57.8 | 57.4 | |

| 07:45 | EUR | Italy Manufacturing PMI May | 55.1 | 56.1 | 56.2 | |

| 07:50 | EUR | France Manufacturing PMI May F | 53.8 | 54 | 54 | |

| 07:55 | EUR | Germany Manufacturing PMI May F | 59.5 | 59.4 | 59.4 | |

| 08:00 | EUR | Eurozone Manufacturing PMI May F | 57 | 57 | 57 | |

| 08:00 | EUR | Italian GDP Q/Q Q1 F | 0.40% | 0.20% | 0.20% | 0.40% |

| 08:30 | GBP | PMI Manufacturing May | 56.7 | 56.5 | 57.3 | |

| 11:30 | USD | Challenger Job Cuts Y/Y May | 71.40% | -42.90% | ||

| 12:15 | USD | ADP Employment Change May | 253K | 181K | 177K | |

| 12:30 | USD | Initial Jobless Claims (27 MAY) | 248K | 238K | 234K | 235K |

| 14:00 | USD | ISM Manufacturing May | 54.9 | 54.6 | 54.8 | |

| 14:00 | USD | ISM Prices Paid May | 60.5 | 67 | 68.5 | |

| 14:00 | USD | Construction Spending M/M Apr | -1.40% | 0.50% | -0.20% | 1.10% |

| 14:30 | USD | Natural Gas Storage | 81B | 78B | 75B | |

| 15:00 | USD | Crude Oil Inventories | -2.7M | -4.4M |