Euro has been under broad based pressure today after PMIs suggest more weakness in the economy ahead. The common currency then spikes further lower ECB President Mario Draghi sounds rather cautious and downbeat in the post meeting press conference. However, Euro quickly recovers as Draghi actually didn’t bring out any “new” dovishness. The March meeting with new economic projection is the more crucial one, not today’s.

Dollar, on the other hand, is firm as boosted by strong job data. But that is offset my US Commerce Secretary Wilbur Ross’s comments that US and China are “miles and miles” from a trade deal. For now, Australian Dollar is the weakest one for the day, followed by Sterling, and then Euro. Swiss Franc is the strongest one, followed by Yen and then Dollar.

Technically, despite dipping to 1.1306, EUR/USD’s quick recovery suggests that fall from 1.1569 is not ready to resume yet. More consolidations would be seen with risk of further recovery. USD/CHF is also in consolidation and might have slightly deeper pull back. Even though Yen is trading up against most, it’s clearly held above below intraday resistance against others. Thus, today’s strength in Yen is more of recovery rather than reversal.

In other markets, FTSE is currently down -0.37%. DAX is up 0.15%. CAC is up 0.39%. German 10-year yield is down -0.0336 at 0.194, back below 0.2 handle. Earlier in Asia, Nikkei dropped -0.09%. Hong Kong HSI rose 0.42%. China Shanghai SSE rose 0.41%. Singapore Strait Times rose 0.62%. Japan 10-year JGB yield rose 0.0058 to 0.011.

US initial jobless claims dropped to 199k, lowest since 1969

US initial jobless claims dropped -13k to 199k in the week ending January 19, below expectation of 215k. That’s the lowest level since November 15, 1969. Four-week moving average of initial claims dropped -5.5k to 215k. Continuing claims dropped -24k to 1.713M in the week ending January 12. Four-week moving average of continuing claims rose 1.25k to 1.730M.

ECB stands pat, said risks moved the to the downside

ECB kept main refinancing rate unchanged at 0.00% as widely expected. The forward guidance is also held unchanged. That is, “key ECB interest rates to remain at their present levels at least through the summer of 2019.

In the post meeting press conference, Draghi noted that “The risks surrounding the euro area growth outlook have moved to the downside on account of the persistence of uncertainties related to the geopolitical factors and the threat of protectionism, vulnerabilities in emerging markets and financial market volatility.” As he added that “The persistence of uncertainties, in particular relating to geopolitical factors and the threat of protectionism, is weighing on economic sentiment.”

Later in the Q&A, Draghi said today’s ECB meeting was devoted to an “assessment” on the slowdown. And about the questions of “Where are we? Why we’re here? And how long will the slowdown last”. The meeting was not about the implications on monetary policy. And ECB policymakers were “unanimous” on acknowledging weaker momentum” and “changing of the balance of risks for growth”. The Governing Council will give itself more time to assess the risk factors, and there will be another discussion in March with new economic projections.

ECB press conference and statement.

Eurozone PMI composite dropped to 66-month low, both the manufacturing and service close to stagnation

Eurozone PMI manufacturing dropped to 50.5 in January, down from 51.4, missed expectation of 51.3. That’s the lowest in 50 months. PMI services dropped to 50.8, down from 51.2, missed expectation of 51.5. That’s the lowest in 65 months. PMI composite dropped to 50.7, down from 51.1. That’s the lowest in 66 months.

Chris Williamson, Chief Business Economist at IHS Markit noted in the release that “The Eurozone economy slipped closer to stall speed in January, with companies reporting the first drop in demand for over four years. The disappointing survey data indicate that GDP is rising at a quarterly rate of just 0.1%.”

He added “both the manufacturing and service sectors are close to stagnation”. And, “companies are concerned about a wider economic slowdown gathering momentum, with rising political and economic uncertainty increasingly affecting risk appetite and demand.

Also, “the survey’s output and price gauges have both now fallen into territory more associated with the ECB loosening rather than tightening policy, raising pressure on the central bank to acknowledge that downside risks to the outlook now predominate.”

Germany PMI composite broke down trend, but manufacturing in contraction

Germany PMI manufacturing dropped to 49.9 in January, down from 51.5 and missed expectation of 51.5. That’s the lowest in 50 months. PMI services rose to 53.1, up from 51.8 and beat expectation of 52.2. PMI composite rose to 52.1, up from 51.6.

Phil Smith, Principal Economist at IHS Markit said “growth performance signalled by the index was still one of the worst over the past four years.” Also, “firms are also showing greater caution towards hiring with job creation at a 25-month low, though in a historic context these are still healthy employment figures.”

And, “Manufacturing fell into contraction in January as the sector’s order book situation continued to worsen, showing the steepest decline in incoming new work since 2012. Weakness in the auto industry was once again widely reported, as was a slowdown in demand from China.

France PMI composite dropped to 47.9, 50-month low, further weakness ahead

France PMI manufacturing recovered back to 51.2 in January, up from 49.7 and beat expectation of 50.0. However, PMI services dropped to 47.5, down from 49.0 and missed expectation of 50.5. That’s also the lowest level in 59 months. PMI composite dropped to 47.9, down from 48.7, hitting a 50-month low.

Eliot Kerr, Economist at IHS Markit said, “the latest decline was the fastest for over four years, even quicker than the fall in protest-hit December.” “Although firms reported higher confidence in January, other forward looking indicators such as new orders fell at the fastest pace for over four years. This suggests further weak performance for France in the coming months.”

EU Parliament: No consent to Brexit agreement without Irish backstop

The European Parliament’s Brexit group issued a statement today, reiterating that the Brexit agreement must include Irish backstop solution. The group noted that the “Withdrawal Agreement is fair and cannot be re-negotiated. This applies especially to the backstop since it is the guarantee that under no circumstances will there be a hardening of the border on the island of Ireland while at the same time safeguarding the integrity of the Single Market.”

Also, “the EU remains clear, firm and united on this even if the negotiated backstop is not meant to be used. Therefore, the BSG insists that, without such an “all-weather” backstop-insurance, the European Parliament will not give its consent to the Withdrawal Agreement.”

Additionally after rejection by UK Commons, the group urged “the UK Government must work together with all political parties in the House of Commons to overcome this deadlock. It expects the UK side to come back as quickly as possible with a positive and viable proposal on the way forward.”

EU Chief Brexit negotiator Michel Barnier rejected the idea of time-limited backstop. He said “We have to maintain the credibility of this reassurance … it cannot be time-limited… It’s not just about Ireland.”

Japan PMI manufacturing dropped to 50, exports drop steepest in over 2.5 years

Japan PMI manufacturing dropped to 50.0 in December, down from 52.6. That also marked the end of the longest expansionary run for over a decade. In particular, exports decline at strongest pace in two-and-a-half years. And, production scaled back for first time since July 2016, while confidence lowest in over six years.

Joe Hayes, Economist at IHS Markit, noted “Preliminary PMI data for January bodes ill for Japan’s manufacturing sector, indicating the end of a near two-and-a-half-year growth run as the index dropped to 50.0. The underlying picture will raise concern given renewed reductions were seen in new orders and output. Further signs that the downturn in the global trade cycle could yet worsen were also signalled, with new export orders falling at the sharpest rate since July 2016. The widely-anticipated rebound in Q4 should not distract from the bigger picture. Domestic economic weakness compounded with slowing global growth coincided with the lowest level of business confidence for over six years.”

Australia job growth driven by part time jobs, participation rate fell

Australia job market grew 21.6k in December, above expectation of 18.1k. Full-time jobs, however, dropped -3k. Part-time jobs rose 24.6k. Unemployment rate dropped -0.1% to 5.0%, better than expectation of 5.0%. That equals the lowest level in more than 6 years, as touched back in September and October. However, participation rate dropped by -0.1% to 65.6%. While the set of data was solid, it isn’t too encouraging and paints no sign of tightening in the Australian job market.

EUR/USD Mid-Day Outlook

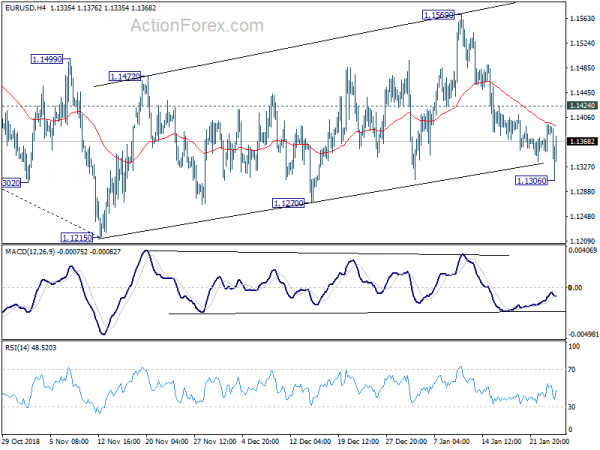

Daily Pivots: (S1) 1.1356; (P) 1.1375; (R1) 1.1400; More…..

EUR/USD spikes lower to 1.1306 but quickly recovered. Intraday bias remains neutral first and some more consolidation could be seen. But still, further decline is expected as long as 1.1424 resistance holds. And, we’re still slightly favoring that corrective rise from 1.1215 should have completed at 1.1569. On the downside, break of 1.1306 will resume the fall from 1.1569 to retest 1.1215 low. However, break of 1.1424 resistance will argue that the corrective pattern from 1.1215 is extending with another rise. And, intraday bias will be turned to the upside for 1.1569 and above..

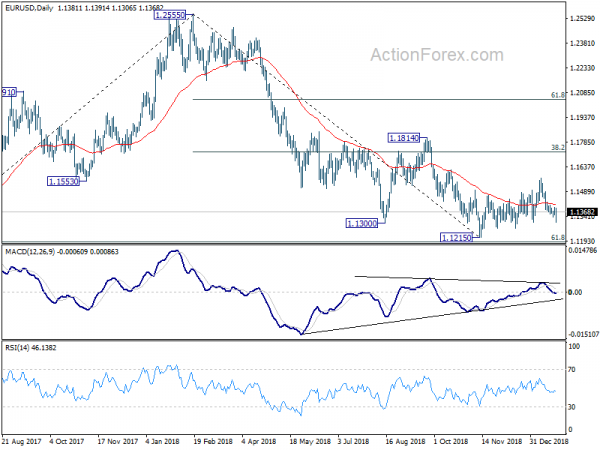

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Employment Change Dec | 21.6K | 18.1K | 37.0K | |

| 00:30 | AUD | Unemployment Rate Dec | 5.00% | 5.10% | 5.10% | |

| 00:30 | JPY | PMI Manufacturing Jan P | 50 | 52.6 | ||

| 08:15 | EUR | France Manufacturing PMI Jan P | 51.2 | 50 | 49.7 | |

| 08:15 | EUR | France Services PMI Jan P | 47.5 | 50.5 | 49 | |

| 08:30 | EUR | Germany Manufacturing PMI Jan P | 49.9 | 51.4 | 51.5 | |

| 08:30 | EUR | Germany Services PMI Jan P | 53.1 | 52.2 | 51.8 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Jan P | 50.5 | 51.3 | 51.4 | |

| 09:00 | EUR | Eurozone Services PMI Jan P | 50.8 | 51.5 | 51.2 | |

| 12:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | 0.00% | |

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | USD | Initial Jobless Claims (JAN 19) | 199K | 215K | 213K | 212K |

| 14:45 | USD | US Manufacturing PMI Jan P | 53.5 | 53.8 | ||

| 14:45 | USD | US Services PMI Jan P | 54.1 | 54.4 | ||

| 15:00 | USD | Leading Index Dec | -0.10% | 0.20% | ||

| 15:30 | USD | Natural Gas Storage | -145B | -81B | ||

| 16:00 | USD | Crude Oil Inventories | -0.2M | -2.7M |