Dollar trades broadly lower in early US session after poor job report which shows only 20k growth, weakest since September 2017. However, weakness is at this point limited since the set of data is not totally negative. Unemployment rate did decline while wage growth accelerated. For now, Sterling is the weakest one for today on Brexit uncertainty, followed by Dollar, and then Australian. New Zealand Dollar is the strongest one, followed by Yen.

For the week, Yen is the strongest, followed by Dollar, and then Kiwi. Euro is the worst performing one, still holding on to post ECB losses. Sterling is the second weakest while Swiss is the third.

In other markets, DOW futures is currently down -194 pts and will likely have another day of decline before weekly close. In Europe, FTSE is down -1.08%. DAX is down -0.86%. CAC is down -0.81%. German 10-year yield is down -0.0014 at 0.066.

Earlier in Asia, Nikkei dropped -2.01%. Hong Kong HSI dropped -1.91%. China Shanghai SSE dropped -4.40%. Singapore Strait Times dropped -1.04%. Japan 10-year JGB yield dropped -0.0234 to -0.033.

US NFP grew only 20k, but unemployment rate dropped to 3.8%, wage growth accelerated

US Non-Farm Payrolls grew only 20k in February, well below expectation of 185k. Unemployment rate dropped to 3.8%, down from 4.0% and missed expectation of 3.9%. Average hourly earnings rose 0.4% mom, beat expectation of 0.3% mom. Labor force participation rate was unchanged at 63.2%.

Also from US, housing starts rose to 1.23M annualized rate in January, above expectation of 1.18M. Building permits rose to 1.35M, beat expectation of 1.29M.

Canada employment data is strong, showing 55.9k growth in February, versus expectation of -2.5k fall. Unemployment rate was unchanged at 5.8%.

UK PM May to MPs: The only certainty would uncertainty if Brexit deal voted down

UK Prime Minister Theresa May urged MPs to support her Brexit deal in a Grimsby. She said “Back it and the U.K. will leave the EU. Reject it and no one knows what will happen”. And she threatened that “we may not leave the EU at all,” and “the only certainty would be uncertainty.”

UK Foreign Minister Jeremy Hunt said “History will judge both sides very badly if we get this wrong” And, “we want to remain the best of friends with the EU, that means getting this agreement through in a way that doesn’t inject poison into our relations for many years to come”.

Separately, it’s also reported that the trip of UK Attorney General Geoffrey Cox and Brexit Minister Stephen Barclay to Brussels has been called off. And there is no plan for May to meet EU officials over the weekend.

Without any fundamental change regarding Irish backstop, there is practically no chance for May to get her Brexit deal through the Parliament on March 12, next Tuesday. A vote on no-deal Brexit will then be held on March 13 to see if there is explicit consent on this path. If not, there will be another vote on Article 50 extension on March 14.

Irish Varadkar said Brexit is a problem of UK’s own creation, open to revert to North Ireland only backstop

Ireland Prime Minister Leo Varadkar said today that “it requires a change of approach by the UK government to understand that Brexit is a problem of their own creation.” And, “what was agreed was already a compromise” by the EU. UK government failed to secure ratification of the deal and “it should be a question of what they are now willing to offer us.”

Varadar also emphasized that “we have made a lot of compromises already and what is not evident is what the UK government is offering to the European Union and Ireland should they wish us to make any further compromises”. He added, “we were and remain happy to apply the backstop only to Northern Ireland if they want to go back to that. It doesn’t have to trap, or keep, all of Great Britain in the customs territory at all.”

European Commission spokesman Alexander Winterstein said “Technical discussions are ongoing. The EU side has offered ideas how to give further reassurances regarding the backstop, you are aware of all this, so there is no need for me to repeat it”.

ECB still in preparation for details of TLTRO-III

ECB announced yesterday to start a new quarterly targeted longer-term refinancing operations (TLTRO-III). in September. That’s three month later than some expected. Some lenders might start to face a funding gap in June already. ECB Governing Council member Ewald Nowotny said “to make this a successful program, it has to be well-prepared.” Meanwhile, Nowotny also hailed that “what the ECB did was the correct reaction” to risks in the external situation.

Another ECB Governing Council member Vitas Vasiliauskas said the central bank has time up until September to decide details of the TLTRO-III. He added that the program won’t be extended to mortgages.

China trade surplus shrank to $4.1B in Feb, US imports tumbled -35% yoy ytd

China’s February trade balance data is rather terrible. Trade surplus shrank sharply to USD 4.1B, well below expectation of USD 27.2B. That’s primarily due to steep contraction in exports by -20.7% yoy, largest decline since February 2016. The data could be distorted by the timing of the New Year. But January and February combined, exports still dropped -4.6% yoy while imports dropped -3.1% yoy.

Looking at some January and February combined details, trade with the US continued to deteriorate drastically . Total trade with US dropped -19.9% yoy, exports dropped -14.1% yoy but imports dropped -35.1% yoy. Trade with EU wasn’t too bad, still recorded 3.7% yoy growth in total trade, 2.4% yoy rise in exports and 5.7% rise in imports. One interesting point to note is that imports from Brazil jumped 33.5% yoy while imports from Canada rose 34.9% yoy.

Japan Q4 GDP finalized at 0.5%, modest recovery with external risks

Japan Q4 GDP growth was finalized at 0.5% qoq, revised up from 0.3% qoq and beat expectation of 0.4%. GDP deflator was finalized at -0.3% yoy, unrevised. In January, overall household spending rose 2.0% yoy, beat expectation of -0.6% fall. Current account surplus widened to JPY 1.8T.

Japan Economy Minister Toshimitsu said Q4’s data showed modest recovery but weak external demand warranted attention. He sounded confident that steady recovery has been confirmed. However, the government is watching overseas risks including slowdown in China.

Vice Finance Minister for International Affairs Masatsugu Asakawa also sounded cautious regarding China. He noted that it’s “inevitable for Chinese economy to slow, with its potential growth lowering as a trend:. Though, he also noted that “it is unlikely to falter greatly as there’s room for authorities’ stimulus measures.”

EUR/USD Mid-Day Outlook

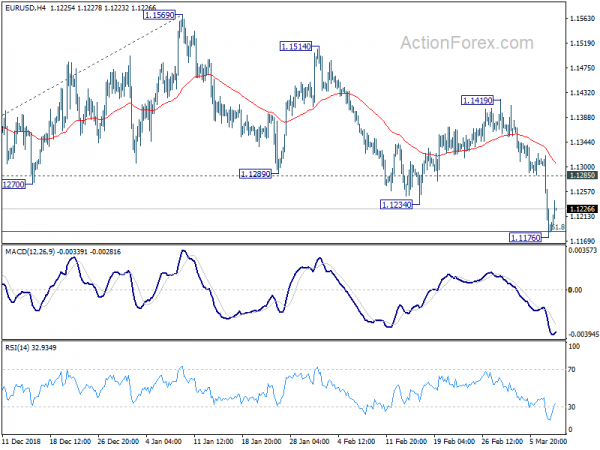

Daily Pivots: (S1) 1.1141; (P) 1.1230; (R1) 1.1284; More…..

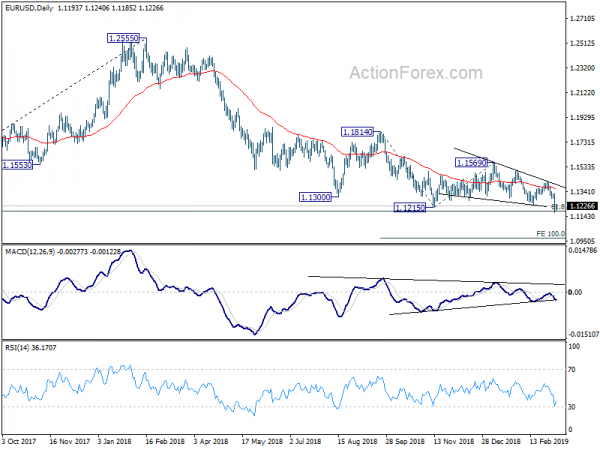

EUR/USD recovers notably after hitting 1.1176. But with 1.1285 minor resistance intact, and 4 hour MACD staying below signal line, intraday bias stays on the downside for deeper decline. Prior break of 1.1215 low indicates resumption of whole down trend from 1.2555. Further fall should be seen to 100% projection of 1.1814 to 1.1215 from 1.1569 at 1.0970 next. On the upside, above 1.1285 minor resistance will turn intraday bias neutral first. But outlook will remain bearish as long as 1.1419 resistance holds.

In the bigger picture, down trend down trend from 1.2555 medium term top is still in progress. 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 is also met. Sustained break there will pave the way to retest 1.0339. However, break of 1.1569 resistance will now indicate completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Manufacturing Sales Q/Q Q4 | -0.50% | 2.00% | 1.80% | |

| 23:30 | JPY | Overall Household Spending Y/Y Jan | 2.00% | -0.60% | 0.10% | |

| 23:50 | JPY | GDP Q/Q Q4 F | 0.50% | 0.40% | 0.30% | |

| 23:50 | JPY | GDP Deflator Y/Y Q4 F | -0.30% | -0.30% | -0.30% | |

| 23:50 | JPY | Current Account Total (JPY) Jan P | 1.8.T | 1.38T | 1.56T | 1.63T |

| 00:00 | CNY | Trade Balance (USD) Feb | 4.12B | 27.15B | 39.16B | |

| 00:00 | CNY | Trade Balance (CNY) Feb | 34.4B | 122.0B | 271.2B | |

| 07:00 | EUR | German Factory Orders M/M Jan | -2.60% | 0.50% | -1.60% | 0.90% |

| 13:15 | CAD | Housing Starts Feb | 173.1K | 203K | 208K | 206.8K |

| 13:30 | CAD | Net Change in Employment Feb | 55.9K | -2.5K | 66.8K | |

| 13:30 | CAD | Unemployment Rate Feb | 5.80% | 5.80% | 5.80% | |

| 13:30 | CAD | Capacity Utilization Rate Q4 | 81.70% | 82.10% | 82.60% | 82.80% |

| 13:30 | USD | Change in Non-farm Payrolls Feb | 20K | 185K | 304K | 311K |

| 13:30 | USD | Unemployment Rate Feb | 3.80% | 3.90% | 4.00% | |

| 13:30 | USD | Average Hourly Earnings M/M Feb | 0.40% | 0.30% | 0.10% | |

| 13:30 | USD | Building Permits Jan | 1.35M | 1.29M | 1.33M | |

| 13:30 | USD | Housing Starts Jan | 1.23M | 1.18M | 1.08M | 1.04M |