Despite the deep selloff in US stocks overnight, Asian markets are rather calm. Sentiments are somewhat lifted as China pledged to provide more stimulus, in particular to private and small companies. At the time of writing, Yen is trading as the weakest one for today, continuing to pare back the “flash crash gains”. But it’s followed by New Zealand Dollar and then Euro as the next weakest. On the other hand, Australian Dollar is the strongest one, followed by Canadian and then Dollar.

For the week, Yen is overwhelmingly the strongest one. Canadian Dollar followed as second strongest as it wasn’t at the center of the flash crash storm. Loonie was also lifted by rebound in oil prices. Dollar is the third strongest. European majors, rather than Aussie, are indeed weakest for the week. Sterling leads the way down on Brexit worries, followed by Euro.

In other markets, DOW closed down -660.02 pts or -2.83% at 22686.232. But it’s kept well above key near term support at 22267.42. Thus, recent corrective rebound from 21712.53 low might still extend. S&P 500 dropped -2.48% while NASDAQ dropped -3.04%. Treasury yields suffered another day of deep decline with 10-year yield down -0.107 to 2.554. 30-year yield dropped -0.082 to 2.900. Two year yield dropped to 2.42%, back within Fed’s target range of 2.25-2.50% for the first time since 2008.

In Asia, Nikkei closed down -2.26% to 19561.96, catching up others as it’s back from holiday. Hong Kong HSI is up 1.34%. China Shanghai SSE is up 1.34%. Singapore Strait Times is up 1.13%.

Chinese Premier Li pledged to step up countercyclical measures

The Chinese State Council noted in a brief statement in its website that Premier Li Keqiang pledged to step up “countercyclical adjustments” of macro policies. The comments were made when Li at a meeting with officials of the country’s banking and insurance regulator after visiting Bank of China, Industrial and Commercial Bank of China and China Construction Bank. Measures will include tax cuts, targeted lowering of reserve requirements to help small and private companies.

China MOFCOM confirmed trade meeting with US in Beijing on Jan 7-8

China’s Ministry of Commerce confirmed in a brief statement that there will be US-China vice ministerial level trade talks in Beijing on Jan 7-8. The date is confirmed in a phone call today. There will be “positive and constructive discussions” in following up to the agreement of Xi and Trump in Argentina. Deputy U.S. Trade Representative Jeffrey Gerrish will lead the team on the US side.

China PMI services rose to 53.9, employment gauge slipped further into negative territory

China Caixin PMI services rose to 53.9 in December, up from 53.8 and beat expectation of 53.1. PMI composite also rose from 51.9 to five-month high of 52.2. However, Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group, warned in the release that “employment gauge slipped further into negative territory, implying increasing challenges to stabilizing employment, which was the broader context of December’s central government policies to increase jobs.”

Japan MoF to monitor FX closely after flash crash, BoJ may downgrade inflation outlook

After yesterday’s spike in Yen, Masatsugu Asakawa, Japan’s Vice Finance Minister for International Affairs, said the ministry will “monitor the situation for speculative moves in the foreign exchange market.” He noted that “volatility remains quite high high during Sydney trading.” And, “currency markets are trading in extremely thin liquidity, exacerbating price movements.” For for now, the MoF is not considering to call a meeting with the BoJ on the issue yet.

Talking about the BoJ, Nikkei Asian review reported that BoJ board is considering to lower inflation outlook again due to lower oil prices. For fiscal 2019, core inflation forecast could be lowered to 1%, down from October projection of 1.4%. For fiscal 2020, however, there might be just slight revision to current forecast of 1.5%.

Japan PMI manufacturing: Demand pressures relatively subdued

Japan PMI manufacturing is finalized at 52.6 in December, up from November’s 15-month low of 52.2. Markit noted “solid output expansion on average over Q4, but demand pressures remain subdued”. Also, “business optimism at lowest since November 2016”. Joe Hayes at IHS Markit noted in the release that “Survey data provide reason to remain cautious on growth prospects. Most notably, demand pressures were relatively subdued. Exports also declined on the month amid reports of sluggish sales to Europe and China. The fall in confidence, the seventh time this has been the case in as many months, also suggests that companies are becoming increasingly less bullish on the year-ahead outlook. With the sales tax increase set to come into play, fears over the durability of demand conditions are worrying.”

64% UK Conservatives prefer no-deal Brexit to May’s deal

According to a survey by YouGov funded by Economic and Social Research Council, many more Conservative Party members opposed to Prime Minister Theresa May’s Brexit deal than supported it.

The survey was conducted Dec 17-22, on 1215 Tories. 59% percent opposed May’s deal while only 38% were in favor. If there is another referendum, 64% would opt for no-deal Brexit while 29% would pick May’s agreement.

Only 11% thought the Irish backstop made sense. 23% thought it’s a bad idea but worth to be included to secure the deal. 40% rejected the backstop arrangement.

Looking ahead

The economic calendar is extremely busy today. Eurozone services PMI final will be featured. But more focuses will likely be on Eurozone CPI, PPI and Germany unemployment. UK will also release PMI services.

Later today, Canada will release job data, IPPI and RMPI. US will release non-farm payrolls. USD/CAD will be a pair to watch as it dropped sharply overnight. Rebound in oil prices lifted the Loonie. Dollar was weighed down by soft ISM manufacturing and dovish comments from Dallas Fed Robert Kaplan. More volatility is anticipated in the pair.

USD/JPY Daily Outlook

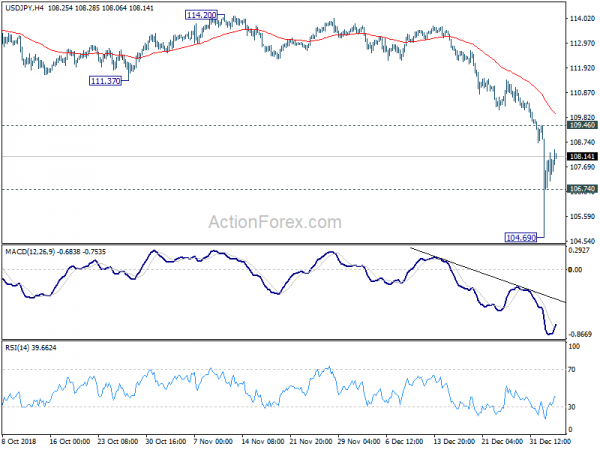

Daily Pivots: (S1) 105.57; (P) 107.25; (R1) 109.31; More..

Intraday bias in USD/JPY stays neutral for now as more consolidation would be seen. But upside should be limited by 109.36 minor resistance to bring fall resumption. On the downside, below 106.74 minor support will turn bias to the downside for 104.62 low. Decisive break of 104.62 low will extend larger down trend and target 100% projection of 118.65 to 104.62 from 114.54 at 100.51, which is close to 100 psychological level.

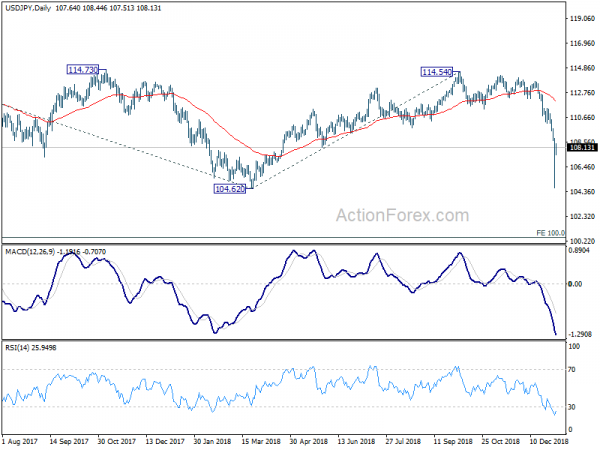

In the bigger picture, price actions from 125.85 (2015 high) are seen as a long term corrective pattern, no change in this view. Apparently, such corrective pattern is not completed yet. Fall from 114.54 is seen as another medium term down leg, targeting 98.97/104.62 support zone. For now, we’d expect strong support from there to contain downside to bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:01 | GBP | BRC Shop Price Index Y/Y Dec | 0.30% | 0.10% | ||

| 0:30 | JPY | PMI Manufacturing Dec F | 52.6 | 52.4 | 52.4 | |

| 1:45 | CNY | PMI Services Dec | 53.9 | 53.1 | 53.8 | |

| 8:45 | EUR | Italy Services PMI Dec | 50.1 | 50.3 | ||

| 8:50 | EUR | France Services PMI Dec F | 49.7 | 49.6 | ||

| 8:55 | EUR | German Unemployment Change Dec | -13K | -16K | ||

| 8:55 | EUR | German Unemployment Claims Rate Dec | 5.00% | 5.00% | ||

| 8:55 | EUR | Germany Services PMI Dec F | 52.5 | 52.5 | ||

| 9:00 | EUR | Eurozone Services PMI Dec F | 51.4 | 51.4 | ||

| 9:30 | GBP | Mortgage Approvals Nov | 66K | 67K | ||

| 9:30 | GBP | Money Supply M4 M/M Nov | 0.60% | 0.70% | ||

| 9:30 | GBP | Services PMI Dec | 50.8 | 50.4 | ||

| 10:00 | EUR | Eurozone PPI M/M Nov | -0.20% | 0.80% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Nov | 4.10% | 4.90% | ||

| 10:00 | EUR | Eurozone CPI Estimate Y/Y Dec | 1.80% | 2.00% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec A | 1.00% | 1.00% | ||

| 13:30 | CAD | Net Change in Employment Dec | 5.0K | 94.1K | ||

| 13:30 | CAD | Unemployment Rate Dec | 5.70% | 5.60% | ||

| 13:30 | CAD | Raw Materials Price Index M/M Nov | -2.40% | |||

| 13:30 | CAD | Industrial Product Price M/M Nov | 0.20% | |||

| 13:30 | USD | Change in Non-farm Payrolls Dec | 178K | 155K | ||

| 13:30 | USD | Unemployment Rate Dec | 3.70% | 3.70% | ||

| 13:30 | USD | Average Hourly Earnings M/M Dec | 0.30% | 0.20% | ||

| 14:45 | USD | Services PMI Dec F | 53.4 | 53.4 | ||

| 15:30 | USD | Natural Gas Storage | -48B | |||

| 16:00 | USD | Crude Oil Inventories | 0.0M |