Australian Dollar was the center of focus in Asian session today. Stellar job data provided some brief boost to the Aussie. It was then hammered by talks of two RBA rate cuts this year. Selloff accelerates further on news that China’s Dalian ports banned the countries’ coal imports. In the background, US and China are working on six MOUs to cover core issues, which could be ready after the high level meetings in Washington which starts today. But the news is somewhat offset by FOMC minutes which suggested Fed could still hike once more this year.

Staying in the currency markets, Aussie is the weakest one for today so far, followed by Kiwi and then Canadian. Yen is the strongest one, followed by Dollar and then Swiss Franc. Over the week, Sterling is the strongest one for now followed by Canadian. New Zealand and Australian Dollars are the weakest.

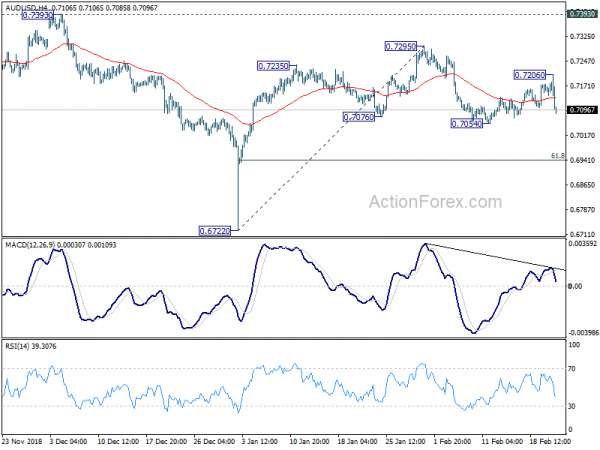

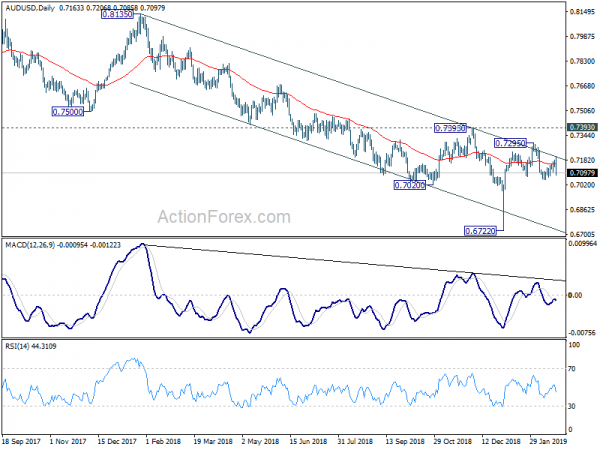

Technically, AUD/USD is now looking back at 0.7054 support. Break should extend the fall from 0.7295 towards 0.6722 low. With today’s rebound, EUR/AUD is also looking at 1.6060 resistance. Break will target 1.6765 high. Dollar’s declines against Euro, Sterling, Canadian, Swiss are losing momentum as seen in 4H charts. We’ll if the greenback could strike a recovery from here.

In Asia, Nikkei closed up 0.15%. Hong Kong HSI is up 0.21%. China Shanghai SSE is down -0.33%. Singapore Strait Times is down -0.01%. Japan 10-year JGB yield is down -0.0036 at -0.04. Overnight, DOW rose 0.24%. S&P 500 rose 0.18%. NASDAQ rose 0.03%. 10 year-yield rose 0.007 to 2.654. 10-year yield rose 0.009 to 3.000.

AUD lifted by job data, knocked down as Westpac forecasts two RBA cuts in 2019

Australian job market grew 39.1k in January, more than double of expectation of 15.2k. Full time jobs rose 65.4k to 8.M. Part-time jobs dropped -26.3k to 4.01M. Particular rate also rose 0.1% to 65.7% while unemployment rate was unchanged at 5.0%, a seven-year low. Also from Australian, CBA PMI manufacturing dropped to 53.1 in February, down from 53.9. CBA PMI services dropped into contraction region at 49.3, down from 51.0.

Australian Dollar was initially lifted by the employment data, but was then knocked down as Westpac forecasts RBA to cut interest rate in August and November. Westpac noted that “the forces around a slowing economy, falling house prices, and weak consumer spending are already apparent.” But RBA might take time to recognize this “persistence”.

The central bank’s decision to “accept the possibility that interest rates could fall further, despite the current record low levels, is profoundly important.” Westpac is now “confident” that if their growth profile does evolve, RBA will be “prepared to act”.

China Dalian harbours ban Australian coal imports

Selloff in Aussie accelerates further on news that China’s Dalian port has banned imports of the countries’ coal. The ban came effective at the start of February already and it’s indefinite. Under the control of Dalian customers, Dalian, Bayuquan, Panjin, Dandong and Beiliang harbour will not allow Australian coal to clear through customers.

That’s part of the measures to cap overall coal imports through the above harbours to 12m tonnes this year. Coal imports from Russia and Indonesia will not be affected. It’s also reported that clearing times for Australian coal at other ports are prolonged to at least 40 days.

US-China trade talks: Six MOUs on structural issues being drawn up

US-China trade negotiation is going to enter into high-level talks in Washington on Thursday. Reuters reported that the broad outline of the trade agreement is beginning to emerge after all the discussions.

The teams are now drawing up six memorandums of understanding on structural issues: forced technology transfer and cyber theft, intellectual property rights, services, currency, agriculture and non-tariff barriers to trade.

The work on the MOUs was seen by an unnamed source as a significant step in getting China agreeing on broad principles and specific commitments.

FOMC minutes keep a rate cut in 2019 alive

Minutes of the January 29/30 FOMC meeting were all in all in-line with the messages delivered by the statement and Chair Jerome Powell’s press conference. FOMC members supported the change in forward guidance. That is, Fed would now “be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate.”

Nevertheless, the minutes also noted that “some participants believed “if the economy evolved as they expected, they would view it as appropriate to raise the target range for the federal funds rate later this year.” This view keeps the case for another hike in 2019 alive.

Regarding the balance sheet rolloff plan, “almost all participants thought that it would be desirable to announce before too long a plan to stop reducing the Federal Reserve’s asset holdings later this year.” And, options on “substantially slowing” the runoff were presented during the meeting.

More on FOMC minutes:

- FOMC Minutes – Balance Sheet Reduction Likely Ends This Year

- FOMC Minutes: Two Key Takeaways That Will Shape Monetary Policy Moving Forward

- FOMC Participants Debate Ending Balance Sheet Runoff in its Pivot to Patience

Fed Daly: Balance sheet rolloff and interest rate shouldn’t work at cross purposes

San Francisco Fed President Mary Daly said the economy is slowing faster than she expected. And, tighter financial conditions, slower growth abroad, and rising uncertainty are also threatening to slow US growth. Though, she added that “there’s nothing on the radar that says we’re slipping into recession.”

Daly also said interest rates are now within a “hair’s breadth” of neutral. And she support a pause in rate hikes until there are signs of overheating. At the same time, she said Fed should align the balance sheet policy with the “patient” interest rate stance. “Those two are meant to work together and not at cross purposes,” she said.

UK May and EU Juncker held constructive talks on Irish backstop

European Commission President Jean-Claude Juncker and UK Prime Minister Theresa May held “constructive” talks in Brussels yesterday. According to a joint statement, they discussed the guarantees that could be give to underline once again that the Irish backstop’s “temporary nature”. And the “role alternative arrangement” could play in “replacing the backstop” in future. Also, additions or changes to the Political Declaration could be made to “increase confidence in the focus and ambition of both sides in delivering the future partnership envisaged as soon as possible.” EU Chief Negotiator Michel Barnier and UK Secretary of State Stephen Barclay will follow up and progress will be reviewed in the coming days.

May said after meeting with Juncker that “I have underlined the need for us to see legally binding changes to the backstop that ensure that it cannot be indefinite. That’s what is required if a deal is to pass the House of Commons. We have agreed that work to find a solution will continue at pace. Time is of the essence and it is in both our interests that when the UK leaves the EU it does so in an orderly way. So, we have made progress.”

Japan PMI manufacturing dropped to 48.5, chance of recession in 2019 rises

Japan PMI manufacturing PMI dropped to 48.5 in February, down from 50.3. That’s the lowest level in 32 months and the first contraction reading since 2016. Markit noted that “deterioration in manufacturing sector reflects stronger falls in production and new orders.” Also, “future output expectations turn negative for the first time since November 2012.”

Joe Hayes, Economist at IHS Markit, said the data reflected “sharper reductions in demand and production” and “underlying business conditions are unfavourable.”.And, “this was further highlighted by output expectations turning negative for the first time in over six years, which comes as no surprise given the international headwinds Japanese manufacturers are facing such as a China slowdown and the global trade cycle losing further steam.

He added that “unless service sector activity can offset manufacturing weakness, the chance of Japan entering a recession in 2019 looks set to rise.”

Also from Japan, all industry activity index dropped -0.4% mom in December, below expecttion of -0.2% mom.

Looking ahead

ECB monetary policy meeting accounts will be a major focus today. Eurozone PMIs will also be watched for signs on further slowodwn. UK will relase public sector net borrowing.

Later in the day, US will release Philly Fed survey. jobless claims, durable goods orders, PMIs, leading indicator and existing home sales.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7142; (P) 0.7162; (R1) 0.7184; More…

AUD/USD’s sharp decline today suggests that recovery from 0.7054 has completed at 0.7206 already. Intraday bias is cautiously back on the downside for 0.7054 support first. Decisive break there will complete a head and shoulder term pattern (ls: 0.7235, h: 0.7295, rs: 0.7206). That should confirm completion of rebound from 0.6722. Further decline should be seen to 61.8% retracement of 0.6722 to 0.7295 at 0.6941 next. On the upside, though, break of 0.7206 will turn focus back to 0.7295 resistance instead.

In the bigger picture, as long as 0.7393 resistance holds, we’d treat fall from 0.8135 as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | CBA PMI Manufacturing Feb P | 53.1 | 53.9 | ||

| 22:00 | AUD | CBA PMI Services Feb P | 49.3 | 51 | ||

| 0:30 | JPY | PMI Manufacturing Feb P | 48.5 | 50.3 | ||

| 0:30 | AUD | Employment Change Jan | 39.1K | 15.2K | 21.6K | |

| 0:30 | AUD | Unemployment Rate Jan | 5.00% | 5.00% | 5.00% | |

| 4:30 | JPY | All Industry Activity Index M/M Dec | -0.40% | -0.20% | -0.30% | |

| 7:00 | EUR | German CPI M/M Jan F | -0.80% | -0.80% | -0.80% | |

| 7:00 | EUR | German CPI Y/Y Jan F | 1.40% | 1.40% | 1.40% | |

| 8:15 | EUR | France Manufacturing PMI Feb P | 51 | 51.2 | ||

| 8:15 | EUR | France Services PMI Feb P | 48.5 | 47.8 | ||

| 8:30 | EUR | Germany Manufacturing PMI Feb P | 49.9 | 49.7 | ||

| 8:30 | EUR | Germany Services PMI Feb P | 52.9 | 53 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Feb P | 50.3 | 50.5 | ||

| 9:00 | EUR | Eurozone Services PMI Feb P | 51.3 | 51.2 | ||

| 9:30 | GBP | Public Sector Net Borrowing Jan | -11.1B | 2.1B | ||

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | CAD | Wholesale Trade Sales M/M Dec | -0.30% | -1.00% | ||

| 13:30 | USD | Philadelphia Fed Business Outlook Feb | 14.8 | 17 | ||

| 13:30 | USD | Initial Jobless Claims (FEB 16) | 230k | 239k | ||

| 13:30 | USD | Durable Goods Orders Dec P | 1.80% | 0.70% | ||

| 13:30 | USD | Durables Ex Transportation Dec P | 0.30% | -0.40% | ||

| 14:45 | USD | US Manufacturing PMI Feb P | 55 | 54.9 | ||

| 14:45 | USD | US Services PMI Feb P | 54.3 | 54.2 | ||

| 15:00 | USD | Leading Index Jan | 0.20% | -0.10% | ||

| 15:00 | USD | Existing Home Sales Jan | 5.01M | 4.99M | ||

| 15:30 | USD | Natural Gas Storage | -78B | |||

| 16:00 | USD | Crude Oil Inventories | 3.6M |