It seems that the impacts of poor economic data and Fed’s dovish turn on the markets are “roughly balanced” for now. Stocks in the US and Asia turned mixed and stayed mixed since yesterday. Poor Chinese manufacturing data gives the markets nothing to cheer for, yet there is no notable selloff in equities. Dollar continues to recover post FOMC selloff and it’s for now the strongest one for today, followed by Yen. On the other hand, commodity currencies are the weakest, led by Aussie.

The two-day US-China trade talks ended without anything concrete, expect China’s pledge to buy 5M tons of soybeans per day. The demand on enforcement of the agreement was emphasized throughout. And China seemed to have listened. But even Trump admitted it’s not yet at the stage to set up a meeting with Chinese Xi to seal the deal yet. The next milestone will be USTR Lighthizer’s visit to Beijing after Chinese New Year. For now, Dollar and stocks will turn to today’s non-farm payroll first.

In other markets, the most notable development is the free fall in US treasury yields overnight. 10-year yield dropped -0.60 to 2.635, moved further away from 2.7 handle. 30-year yield dropped -0.048 to 3.005, threatening 3.0 handle. Major US stock indices were mixed. DOW dropped -0.06%. S&P 500 rose 0.86%. NASDAQ rose 1.37% Asian markets are also mixed. Nikkei closed up 0.07% at 20788.39. Hong Kong HSI is down -0.21%. China Shanghai SSE is up 1.30%. Singapore Strait Times is down -0.02%. Japan 10-year JGB yield is down -0.0188 to -0.016.

Trump: Not quite at the stage to meet Xi to seal trade deal yet

Trump met with Chinese Vice Premier Liu He in the oval office yesterday as the two-day top level US-China trade talks concluded. Trump said in during the meeting that “we’re not quite at that stage yet”, referring to the meeting with Chinese President Xi JinPing. He noted the representatives of both sides were “coming to a conclusion, except for certain very important points.” When he and Xi meets, “we want to have it down so that we have certain points that we can discuss and, I would say, agree to.” For now the meeting wasn’t set up yet.

Nevertheless, Trump hailed that Liu’s promise to buy five millions tons of soybeans per days. He said ” it really is a sign of good faith for China to buy that much of our soybeans and other product that they’ve just committed to us prior to the signing of the deal — is something that makes us very proud to be dealing with them.”

On the March 1 negotiation dead line, Trump said it has stayed and “we haven’t talked about extending the deadline.” But he added that “at a certain point, you’re going to have — this is a very complex, and a very large — it’s the largest transaction ever made, to be perfectly straight.” Regarding Huawei’s case Trump said “it will be discussed” at some point. And it’s “very small compared to the overall deal, but that will be discussed.”

US Trade Representative Robert Lighthizer reiterated in the meeting that ” We focused on the most important issues, which are the structural issues and the protection of U.S. intellectual property, stopping forced technology transfer, intellectual property protection, agriculture and services issues, and enforcement, enforcement, enforcement.” And, “both sides agree this agreement is worth nothing — if we can get an agreement, it’s worth nothing without enforcement.” Lighthizer will go to China shortly, after Chinese Year Year.

During the meeting, Liu also noted the need to establish three key themes, including “enforcement or implementation.”

China Caixin PMI manufacturing dropped to 48.3, no significant effect from countercyclical economic policy

China Caixin PMI manufacturing dropped to 48.3 in January, down from 49.7 and missed expectation of 49.7. That’s the lowest reading since February 2016 and points to continued softening in the health of China’s manufacturing sector. Markit also noted that underlying trend in production weakens. Export sales increase slightly, but overall new work softens. Though, a positive note is that business confidence rose to eight-month high.

Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said “On the whole, countercyclical economic policy hasn’t had a significant effect. While domestic manufacturing demand shrank, external demand turned positive and became a bright spot amid positive progress in Sino-U.S. trade talks. As companies were more willing to reduce their inventories, their output declined, indicating notable downward pressure on China’s economy. China is likely to launch more fiscal and monetary measures and speed up their implementation. Yet the stance of stabilizing leverage and strict regulation hasn’t changed, which means the weakening trend of China’s economy will continue.”

Japan PMI manufacturing finalized at 29-month low, bad news for global trade cycle

Japan PMI manufacturing was finalized at 50.3 in January, revised up from 50.0. But that’s still the lowest level in 29 months. And, new export orders decline at sharpest pace since July 2016. Also, business confidence falls for the eighth month running.

Joe Hayes, Economist at IHS Markit said “the data “brought bad news for the global trade cycle at the start of 2019, with new export orders falling at the sharpest rate in two-and-a-half years” And, “domestic markets also showed signs of frailty as total demand declined for the first time since September 2016.”

Besides, “with Abe set to levy the consumption tax this year, and Sino-US trade tensions still lurking, domestic weakness in Japan further adds to already existing challenges.

Also from Japan, jobless rate dropped to 2.4% in December, below expectation of 2.5%.

Looking ahead

PMI data will be the focuses in European session. In particular, UK and Swiss will release PMI manufacturing. Eurozone will also release PMI manufacturing final too. In addition, Eurozone will release CPI flash. Later in the day, US non-farm payroll will be the major focus. US will also release ISM manufacturing and construction spending.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9918; (P) 0.9935; (R1) 0.9963; More….

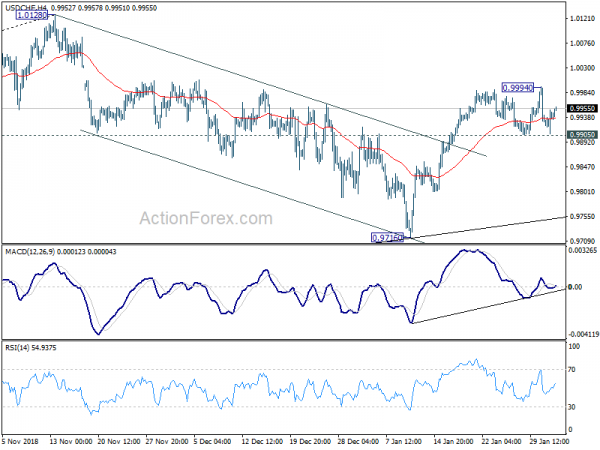

USD/CHF is staying in consolidation from 0.9994 and intraday bias remains neutral first. As long as 0.9905 support holds, further rally is expected in the pair. We’re holding on to the view that corrective pull back from 1.0128 has completed at 0.9716 already. On the upside, break of 0.9994 will resume the rise from 0.9716 to retest 1.0128 high. However, break of 0.9905 will dampen this view and turn bias to the downside.

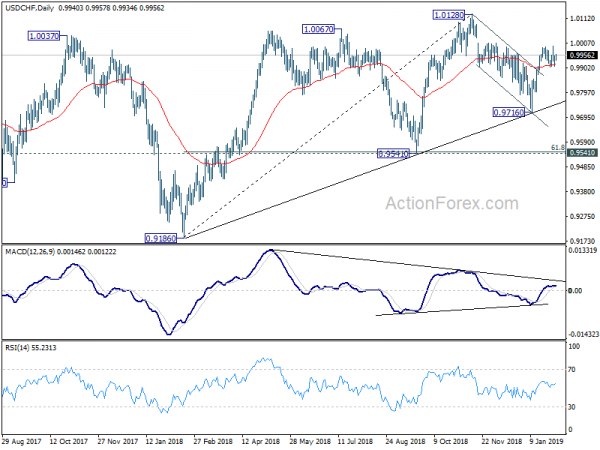

In the bigger picture, USD/CHF drew strong support from medium term trend line and rebounded. That suggests rise from 0.9186 is still in progress. Break of 0.9963 will affirm this bullish case. Further break of 1.0128 will confirm up trend resumption and target 1.0342 key resistance. Nevertheless, break of 0.9716 will dampen this bullish view and at least bring deeper fall to 0.9541 key support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Manufacturing Index Jan | 52.5 | 49.5 | 50 | |

| 23:30 | JPY | Jobless Rate Dec | 2.40% | 2.50% | 2.50% | |

| 0:30 | AUD | PPI Q/Q Q4 | 0.50% | 0.60% | 0.80% | |

| 0:30 | AUD | PPI Y/Y Q4 | 2.00% | 2.10% | ||

| 0:30 | JPY | PMI Manufacturing Jan F | 50.3 | 50 | 50 | |

| 1:45 | CNY | Caixin PMI Manufacturing Jan | 48.3 | 49.7 | 49.7 | |

| 6:45 | CHF | SECO Consumer Confidence Jan | -4 | -5 | -6 | |

| 7:30 | CHF | Retail Sales Real Y/Y Dec | 0.40% | -0.50% | ||

| 8:30 | CHF | PMI Manufacturing Jan | 56.6 | 57.8 | ||

| 8:45 | EUR | Italy Manufacturing PMI Jan | 49 | 49.2 | ||

| 8:50 | EUR | France Manufacturing PMI Jan F | 51.2 | 51.2 | ||

| 8:55 | EUR | Germany Manufacturing PMI Jan F | 49.9 | 49.9 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Jan F | 50.5 | 50.5 | ||

| 9:30 | GBP | PMI Manufacturing Jan | 53.5 | 54.2 | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Jan A | 1.00% | 1.00% | ||

| 10:00 | EUR | Eurozone CPI Estimate Y/Y Jan | 1.40% | 1.60% | ||

| 13:30 | USD | Change in Non-farm Payrolls Jan | 165K | 312K | ||

| 13:30 | USD | Unemployment Rate Jan | 3.80% | 3.90% | ||

| 13:30 | USD | Average Hourly Earnings M/M Jan | 0.30% | 0.40% | ||

| 14:30 | CAD | Manufacturing PMI Jan | 53.6 | |||

| 14:45 | USD | Manufacturing PMI Jan F | 54.9 | 54.9 | ||

| 15:00 | USD | ISM Manufacturing Jan | 54.3 | 54.1 | ||

| 15:00 | USD | ISM Prices Paid Jan | 58 | 54.9 | ||

| 15:00 | USD | ISM Employment Jan | 56.2 | |||

| 15:00 | USD | Construction Spending M/M Dec | ||||

| 15:00 | USD | U. of Mich. Sentiment Jan F | 90.7 | 90.7 |