Australian Dollar is again the focus in Asian session today. It drops sharply on surprised turn in RBA Governor Philip Lowe’s stance. To him, the next interest rate move is no longer more likely a hike, but evenly balanced. Aussie reversed all of yesterday’s gains and it’s now trading as the weakest one for today and the week. New Zealand and Canadian follow as second and third weakest. On the other hand, Yen is the strongest one for now, followed by Sterling and then Swiss Franc.

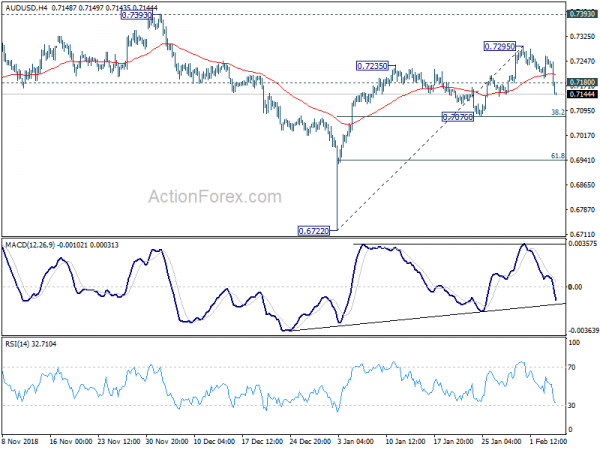

Technically, AUD/USD’s break of 0.7180 minor support is taken as the first sign that recent rebound from 0.6722 flash crash has completed. Focus will turn to 0.7076 support for confirmation. EUR/AUD also jumps today and focus will be on 1.6038 resistance to align the outlook with AUD/USD. EUR/USD’s breach of 1.1407 minor support suggests that rebound from 1.1289 has completed. Now, outlook in EUR/USD, GBP/USD, USD/CHF and AUD/USD suggests more upside in the greenback. 1.3165 minor resistance in USD/CAD will be watched to confirm the come back of Dollar.

In other markets, Nikkei is closed up 0.15% at 20875.63. Japan 10-year JGB yield is down -0.0062 at -0.015, staying negative. China, Hong Kong and Singapore are still on lunar new year holiday. Overnight, DOW rose 0.68%. S&P 500 rose 0.47%. NASDAQ rose 0.74%. 100year yield dropped -0.022 to 2.702, defended 2.7 handle.

RBA Lowe: Evenly balanced chance of hike or cut in next move

Australian Dollar drops sharply after RBA Governor Philip Lowe dropped the rhetoric that the next move in interest rate is more likely a hike than a cut. Instead, he said the probabilities of hike and cut are now more “evenly balanced”. That is, rate cut is now back on the table.

Lowe delivered a speech “The Year Ahead” to the National Press Club of Australia today. Lowe maintained the view that ” tighter labour market and reduced spare capacity will see underlying inflation rise further towards the midpoint of the target range.” And given that, RBA “maintained a steady setting of monetary policy” yesterday.

However, he also noted given the uncertainties “it is possible that the economy is softer than we expect, and that income and consumption growth disappoint.” In particular, “in the event of a sustained increased in the unemployment rate and a lack of further progress towards the inflation objective, lower interest rates might be appropriate at some point.

Thus, on the scenarios of next-move-is-up and next-move-is-down, “the probabilities appear to be more evenly balanced.” Though Lowe also maintained that RBA “does not see a strong case for a near-term change in the cash rate”.

USTR Lighthizer to travel to China next week for trade talks

It’s reported that US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin will travel to Beijing for the another round of trade talks next week, following the Lunar New Year break. The scope of discussions extended beyond trade balance to intellectual property theft, forced technology transfer and China’s state own enterprises. And Lighthizer has repeatedly emphasized the word “enforcement”, regarding the implementation of the agreement.

Trump is expected to meet with Chinese President Xi Jinping to seal the deal before March 1 dead line. But for now, there is no set dates for the meeting yet. In his state of Union Address, Trump said China has target US industries for their intellectual property for years. And, he emphasized the new trade deal must end trade practices, reduce our chronic trade deficit, and protect American jobs.

Also, Trump announced to meet North Korean leader Kim Jong Un again in Vietnam on February 27 and 28.

On the data front

Germany will release factory orders in European session. Later in the day, Canada will release building permits and Ivey PMI. US will release non-farm productivity and unit labor costs.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7198; (P) 0.7232; (R1) 0.7269; More…

AUD/USD’s sharp fall and break of 0.7180 minor support today suggests that rebound from 0.6722 has completed at 0.7295 already. Intraday bias is turned to the downside for 0.7076 cluster support (38.2% retracement of 0.6722 to 0.7295 at 0.7076). Decisive break there should confirm this bearish case and target 61.8% retracement at 0.6941 next. On the upside, break of 0.7295 will extend the rebound. but we’d expect strong resistance from 0.7393 key resistance to limit upside to complete the rebound.

In the bigger picture, as long as 0.7393 resistance holds, we’d treat fall from 0.8135 as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | EUR | German Factory Orders M/M Dec | 0.30% | -1.00% | ||

| 13:30 | CAD | Building Permits M/M Dec | -0.40% | 2.60% | ||

| 13:30 | USD | Unit Labor Costs Q4 P | 1.70% | 0.90% | ||

| 13:30 | USD | Nonfarm Productivity Q4 P | 1.70% | 2.30% | ||

| 15:00 | CAD | Ivey PMI Jan | 60.2 | 59.7 | ||

| 15:30 | USD | Crude Oil Inventories | 0.9M |