Mild risk aversion is the main theme in the financial markets today. Selloff started in Asia, in particular in China, and spread to European session. Japan 10-year JGB yield also turned negative again. In the currency markets, Australian Dollar leads other commodity currencies lower in a typical day of risk aversion. Yen is the strongest one as usual. Sterling is boosted by solid job data, but gain is limited as Brexit stalemate continues. Dollar is the third strongest so far.

Technically, USD/CAD’s earlier break of 1.3323 resistance suggests short term bottoming at 1.3180. Stronger rebound could be seen back to 1.3664 resistance. AUD/USD is pressing 0.7116 minor support now. Break will indicate completion of rebound from 0.6722 low and bring deeper fall back to this level. EUR/USD is also extending fall from 1.1569 towards 1.1307 support. One thing to note is that while Yen is strong, USD/JPY, EUR/JPY and GBP/JPY are all held well above near term support level. Thus, there is no confirmation of completion of recent rebound in yen crosses yet.

In other markets, at the time of writing, FTSE is down -0.58%, DAX is down -0.46%, CAC is down 0.45%. German 10-year yield is down -0.015 at 0.241. Earlier in Asia, Nikkei dropped -0.47%, Hong Kong HSI dropped -0.70%, China Shanghai SSE dropped -1.18%, Singapore Strait Times dropped -0.86%. Japan 10-year JGB yield dropped -0.006 to -0.001, turned negative.

Released from Canada, wholesale sales dropped -1.0% mom in November, manufacturing sales dropped -1.4% mom. US government shutdown is extending its record one.

German ZEW rose to -15, remarkable for no deterioration on risks

German ZEW economic sentiment improved to -15 in January, up from -17.5, and beat expectation of -18.5. ZEW current situation, however, dropped to 27.6, down from 45.3 and missed expectation of 43.3. ZEW noted that the indicator is still well below the long-term average of 22.4. And current economic situation once again decreased considerably.

ZEW President Achim Wambach said “It is remarkable that the ZEW Economic Sentiment for Germany has not deteriorated further given the large number of global economic risks. The financial market experts have already considerably lowered their expectations for economic growth in the past few months. New, potentially negative factors such as the rejection of the Brexit deal by the British House of Commons and the relatively weak growth in China in the last quarter of 2018 have thus already been anticipated,”

Eurozone ZEW economic sentiment, however, rose just marginally to -20.9, up from -21.0 and missed expectation of -20.1. Eurozone current situation also dropped -6.8 pts to 5.3.

UK unemployment rate dropped to 4.0%, lowest since 1975, Sterling jumps

Sterling rises mildly after better than expected job data. Unemployment rate dropped to 4.0% in November, down from 4.1% and beat expectation of 4.1%. That’s also the lowest level since February 1975. Wage growth also shows sign of pick up. Average earnings including bonus accelerated to 3.4% 3moy, above expectation of 3.3% 3moy. Average earnings excluding bonus rose 3.3% 3moy, unchanged. Claimant count rose 20.8k in December, slightly above expectation of 20.0k.

UK Barclay: Interest of both EU and UK to have a Brexit deal

UK Brexit Minister Stephen Barclay told BBC today that the government is working on what to ask from the EU to get the deal approved in the parliament. He noted that “the EU don’t want to be in a situation of having no deal – that would have a big impact not just on the Irish economy but other economies, the Dutch economy – so it’s in both sides’ interest to have a deal.”

Separately, German Minister for European Affairs Michael Roth expressed disappointment on UK Prime Minister Theresa May’s statement yesterday. He tweeted “Where is the plan B? Just asking for a friend…” German Justice Minister Katarina Barley also said she was “disappointed” and “that’s not the way forward”.

Polish suggestion of 5-year limit on Irish backstop is not EU position

Polish Foreign Minister Jacek Czaputowicz suggested limiting the Irish backstop arrangement to five years, to help get the Brexit deal through UK parliament. However, European Commission spokesman Margaritis Schinas said that is not EU’s position.

Schinas told reports that “we have a unanimous, and I repeat unanimous, EU 27 position on the Withdrawal agreement and it’s clear that the doorstep statement you’re referring to was not part of the EU position.”

China NDRC: Downward pressure on economy will be passed onto jobs

China National Development and Reform Commission spokeswoman Meng Wei warned that the job market faces “new changes” ahead and slowdown in the economy will pressure the job markets. She also noted that some factories in the export hub of Guangdong province have shut earlier than usual ahead of Lunar new year holiday.

Meng said “from the viewpoint of ‘changes’, the external environment is complex and austere.” And, “Within the changes, there is something to worry about, and there is downward pressure on the economy. To a certain extent, the pressure will be passed onto jobs.”

Her comments came after survey-based data showed unemployment rate rose 0.1% to 4.9% in December, release yesterday.

EUR/USD Mid-Day Outlook

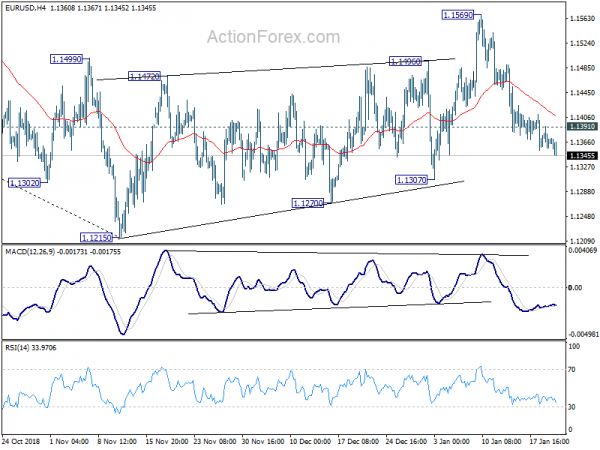

Daily Pivots: (S1) 1.1352; (P) 1.1371; (R1) 1.1386; More…..

Intraday bias in EUR/USD remains on the downside as fall from 1.1569 is extending, towards 1.1307 support. The corrective rise from 1.1215 should have completed at 1.1569. Break of 1.1307 should resume larger down trend through 1.1215 low. On the upside, above 1.1391 minor resistance will turn intraday bias neutral again.

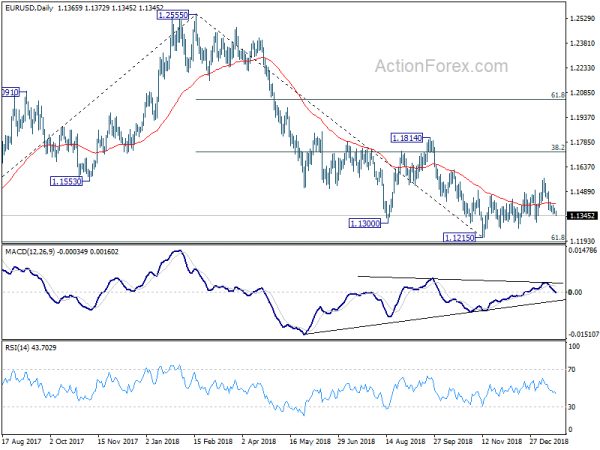

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 09:30 | GBP | Jobless Claims Change Dec | 20.8K | 20.1K | 21.9K | 24.8K |

| 09:30 | GBP | Claimant Count Rate Dec | 2.80% | 2.80% | ||

| 09:30 | GBP | Average Weekly Earnings 3M Y/Y Nov | 3.40% | 3.30% | 3.30% | |

| 09:30 | GBP | Weekly Earnings ex Bonus 3M Y/Y Nov | 3.30% | 3.30% | 3.30% | |

| 09:30 | GBP | ILO Unemployment Rate 3Mths Nov | 4.00% | 4.10% | 4.10% | |

| 09:30 | GBP | Public Sector Net Borrowing (GBP) Dec | 2.1B | 1.1B | 6.3B | |

| 10:00 | EUR | German ZEW Economic Sentiment Jan | -15 | -18.5 | -17.5 | |

| 10:00 | EUR | German ZEW Current Situation Jan | 27.6 | 43.3 | 45.3 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Jan | -20.9 | -20.1 | -21 | |

| 13:30 | CAD | Wholesale Trade Sales M/M Nov | -1.00% | 0.20% | 1.00% | 0.70% |

| 13:30 | CAD | Manufacturing Sales M/M Nov | -1.40% | -0.50% | -0.10% | |

| 15:00 | USD | Existing Home Sales Dec | 5.27M | 5.32M |