Sterling is trading generally soft today, except versus Yen, as market focus turns to UK data. GDP, productions and trade balance will be featured. BoE just downgraded both growth and inflation forecasts last week, based on assumption on smooth Brexit. The Pound would be vulnerable to another round of selloff should data disappoint today.

Meanwhile, Yen is trading broadly lower so far as Chinese markets come back from holiday with a rise. Canadian Dollar is also weak with WTI crude oil struggling below 52.5. On the other hand, Australian and New Zealand Dollar are broadly higher, digesting some of last week’s losses.

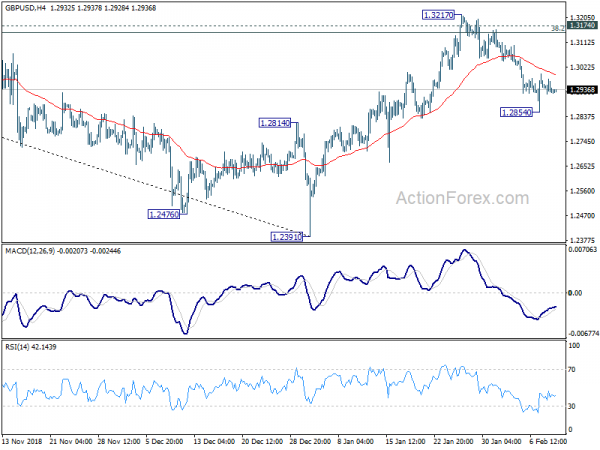

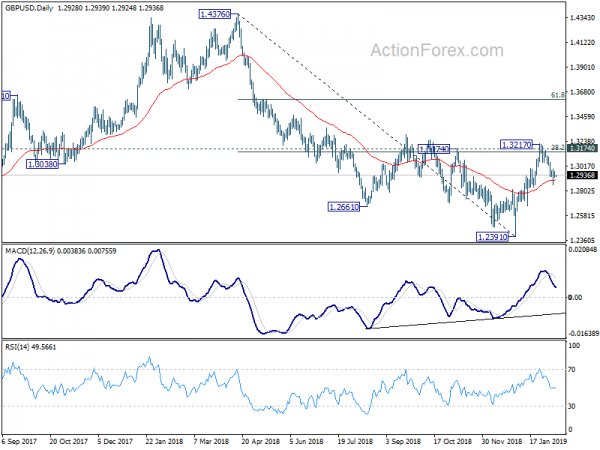

Technically, 1.2854 temporary low in GBP/USD will be a focus today, 0.8821 temporary top in EUR/GBP too. Break of these levels will resume the decline in Pound which started in late January. 140.56 in GBP/JPY will also be watched too and break will indicate near term bearish reversal.

In Asia, Hong Kong HSI is up 0.29%. China Shanghai SSE is up 0.98%. Singapore Strait Times is down -0.44%. Japan is on holiday.

White House Mulvaney: Absolutely cannot rule out another government shutdown after border talks collapsed

In the US, the talks between Republican and Democratic lawmakers appeared to have collapsed over the week end. Nine federal departments and related agencies could be facing another shutdown if there is no breakthrough this week. The special congressional negotiating panel over border security is still aiming to reach a deal on Monday.

The government just had a historic partial shutdown earlier this year after Trump failed to get support from the Democrats on funding for the border wall. Now, it’s believed that in return for some funding for physical barriers at the border, Democrats requested to lower the cap of detention beds for undocumented migrants. Democrats believed that would force ICE agents to focus on arresting and deporting serious criminals.

White House Acting Chief of Staff Mick Mulvaney warned that he “absolutely cannot” rule out another shutdown. And he added Trump “cannot sign everything they put in front of him. There’ll be some things that simply we couldn’t agree to.”

UK and Swiss signed agreement to protect GBP 32B trade relationship after Brexit

UK and Switzerland signed an agreement on Sunday that will protect GBP 32B trade relationship between the two countries. With the agreement, both countries will continue to trade on preferential terms after Brexit. That is, the two countries could continue to trade freely without new tariffs. But financial services are not included in the deal.

UK Trade Minister Liam Fox hailed that “Switzerland is one of the most valuable trading partners that we are seeking continuity for.” And, “this is of huge economic importance to UK businesses so I’m delighted to be here in Bern ensuring continuity for 15,000 British exporters. ”

Fox added that “not only will this help to support jobs throughout the UK but it will also be a solid foundation for us to build an even stronger trading relationship with Switzerland as we leave the EU.”

RBNZ to stand pat this week, might deliver more dovish tone

RBNZ is widely expected to keep OCR unchanged at 1.75% this week. The central bank would likely reiterate the stance that “the next move in the OCR could be up or down”. And, the tone of the overall announcement could be tiled to the dovish side as both global and domestic environment deteriorated since November meeting. RBNZ might also downgrade growth forecasts. While the majority of market participants judge that the policy rate has bottomed at the current 1.75%, some believe that further rate cut is possible. We expect there would be no rate change at least until second half of 2020. More in RBNZ Preview – Turning More Dovish while Affirming Next Move Can be Up or Down.

Global slowdown, Brexit and trade war the three main themes

Global slowdown, Brexit and US-China trade talks will be the three main themes this week. GDP data from UK, Japan, Germany and Eurozone reveal how poorly respective economy performed in at the end of Q4. Japan and German GDP already contracted in Q3. Any downside surprises there with contraction numbers would confirm technical recession. In particular, markets are expecting German data to show 0.1% qoq. It’s really quite marginal. In terms of data, it will also be a big week for the UK with productions, trade balance, CPI and retail sales featured. Attention will also be on US CPI, PPI and retail sales, and China trade balance.

UK Prime Minister Theresa May came back from Brussels last week empty and there is little chance for to bring back a deal for vote by February 13. May is expected to give a statement that date, and as she promised, Brexit debate will resume in the Commons on February 14. The main focus would be on any motions that could shift the control of Brexit from the government to the parliament. And if so, that would open up the route for lawmakers to renegotiate, delay, or even block Brexit.

US-China trade negotiations will resume this week. Lower-level officials will kick off meetings in Beijing on Monday, on the US side led by Deputy Trade Representative Jeffrey Gerrish. Later on Thursday and Friday, high level talks will be carried out involving USTR Robert Lighthizer, Treasury Secretary Steven Mnuchin, and Chines Vice Premier Liu He. The main focuses will remain on intellectual property theft, forced technology transfer, State owned enterprises, and enforcement of agreement. Without, breakthrough in these area, it’s quite justifiable for Trump to refuse to meet Chinese President Xi Jinping again this month.

Here are some highlights for the week:

- Monday: Swiss CPI; UK GDP, trade balance, industrial and manufacturing productions.

- Tuesday: Australia home loans, NAB business confidence; Japan tertiary industry index, machine tool orders.

- Wednesday: RBNZ rate decision; Japan PPI; UK CPI, PPI; Eurozone industrial production; US CPI.

- Thursday: Japan GDP; China trade balance; Germany GDP; Swiss PPI; Eurozone GDP, employment; Canada manufacturing sales, new housing price index; US retail sales, PPI, jobless claims, business inventories;

- Friday: New Zealand BusinessNZ manufacturing index; China CPI, PPI; UK retail sales; Eurozone trade balance; Canada foreign securities purchases; US Empire State manufacturing index, import price, industrial production, U of Michigan sentiments.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2917; (P) 1.2947; (R1) 1.2972; More….

Intraday bias in GBP/USD remains neutral for consolidation above 1.2854 temporary low. Further recovery cannot be ruled out but risk will stay on the downside as long as 1.3217 resistance holds. As noted before, current development suggests that rebound from 1.2391 has completed at 1.3217 already, after rejection by 1.3174 key resistance. On the downside, break of 1.2854 will turn bias to the downside for retesting 1.2391 low.

In the bigger picture, the rejection by 1.3174 key resistance revived the original view on GBP/USD. That is, decline from 1.4376 is possibly resuming long term down trend from 2.1161 (2007 high). Firm break of 1.2391 will solidify this bearish case and target 1.1946 (2016 low). However, decisive break of 1.3174 will invalidate this bearish case again and turn outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:30 | CHF | CPI M/M Jan | -0.30% | -0.30% | ||

| 07:30 | CHF | CPI Y/Y Jan | 0.60% | 0.70% | ||

| 09:30 | GBP | GDP M/M Dec | 0.00% | 0.20% | ||

| 09:30 | GBP | GDP Q/Q Q4 P | 0.30% | 0.60% | ||

| 09:30 | GBP | GDP Y/Y Q4 P | 1.40% | 1.50% | ||

| 09:30 | GBP | Total Business Investment Q/Q Q4 P | -1.00% | -1.10% | ||

| 09:30 | GBP | Index of Services 3M/3M Dec | 0.40% | 0.30% | ||

| 09:30 | GBP | Visible Trade Balance (GBP) Dec | -12.0B | -12.0B | ||

| 09:30 | GBP | Industrial Production M/M Dec | 0.10% | -0.40% | ||

| 09:30 | GBP | Industrial Production Y/Y Dec | -0.50% | -1.50% | ||

| 09:30 | GBP | Manufacturing Production M/M Dec | 0.20% | -0.30% | ||

| 09:30 | GBP | Manufacturing Production Y/Y Dec | -1.10% | -1.10% | ||

| 09:30 | GBP | Construction Output M/M Dec | 0.10% | 0.60% |