Dollar is trading in tight range today with mild strength against Japanese Yen and Swiss Franc. Markets are looking into today’s FOMC minutes to solidify the expectation of a June Fed hike. Euro, despite the retreat against Dollar and Sterling, stays firm with near term bullish outlook. Meanwhile, the financial markets elsewhere are generally steady. European indices are weighed down mildly by news of Moody’s downgrade of China, but loss is very limited. US futures are pointing to a flat open. Gold hovers in tight range around 1250.

** Quick update: Canadian Dollar jumps after BoC left interest rate unchanged at 0.50%. The central noted in the statement that "the Canadian economy’s adjustment to lower oil prices is largely complete and recent economic data have been encouraging, including indicators of business investment. Consumer spending and the housing sector continue to be robust on the back of an improving labour market, and these are becoming more broadly based across regions."

CAD looks into BoC and OPEC

Canadian Dollar retreats mildly today as markets await BoC rate decision as well as OPEC meeting. BoC is widely expected to keep interest rate unchanged at 0.50%. Recent economic data from Canada have been solid with job gains for six straight month. Consumer spending grew at healthy pace with support from rising home values. But BoC Governor Stephen Poloz has been reluctant to turn more upbeat on the economy and maintained that it’s still playing catch up to the US.

Meanwhile, OPEC is generally expected to agree to extend production cut by nine months to March 2018. Kuwaiti oil minister Essam al-Marzouq said that "all options are on the table" and the discussions would include the possibility of deeper production cut or extension by 12 months. WTI crude oil edges higher to 51.88 earlier today but turns cautious then. It’s trading at 51.25 at the time of writing.

Top ECB officials sound cautious

ECB Vice President Vitor Constancio said today that the central bank is "fully aware" of the call for ECB to wind down the stimulus measures given the improvement in the economic outlook. And he noted that "there’s even a unanimous view about economic developments, that the situation is improving and this will of course be fully reflected in our future decisions." But Constancio noted that caution is warranted given the large slack in labor market and weak wage growth.

On the other hand, ECB chief economist Peter Praet cautioned that "underlying inflation pressures still give scant indications of a convincing upward trend as domestic cost pressures, notably wage growth, remain subdued." Praet also noted that "overall, while we are certainly seeing a firming, broadening and more resilient economic recovery, we still need to create a sufficiently broad and solid information basis to build confidence that the projected path of inflation is robust, durable and self-sustained."

Moody’s downgraded China’s rating for the first time since 1989

Moody’s Investors Service lowered China’s credit rating to A1 today, down from Aa3. That’s the first downgrade of China in nearly 30 years sin 1989. Moody’s noted in a statement that "the downgrade reflects Moody’s expectation that China’s financial strength will erode somewhat over the coming years, with economy-wide debt continuing to rise as potential growth slows." The rating agency also warned that "while ongoing progress on reforms is likely to transform the economy and financial system over time, it is not likely to prevent a further material rise in economy-wide debt, and the consequent increase in contingent liabilities for the government."

China’s Finance Ministry criticized the that the downside was based on "in appropriate methodology". And, "Moody’s views that China’s non-financial debt will rise rapidly and the government would continue to maintain growth via stimulus measures are exaggerating difficulties facing the Chinese economy, and underestimating the Chinese government’s ability to deepen supply-side structural reform and appropriately expand aggregate demand."

Japanese parliament approved two new BoJ board members

In Japan, the upper house of parliament approved two government nominees for BoJ policy board. The two include economist at Mitsubishi UFJ Research and Consulting Goushi Kataoka and Director of Bank of Tokyo Mitsubishi UFJ Hitoshi Suzuki. Kataoka is known to be a vocal advocate of Prime Minister Shinzo Abe’s economic policies and the BoJ’s asset purchase program. Outgoing board member Takahide Kiuchi and Takehiro Sato are both known to oppose to BoJ’s unorthodox policy. Markets generally view the nomination as supportive to BoJ Governor Haruhiko Kuroda’s ultra loose monetary policies.

Former Fed Chair Bernanke urged explicit coordination of monetary and fiscal policies in Japan

Former Fed Chair Ben Bernanke said at the BoJ in Tokyo today that "if all goes well, the BOJ’s current policy framework may yet be sufficient to achieve the inflation objective." However, "if not, there are relatively few options available." Meanwhile Bernanke also emphasized that "the most promising possibility — should we get to that point — is more explicit coordination of monetary and fiscal policies." He explained that "monetary policy that is aimed at limiting the impact of fiscal expansion on the government’s debt could both make fiscal policy makers more willing to act and increase the impact of their actions,"

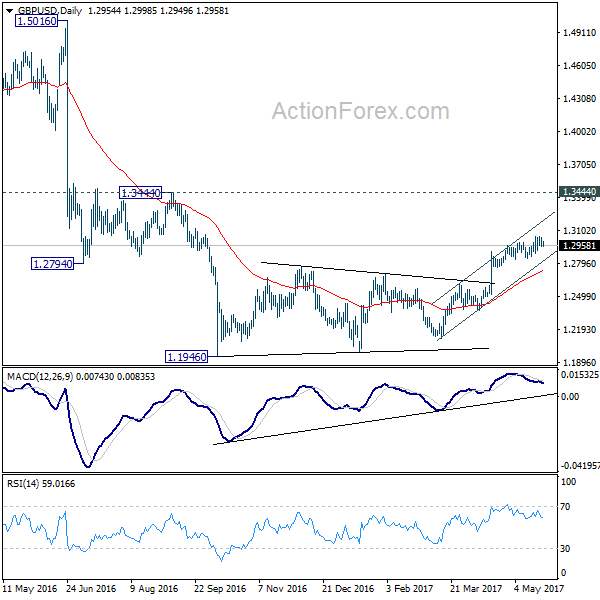

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2931; (P) 1.2982; (R1) 1.3012; More…

GBP/USD is still bounded in range trading below 1.3047 and intraday bias remains neutral. As long as 1.2844 minor support holds, further rise remains mildly in favor. Nonetheless, as we are still viewing price actions from 1.1946 as a corrective move, we’d expect upside to be limited below 1.3444 resistance to bring near term reversal. On the downside, break of 1.2844 will indicate short term topping and turn bias back to the downside for 1.2614 resistance turned support first.

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There are signs of reversal, like breaking of 55 week EMA, weekly MACD turned positive, and monthly MACD crossed above signal line. But still, break of 1.3444 resistance is need to confirm medium term bottoming. Otherwise, outlook will remains bearish for extend the down trend through 1.1946 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Apr | 578M | 267M | 332M | 277M |

| 00:30 | AUD | Westpac Leading Index M/M Apr | -0.10% | 0.10% | ||

| 06:00 | EUR | German GfK Consumer Sentiment Jun | 10.4 | 10.2 | 10.2 | |

| 13:00 | USD | House Price Index M/M Mar | 0.60% | 0.60% | 0.80% | |

| 14:00 | CAD | BoC Rate Decision | 0.50% | 0.50% | 0.50% | |

| 14:00 | USD | Existing Home Sales Apr | 5.57M | 5.65M | 5.71M | |

| 14:30 | USD | Crude Oil Inventories | -1.8M | |||

| 18:00 | USD | FOMC Minutes May 3 Meeting |