Australian dollar was given a brief boost by retail sales data in Asian session but quickly reversed. It’s trading as the biggest loser so far for the day and the week. Retail sales rose 1.0% mom in April, above expectation of 0.3% mom. However, markets seem to be more sensitive to private capital expenditure, which rose a mere 0.3% in Q1, even worse than expectation of 0.5%. Meanwhile, China’s private Caixin PMI manufacturing tumbled to 49.6 in May, down from 50.3 and missed expectation of 50.2. That’s the first contraction reading in 11 months. Comparing with the official PMI, the Caixin one focuses more on SMEs and indicates that these companies could be under some pressure in May which might drag down the economy ahead.

Kiwi firms up mildly

New Zealand Dollar, on the other hand, is lifted mildly by as terms of trade index rose 5.1% qoq, in Q1, just slightly down from prior quarter’s 5.8% qoq, and beat expectation of 3.9% qoq. The Kiwi was also supported by comments from RBNZ governor Graeme Wheeler earlier this week that risks to the financial system, domestically and from broad, have reduced. AUD/NZD extends the decline from March high at 1.1017 to as low as 1.0045 so far. It’s clear that the corrective rebound from 1.0234 has completed with three waves up to 1.1017. Near term outlook will stay bearish as long as 1.0608 resistance holds, for 1.0323 support and then 1.0234 low.

BoJ Harada: No big long term losses on stimulus exit

BoJ board member Yutaka Harada addressed the concerns of stimulus exit and noted that the central bank won’t suffer large long-term losses because of that. Harada said that it’s "of course possible" that BoJ would register losses because it will "receive low interest rates while paying high interest rates". But such losses will be temporary. Instead, BoJ will "always make a profit in the long rung as it can buy high-yielding government bonds using cash and current account deposits that carry almost no cost." Regarding the economy, he pointed to the fall in unemployment rate to 2.8% and emphasized that "if this trend continues and the jobless rate falls further, there’s no doubt prices will rise".

Released from Japan, capital spending rose 4.5% in Q1, above expectation of 3.9%. PMI manufacturing was finalized at 53.1 in May.

Fed’s Beige Book affirmed June hike expectations

The upbeat Beige Book from Fed solidifies the case of a June rate hike. Fed fund futures are pricing in 91.2% chance of that. The reported suggested that most of the twelve Fed Districts reported a continued expansion in activity "at a modest or moderate pace", although Boston, Chicago and New York indicated some degrees of slowdown. Labour markets continued to tighten, with most Districts reporting shortages in a wide range of jobs. Despite continuing improvement in the employment condition, wage growth remained "modest to moderate". Overall, pricing pressures were reported to be little changed from the last report, with most Districts reporting "modest" increases.

Trump to announce decision on Paris accord

US President Donald Trump will announce his decision regarding the global pact to fight climate change at 1900 GMT today. It is reported that Trump will deliver his election promise and pull out from the accord. And that will leave US as one of the only three non-participant in the 195-nation agreement, with Syria and Nicaragua. Republican Mitt Romney expressed his disagreement and emphasized that the Paris agreement is "is not only about the climate: It is also about America remaining the global leader." Meanwhile, European Commission President Jean-Claude Juncker said that "the Americans can’t just leave the climate protection agreement. Mr. Trump believes that because he doesn’t know the details."

Also…

News regarding UK election next week will continue to influence the Pound. And for today, UK PMI manufacturing will also be watched. In European session, Eurozone PMI manufacturing final, Italian GDP, Swiss retail sales and SVME PMI, Swiss GDP will also be released. Later in US session, ISM manufacturing will be the main focus together with ADP employment. Jobless claims, non-farm productivity and construction spending will also be featured.

EUR/AUD Daily Outlook

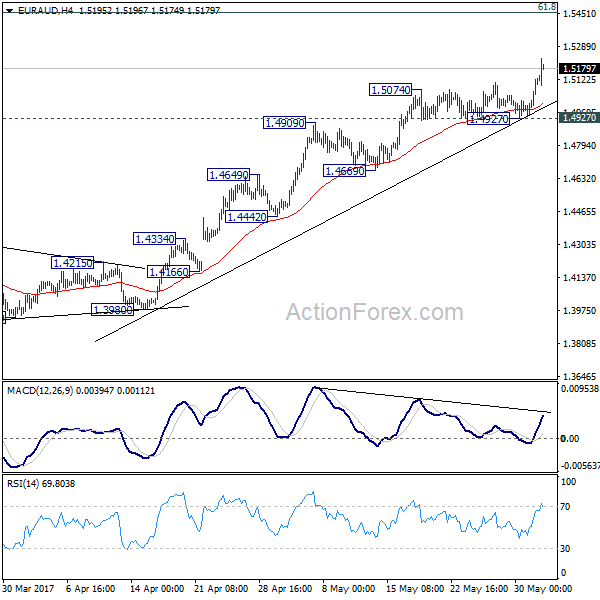

Daily Pivots: (S1) 1.5004; (P) 1.5067; (R1) 1.5191; More…

EUR/AUD’s rally resumes today and surges to as high as 1.5226 so far. Intraday bias is back on the upside for next medium term fibonacci level at 1.5455. On the downside, break of 1.4927 is needed to signal short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, price actions from 1.6587 medium term top are viewed as a corrective pattern. Such correction should be completed at 1.3624 after defending 1.3671 key support. Rise from 1.3642 is now expected to target 61.8% retracement of 1.6587 to 1.3624 at 1.5455. Sustained break there will pave the way to retest 1.6587. In any case, outlook will now stay cautiously bullish as long as 1.4669 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q/Q Q1 | 5.10% | 3.90% | 5.70% | 5.80% |

| 23:50 | JPY | Capital Spending Q1 | 4.50% | 3.90% | 3.80% | |

| 0:30 | JPY | PMI Manufacturing May F | 53.1 | 52 | 52 | |

| 1:30 | AUD | Private Capital Expenditure Q1 | 0.30% | 0.50% | -2.10% | -1.00% |

| 1:30 | AUD | Retail Sales M/M Apr | 1.00% | 0.30% | -0.10% | -0.20% |

| 1:45 | CNY | Caixin PMI Manufacturing May | 49.6 | 50.2 | 50.3 | |

| 5:45 | CHF | GDP Q/Q Q1 | 0.50% | 0.10% | ||

| 6:00 | GBP | Nationwide House Prices M/M May | 0.20% | -0.40% | ||

| 7:15 | CHF | Retail Sales (Real) Y/Y Apr | 2.40% | 2.10% | ||

| 7:30 | CHF | SVME PMI May | 57.8 | 57.4 | ||

| 7:45 | EUR | Italy Manufacturing PMI May | 56.1 | 56.2 | ||

| 7:50 | EUR | France Manufacturing PMI May F | 54 | 54 | ||

| 7:55 | EUR | Germany Manufacturing PMI May F | 59.4 | 59.4 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI May F | 57 | 57 | ||

| 8:00 | EUR | Italian GDP Q/Q Q1 F | 0.20% | 0.20% | ||

| 8:30 | GBP | PMI Manufacturing May | 56.5 | 57.3 | ||

| 11:30 | USD | Challenger Job Cuts Y/Y May | -42.90% | |||

| 12:15 | USD | ADP Employment Change May | 181K | 177K | ||

| 12:30 | USD | Non-Farm Productivity Q1 F | -0.60% | -0.60% | ||

| 12:30 | USD | Unit Labor Costs Q1 F | 3.00% | 3.00% | ||

| 12:30 | USD | Initial Jobless Claims (27 MAY) | 238K | 234K | ||

| 14:00 | USD | ISM Manufacturing May | 54.6 | 54.8 | ||

| 14:00 | USD | ISM Prices Paid May | 67 | 68.5 | ||

| 14:00 | USD | Construction Spending M/M Apr | 0.50% | -0.20% | ||

| 14:30 | USD | Natural Gas Storage | 75B | |||

| 15:00 | USD | Crude Oil Inventories | -4.4M |