Risk appetite fades today as sentiments are weighed down by a string of weak economic data from Eurozone and US. In short, German retail sales dropped the most in 11 years. Eurozone GDP growth was stuck at 4-year low in Q4. Italy was in technical recession in H2 2018. US initial jobless claims jumped to highest since Sep 2017. Canada GDP contracted in November. Fed’s dovish turn yesterday boosted stocks yesterday. But it’s worth a thought on whether such turn is a positive or negative sign.

In the currency markets, Yen is the strongest for today for the moment, followed by Australian Dollar. Sterling is the worst performing one, followed by Canadian. Dollar is trying to recover as FOMC triggered selloff lost momentum. Trump’s comments on US-China trade talks are positive. But Dollar will probably need to get a rather impressive non-farm payroll report for staging a sustainable rebound.

In other markets, DOW futures is currently down near 100 pts. FTSE is trading up 0.50%. DAX is down -0.52%. CAC is up 0.04%. German 10-year yield is down -0.021 to 0.169. Earlier in Asia, Nikkei rose 1.06%. Hong Kong HSI rose 1.08%. China Shanghai SSE rose 0.35%. Singapore Strait Times rose 0.50%. Japan 10-year JGB yield dropped -0.0014 to 0.002.

US initial jobless claims jumped to 253k, highest since Sep 2017

US initial jobless claims jumped 53k to 253k in the week ending January 26, well above expectation of 210k. That’s also the highest level since September 30, 2017. Four-week moving average of initial claims rose 5k to 220.25k.

Continuing claims rose 69k to 1.782M in the week ending January 19. It’s also the highest level since April 28, 2018. Four-week moving average of continuing claims rose 8k to 1.738M, highest since August 4, 2018.

Also from US, employment cost index rose 0.7% in Q4, below expectation of 0.8%.

Trump: Working with China on a complete deal, leave nothing unresolved

Trump sounds optimistic again in a serious of tweets regarding trade talk with China. He said the meetings in Washington are “going well with good intent on both sides”. Trump is expected to meet with China’s representatives, including Vice Premier Liu He, in the Oval Office today”.

But he also emphasized that “no final deal will be made until my friend President Xi, and I, meet in the near future to discuss and agree on some of the long standing and more difficult points.” He noted that both sides are trying to do a “complete deal, leaving NOTHING unresolved on the table”.

Separately, WSJ reported that China’s trade negotiators are proposing Trump-Xi meeting in China next month.

Canada GDP contracted -0.1% mom, matched expectations

Canada GDP contracted -0.1% mom in November, matched expectations. Looking at the details, decreases in wholesale trade, finance and insurance, manufacturing and construction more than offset gains in 13 of 20 industrial sectors. Goods-producing industries were down 0.3%, the third decline in four months, while services-producing industries were essentially unchanged.

Also from Canada, RMPI rose 3.8% mom in December versus expectation of 3.9% mom. IPPI dropped -0.7% mom versus expectation of 0.1% mom.

Eurozone GDP grew 0.2% qoq in Q4, Italy contracted -0.2% qoq

Eurozone (EA19) GDP growth came in at to 0.2% qoq in Q4, matched expectations. it’s also the same rate as in Q3. That’s also the lowest rate in four years since Q2 of 2014. Annual rate slowed to 1.2% yoy, down from Q3’s 1.6% yoy. The year-on-year rate is a five year low. European Union (EU28) GDP growth came in at 0.3% qoq. Annual rate slowed to 1.5% yoy, down from 1.8% yoy.

Also released, Italy GDP contracted -0.2% qoq in Q4, worse than expectation of -0.1% qoq. Italian was in technical recession with two consecutive quarters of contraction.

Weak German retail sales and France CPI

German retail sales dropped -4.3% mom in December, way below expectation of -0.5% mom. That’s also the fastest decline in 11 years since 2007. The decline was partly due to a strong November with pre-Christmas shopping and one-off discounts. But it’s yet another warning that the growth engine of Eurozone is slowing down quickly. Also from Germany, unemployment rate was unchanged at 5.0% in January. But unemployment dropped less than expected by -2k only.

From France, CPI dropped -0.4% mom in January. Annual rate slowed sharply from 1.6% yoy to 1.2% yoy. INSEE noted that “The fall in inflation should result from a pronounced deceleration in the prices of energy. Services prices should rise at the same pace as in December and those in manufactured products should drop barely less than in the previous month. Contrariwise, food and tobacco prices should gather pace.”

UK Hunt: Takes a few days to prepare new Irish border backstop proposal

UK Foreign Minister Jeremy Hunt said the government is putting together the new Irish border backstop proposal for the EU. And “it is going to take a few days to do that”.

Hunt added “there is potential along all the different routes that have been discussed. But we need to put those together, make sure they meet the concerns the EU has expressed and then I think… we will have a proper discussion.”

While the March 29 formal Brexit date approaching, Hunt still maintained that it’s too early to say if extension to Article 50 is needed.

BoJ opinions: Swift decisive actions needed should downside risks materialize

BoJ released summary of opinions of January 22/23 monetary policy meeting today. It’s noted there that “hard data suggest that the trend in Japan’s economy has been firm”. However, “some market participants hold excessively pessimistic views.” And, risks to overseas economies have been “increasingly tilted to the downside” and there are concerns that some “may materialize”.

BoJ also noted that recent fall in stocks prices “to a certain extent indicates the anticipation of a global decline in the real economic growth rate.” And, “this is clear from developments in exports and imports, rather than GDP, which is declining marginally.”

The central bank also reiterated the stance to maintain current monetary easing. And more importantly, if downside risks materialize, BoJ “should be prepared to make policy responses”. It’s added that “Since achieving the price stability target has been delayed, it is not desirable to adopt a stance of not taking actions until a serious crisis occurs. Rather, a stance of taking swift, flexible, and decisive actions, including additional easing, in response to changes in the situation is desirable.”

China PMI manufacturing broke downtrend, but stayed contractionary

China PMI manufacturing rose 0.1 to 49.5 in January, up from 49.4 and beat expectation of 49.3. It’s, nonetheless, the second month of contractionary reading. It’s noted in the release that the continuous decline since August last year was finally broken, showing signs of stabilization. Slight increase in export orders also suggested that sharp decline export growth since November was slowing down.

However, decline in new orders and backlog orders reflected downward pressure on demand. Overall, “the current economy has signs of stabilization, but the foundation still needs to be consolidated. Also from China PMI non-manufacturing rose to 54.7, up from 53.8, and beat expectation of 53.9.

Also release in Asia session, Japan industrial production dropped -0.1% mom in December versus expectation of -0.5% mom. Housing starts rose 2.1% yoy in December, matched expectation. Australia import prices rose 0.5% qoq in Q4, above expectations of 0.3% qoq. UK Gfk consumer confidence was unchanged at -14 in January.

USD/JPY Mid-Day Outlook

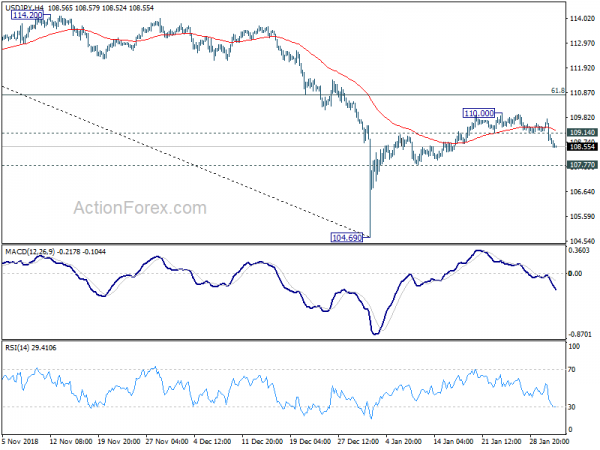

Daily Pivots: (S1) 108.66; (P) 109.20; (R1) 109.60; More…

Intraday bias in USD/JPY remains on the downside for 107.77 support. The rebound from 104.69 could have completed at 110.00 already. Firm break of 107.77 will confirm and bring retest of 104.69. On the upside, above 109.14 will turn intraday bias neutral first. Break of 110.00 will extend the rebound. But we’d expect strong resistance from 61.8% retracement of 114.54 to 104.69 at 110.77 to limit upside.

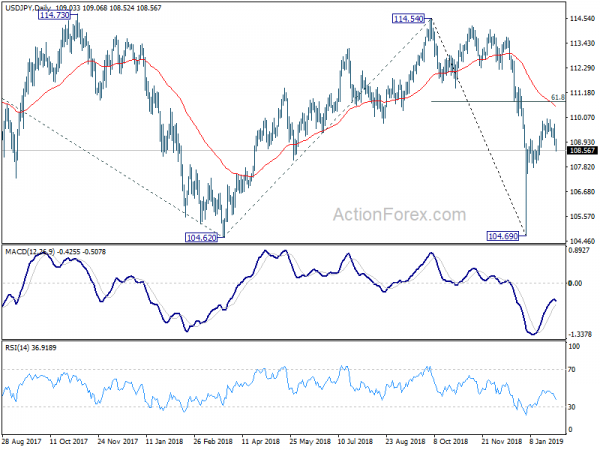

In the bigger picture, while the rebound from 104.69 is strong, there is no change in the view that it’s a corrective move. That is, fall from 114.54, as part of the decline from 118.65 (2016 high), is not completed yet. Break of 104.62 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51, which is close to 100 psychological level. Nevertheless, sustained trading above 55 day EMA (now at 110.82) will dampen this bearish view and turn focus back to 114.54 resistance instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Summary of Opinions Jan | ||||

| 23:50 | JPY | Industrial Production M/M Dec P | -0.10% | -0.50% | -1.00% | |

| 00:01 | GBP | GfK Consumer Confidence Jan | -14 | -14 | -14 | |

| 00:30 | AUD | Import Price Index Q/Q Q4 | 0.50% | 0.30% | 1.90% | |

| 01:00 | CNY | Manufacturing PMI Jan | 49.5 | 49.3 | 49.4 | |

| 01:00 | CNY | Non-manufacturing PMI Jan | 54.7 | 53.9 | 53.8 | |

| 05:00 | JPY | Housing Starts Y/Y Dec | 2.10% | 2.10% | -0.60% | |

| 08:55 | EUR | German Unemployment Change Jan | -2K | -10K | -14k | -12K |

| 08:55 | EUR | German Unemployment Claims Rate Jan | 5.00% | 5.00% | 5.00% | |

| 10:00 | EUR | Eurozone Unemployment Rate Dec | 7.90% | 7.90% | 7.90% | |

| 10:00 | EUR | Eurozone GDP Q/Q Q4 | 0.20% | 0.20% | 0.20% | |

| 10:00 | EUR | Italian GDP Q/Q Q4 P | -0.20% | -0.10% | -0.10% | |

| 12:30 | USD | Challenger Job Cuts Y/Y Jan | 18.70% | 35.30% | ||

| 13:30 | CAD | GDP M/M Nov | -0.10% | -0.10% | 0.30% | |

| 13:30 | CAD | Industrial Product Price M/M Dec | -0.70% | 0.10% | -0.80% | |

| 13:30 | CAD | Raw Materials Price Index M/M Dec | 3.80% | 3.90% | -11.70% | -11.80% |

| 13:30 | USD | Employment Cost Index Q4 | 0.70% | 0.80% | 0.80% | |

| 13:30 | USD | Initial Jobless Claims (JAN 26) | 253K | 210K | 199K | 200K |

| 14:45 | USD | Chicago PMI Jan | 61 | 65.4 | ||

| 15:30 | USD | Natural Gas Storage | 30.3B | -163B |