Dollar is trading broadly higher today, trying to recovery some of last week’s losses. New Zealand Dollar follows closely, which Canadian Dollar is also a close third. Yen and Australian Dollar are taking turns to be the weakest ones. Mildly risk appetite is pressuring both Yen and Swiss Franc. But Asian markets have been generally quite as Lunar New Year approaches. Australian Dollar is weighed down by poor housing data. There is more downside potential for Aussie as RBA rate decision and statement looms.

Technically, despite today’s recovery, the greenback is held below near term resistance against Euro, Australian, Canadian and even Sterling. There is no clear sign of bottoming yet. The clearer development is probably found in the Japanese yen. EUR/JPY is extending recent rebound from 118.62. USD/JPY is likely set to take on 110.00 resistance too. We’d probably see more broad based rally in Yen crosses is risk appetite persists for the day.

In other markets, Nikkei closed up 0.46%. Hong Kong HSI is up 0.21%. Singapore Strait Times is down -0.13%. Japan 10-year JGB yield is up 0.0096 at -0.0011, staying negative.

Fed Kashkari: Let’s not tap the brakes prematurely

Minneapolis Fed President Neel Kashkari said the US economy is “fundamentally healthy”. While “we at the Fed cannot control if Europe has a crisis, or if China has a hard landing”, “we can control our own mistakes”. He added that ” if we can avoid tapping the brakes prematurely, I think the expansion can continue.”

Kashkari also noted that”let’s let the economy continue to strengthen and if we see signs then, wages pick up, inflation picks up, we can always tap the brakes then; let’s just not tap the brakes prematurely.”

UK PM May, armed with fresh mandate, to go back to EU with pragmatic Brexit solution

UK Prime Minister Theresa May said she is seeking a “pragmatic solution” for the Brexit withdrawal agreement. She wrote in The Sunday Telegraph that “with changes to the Northern Ireland backstop, they would support the deal that I agreed with Brussels to take us out of the EU”. And, “when I return to Brussels I will be battling for Britain and Northern Ireland, I will be armed with a fresh mandate, new ideas and a renewed determination to agree a pragmatic solution that delivers the Brexit the British people voted for.”

May’s office also said that the government is establishing an “Alternative Arrangements Working Group” to work on alternative arrangement to the Irish border backstop arrangement. Brexit Minister Stephen Barclay will lead the group involving pro-Brexit lawmakers Steve Baker, Marcus Fysh and Owen Paterson, as well as pro-EU Conservatives Damian Green and Nicky Morgan. The first meeting will start today.

Trade Minister Liam Fox said EU would be irresponsible if they insist on refusing to reopen negotiation. He told Sky News that “are they really saying that they would rather not negotiate and end up in a ‘no-deal’ position?” And, “it is in all our interests to get to that agreement and for the EU to say we are not going to even discuss it seems to me to be quite irresponsible.”

China Caixin PMI dropped to 50.9, hard to turn around without strong stimulus

China Caixin PMI services dropped to 53.6 in January, down from 53.9 but beat expectation of 53.3. PMI composite dropped to 50.9, down from 52.2. Caixin noted that “services activity continues to rise solidly, but manufacturing sector remains subdued”, “new orders rise only slightly, despite rebound in export sales”, “overall employment stabilises”.

Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said in the release that “Overall, China’s economic growth was weighed on by weakening domestic demand in January, although exports improved marginally as the Sino-U.S. trade negotiations flagged signs of progress. The effects of China’s policies to support domestic demand and the development of the trade war between the country and the U.S. will remain key to the prospects of the Chinese economy. Given that the government has refrained from taking policies of strong stimulus, the downward trend of the economy may be hard to turn around for the time being.”

Released earlier today, Australia building approvals dropped -8.4% mom in December versus expectation of 2.1% mom. TD securities inflation dropped -0.1% mom in January. New Zealand building permits rose 5.1% mom in December. Japan monetary base rose 4.7% yoy in January.

The week ahead: RBA and BoE to stand pat, publish new forecasts

Two central banks will meet this week. Both RBA and BoE are expected to stand pat. And focuses will be on new economic projections from both. Despite recent soft batch of data, RBA will likely maintain that growth will be above trend in the coming two years. And thus, that would justify the central bank’s tightening bias. That is, the next move in interest rate is up even though RBA is in no rush to deliver it. However, there is some dovish possibility that RBA could take a even more cautious stance on downward revisions to both growth and inflation forecasts.

While the focus of the BoE meeting remains on Brexit uncertainty, economic assessment and forward guidance, the dynamics of the political and economic situation signals that the members would turn more dovish. BOE can still retain its forward guidance, suggesting that, under the scenario of a smooth Brexit, an “ongoing tightening of monetary policy over the forecast period, at a gradual pace and to a limited extent, would be appropriate”. It should also reaffirm that “the monetary policy response to Brexit, whatever form it takes, will not be automatic and could be in either direction”. More in BOE Preview – Downgrade on Economic Outlook as Brexit Remains Uncertain.

On the data front, UK PMIs, US ISM services; Canada job data, New Zealand employment, etc, could trigger volatility in respective currencies.

Here are some highlights of the week:

- Monday: Eurozone Sentix investor confidence, PPI; UK construction PMI; US factory orders

- Tuesday: RBA rate decision, retail sales; Eurozone PMI services final, retail sales; UK PMI services, BRC sales monitor; US ISM non-manufacturing

- Wednesday: Germany factory orders; Canada building permits, Ivey PMI; US non-farm productivity, trade balance

- Thursday: New Zealand employment, labor cost; Australian NAB business confidence; Japan leading indicators; Germany industrial production; Swiss foreign currency reserves; ECB monthly bulletin; BoE rate decision and inflation report; US jobless claims

- Friday: Japan household spending, currency account, average cash earnings; RBA Statement on Monetary Policy; Swiss unemployment rate; Germany trade balance; Canada housing starts, employment

USD/CAD Daily Outlook

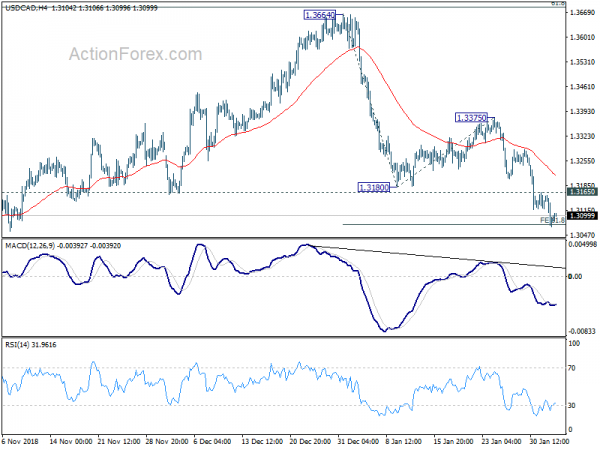

Daily Pivots: (S1) 1.3059; (P) 1.3110; (R1) 1.3150; More…

USD/CAD recovers mildly today but stays below 1.3165 resistance. Further decline could be seen. But we’d start to be cautious on bottoming as it approaches channel support (now at 1.3056). On the upside break of 1.3165 will turn bias to the upside for rebounding towards 1.3375 resistance. However, sustained break of the channel support will pave the way to 100% projection of 1.3664 to 1.3180 from 1.3375 at 1.2891.

In the bigger picture, structure of the medium term rise from 1.2061 (2017 low) to 1.3664 is not clearly impulsive. Hence, we’d stay cautious on strong resistance from 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 and 1.3793 resistance to limit upside, and bring medium term topping. But in any case, medium term outlook will stay bullish as long as channel support (now at 1.3049) holds. Sustained break of 1.3793 will pave the way to retest 1.4689 (2015 high). Firm break of the channel support should confirm reversal target 1.2061 low again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:45 | CNY | Caixin China PMI Services Jan | 53.6 | 53.3 | 53.9 | |

| 21:45 | NZD | Building Permits M/M Dec | 5.10% | -2.00% | -1.90% | |

| 23:50 | JPY | Monetary Base Y/Y Jan | 4.70% | 4.60% | 4.80% | |

| 0:00 | AUD | TD Securities Inflation M/M Jan | -0.10% | 0.40% | ||

| 0:30 | AUD | Building Approvals M/M Dec | -8.40% | 2.10% | -9.10% | -9.80% |

| 9:30 | EUR | Eurozone Sentix Investor Confidence Feb | -1.1 | -1.5 | ||

| 9:30 | GBP | Construction PMI Jan | 52.6 | 52.8 | ||

| 10:00 | EUR | Eurozone PPI M/M Dec | -0.60% | -0.30% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Dec | 3.30% | 4.00% | ||

| 15:00 | USD | Factory Orders Dec | 0.30% | -2.10% |