Dollar remains in the spotlight today as it suffers renewed selling in European session. It could be part of delayed reaction to the dovish FOMC rate hike yesterday. But then, while the greenback is the worst performing one today, loss greenback is limited so far except versus the Japanese Yen. Commodity currencies remain generally weakest ones for today and the week. Yen is currently trading as the strongest for today as risk aversion continues. Euro followed as second strongest. BoE and BoJ rate decisions today triggered little reactions.

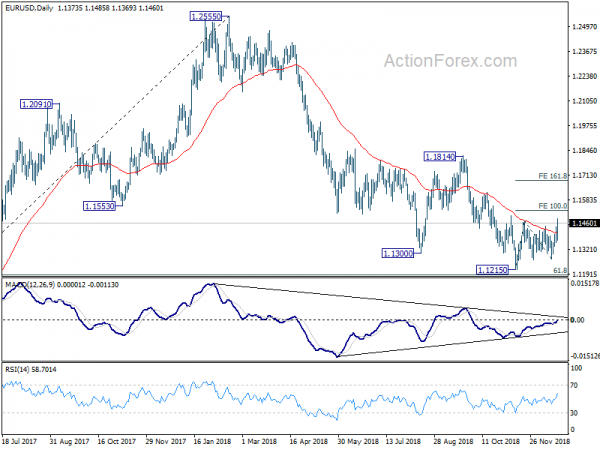

Technically, most important development today is the break of 1.1443 resistance in EUR/USD. It firstly suggests resumption of rebound from 1.1215 low. Also, it’s an early signal of bullish reversal As long as 1.1364 minor support holds, further rally is now in favor back to 1.1814 key resistance. However, Dollar is only more bearish against Euro and Yen. Even USD/CHF recovers well ahead of 0.9848 key support. GBP/USD is held in tight range. AUD/USD stays near term bearish and USD/CAD remains near term bullish. More is needed to confirm underlying weakness of Dollar.

In other markets, major European indices are generally lower at the time of writing. FTSE is down -0.23%, DAX is down -1.14%, CAC is down -1.62%. German 10 year yield is down -0.0128 at 0.229. Italian 10 year yield is down -0.0327 at 2.738. Earlier today, Nikkei dropped -2.84%, Hong Kong HSI dropped -0.94%, China Shanghai SSE dropped -0.52%, Singapore Strait Times dropped -0.26%. Japan 10 year JGB yield dropped -0.0032 to 0.031.

BoE stands pat with dovish shift, UK retail sales shone

BOE voted 9-0 to leave the Bank rate unchanged at 0.75% in December. The committee also voted unanimously to leave the asset purchase program at 435B pound .It has turned more cautious than November, warning that Brexit uncertainty has “intensified considerably” since November. Thanks to lower oil prices, policymakers expect inflation to fall below +2% in as soon as January 2019. This should give more room for BOE in keeping interest rates on hold. More in BOE Turns Dovish as Brexit Deadline Nears, Yet No Deal is Secured

UK retail sales came in stronger than expected in November. Retail sales including auto and fuel rose 1.4% mom, 3.6% yoy versus expectation of 0.3% mom, 1.9% yoy. Retail sales excluding auto and fuel rose 1.2% mom, 3.8% yoy versus expectation of 0.2% mom, 2.3% yoy. ONS noted that “retailers reported strong growth on the month due to Black Friday promotions in November, which continues the shifting pattern in consumer spending to sales occurring earlier in the year”.

US jobless claims rose to 214k, Philly Fed business outlook dropped to 9.4

US initial jobless claims rose 8k to 214k in the week ended December 15, below expectation of 219k. Four-week moving average of initial claims dropped -2.75k to 222k. Continuing claims rose 27k to 1.688M in the week ended December 8. Four-week moving average of continuing claims rose 6.75k to 1.6725M. Also released Philly Fed business outlook dropped sharply to 9.4 in December, down from 12.9 and missed expectation of 15.6. That’s also the lowest level since August 2016.

Yesterday, Fed raised federal funds rate by 25bps to 2.25-2.50% as widely expected. The decision was made by unanimous vote. The latest economic projections were rather dovish. 2019 growth and inflation forecast was revised down. Fed also projected few rate hikes ahead. More in:

- FOMC Review – Fed Not As Dovish As Expected

- FOMC to Continue With Hikes, but Mindful of Risks

- Where The Fed May Be Wrong

- The Fed Hikes Rates, But Acknowledges Risks

- Fed Delivers Dovish Hike But Tightening Isn’t Done Yet

- Fed Raises Rates, and Expects “Some” Further Gradual Hikes Will be Required

- FOMC Review Fed To Markets: ‘Just A Couple Of More Hikes’

- Fed Recap: ‘Some’ What Dovish Hike Not Enough For Stocks

MOFCOM: Both US and China took proactive measures on to resolve trade frictions, more talks in Jan

Chinese Commerce Ministry spokesman Gao Feng confirmed in a regular press briefing there were talks between China and US on trade yesterday. Both sides exchanged opinions on topics including balancing trade and intellectual property protection. Further than that, there are plans for more US-China trade talks in January. He said that both sides had maintained very close communications after Xi-Trump meeting earlier this month.

Also Gao hails that both sides took “proactive” measures on resolving trade conflicts and released “positive signals”. And he emphasized this is ” an important condition for the smooth progress of the consultations” on trade and economic frictions. Gao pointed to US formally suspended additional tariffs on Chinese imports till March 2. Also, China suspended additional tariffs on US autos still March 31.

BoJ stands pat as widely expected, with 7-2 vote

BoJ left monetary policy unchanged today as widely expected. Short term policy rate is held negative at -0.1%. The central bank will continue with asset purchase at around JPY 80T a year to keep 10 year JGB yield at around 0%. The decision was again made by 7-2 vote. Y. Harada against said allowing long-term yields to move to some extent was too ambiguous. G. Kataoka continued to push for strengthen easing.

On economic outlook, BoJ said the economy is “likely to continue its moderate expansion”. Domestic demand is likely to follow an uptrend, “with a virtuous cycle from income to spending being maintained in both the corporate and household sectors”. CPI is “likely to increase gradually toward 2 percent, mainly on the back of the output gap remaining positive and medium- to long-term inflation expectations rising”.

BoJ also maintained the risks include US macroeconomic policies, protectionist moves, emerging markets, Brexit and geopolitical risks.

BoJ Kuroda laid out options for additional easing if necessary

In the post meeting press conference, BoJ Governor Haruhiko Kuroda warned of downside risks to the economy “particularly via overseas economic developments”. He added, “if trade frictions persist, that could have a broad impact on Japanese and overseas economies.” Nevertheless, he also pointed to tankan survey and BoJ’s internal hearings, and noted “trade frictions on Japan’s economy is limited for now”. There is so far no change in the view that the economy is “expanding moderately”. Also, ” momentum for achieving our price target is sustained.”

Kuroda also sounded open to more easing and noted “If we think doing so would be necessary to sustain the momentum for achieving our price target, we will ease monetary policy further as appropriate.” The options for additional easing include cutting the short-term interest rate target, lowering the long-term yield target, ramping up asset buying and accelerating the pace of increase in base money.

Australia employment grew 37k, but full time jobs dropped -6.4k

Australian employment market grew 37.0k, seasonally adjusted, in November, much better than expectation of 20.0k. However, the growth was mainly driven by part-time jobs, which rose 43.4k. Full-time employment has indeed dropped -6.4k. Unemployment rate also rose 0.1% to 5.1%, above expectation of 5.0%. Participation rate rose 0.2% to 65.7%.

New Zealand GDP grew only 0.3%, sharp contraction in construction and manufacturing

New Zealand Dollar drops sharply today after big miss in GDP data. GDP grew 0.3% qoq in Q3, sharp slow down from Q2’s 1.0% qoq and missed expectation of 0.6% qoq. Deep contraction is seen in both construction and manufacturing. Construction fell -0.8%, driven by a decrease in heavy and civil construction. Manufacturing dropped -0.8% “with 6 of 9 manufacturing industries declining.” Services growth also eased to 0.5%, slowest rate of growth in six years. Also from New Zealand, trade deficit shrank to NZD -861M in November.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1344; (P) 1.1393; (R1) 1.1424; More…..

EUR/USD’s strong rise and break of 1.1443 resistance indicates resumption of rebound from 1.1215. Also, considering bullish convergence condition in daily MACD, it’s taken as an early sign of bullish reversal. Intraday bias is now on the upside for 100% projection of 1.1215 to 1.1472 from 1.1270 at 1.1527 first. Break will target 161.8% projection at 1.1686 next. On the downside, however, break of 1.1364 will suggest that the rebound is completed and turn bias back to the downside for 1.1215 low.

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Nov | -861M | -880M | -1295M | -1317M |

| 21:45 | NZD | GDP Q/Q Q3 | 0.30% | 0.60% | 1.00% | |

| 00:30 | AUD | Employment Change Nov | 37.0K | 20.0K | 32.8K | |

| 00:30 | AUD | Unemployment Rate Nov | 5.10% | 5.00% | 5.00% | |

| 02:00 | JPY | BOJ Rate Decision | -0.10% | -0.10% | -0.10% | |

| 04:30 | JPY | All Industry Activity Index M/M Oct | 1.90% | 2.00% | -0.90% | -1.00% |

| 09:00 | EUR | Eurozone Current Account (EUR) Oct | 23.0B | 18.4B | 17.0B | 17.6B |

| 09:30 | GBP | Retail Sales Inc Auto Fuel M/M Nov | 1.40% | 0.30% | -0.50% | -0.40% |

| 09:30 | GBP | Retail Sales Inc Auto Fuel Y/Y Nov | 3.60% | 1.90% | 2.20% | 2.40% |

| 09:30 | GBP | Retail Sales Ex Auto Fuel M/M Nov | 1.20% | 0.20% | -0.40% | |

| 09:30 | GBP | Retail Sales Ex Auto Fuel Y/Y Nov | 3.80% | 2.30% | 2.70% | 2.80% |

| 12:00 | GBP | BoE Bank Rate | 0.75% | 0.75% | 0.75% | |

| 12:00 | GBP | BoE Asset Purchase Target Dec | 435B | 435B | 435B | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 13:30 | CAD | Wholesale Trade Sales M/M Oct | 1.00% | 0.20% | -0.50% | -0.70% |

| 13:30 | USD | Philadelphia Fed Business Outlook Dec | 9.4 | 15.6 | 12.9 | |

| 13:30 | USD | Initial Jobless Claims (DEC 15) | 214K | 219K | 206K | |

| 15:00 | USD | Leading Index Nov | 0.00% | 0.10% | ||

| 15:30 | USD | Natural Gas Storage | -136B | -77B |